Chapter: Business Science : Financial Management : Financing and Dividend Decision

Financing and Dividend Decision

FINANCING AND DIVIDEND DECISION

1 Leverages

1.1 Financial leverage

1.2 Uses of Financial Leverage

1.3 Operating leverage

2 Capital Structure

2.1 Meaning of Capital Structure

2.2 Objectives of Capital Structure

2.3 Factors Determining Capital structure

3 Cost Of Capital And Valuation

4 Designing Capital Structure

5 Dividend Policy

5.1 Determinants of dividend policy

6 Aspects Of Dividend Policy

7 Practical Consideration

8 Forms Of Dividend Policy

9 Share split

1 Leverages

Leverage refers to ―an increased means of

accomplishing some purpose‖. Leverage allows us to accomplish certain things

which are otherwise not possible, viz lifting of heavy objects with the help of

leverages.

In financial management , the term ‗leverage‘ is

used to describe the firm‘s ability to use fixed cost asset or funds to

increase the return to its owners i.e, Equity shareholders.

The employment of an asset or sources of funds for

which the firm has to pay a fixed cost or fixed return. The fixed cost is also

called as fixed operating cost and the fixed return is called financial cost

remains constant irrespective of the change in volume of output of sales

Higher

the degree of leverage, higher is the risk as well as return to the owner.

1. Financial

leverage or Trading on equity

2. Operating

leverage

3. Combined

leverage or composite leverage

1.1 Financial leverage

Leverage activities with financing activities is called

financial leverage. Financial leverage represents the relations hip between the

company‘s earnings before interest and taxes (EBIT) or operating profit and the

earning available to equity shareholders.

Financial

leverage is defined as ―the ability of a firm to use fixed financial charges to

magnify the effects of changes in EBIT on the earnings per share‖.

Financial

leverage may be favourable or unfavourable depends upon the use of fixed cost

funds. Favourable financial leverage occurs when the company earns more on the

assets purchased with the funds, then the fixed cost of their use. Hence, it is

also called as positive financial leverage.

Unfavourable

financial leverage occurs when the company does not earn as much as the funds

cost. Hence, it is also called as negative financial leverage.

Financial

leverage can be calculated with the help of the following formula:

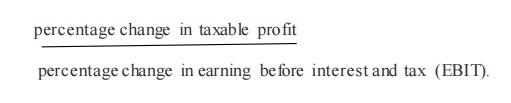

Degree of Financial Leverage

Degree of

financial leverage may be defined as the percentage change in taxable profit as

a result of percentage change in earning before interest and tax (EBIT). This

can be calculated by the following formula

Alternative Definition of Financial Leverage

According

to Gitmar, ―financial leverage is the ability of a firm to use fixed financial

changes

to magnify the effects of change in EBIT and EPS‖.

FL =

Financial Leverage

EBIT =

Earning Before Interest and Tax

EPS = Earning

Per share.

1.2 Uses of Financial Leverage

Financial leverage helps to

examine the relationship between EBIT and EPS.

Financial leverage measures the

percentage of change in taxable income to the percentage change in EBI T.

Financial leverage locates the

correct profitable financial decision regarding capital structure of the

company.

Financial leverage is one of the

important devices which is used to measure the fixed cost proportion with the

total capital of the company.

If the firm acquires fixed cost

funds at a higher cost, then the earnings from those assets, the earning per

share and return on equity capital will decrease.

The impact of financial leverage

can be understood with the help of the following exercise.

1.3 Operating leverage

The leverage associated

with investment activities is

called as operating leverage.

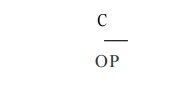

Operating leverage can be calculated with the

help of the following formula:

Where,

OL =

Operating Leverage

C =

Contribution

OP =

Operating Profits

Uses of Operating Leverage

Operating

leverage is one of the techniques to measure the impact of changes in sales

which lead for change in the profits of the company.

If any

change in the sales, it will lead to corresponding changes in profit. Operating

leverage helps to identify the position of fixed cost and variable cost.

Operating leverage measures the relationship

between the sales and revenue of the company during a particular period.

Operating leverage helps to understand the

level of fixed cost which is invested in the operating expenses of business

activities.

Operating leverage describes the over all

position of the fixed operating cost.

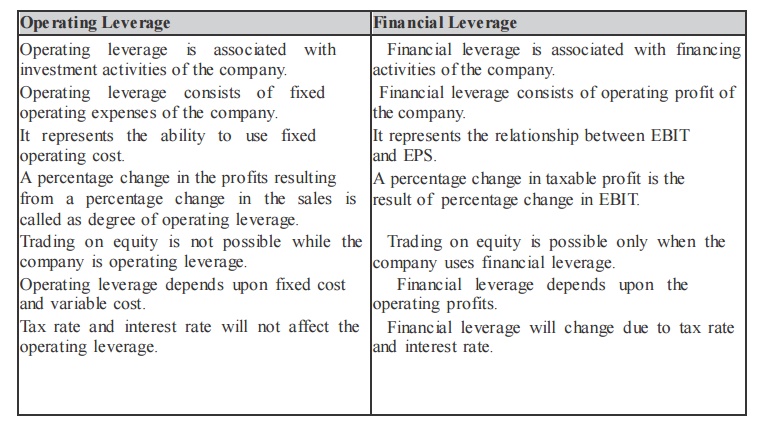

DISTINGUISH BETWEEN OPERATING LEVERAGE AND

FINANCIAL LEVERAGE

Operating Leverage

Operating

leverage is associated with investment activities of the company.

Operating

leverage consists of fixed operating expenses of the company.

It

represents the ability to use fixed operating cost.

A

percentage change in the profits resulting from a percentage change in the

sales is called as degree of operating leverage.

Trading

on equity is not possible while the company is operating leverage.

Operating

leverage depends upon fixed cost and variable cost.

Tax rate

and interest rate will not affect the operating leverage.

Financial Leverage

Financial

leverage is associated with financing activities of the company.

Financial

leverage consists of operating profit of the company.

It represents

the relationship between EBIT and EPS.

A

percentage change in taxable profit is the result of percentage change in EBIT.

Trading

on equity is possible only when the company uses financial leverage.

Financial

leverage depends upon the operating profits.

Financial

leverage will change due to tax rate and interest rate.

Composite leverage

Combination

of operating &financial leverage is called composite leverage

Working Capital Leverage

One of

the new models of leverage is working capital leverage which is used to locate

the investment in working capital or current assets in the company.

Working

capital leverage measures the sensitivity of return in investment of charges in

the level of current assets.

2 Capital Structure

Introduction

Capital

is the major part of all kinds of business activities, which are decided by the

size, and nature of the business concern. Capital may be raised with the help

of various sources. If the company maintains proper and adequate level of

capital, it will earn high profit and they can provide more dividends to its

shareholders.

Meaning

of Capital Structure

Capital

structure refers to the kinds of securities and the proportionate amounts that

make up capitalization. It is the mix of different sources of long-term sources

such as equity shares, preference shares, debentures, long-term loans and

retained earnings.

The term

capital structure refers to the relations hip between the various long- term

source financing such as equity capital, preference share capital and debt

capital.

Deciding

the suitable capital structure is the important decision of the financial management

because it is closely related to the value of the firm.

Capital

structure is the permanent financing of the company represented primarily by long-term

debt and equity.

Definition

of Capital Structure

The

following definitions clearly initiate, the meaning and objective of the

capital structures.

According to the definition of Gerestenbeg,

―Capital Structure of a company refers to the composition or make up of its

capitalization and it includes all long-term capital resources.

2.1 Meaning Of Capital Structure

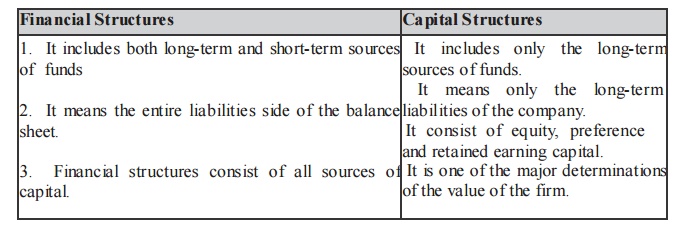

The term

financial structure is different from the capital structure. Financial

structure shows the pattern total financing. It measures the extent to which

total funds are available to finance the total assets of the business.

Financial

Structure = Total liabilities

Or

Financial

Structure = Capital Structure + Current liabilities.

Financial Structures

1. It

includes both long-term and short-term sources of funds

2. It

means the entire liabilities side of the balance sheet.

3.

Financial structures consist of all sources of capital.

Capital Structures

It

includes only the long-term sources of funds.

It means

only the long-term liabilities of the company.

It

consist of equity, preference and retained earning capital.

It is one

of the major determinations of the value of the firm.

Optimum Capital Structure

Optimum

capital structure is the capital structure at which the weighted average

cost of

capital is minimum and thereby the value of the firm is maximum.

Optimum capital structure may be defined as the

capital structure or combination

of debt

and equity, that leads to the maximum value of the fir m.

2 .2 Objectives of Capital Structure

Decision

of capital structure aims at the following two important objectives:

1.

Maximize the value of the fir m.

2.

Minimize the overall cost of capital.

Forms of Capital Structure

Capital

structure pattern varies from company to company and the availability of

finance.

Normally the following forms of capital structure are popular in practice.

o Equity

shares only.

o Equity

and preference shares only.

o Equity

and Debentures only.

o Equity

shares, preference shares and debentures.

2.3 Factors Determining Capital structure

Leverage

It is the

basic and important factor, which affect the capital structure. It uses the

fixed cost financing such as debt, equity and preference share capital. It is

closely related

To the

overall cost of capital.

Cost of Capital

Cost of

capital constitutes the major part for deciding the capital structure of a

firm. Normally long- term finance such as equity and debt consist of fixed cost

while mobilization. When the cost of capital increases, value of the firm will

also decrease. Hence the fir m must take careful steps to reduce the cost of

capital.

Nature of the business:

Use of fixed interest/divide nd bearing finance depends upon the nature of the

business. If the business consists of long period of operation, it will apply

for equity than debt, and it will reduce the cost of capital.

Size of the company:

It also affects the capital structure of a firm. If the fir m belongs to large

scale, it can manage the financial requirements with the help of internal sources. But

if it is small size, they will go for external finance.

It

consists of high cost of capital.

Legal requirements :

Legal require me nts are also one of the considerations while dividing the

capital structure of a firm. For example, banking companies are restricted to

raise funds from some sources.

Requirement of investors :

In order to collect funds from different type of investors, it will be

appropriate for the companies to issue different sources of securities.

3 Cost Of Capital And Valuation

v Every

rupee invested in a firm has a cost

v It is the

minimum return expected by the suppliers.

v Debt is

the cheaper source of finance due to (I) fixed rate of interest on debt (ii)

legal obligation to pay interest (iii) repayment of loan (iv) priority at the

time of winding up of the company

v Equity

shares , not legal obligation to pay dividend and shareholders undertake more

risk, investment is repaid at the time of winding up after paying to others

v Preference

capital is also cheaper, less risk involved, fixed rate of dividend payable and

priority given at the time of winding up of the company

Cash flow ability to service debt

v Firm

generating larger and stable cash inflow use more debt in capital structure

v Debt

implies burden of fixed charge due to the fixed payment of interest and

principal

v Whenever

firm wants to raise additional funds ,it should estimate, project future cash

inflow to cover the fixed charges

Nature and size of firm

v All

public utility has different capital structure as compared to manufacturing

concern

v Public

utility employ more debt because of stable and regularity of earnings

v Concern

cannot provide stable earnings will depend on equity shares

v Small

companies depend on owned capital it is very difficult to raise long term loans

Control

v Whenever

additional funds are required by firm the management should raise without any

loss of control over the firm

v If firm

issue equity shares then the control of existing share holder is diluted

v So it

might be raised by debt or preference capital

v Preference

share and debt do not have voting right.

Flexibility

v Capital

structure should be flexible

v It should

be capable of being adjusted according to the needs of the changing condition

v It should

be possible to raise additional funds with mush risk and delay.

v Redeemable

preference shares and convertible debenture is preferred for flexibility

Requirement of investors

v Requirement

is the another factor that influence the capital structure of the firm

v It is

necessary to meet requirement of institutional as well as investor when debt

financing is used

v Investors

3 kinds

Bold

investor- takes all type of risk; prefer capital gains and control – so equity

capital is preferred

Over-cautious

– prefer safety of investment and stability in returns – so debenture is

preferred

Less

cautious - prefer stability in return –

so preference share capital is used.

Capital market condition

v Capital

market conditions do not remain same forever.

v Sometime

depression or may be boom in the market

v Share

market depressed, then company should not issue equity capital as investor

prefer safety

v Boom

period, firm must issue equity shares.

Asset structure

v The

liquidity and composition of assets should kept in mind while selecting capital

structure.

v Fixed

asset contribute the major portion of the company then company should raise

long-term debt.

Purpose of financing

v Funds are

required for productive purpose – debt financing is suitable because the

company can pay interest out of profit generated.

v Funds are

needed for unproductive or general development – company prefer equity capital

Period of finance

The period is an important factor

to be kept in mind while selecting appropriate capital mix

Finance required for limited

period (7 years) – debenture should be preferred

Redeemable preference shares is

also used for limited period

Funds needed for permanent basis

equity share capital is more appropriate.

4 Designing Capital structure

Capital

structure is the major part of the firm‘s financial decision which affects the

value of the firm and it leads to change EBIT and market value of the shares.

There is a relations hip among the capital structure, cost of capital and value

of the firm. The aim of effective capital structure is to maximize the value of

the firm and to reduce the cost of capital.

There are

two major theories explaining the relations hip between capital struc ture,

cost of capital and value of the fir m.

Traditional Approach

It is the

mix of Net Income approach and Net Operating Income approach. Hence, it is also

called as inter mediate approach. According to the traditional approach, mix of

debt and equity capital can increase the value of the firm by reducing overall

cost of capital up to certain level of debt. Traditional approach states that

the Ko decreases only within the responsible limit of financial leverage and

when reaching the minimum level, it starts increasing with financial leverage.

Assumptions

Capital

structure theories are based on certain assumption to analysis in a single and

convenient manner:

There are only two sources of

funds used by a firm; debt and shares.

The firm pays 100% of its earning

as dividend.

The total assets are given and do

not change.

The total finance re ma ins constant.

The operating profits (EBIT) are

not expected to grow.

The business risk re mains constant.

The firm has a perpetual life.

The investors behave rationally.

Net Income (NI) Approach

Net

income approach suggested by the Dura nd. According to this approach, the

capital structure decision is relevant to the valuation of the firm. In other

words, a change in the capital structure leads to a corresponding change in the

overall cost of capital as well as the total value of the firm.

According

to this approach, use more debt finance to reduce the overall cost of capital and increase the value of fir m.

Net

income approach is based on the following three important assumptions :

There are no corporate taxes.

The cost debt is less than the

cost of equity.

The use of debt does not change

the risk perception of the investor.

where

V = S+B

V = Value

of fir m

S =

Market value of equity

B =

Market value of debt

Market

value of the equity can be ascertained by the following formula:

S =NI/ Ke

where

NI =

Earnings available to equity shareholder

Ke = Cost

of equity/equity capitalization rate

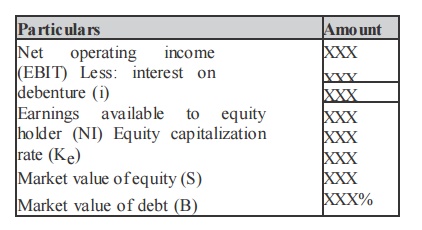

Format

for calculating value of the firm on the basis of NI approach.

Net Operating Income (NOI) Approach

Another

modern theory of capital structure, suggested by Dura nd. This is just the

opposite to the Net Income approach. According to this approach, Capital

Structure decision is irrelevant to the valuation of the firm. The market value

of the firm is not at all affected by the capital structure changes.

According

to this approach, the change in capital structure will not lead to any change

in the total value of the firm and market price of shares as well as the overall

cost of capital.

NI

approach is based on the following important assumptions;

The overall cost of capital remains

constant;

There are no corporate taxes;

The market capitalizes the value

of the firm as a whole;

Value of the firm (V) can be calculated with the help of the following formula

V = E BIT /K0

Modigliani and Miller Approach

Modigliani and Miller approach states that the financing

decision of a firm does not affect the market value of a firm in a perfect

capital market. In other words MM approach maintains that the average cost of

capital does not change with change in the debt weighted equity mix or capital

structures of the fir m.

Modigliani and Miller

approach is based on the

following important assumptions:

v There is a perfect

capital market.

v There are no

retained earnings.

v There are no corporate taxes.

v The investors act

rationally.

v The dividend payout ratio

is 100%.

v The business consists of the same level of business risk.

5 Dividend Policy

The term

dividend refers to that part of profits of a company which is distributed by

the company among its shareholders. It is the reward of the shareholders for

investments made by them in the shares of the company. The investors are

interested in earning maximum return to maximize their wealth.

A firm

needs funds to meet its long-term growth. If a company pays most of the profit

as dividend, then for business requirement or further expansion then it will

have to depend on outsiders for funds. Such as issue of debt or new shares.

Firms

decision to pay dividend in equitable proportion of dividend and retained

earnings.

5.1 Determinants Of Dividend Policy

1. Legal restrictions

Legal

provision related to dividends are laid down in sec 93,205,205A, 206 and 207 of

companies act.Dividend can be paid only out of current profit or past profit

after providing depreciation Company providing more than 10% dividend to

transfer certain percentage of current year profit to reserves.

2. Magnitude and trend of earnings

The

amount and trend of earnings is an important in dividend policy. Dividend can

be paid only out of present or past year‘s profit; earnings of a company fix

the upper limit on dividends. Past trend is kept in mind while decision

dividend decision .

3. Desire and type of shareholders

Discretion

to declare dividend or not is decided by the board of directors. Directors give

importance to the desire of the shareholder in declaration of dividends. Desire

for dividend depends on their economic status. Investor such as retired person,

widows and other economically weaker person view dividend as a source of funds

to meet their day-to-day living expenses – the company will pay regular

dividend. Investor with high income tax bracket will not prefer current

dividend they will expect only capital gains.

4. Nature of industry

Nature of

industry to which the company is engaged also affects dividend policy. Certain

industry has steady and stable demand irrespective of prevailing economic

condition. Eg : people used to drink liquor both in boom and in recession. Such

firm gets regular earning and hence follows consistent dividend policy. Earning

are uncertain in such case conservative dividend policy is used. Such firms

should retain substantial part of their current earnings during boom period in

order to provide funds to pay dividends in recession period

5. Age of the company

Age also

influence the dividend decision of the company. Newly established concern has

limit in payment of dividend and retain substantial part for financing future

growth and development Older company has sufficient reserves can pay liberal

dividends.

6. Future financial requirement

Future

financial requirement is to be considered while deciding dividend. Company has

profitable investment opportunities then the firm will pay limited amount as

dividend and invest the remaining amount. If there is no investment

opportunities then the company will pay more dividend

7. Government economic policy

The

dividend policy of a firm has also to be adjusted to the economic policy of the

government

In 1974

and 1975 companies were allowed to pay dividends not more than 33 % of their

profits or 12% on paid-up value of the shares, whichever was lower

8. Taxation policy

A high or

low rate of business taxation affect the net earnings of company and thereby

its dividend policy. A firm‘s dividend policy may be dictated by the income-tax

status of its shareholders. If the dividend income of shareholders is heavily

taxed being in high income bracket, then the shareholder will prefer capital

gains and bonus shares.

6 Aspects Of Dividend Policy

Relevance Of Dividend

According

to this concept, dividend policy is considered to affect the value of the firm.

Dividend relevance implies that shareholders prefer curre nt dividend and there

is no direct relations hip between dividend policy and value of the firm.

Relevance of dividend concept is supported by two e mine nt persons like Walter

and Gordon.

Walter’s Model

Prof.

James E. Walter argues that the dividend policy almost always affects the value

of the firm.

Walter

model is based in the relationship between the following important factors:

• Rate of

return I

• Cost of

capital (k)

According to the Walter‘s model, if r > k,

the firm is able to earn more than what the shareholders could by reinvesting,

if the earnings are paid to them. The implication of r > k is that the shareholders

can earn a higher return by investing elsewhere.

If the firm has r = k, it is a matter of

indifferent whether earnings are retained or distributed.

Assumptions

Walters

model is based on the following important assumptions :

1. The

firm uses only internal finance.

2. The

firm does not use debt or equity finance.

3. The

firm has constant return and cost of capital.

4. The

firm has 100 recent payout.

5. The

firm has constant EPS and dividend.

6. The

firm has a very long life.

Walter

has evolved a mathematical formula for determining the value of market share.

Criticism of Gordon’s Model

Gordon‘s

model consists of the following important criticisms:

Gordon

model assumes that there is no debt and equity finance used by the firm.

It is not

applicable to present day business.

Ke and r

cannot be constant in the real practice.

According

to Gordon‘s model, there are no tax paid by the firm. It is not practically

applicable.

7 Practical aspects of dividend policy

Two

important dimensions of a firms dividend policy are:

* Quantum

of the average payout ratio

*

Stability of dividends over a time period

These two

dimensions are conceptually distinct from one another.

The

considerations which are relevant for determining the average payout ratio are:

Funds

requirements.

Liquidity.

Access to

external sources of financing.

Shareholders

preferences.

Differences

in the cost of external equity and retained earnings.

Control&Taxes.

Irrespective

of the long-run payout ratio followed, the fluctuations in the year-to-year

dividend may be determined mainly by one of the two guidelines.

(i) Stable

dividend payout ratio

(ii) Stable

dividends or steadily changing dividends. Firms generally follow a policy of

stable

dividends

or gradually rising dividends.

Since

internal equity (in the form of retained earnings) is cheaper than external

equity an important dividend prescription advocates a residual policy to

dividends. According to this policy the equity earnings of the firm are first

applied to provide equity finance required for supporting investments. The

surplus, if any, is distributed as dividends.

Firms

subscribing to the residual dividend policy may adopt one of the following

approaches:

(i) Pure

residual dividend policy approach (ii) Fixed dividend payout approach and (iii)

smoothed residual dividend approach. The smoothed residual dividend approach,

which produces a table and steadily growing stream of dividend, often appears

to be the most sensible approach in practice.

Not

withstanding the normative prescription of the smoothed residual dividend

approach,

Lintner’s

classic study of corporate dividend behavior showed that: (i) Most of the firms

think primarily in terms of the proportion of earnings that should be paid out

as dividends

8 Forms Of Dividend Policy

Dividend policy depends upon the nature of the firm, type of

shareholder and profitable position. On the basis of the dividend declaration

by the firm, the dividend policy may be classified under the following types:

§ Regular dividend

§ Stable dividend policy

§ Irregular dividend policy

§ No dividend policy.

Regular Dividend Policy

Dividend

payable at the usual rate is called as regular dividend policy. This type of

policy is suitable to the small investors, retired persons and others.

Stable Dividend Policy

Stable

dividend policy means payment of certain minimum a mount of dividend regularly.

This dividend policy consists of the following three importa nt forms:

Constant

dividend per share

Constant

payout ratio

Stable

rupee dividend plus extra dividend.

Irregular Dividend Policy

When the

companies are facing constraints of earnings and unsuccessful business

operation, they may follow irregular dividend policy. It is one of the

temporary arrangements to meet the financial problems. These types are having

adequate profit.

For

others no dividend is distributed.

No Dividend Policy

Sometimes

the company may follow no dividend policy because of its unfavourable working

capital position of the a mo unt required for future growth of the concerns.

Forms Of Dividends

Cash Dividend

If the

dividend is paid in the form of cash to the shareholders, it is called cash

dividend. It is paid periodically out the business concerns EAIT (Earnings

after interest and tax). Cash dividends are common and popular types followed

by majority of the business concerns.

Stock Dividend

Stock

dividend is paid in the form of the company stock due to raising of more

finance. Under this type, cash is retained by the business concern. Stock

dividend may be bonus issue. This issue is given only to the existing shareholders

of the business concern.

Bond

Dividend

Bond

dividend is also known as script dividend. If the company does not have sufficient

funds to pay cash dividend, the company promises to pay the shareholder at a

future specific date with the help of issue of bond or notes.

Property Dividend

Property

dividends are paid in the form of some assets other than cash. It will

distributed under the exceptional circumstance. This type of dividend is not

published in India.

9 Share Split

Definition

A

corporate action in which a company's existing shares are divided into multiple

shares. Although the number of shares outstanding increases by a specific

multiple, the total dollar value of the shares remains the same compared to

pre-split amounts, because no real value has been added as a result of the

split.

Share split

Share

split is the process of splitting shares with high face value into shares of a

lower face value.

v Alteration

of shares

v Increase

the number of outstanding shares

v Approval

from board of directors

Reasons of share splits

v The price

of their stock exceeds the amount smaller investors would be willing to pay. it

is aimed at making the stock more affordable and liquid from retail investors

point of view

v There are

more buyers and sellers of shares trading Rs 100 than say Rs 400 as retail

shareholders may find low price stocks to be better bargains.

Significance of share splits

v To

improve the market liquidity

v To make

an investor attention with other high quality securities

v Stock

split means of converting odd lot holders into round lot holders

v Round lot

holder plays a very important role in a stocks marketability and liquidity on

The

exchange

Related Topics