Chapter: Business Science : Security Analysis and Portfolio Management : Securities Markets

Book Building Process

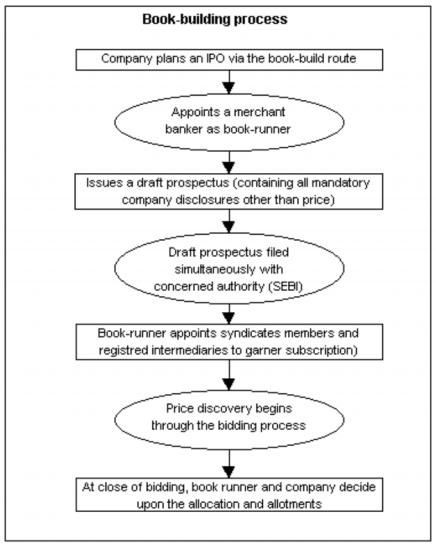

BOOK BUILDING PROCESS

Book Building is basically a capital issuance process used in Initial Public Offer (IPO) which aids price and demand discovery. It is a process used for marketing a public offer of equity shares of a company. It is a mechanism where, during the period for which the book for the IPO is open, bids are collected from investors at various prices, which are above or equal to the floor price. The process aims at tapping both wholesale and retail investors. The offer/issue price is then determined after the bid closing date based on certain evaluation criteria.

The Process:

¸ The Issuer who is planning an IPO nominates a lead merchant banker as a 'book runner'.

¸ The Issuer specifies the number of securities to be issued and the price band for orders.

¸ The Issuer also appoints syndicate members with whom orders can be placed by the investors.

¸ Investors place their order with a syndicate member who inputs the orders into the 'electronic book'. This process is called 'bidding' and is similar to open auction.

¸ A Book should remain open for a minimum of 5 days.

¸ Bids cannot be entered less than the floor price.

¸ Bids can be revised by the bidder before the issue closes.

¸ On the close of the book building period the 'book runner evaluates the bids on the basis of the evaluation criteria which may include -

∑ Price Aggression

∑ Investor quality

∑ Earliness of bids, etc.

¸ The book runner the company concludes the final price at which it is willing to issue the stock and allocation of securities.

¸ Generally, the numbers of shares are fixed; the issue size gets frozen based on the price per share discovered through the book building process.

¸ Allocation of securities is made to the successful bidders.

¸ Book Building is a good concept and represents a capital market which is in the process of maturing.

Book-building is all about letting the company know the price at which you are willing to buy the stock and getting an allotment at a price that a majority of the investors are willing to pay. The price discovery is made depending on the demand for the stock.

Related Topics