Features (or) Characteristics, Advantages | Auditing - Audit of Accounts of Joint Stock Company | 11th Auditing : Chapter 2 and 3 : Classifications of Audit

Chapter: 11th Auditing : Chapter 2 and 3 : Classifications of Audit

Audit of Accounts of Joint Stock Company

Audit of Accounts of Joint

Stock Company

Companies formed and registered under the Companies

Act, 1956 have to compulsorily audit its books of accounts as the owners

(shareholders) and the management of the company is different. The company

auditor’s rights, duties, appointment, remuneration etc. are governed by the

provisions of the Companies Act. This type of audit is called as Statutory

Audit and the person who conducts the audit is called as Statutory Auditor.

The main objective of external or statutory audit

is to examine the accuracy that the financial statements reflect a true and

fair view of the state of affairs of the business. In other words, the company

auditor has to verify that the books of accounts and certify that the books of

accounts and financial statements exhibit a true and fair view of the state of

affairs of the business concern in the form of a report to the shareholders of

the company.

Characteristics (or) Feartures

1. The main objective of external or statutory

audit is to examine the accuracy that the financial statements reflect a true

and fair view of the state of affairs of

the business.

2. The scope of work is determined by the Companies

Act and the auditor possesses an independent status and the management has no

control over the auditor.

3. Auditor should be a qualified Chartered

Accountant as laid down in the provisions of the Companies Act.

4. Statutory auditor is appointed and removed by

the shareholders of the company.

5. The powers and duties of statutory audit are

determined by the Companies Act.

6. Statutory or Company auditor is liable both to

shareholders and to the third parties.

7. After audit of accounts of a company, auditor

has to submit a audit report to the shareholders at annual general meeting in

prescribed format.

8. Company or statutory auditor is responsible to

shareholders and acts as a watch-dog for the shareholders.

Advantages

The following are the advantages of auditing the

accounts of a Joint Stock Company.

1.

Verification

of Accuracy of Books of Accounts: Audit of accounts helps to verify the correctness of the

financial transaction and accuracy of books of accounts.

2.

Detection

and Prevention of Errors and Frauds: Audit helps in detecting and preventing both errors and frauds and

also exhibits a true and fair view of state of affairs of the company to the

shareholders who are the owners of the company.

3.

Moral

Check on the Management: Audit of accounts enables to have a moral check on

the management in order to protect the interest of the shareholders.

4.

Safeguards

Interest of Shareholders: When accounts are audited by an independent and a

qualified auditor, the interest of the shareholders and third parties are

protected and safeguarded against any frauds committed by the directors,

promoters or managers.

5.

Valuable

Suggestions: Besides the above

advantages, auditor who is in touch with the company operations can provide

valuable suggestions.

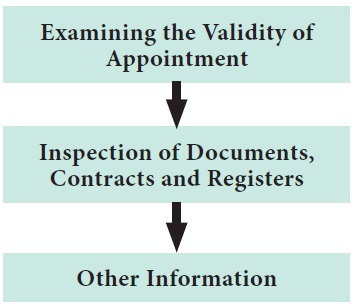

Preliminaries Before Conduct of Audit

A company is an artificial judicial person and has

separate legal entity. The share holders of the company are interested to know

the financial position of the company. Hence, the audit of books of accounts

for the limited company is compulsory. The auditor has to produce a report on

the books examined by him and express a true and fair view of the profit and

loss account prepared by the client. Before commencing the audit work, the

auditor has to undertake certain preliminary steps. They are:

1. Examining the validity of his appointment

2. Inspection of Documents, Contracts and Registers

3. Other Information.

1. Examining the Validity of his Appointment

The auditor has to check that his appointment has

been made as per the provisions of Companies Act. He has to ensure that his

appointment has been validly made based on the different provisions for the

appointment of auditor under Companies Act. The following are the various

circumstances of appointment of auditor:

·

Where he is appointed as first auditor, get a copy

of the resolution by the directors about his appointment;

·

Where he is appointed in the place of retiring

auditor, he should enquire from the retiring auditor in writing, whether due

notice was given to him and also the circumstances under which he retired, and

also if the retiring auditor has any objection to his accepting the

appointment. Failure on the part the auditor shall be treated as a breach of

professional ethics.

·

Where his appointment is made by the shareholders

in annual general meeting, he should procure a copy of the shareholders

resolution regarding his appointment, and inform the Registrar within 30 days

whether he is accepting the appointment.

·

Where he is appointed in a casual vacancy, by the

directors, he should obtain a copy of the director’s resolution to this effect.

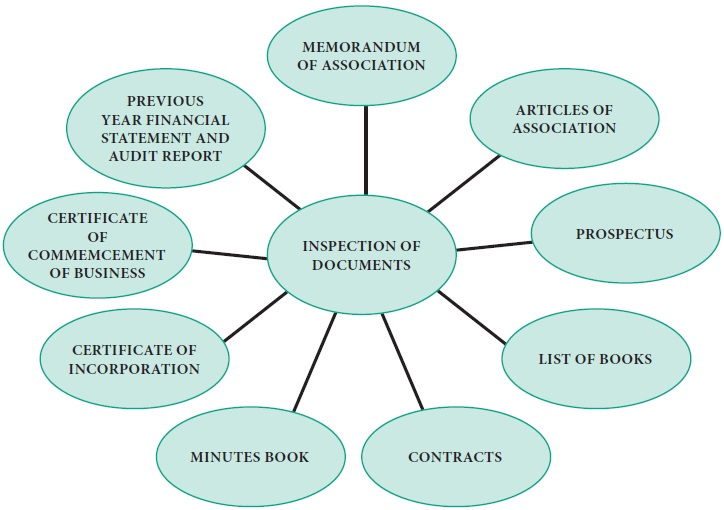

2. Inspection of Documents, Contracts and Registers

He should obtain a certified list of all the books

used in the company and examine the records, documents and registers with

reference to the following:

(A) Memorandum

of Association: The Memorandum

of Association is the basic document of the company.

It authorizes a company to engage in specific

activities. Therefore, it is necessary for the auditor to examine the scope and

powers of the company. The auditor should have a complete study of Memorandum

of Association in the following aspects:

·

Whether the transactions carried by the company is

subject to the clauses in the Memorandum of Association, if not the

transactions of the company become ultravires.

·

The auditor has to check the share capital issued

is within the authorized capital.

·

He should scrutinize the object clause and

borrowing powers of the company.

·

He has to check other provisions, which are likely

to affect the accounts of the company.

(b) Articles

of Association: The Articles

of Association deals with rules and regulations of the internal management

of the company. The auditor has to examine the following particulars in the

Articles of Association:

·

Issue, allotment and forfeiture of shares and

declaration of dividend.

·

Appointment and removal of directors and officers

of the company and the provisions relating thereto.

·

Provisions regarding meeting and voting rights of

share holders.

·

Borrowing powers of company.

·

Payment of interest on capital, under writing

commission and brokerage.

·

The auditor has to make thorough study of the

Articles of Association and he has to apply his skill and knowledge on various

transactions of the company.

(c) Prospectus:

A

Prospectus is an invitation to the

public to subscribe for shares and debentures of the company. It holds all the

rules and regulations for the issue of shares. Normally all the matters which

are in the articles of association are also found in the prospectus. The auditor

should make a detail study in the following matters:

·

He should verify the name, addresses, remuneration

of directors and other statutory officers whose particulars are specified in

the prospectus.

·

He should see that all the statements made in the

prospectus are true.

·

He should examine in the prospectus that the amount

payable at the time of allotment and call.

·

He has to examine that any material contract made

by the company within two years from the date of issue of prospectus.

(d) List

of Books: Auditor should ask the

company to submit a list of all the books of accounts, statistical and

statutory books maintained by the company. Important books are kept at the

Registered Office of the company.

(e) Contracts:

The

auditor has to check the date of agreement

or contracts made by the company with other parties, like, vendors,

underwriters, promoters or brokers etc. Further, the auditor should verify

whether the agreements are made by the authorized person of the company. He

should see that entries relating to contracts are recorded correctly.

(f) Minutes

Book: Every company has to maintain

a book in order to record the proceedings in the general meetings, meetings of

board of directors and committee of the board. They are in the form of a bound

note book. The auditor has to verify that the chairman has certified the

minutes book with date and signature. The audit of the Minutes Book helps the

auditor in vouching various transactions e.g., adoption of the annual accounts,

calls on shares, directors fees and expenses, appointment of first auditor and

his remuneration and authorization of capital expenditure etc.

(g) Certificate

of Incorporation: Certificate of Incorporation is an important

document which brings the company into legal existence.

The auditor has to check that all legal official

procedures have been fulfilled subject to the provisions of the Companies Act.

(h) Certificate

of Commencement of Business: A public company has to get Certificate of Commencement of

business before it commences its business. The auditor should examine the

Certificate of Commencement of business in case of a public company.

(i) Previous

Year Balance Sheet, Profit and Loss Account and Audit Report: The

auditor has to verify the last year Balance Sheet and ensure that the balances

are correctly recorded in the current books. He has to check the minutes book

of the share holders about the adoption of the accounts. Moreover, he has to

get the copies of last year’s Profit and Loss Account and Balance Sheet which

is required for conduct of his audit work. He should ensure that the objections

or qualifications raised in the previous audit report have been duly met by the

company. He should examine the Directors report to the members containing the

recommendations of the Directors in respect of the appropriations of profits

made last year.

3. Other Information

(a) System

of Accounting: The auditor has

to study the accounting system followed in the company and has to observe the

inefficiencies.

(b) List of

Officers: The auditor has to obtain

the list of officers in the company with their specimen signature.

(c) Evaluation

of Internal Check and Control System: The auditor has to obtain detailed information about the

internal check and internal control system in the company. This will enable him

to identify the defects in the accounting system. Further, he has to verify the

recommendations, if any, made in the last year audit report.

Related Topics