Chapter: Business Science : Financial Management : Foundations of Finance

Valuation of Bonds and Shares

Valuation Of Bonds And Shares

1 Valuation Of Bonds

A bond or

a debenture is a long-term debt instrument or security. It is issued by

business enterprises or government agencies to raise long-term capital. A bond

usually carries a fixed rate of interest. It is called as coupon payment and

the interest rate is called as the coupon rate. The coupon payment can be

either annually or semi-annually.

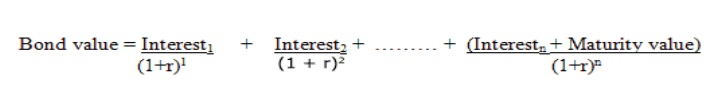

Where:

Interest

1 to n = Interests in periods 1 to n.

Unless

otherwise mentioned, the maturity value of the bond is the face value.

When the

required rate of return is equal to the coupon rate, the bond value equals the

par value.

When the

required rate of return is more than the coupon rate, the bond value would be

less than its par value. The bond in this case would sell at a discount.

When the

required rate of return is less than the coupon rate, the bond value would be

more than its par value. The bond in this case would sell at a premium.

2 Valuation Of Shares

Factors Which Influence The Value Of Shares

The

factors which influence the value of shares can be broadly classified into two

groups- internal and external factors. They are stated below-

(i)

Internal

factors

v Earning

capacity of assets

v Return on

investments

v Profit

after tax

v Profit

available to equity shareholders

v Earnings

per share

v Dividend

per share or Rate of dividend.

(ii) External Factors

v General

economic condition of the country.

v Political

and social environment.

v International

economic scenario.

v International

political environment.

METHODS OF VALUATION OF SHARES

The

methods of valuation depend on the purpose for which valuation is required.

Generally, there are three methods of valuation of shares:

1.Net Assets Method of Valuation of Shares

Under this

method, the net value of assets of the company is divided by the number of

shares to arrive at the value of each share. For the determination of net value

of assets, it is necessary to estimate the worth of the assets and liabilities.

The goodwill as well as non-trading assets should also be included in total

assets.

Value per

Share= (Net Assets-Preference Share Capital)/Number of Equity Shares

2. Yield or Market Value Method of Valuation Of

Shares

The

expected rate of return in investment is denoted by yield. The term "rate

of return" refers to the return which a shareholder earns on his

investment. Further it can be classified as

(a) Rate

of earning and (b) Rate of dividend. In other words, yield may be earning yield

and dividend yield.

a. Earning Yield

Value per

Share = (Expected rate of earning/Normal rate of return) X Paid up value of

equity share

Expected

rate of earning = (Profit after tax/paid up value of equity share) X 100

b. Dividend Yield

Expected

rate of dividend = (profit available for dividend/paid up equity share capital)

X 100 Value per share = (Expected rate of dividend/normal rate of return) X 100

3. Earning Capacity Method Of Valuation Of Shares

Under

this method, the value per share is calculated on the basis of disposable profit

of the company. The disposable profit is found out by deducting reserves and

taxes from net profit.

Value per

share = Capitalized Value/Number of Shares

Related Topics