Chapter: Business Science : Financial Management : Foundations of Finance

Foundations of Finance

FOUNDATIONS OF FINANCE

1 Introduction

1.1Meaning of Finance

1.2Definition of Finance

1.3Types of Finance

2 Overview

2.1 Scope of Financial Management

2.2 Objectives of Financial Management

2.3 Approaches to Financial Management

2.4 Importance of Financial Management

3 Time Value Of Money

3.1 Concept

3.2 Compound Interest

3.3 Present Value

4 Introduction To The Concept Of Return Of A Single

Asset

4.1 Introduction

4.2 Concept and Types of Risk

4.3 Risk and Return of the Portfolio

4.4. Relationship Between The Risk And Return

5 Valuation Of Bonds And Shares

5.1 Valuation of Bonds

5.2 Valuation of Shares

6 Option Valuation

6.1 Factors Affecting Value Of Options

1 Introduction

Business

concern needs finance to meet their requirements in the economic world. Any

kind of business activity depends on the finance. Hence, it is called as

lifeblood of business organization. Whether the business concerns are big or

small, they need finance to fulfill their business activities.

In the

modern world, all the activities are concerned with the economic activities and

very particular to earning profit through any venture or activities. The entire

business activities are directly related with making profit. According to the

economics concept of factors of production, rent given to landlord, wage given

to labour, interest given to capital and profit given to shareholders or

proprietors, a business concern needs finance to meet all the requirements.

Hence finance may be called as capital, investment, fund etc., but each term is

having different meanings and unique characters. Increasing the profit is the

main aim of any kind of economic activity.

1.1 Meaning Of Finance

Finance

may be defined as the art and science of managing money. It includes financial

service and financial instruments. Finance also is referred as the provision of

money at the time when it is needed. Finance function is the procurement of

funds and their effective utilization in business concerns. The concept of

finance includes capital, funds, money, and amount. But each word is having

unique meaning. Studying and understanding the concept of finance become an

important part of the business concern.

1.2 Definition Of Finance

v According

to Khan and Jain, ―Finance is the

art and science of managing money‖.

v Webster’s Ninth New Collegiate Dictionary

defines finance as ―the Science on study

of the management of funds‘ and the management of fund as the system that

includes the circulation of money, the granting of credit, the making of

investments, and the provision of

banking

facilities.

Definition Of Business Finance

According

to the Guthumann and Dougall,

―Business finance can broadly be defined as the activity concerned with

planning, raising, controlling, administering of the funds used in the

business‖.

Corporate

finance is concerned with budgeting, financial forecasting, cash management,

credit administration, investment analysis and fund procurement of the business

concern and the business concern needs to adopt modern technology and

application suitable to the global environment.

1.3 Types Of Finance

Finance

is one of the important and integral part of business concerns, hence, it plays

a major role in every part of the business activities. It is used in all the

area of the activities under the different names.

v

Private Finance

v

Public Finance

Types of Finance

Private Finance, which includes the Individual,

Firms, Business or Corporate Financial activities to meet the requirements.

Public Finance

which concerns with revenue and disbursement of Government such as Central

Government, State Government and Semi-Government Financial matters.

2 OVERVIEW

Definition

The most

popular and acceptable definition of financial management as given by S.C. Kuchal is that ―Financial Management deals with procurement of

funds and their effective utilization

in the business‖.

Joshep and Massie: Financial

management ―is the operational activity of a business that is responsible for obtaining and effectively utilizing the

funds necessary for efficient operations.

2.1 Scope Of Financial Management

1. Financial Manage ment and Economics

Economic

concepts like micro and macroeconomics are directly applied with the financial

management approaches. Investment decisions, micro and macro environmental

factors are closely associated with the functions of financial manager.

Financial management also uses the economic equations like money value discount

factor, economic order quantity etc. Financial economics is one of the emerging

area, which provides immense opportunities to finance, and economical areas.

2. Financial Management and Accounting

Accounting

records includes the financial information of the business concern. Hence, we

can easily understand the relationship between the financial management and

accounting. In the olden periods, both financial management and accounting are

treated as a same discipline and then it has been merged as Management

Accounting because this part is very much helpful to finance manager to take

decisions. But nowadays financial management and accounting discipline are

separate and interrelated.

3. Financial Management or Mathematics

Modern

approaches of the financial management applied large number of mathematical and

statistical tools and techniques. They are also called as econometrics.

Economic order quantity, discount factor, time value of money, present value of

money, cost of capital, capital structure theories, dividend theories, ratio

analysis and working capital analysis are used as mathematical and statistical

tools and techniques in the field of financial management.

4. Financial Management and Production Management

Production

management is the operational part of the business concern, which helps to

multiple the money into profit. Profit of the concern depends upon the

production performance. Production performance needs finance, because

production department requires raw material, machinery, wages, operating

expenses etc. These expenditures are decided and estimated by the financial

department and the finance manager allocates the appropriate finance to

production department. The financial manager must be aware of the operational

process and finance required for each process of production activities.

5. Financial Management and Marketing

Produced

goods are sold in the market with innovative and modern approaches. For this,

the marketing department needs finance to meet their requirements. The

financial manager or finance department is responsible to allocate the adequate

finance to the marketing department. Hence, marketing and financial management

are interrelated and depends on each other.

6. Financial Management and Human Resource

Financial

management is also related with human resource department, which provides

manpower to all the functional areas of the management. Financial manager

should carefully evaluate the requirement of manpower to each department and

allocate the finance to the human resource department as wages, salary,

remuneration, commission, bonus, pension and other monetary benefits to the

human resource department. Hence, financial management is directly related with

human resource management.

2.2 Objectives Of Financial Management

Effective

procurement and efficient use of finance lead to proper utilization of the

finance by the business concern. It is the essential part of the financial

manager. Hence, the financial manager must determine the basic objectives of

the financial management. Objectives of Financial Management may be broadly divided

into two parts such as:

1. Profit

maximization

2. Wealth

maximization.

Profit Maximization

v

Profit maximization is also called as cashing per

share maximization. It leads to maximize the business operation for profit

maximization.

v Ultimate aim of the business concern is earning

profit, hence, it considers all the possible

ways to

increase the profitability of the concern.

v

Profit is the parameter of measuring the efficiency

of the business concern. So it shows the entire position of the business

concern.

v

Profit maximization objectives help to reduce the

risk of the business.

Favourable Arguments for Profit Maximization

(i) Main aim

is earning profit.

(ii) Profit is

the parameter of the business operation.

(iii)Profit

reduces risk of the business concern.

(iv)Profit is

the main source of finance.

(v) Profitability

meets the social needs also.

Unfavourable Arguments for Profit Maximization

(i)

Profit maximization leads to exploiting workers and consumers.

(ii) Profit

maximization creates immoral practices such as corrupt practice, unfair trade

practice, etc.

(iii) Profit

maximization objectives leads to

inequalities among the stake

holders such as

customers,

suppliers, public shareholders, etc.

Drawbacks of Profit Maximization

(i)

It is

vague: In this objective, profit is not defined precisely or correctly. It

creates some unnecessary opinion

regarding earning habits of the business concern.

(ii)

It

ignores the time value of money: Profit maximization does not

consider the time

value of

money or the net present value of the cash inflow. It leads certain differences

between the actual cash inflow and net present cash flow during a particular

period.

(iii)

It

ignores risk: Profit maximization does not consider risk of the

business concern.

Risks may

be internal or external which will affect the overall operation of the business

concern

.

Wealth Maximization

Wealth

maximization is one of the modern approaches, which involves latest innovations

and improvements in the field of the business concern. The term wealth means

shareholder wealth or the wealth of the persons those who are involved in the

business concern. Wealth maximization is also known as value maximization or

net present worth maximization. This objective is an universally accepted

concept in the field of business.

Favourable Arguments for Wealth Maximization

(i) Wealth

maximization is superior to the profit maximization because the main aim of the

business concern under this concept is to improve the value or wealth of the

shareholders.

(ii) Wealth maximization

considers the comparison of the value to cost associated with the business

concern. Total value detected from the total cost incurred for the business

operation.

It

provides extract value of the business concern.

(iii)Wealth

maximization considers both time and risk of the business concern.

(iv)Wealth

maximization provides efficient allocation of resources.

(v) It

ensures the economic interest of the society.

Unfavourable Arguments for Wealth Maximization

(i) Wealth

maximization leads to prescriptive idea of the business concern but it may not

be suitable to present day business activities.

(ii) Wealth

maximization is nothing, it is also profit maximization, it is the indirect

name of the profit maximization.

(iii)Wealth

maximization creates ownership- management controversy.

(iv)Management

alone enjoys certain benefits.

(v) The

ultimate aim of the wealth maximization objectives is to maximize the profit.

(vi)Wealth

maximization can be activated only with the help of the profitable position of

the business concern.

2.3 Approaches To Financial Management

Theoretical

points of view, financial management approach may be broadly divided into two

major parts.

v Traditional Approach

v Modern Approach

Traditional Approach

Traditional

approach is the initial stage of financial management, which was followed, in

the early part of during the year 1920 to 1950. This approach is based on the

past experience and the traditionally accepted methods. Main part of the

traditional approach is rising of funds for the business concern. Traditional

approach consists of the following important area.

v Arrangement

of funds from lending body.

v Arrangement

of funds through various financial instruments.

v Finding

out the various sources of funds.

Functions Of Finance Manager

1. Forecasting Financial Require ments

It is the

primary function of the Finance Manager. He is responsible to estimate the

financial requirement of the business concern. He should estimate, how much

finances required to acquire fixed assets and forecast the amount needed to

meet the working capital requirements in future.

2. Acquiring Necessary Capital

After

deciding the financial requirement, the finance manager should concentrate how

the finance is mobilized and where it will be available. It is also highly

critical in nature.

3. Investment Decision

The

finance manager must carefully select best investment alternatives and consider

the reasonable and stable return from the investment. He must be well versed in

the field of capital budgeting techniques to determine the effective

utilization of investment. The finance manager must concentrate to principles

of safety, liquidity and profitability while investing capital.

4. Cash Management

Present

day‘s cash management plays a major role in the area of finance because proper

cash management is not only essential for effective utilization of cash but it

also helps to meet the short-term liquidity position of the concern.

5. Interrelation with Other Departments

Finance

manager deals with various functional departments such as marketing,

production, personnel, system, research, development, etc. Finance manager

should have sound knowledge not only in finance related area but also well

versed in other areas. He must maintain a good relationship with all the

functional departments of the business organization.

2.4 Importance Of Financial Management

Financial Planning

Financial

management helps to determine the financial requirement of the business concern

and leads to take financial planning of the concern. Financial planning is an

important part of the business concern, which helps to promotion of an

enterprise.

Acquisition of Funds

Financial

management involves the acquisition of required finance to the business concern.

Acquiring needed funds play a major part of the financial management, which

involve possible source of finance at minimum cost.

Proper Use of Funds

Proper

use and allocation of funds leads to improve the operational efficiency of the

business concern. When the finance manager uses the funds properly, they can

reduce the cost of capital and increase the value of the firm.

Financial Decision

Financial

management helps to take sound financial decision in the business concern.

Financial decision will affect the entire business operation of the concern.

Because there is a direct relationship with various department functions such

as marketing, production personnel, etc.

Improve Profitability

Profitability

of the concern purely depends on the effectiveness and proper utilization of

funds by the business concern. Financial management helps to improve the

profitability position of the concern with the help of strong financial control

devices such as budgetary control, ratio analysis and cost volume profit

analysis.

Increase the Value of the Firm

Financial

management is very important in the field of increasing the wealth of the

investors and the business concern. Ultimate aim of any business concern will

achieve the maximum profit and higher profitability leads to maximize the

wealth of the investors as well as the nation.

Promoting Savings

Savings

are possible only when the business concern earns higher profitability and

maximizing wealth. Effective financial management helps to promoting and mobilizing

individual and corporate savings.

Nowadays

financial management is also popularly known as business finance or corporate

finances. The business concern or corporate sectors cannot function without the

importance of the financial management.

3 Time Value Of Money

3.1 Concept

Time value of money shows the relation of

value of money with time. Time value of money is also value of interest which we have

earned for giving money to other for specific period. Value of Rs. 1 which you have today is more valuable than

what Rs. 1 you will receive after one year because you can invest today receive

Rs. 1 in any scheme and you can earn minimum interest on it. It means today

received money is important than tomorrow receivable money. Interest rate is the cost of borrowing money as a yearly

percentage. For investors, interest rate is the

rate earned on an investment as a yearly percentage.

Time

value of money results from the concept of interest. So it now time to discuss

Interest.

1. Simple Interest

It may be

defined as Interest that is calculated as a simple percentage of the original

principal amount. The formula for calculating simple interest is

SI = P0

(i)(n)

Future value of an account at the end of n period

FVn = P0+ SI = P0 + P0(i)(n)

3.2 Compound Interest

If

interest is calculated on original principal amount it is simple interest. When

interest is calculated on total of previously earned interest and the original

principal it compound interest. Naturally, the amount calculated on the basis

of compound interest rate is higher than when calculated with the simple rate.

FV n

= Po (1+ i) n

Where,

i = Annual rate of interest / Number of

payment periods per year

= r/k

So, FV n

= P0 (1 + r/k)n

When

compounding is done k times a year at an annual interest rate r.

Or

FVn

= Po (i + FVIF) in

Where,

Effective Rate of Interest

It is the

actual equivalent annual rate of interest at which an investment grows in value

when interest is credited more often than once a year. If interest is paid m

times in a year it can be found by calculating:

Ei = (1+

i/m) m -1

3.3 Present Value

―Present

Value‖ is the current value of a ―Future Amount‖. It can also be defined as the

amount to be invested today (Present Value) at a given rate over specified

period to equal the ―Future Amount‖.

The

present value of a sum of money to be received at a future date is determined

by discounting the future value at the interest rate that the money could earn

over the period. This process is known as Discounting.

The present value interest factor declines as the interest rate rises and as

the length of time increases.

Po =

FVn /(1+ i) n

Po =

FVn (1+ i) -n

Where,

FVn = Future value n years hence

I = Rate of interest per annum

n = Number of years for which discounting

is done.

B. Discount (or) present value technique: -

= (1+ )

![]()

Present

value Vo = Future value (Vn) x DFin

4 Introduction To The Concept Of Return Of A Single

Asset

4.1 Introduction

Risk and

Return of the investments are interrelated covenants in the selection any

investments, which should be studied through the meaning and definition of risk

and return and their classification of themselves in the first part of this

chapter and the relationship in between them is illustrated in the second half

of the chapter.

Meaning Of Return & Rate Of Return

Return is

the combination of both the regular income and capital appreciation of the

investments.The regular income is nothing but dividend/interest income of the

investments. The capital appreciations of the investments are nothing but the

capital gains of the investments i.e. the difference in between the closing and

opening price of the investments.

Return

symbolized as follows D1 + Pt – Pt – 1 / Pt – 1

These two

categories, Earnings yield and Capital gains yield *Earnings Yield = Earnings

per share / Market price per share***

4.2Concept And Types Of Risk

v The

variability of the actual return from the expected return which is associated

with the investment/asset known as risk of the investment. Variability of

return means that the Deviation in between actual return and expected return

which is in other words as variance i.e., the measure of statistics.

v Greater

the variability means that Riskier the security/ investment. Lesser the

variability means that More certain the returns, nothing but Least risky

.

Interest Rate Risk

It is

risk – variability in a security's return resulting from the changes in the

level of interest rates.

Market Risk

It refers

to variability of returns due to fluctuations in the securities market which is

more particularly to equities market due to the effect from the wars,

depressions etc.

Inflation Risk

Rise in

inflation leads to Reduction in the purchasing power which influences only few

people to invest due to Interest Rate Risk which is nothing but the variability

of return of the investment due to oscillation of interest rates due to

deflationary and inflationary pressures.

Business Risk

.

Business risk is nothing but Operational risk which arises only due to the

presence of the fixed cost of operations.

Financial Risk

Connected

with the raising of fixed charge of funds viz Debt finance & Preference

share capital. More the application of fixed charge of financial will lead to

Greater the financial Risk which is nothing but the Trading on Equity.

Liquidity Risk

Liquidity

risk reflects only due to the quality of benefits with reference to certainty

of return to receive after some period which is normally revealed in terms of quality

of benefits.

Measurement of Risk

Standard Deviation:

v Greater

the standard deviation - Greater the risk

v Does not

consider the variability of return to the expected value

v This may

be misleading - if they differ in the size of expected values

Coefficient

of variation = S.D/ Mean

4.3 Risk And Return Of The Portfolio

v Portfolio

is the Combination of two or more assets or investments.

v Portfolio

Expected Return is the weighted average of the expected returns of the

securities or assets in the portfolio.Weights are the Proportion of total funds

in each

security

which form the portfolio Wj Kj.

v Wj =

funds proportion invested in the security.

v Kj =

expected return for security J.

v Benefits

of portfolio holdings are bearing certain benefits to single assets.

v Including

the various types of industry securities - Diversification of assets.

v It is not

the simple weighted average of individual security.

v Risk is

studied through the correlation/co-variance of the constituting assets of the

portfolio. The Correlation among the securities should be relatively considered

to maximize the return at the given level of risk or to minimize the risk.

v Correlation

of the expected returns of the constituent securities in the portfolio.

It is a

Statistical expression which reveals the securities earning pattern in the

portfolio as

together.

Diversification of the Risk of Portfolio

v Diversification of the portfolio

can be done through the selection of the securities which have negative

correlation among them which formed the portfolio. The return of the risky and

riskless assets is only having the possibilities to bring down the risk of the

portfolio.

v The risk of the portfolio cannot

be simply reduced by way adopting the principle of correlation of returns among

the securities in the portfolio. To reduce the risk of the portfolio, the

classification of the risk has to be studied, which are as follows:

v The risk can be further

classified into two categories viz Systematic and Unsystematic risk of the

securities

Systematic Risk: Which only requires the investors

to expect additional return/ compensation

to bear the

Unsystematic Risk: The investors are not given any such additional

compensation to bear unlike the

earlier. The relationship could be obviously understood through the study of

Capital Asset Pricing Model (CAPM).

Ø Developed

by William F. Sharpe

Ø Explains

the relationship in between the risk and expected / required return

Ø Behaviour

of the security prices

Ø Extends

the mechanism to assess the dominance of a security on the total risk and

return

Ø Highlights

the importance of bearing risk through some premium

Ø No

transaction costs - No intermediation cost during the transaction

Ø No single

investor is to influence the market Risk and Return

Ø Highest return for given level of risk

OrLowest risk for a give n level of return

Ø Risk - Expected value, standard deviation

4.4 Relationship Between The Risk And Return

v Total

Return - Risk free rate of return= Excess return (Risk premium)

v Total

return = Risk free return + Risk premium

v Kj = Rf +

bj (Km–Rf)

v Bj is

nothing but Beta of the security i.e., market responsiveness of the security.

It is normally expressed as a b

v b = Non

Diversifiable risk of asset or Portfolio/ Risk of the Market Portfolio

v Risk of

the portfolio = after diversification, the risk of the market portfolio is non

v diversifiable

5 Valuation Of Bonds And Shares

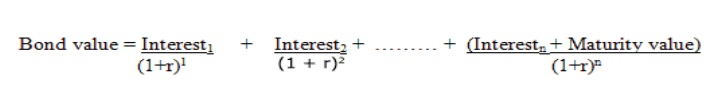

5.1Valuation Of Bonds

A bond or

a debenture is a long-term debt instrument or security. It is issued by

business enterprises or government agencies to raise long-term capital. A bond

usually carries a fixed rate of interest. It is called as coupon payment and

the interest rate is called as the coupon rate. The coupon payment can be

either annually or semi-annually.

Where:

Interest

1 to n = Interests in periods 1 to n.

Unless

otherwise mentioned, the maturity value of the bond is the face value.

When the

required rate of return is equal to the coupon rate, the bond value equals the

par value.

When the

required rate of return is more than the coupon rate, the bond value would be

less than its par value. The bond in this case would sell at a discount.

When the

required rate of return is less than the coupon rate, the bond value would be

more than its par value. The bond in this case would sell at a premium.

5.2 Valuation Of Shares

Factors Which Influence The Value Of Shares

The

factors which influence the value of shares can be broadly classified into two

groups- internal and external factors. They are stated below-

(i)

Internal

factors

v Earning

capacity of assets

v Return on

investments

v Profit

after tax

v Profit

available to equity shareholders

v Earnings

per share

v Dividend

per share or Rate of dividend.

(ii) External Factors

v General

economic condition of the country.

v Political

and social environment.

v International

economic scenario.

v International

political environment.

METHODS OF VALUATION OF SHARES

The

methods of valuation depend on the purpose for which valuation is required.

Generally, there are three methods of valuation of shares:

1.Net Assets Method of Valuation of Shares

Under

this method, the net value of assets of the company is divided by the number of

shares to arrive at the value of each share. For the determination of net value

of assets, it is necessary to estimate the worth of the assets and liabilities.

The goodwill as well as non-trading assets should also be included in total

assets.

Value per

Share= (Net Assets-Preference Share Capital)/Number of Equity Shares

2. Yield or Market Value Method of Valuation Of

Shares

The

expected rate of return in investment is denoted by yield. The term "rate

of return" refers to the return which a shareholder earns on his

investment. Further it can be classified as

(a) Rate

of earning and (b) Rate of dividend. In other words, yield may be earning yield

and dividend yield.

a. Earning Yield

Value per

Share = (Expected rate of earning/Normal rate of return) X Paid up value of

equity share

Expected

rate of earning = (Profit after tax/paid up value of equity share) X 100

b. Dividend Yield

Expected

rate of dividend = (profit available for dividend/paid up equity share capital)

X 100 Value per share = (Expected rate of dividend/normal rate of return) X 100

3. Earning Capacity Method Of Valuation Of Shares

Under

this method, the value per share is calculated on the basis of disposable

profit of the company. The disposable profit is found out by deducting reserves

and taxes from net profit.

Value per

share = Capitalized Value/Number of Shares

6 Option Valuation

An option

is a contract, or a provision of a contract, that gives one party (the option

holder) the right, but not the obligation, to perform a specified transaction

with another party (the option issuer or option writer) according to the

specified terms. The owner of a property might sell another party an option to

purchase the property any time during the next three months at a specified

price.

There are

two options which can be exercised:

v Call

option, the right to buy is referred to as a call option.

v Put

option, the right to sell is referred as a put option.

There are

two types of options: the European options, which can be exercised only at

expiration, and the American options, which may be exercised any time prior to

expiration.

The

American option offers greater flexibility and hence its value, in general, is

greater than the European one.

At this point, we are examining options on stocks

that are not paying any dividends. When a stock pays a dividend then the value

of the stock drops on the ex dividend

date. This predictable drop in the price of a stock will have an effect on the

price of the options on that stock.

6.1 Factors Affecting Value Of

Options

• Price – value

of the call option is directly proportionate to the change in the price of the

underlying.

• Time – as

options expire in future, time has an effect on the value of the options.

• Interest

rates and Volatility – in case where the underlying asset is a bond or

interest rate, interest rate volatility would have an impact on the option

prices.

Properties of Option Values

1. The

minimum value of an option is zero.

This is

because an option is only a choice, not an obligation. The value of an option

cannot be negative, because you do not have to do anything to get rid of it.

The option will always have a zero, or a positive value.

2. The

maximum value of a call option is equal to the value of the underlying asset.

This

makes a lot of economic sense. An option allows you to buy a given asset at a

certain exercise price. The most valuable option will be the one that allows

you to acquire the asset at no cost, and the value of this option will be equal

to the value of the underlying asset.

3. The

total value of an option is the sum of its intrinsic value and its time

premium.

Related Topics