Classification/Division - Types of Companies | 11th Commerce : Chapter 6 : Joint Stock Company

Chapter: 11th Commerce : Chapter 6 : Joint Stock Company

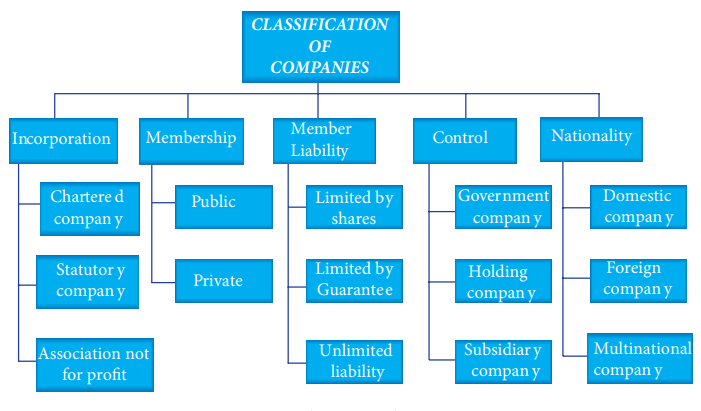

Types of Companies

Types of Companies

1. Classification of Companies on the Basis of Incorporation

a. Chartered Companies

Chartered companies are established

by the King or Queen of a country.

Powers and privileges of chartered company are specified in the charter. Power

to cancel the charter is vested with

King/Queen. Examples: East Indian Company,

Bank of England, Hudson’s Bay

Company. The Companies Act does not apply to them. Such companies cannot be

started in India.

b. Statutory Companies

Companies are established by a Special Act made in Parliament/State

Assembly. Constitution of company is specified

in the Memorandum of Association

(MOA). Rules relating to day-to-day management of statutory companies are specified

in the Articles of Association

(AOA). Audit of statutory company is

conducted by Comptroller and Auditor General of India (CAGI). The report of

CAGI is placed in Parliament/State Assemblies concerned. Examples: Food

Corporation of India, LIC, GIC, RBI, SBI, IDBI, Railways, Electricity, ONGC.

Statutory companies enjoy autonomous status. It need not use the word ‘Limited’

next to its name.

c. Association Not for Profit

According to Section 25, the Central

Government may, by license, grant that an association may be registered as a

company with limited liability, without using the words ‘limited’ or ‘private

limited’ as part of its name. The license will be granted only in the case of

‘association not for profit’. In other words, the Central Government will grant

the license only if it is satisfied that:

(i) The association about to be formed

as a limited company aims at the promotion of Sports, Commerce, Art, Science,

Religion, Charity or any other useful object.

(ii) It intends to apply its profits, if

any, for promoting its objects.

(iii) It prohibits the payment of

dividend to its members.

Such companies may be public or private

companies and may or may not have share capital.

2. Classification of Companies on the Basis of Membership

a. Private Company

Private limited company is a type of

company which is formed with minimum two shareholders and two directors, The

minimum requirement with respect to authorised or paid up capital of Rs. 1,00,000

has been omitted by The Companies (Amendment) Act, 2015 w.e.f. 29th of May,

2015. Another crucial condition of a private limited company is that it by its

articles of association restricts the right to transfer its shares & also

prohibits any invitation to the public to subscribe for any securities of the

company. Maximum of 200 persons can become shareholders in a private company.

The name of private company should be suffixed with pvt ltd or (p) ltd. Ex.

Scientific publishing services private Limited, Chennai. A private Limited

company can be formed in three variations.

(a) as a private limited company; (b) As

a small private limited company; (c) As a One Person Company (OPC).

b. Public Company

Public Company means a company which is

not a private company. A public company may be said to be an association which

i. consists of at least 7 members.

ii. has a minimum paid-up capital of Rs. 5,00,000

or such higher paid up capital as may be prescribed.

iii. is a subsidiary of a company which

is not a private company.

iv. does not restrict the right to

transfer its shares.

v. does not prohibit any invitation to

subscribe for any shares or debentures of the company.

vi. does not prohibit any invitation or

acceptance of deposits. (The name of public company should be suffixed with

ltd. Ex.National Aluminium company Limited, Chennai )

3. Classification of Companies on the Basis of Liability

A company limited by shares is a company

in which the liability of its members is limited by its Memorandum to the

amount (if any) unpaid on the shares respectively held by them. The companies

limited by shares may be either public companies or private companies. If a

member has paid the full amount of shares, then his liability shall be nil.

Thus two main features of a company

limited by shares are as follows:

i. The liability of its members is

limited to the amount (if any) remaining unpaid on the shares held by them.

ii. Such liability can be enforced

either during the lifetime of the company or during the winding up of the

company.

b. Company Limited by Guarantee

A company limited by guarantee is a

company in which the liability of its members is limited by its Memorandum to

such an amount as the members may respectively undertake to contribute to the

assets of the company in the event of its being wound up. Such companies are

generally formed for the promotion of Commerce, Art, Science, Religion, Charity

or any other useful object. The companies limited by guarantee may be either

private companies or public companies.

c. Unlimited Company

An unlimited company is a company in

which the liability of its members is not limited by its Memorandum. In other

words, the liability of members is unlimited i.e., there is no limit on the

liability of members. The members of such companies may be required to pay

company’s losses from their personal property. Because such companies have

separate legal entity, its creditors cannot file a suit against the members

directly. The creditors will have to apply to the court for the winding up of

the company and then the liquidator will direct the members to contribute to

the assets of the company to pay off its liabilities.

4. Classification of Companies on the Basis of Membership

a. Government Companies

A public enterprise incorporated

under the Indian Companies Act,

1956 is called a government company.

These companies are owned and managed by the central or the state government.

Section 617 of the Companies Act, 1956 defines “Government Companies” as any

company in which not less than 51% of the [paid-up share capital] is held by.

1.

The Central Government; or

2.

Any State Government or Governments; or

3.

Partly by the Central Government and

partly by one or more State Governments.

A subsidiary of a Government company

shall also be treated as a Government company. These companies are registered

as private limited companies though their management and their control vest

with the government. This is a type of organization where both the government

and private individuals are shareholders. Sometimes these companies are called

as a mixed ownership company.

Examples:

Steel

Authority of India, Indian Oil Corporation, Oil and Natural Gas Corporation,

Bharath Heavy Electricals.

b. Holding Companies

As per Section 2(87) “subsidiary

company” or “subsidiary”, in relation to any other company (that is to say the

holding company), means a company in which the holding company—

i.

controls the composition of the Board of

Directors; or

ii.

exercises or controls more than one-

half of the total share capital either at its own or together with one or more

of its subsidiary companies:

Provided that such class or classes of

holding companies as may be prescribed shall not have layers of subsidiaries

beyond such numbers as may be prescribed.

c. Subsidiary Companies

“Subsidiary company” or “Subsidiary”, in

relation to any other company (that is to say the holding company), means a

company in which the holding company.

i. controls the composition of the Board

of Directors; or

ii. exercises or controls more than one-

half of the total share capital either at its own or together with one or more

of its subsidiary companies:

Examples:

H Ltd., holds more than 50% of the equity share capital of S Ltd. Now H Ltd.,

is the holding company of S Ltd., and S Ltd., is the subsidiary of H Ltd.

5. Classification of Companies on the Basis of Nationality

a. Domestic Companies

A company which cannot be termed as

foreign company under the provision of the Companies Act should be regarded as a

domestic company.

b. Foreign Companies

A foreign company means a company which

is incorporated in a country outside India under the law of that country. After

the establishment of business in India, the following documents must be filed

with the Registrar of Companies within 30 days from the date of establishment.

(i) A certified copy of the charter or

statutes under which the company is incorporated, or the Memorandum and

articles of the company translated into English.

(ii) The full address of the registered

office of the company.

(iii) A list of directors and secretary

of the company.

(iv) The name and address of any person resident of India who is authorised to accept, on behalf of the company, service of legal process and any notice served on the company.

(v) The full address of the company’s

principal place of business in India.

c. Multi National Companies

A Multi National Company (MNC) is a huge

industrial organisation which,

i. Operates in more than one country

ii. Carries out production, marketing

and research activities on international Scale in those countries.

iii. Seeks to maximise profits world

over.

A domestic company or a foreign company

can be a MNC.

Examples:

Microsoft

Corporation, Nokia Corporation, Nestle, Coca-Cola, International Business

Machine, Pepsico, Sony Corporation.

Related Topics