Accounts of Not-For-Profit Organisation | Accountancy - Steps in preparation of receipts and payments account | 12th Accountancy : Chapter 2 : Accounts of-Not-For Profit Organisation

Chapter: 12th Accountancy : Chapter 2 : Accounts of-Not-For Profit Organisation

Steps in preparation of receipts and payments account

Receipts

and Payments Account

Receipts and Payments

account is a summary of cash and bank transactions of not–for–profit

organisations prepared at the end of each financial year.

It is a real account in

nature. The receipts and payments account begins with the opening balances of

cash and bank and ends with closing balances of cash and bank. All cash

receipts are shown on the debit side and all cash payments are shown on the

credit side of this account. All cash receipts and cash payments whether of

capital or revenue nature will be recorded in the receipts and payments

account. They may relate to the current year or the previous years or the

subsequent years. It means that irrespective of the period for which the amount

is received or paid, it is recorded if cash is received or paid during the

year.

Non–cash items such as

depreciation, outstanding expenses and accrued income are not shown in receipts

and payments account.

1. Steps in preparation of receipts and payments account

Following are the steps

involved in the preparation of receipts and payments account:

a)

Record the opening balance of cash in hand and favourable bank

balance on the debit side of receipts and payments account. If there is bank

overdraft, it must be recorded on the credit side.

b)

Actual cash receipts during the year are recorded on the debit

side and actual cash payments during the year are recorded on the credit side.

c)

While recording cash receipts and payments, no distinction needs

to be made between revenue and capital items. Similarly, no distinction needs

to be made whether the amount received or paid relates to the current period,

previous period or future period.

d)

If the total of the debit side is more than the credit side, the

balancing figure will appear on the credit side. It represents the closing

balance of cash or bank.

e)

If the total of the credit side is more than the debit side, the

balancing figure will appear on the debit side. It represents bank overdraft.

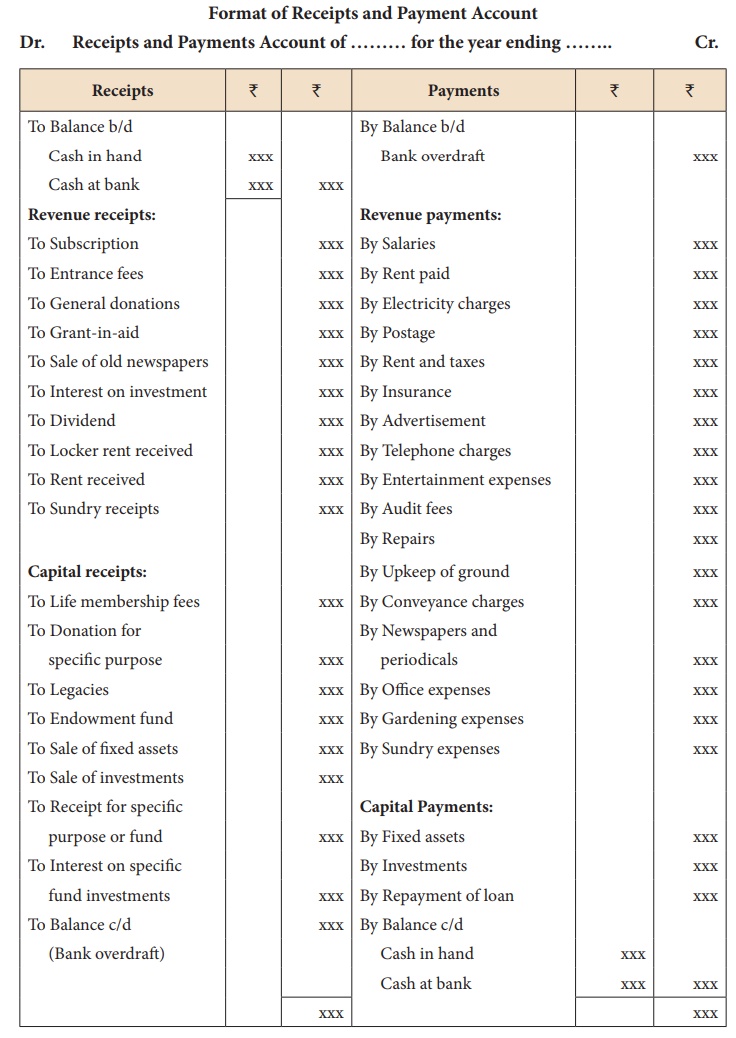

Format of Receipts and

Payment Account

Dr. Receipts

and Payments Account of ……… for the year ending ……..

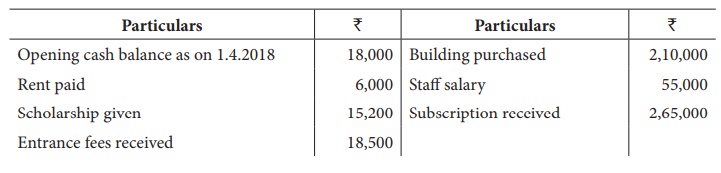

Illustration 1

From the following

particulars of Tamil Educational Society, prepare Receipts and Payments account

for the year ended 31st March, 2019.

Solution

In the books of Tamil

Educational Society

Dr. Receipts

and Payments Account for the year ended 31st March, 2019

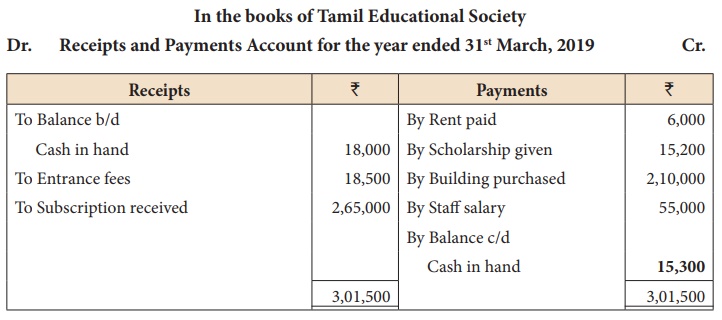

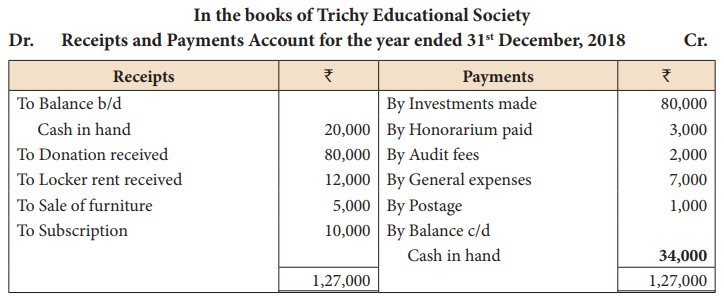

Illustration 2

From the following

particulars of Trichy Educational Society, prepare Receipts and Payments

account for the year ended 31st December, 2018.

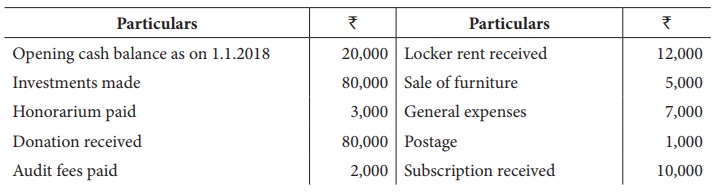

Solution

In the books of Trichy

Educational Society

Dr. Receipts

and Payments Account for the year ended 31st December, 2018

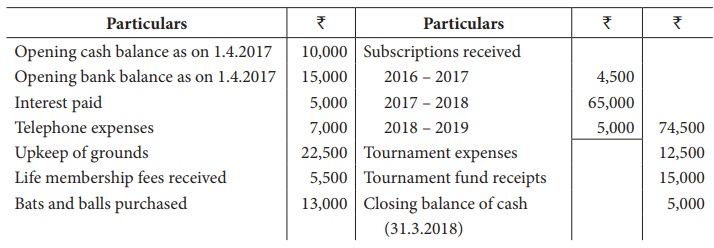

Illustration 3

From the following

particulars of Chennai Sports Club, prepare Receipts and Payments account for

the year ended 31st March, 2018.

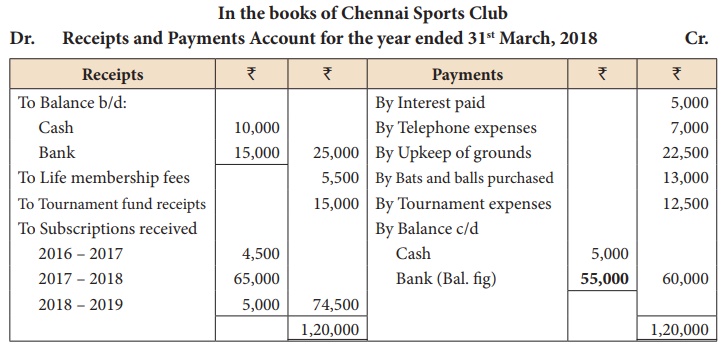

Solution

In the books of Chennai

Sports Club

Dr. Receipts

and Payments Account for the year ended 31st March, 2018

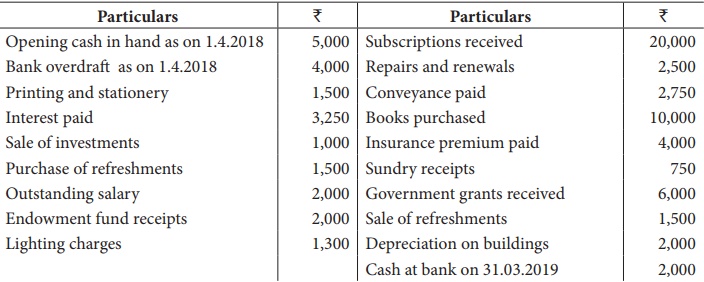

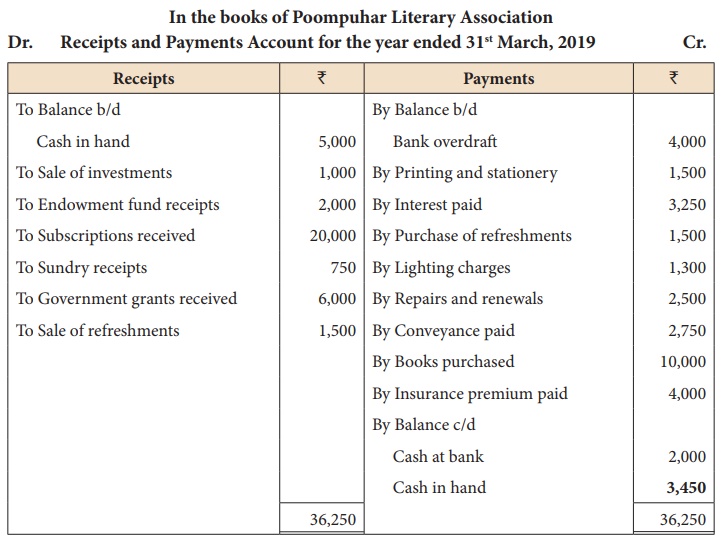

Illustration 4

From the following particulars

of Poompuhar Literary Association, prepare Receipts and Payments account for

the year ended 31st March, 2019.

Solution

In the books of

Poompuhar Literary Association

Dr. Receipts

and Payments Account for the year ended 31st March, 2019

Note: As outstanding salary and

depreciation are non-cash items, both are to be excluded in receipts and

payments account.

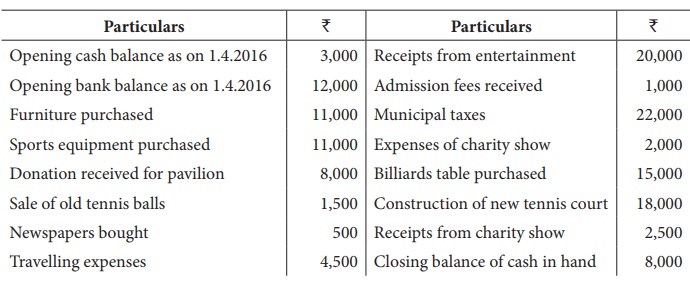

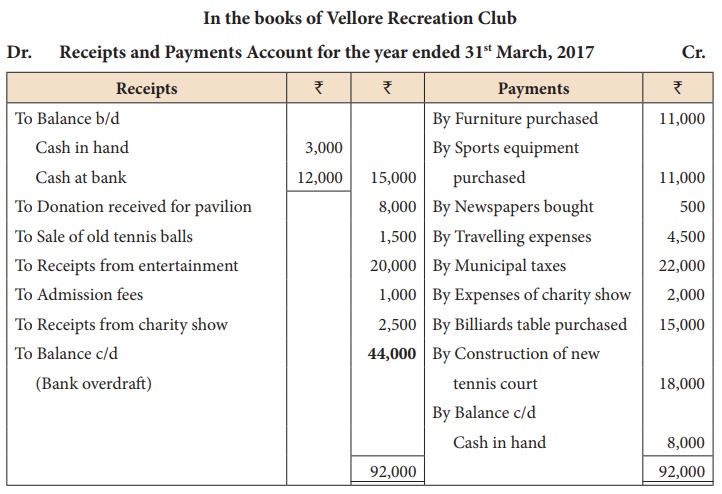

Illustration 5

From the following

particulars of Vellore Recreation Club, prepare Receipts and Payments account

for the year ended 31st March, 2017.

Solution

In the books of Vellore

Recreation Club

Dr. Receipts

and Payments Account for the year ended 31st March, 2017

Related Topics