Accounts of Not-For-Profit Organisation | Accountancy - Income and Expenditure Account | 12th Accountancy : Chapter 2 : Accounts of-Not-For Profit Organisation

Chapter: 12th Accountancy : Chapter 2 : Accounts of-Not-For Profit Organisation

Income and Expenditure Account

Income

and Expenditure Account

Income and expenditure

account is a summary of income and expenditure of a notŌĆōforŌĆōprofit organisation

prepared at the end of an accounting year. It is prepared to find out the

surplus or deficit pertaining to a particular year.

It is a nominal account

in nature in which items of revenue receipts and revenue expenditure, relating

to the current year alone are recorded. It is prepared following the accrual

basis of accounting.

It is just like

preparing a profit and loss account. In this account, incomes are shown on the

credit side and expenses are shown on the debit side. Apart from cash items,

non-cash items such as income accrued but not received, loss or gain on sale of

fixed assets, depreciation, etc. will also be recorded.

It helps to enable the

members to know the working of the organisation and to know whether its income

is sufficient to meet its expenses. It can be prepared from a given receipts

and payments account.

1. Steps in preparation of income and expenditure account from receipts and payments account

Following are the steps

to be followed in preparing income and expenditure account from receipts and

payments account:

i.

Opening and closing balances of cash and bank accounts in receipts

and payments account must be excluded.

ii.

Capital receipts and capital expenditures must be excluded.

iii.

Only revenue receipts pertaining to the current year should be

taken to the credit side of income and expenditure account. Due adjustments

should be made for income received in advance, income accrued for the current

year and for the amount relating to the previous year or years.

iv.

Similarly, revenue expenditure relating to the current year only

must be taken in the debit side of income and expenditure account. Adjustments

must be made for outstanding expenses of the previous year and current year and

for the prepaid expenses of the previous year and current year.

v.

Any income or expense relating to specific fund must not be taken

to income and expenditure account.

vi.

Non-cash items such as bad debts, depreciation, loss or gain on

sale of assets, etc., which are not recorded in receipts and payments account

must be recorded in income and expenditure account.

vii.

The balancing figure of income and expenditure account is either

surplus or deficit and will be transferred to capital fund in the balance

sheet. If the total of credit side of income and expenditure account is more

than the total of debit side (excess of income over expenditure), the difference

represents surplus. If the total of debit side of income and expenditure

account is more than the total of credit side (excess of expenditure over

income), the difference represents deficit.

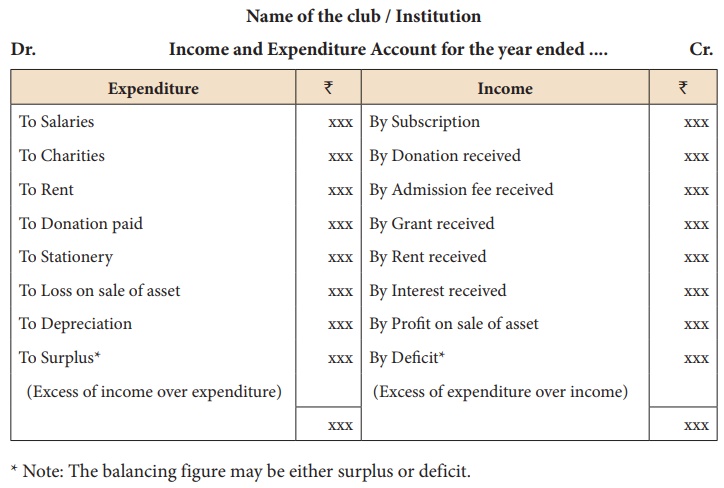

2. Format of Income and Expenditure Account

Name of the club /

Institution

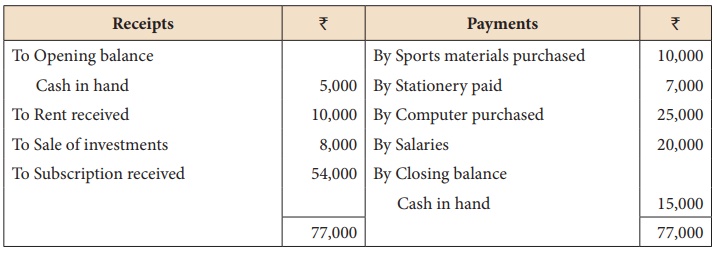

Illustration 6

From the following

Receipts and Payment Account of Ooty Recreation Club, prepare Income and

Expenditure Account for the year ended 31.03.2018.

Solution

In the books of Ooty Recreation Club

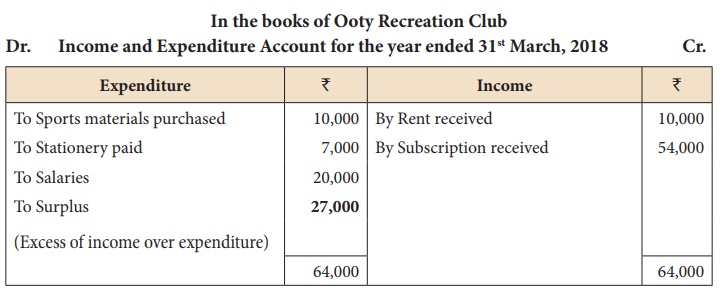

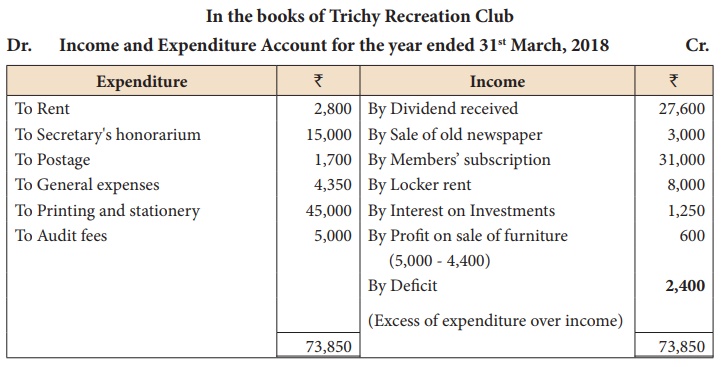

Illustration 7

From the following

Receipts and Payment Account of Trichy Recreation Club, prepare Income and

Expenditure Account for the year ended 31.03.2018.

Solution

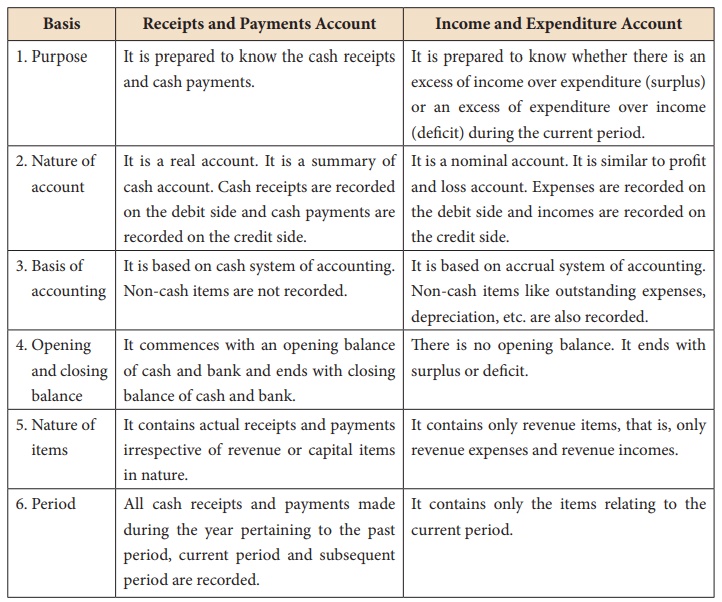

3. Differences between receipts and payments account and income and expenditure account

4. Treatment of revenue receipts

(a) Treatment of subscription in the final accounts of notŌĆōforŌĆōprofit organisation

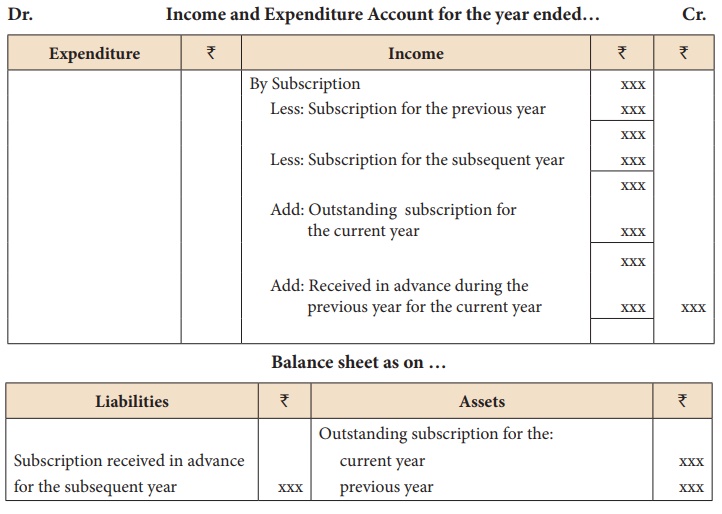

(A) Treatment in Income

and Expenditure Account

When subscription

received for the current year, previous years and subsequent period are given

separately, subscription received for the current year will be shown on the

credit side of Income and Expenditure Account after making the adjustments

given below:

i.

Subscription outstanding for the current year is to be added.

ii.

Subscription received in advance in the previous year which is

meant for the current year, is to be added.

When total subscription

received during the current year is given, that total subscriptions received

during the current year will be shown on the credit side of Income and

Expenditure Account after making the following adjustments:

i.

Subscription outstanding in the previous year which is received in

the current year will be subtracted. Subscription outstanding for the current

year is added.

ii.

Subscriptions received in advance in the previous year which is

meant for the current year, is added and subscriptions received in advance in

the current year which is meant for the subsequent year must be subtracted.

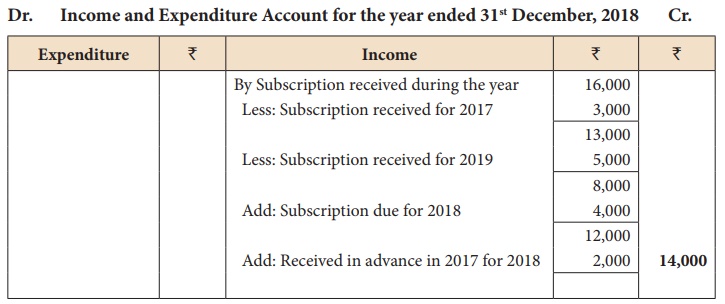

(B) Treatment in Balance

Sheet

i.

Subscriptions outstanding for the current year and still

outstanding for the previous year will be shown on the assets side of the

balance sheet.

ii. Subscriptions received in advance in the current year will be shown on the liabilities side of the balance sheet.

Dr.

Income and Expenditure Account for the year endedŌĆ” Cr.

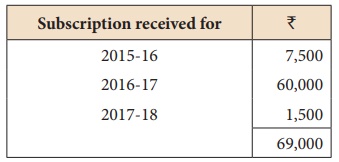

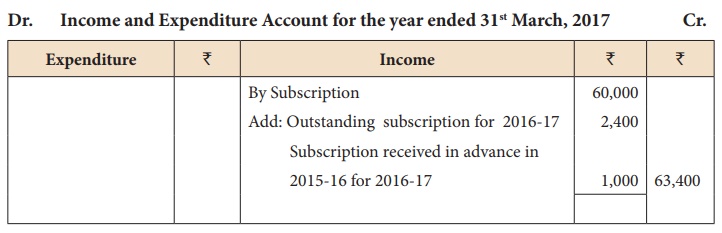

Illustration 8

From the following

details calculate the amount that will be shown as subscription in Income and

Expenditure Account for the year ending 31st March, 2017.

Subscription outstanding

for the year 2016-17 is Ōé╣

2,400. Subscription for 2016-17 received in 2015-16 was Ōé╣ 1,000.

Solution

Tutorial note

(i) Subscription for the

year 2015-16 Ōé╣ 7,500 and for the year

2017-18 Ōé╣ 1,500 do not relate to

the current year. So they should not be recorded in Income and Expenditure

Account.

(ii) Subscription

outstanding for the current year 2016-17 is Ōé╣

2,400. It should be added with the amount of subscription received during

2016-17.

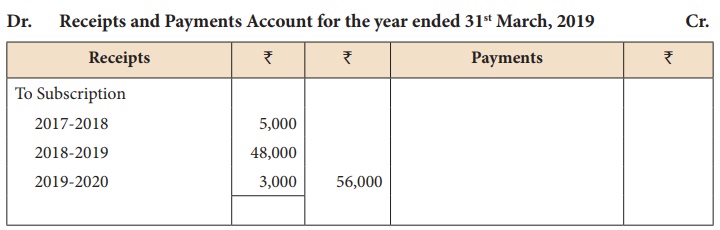

Illustration 9

How the following items

will appear in the final accounts of a club for the year ending 31st March,

2019?

There are 300 members in

the club each paying an annual subscription of Ōé╣ 200 per annum.

Subscription still

outstanding for the year 2017- 2018 is Ōé╣

1,000.

Solution:

Tutorial note

Total Subscription due for current the year (2018-19) 300 x ` 200 = Ōé╣ 60,000

Less: Amount received for the current year (2018-19) = Ōé╣ 48,000

-----------------------------

Outstanding subscription for the current year (2018-2019) = Ōé╣ 12,000

-----------------------------

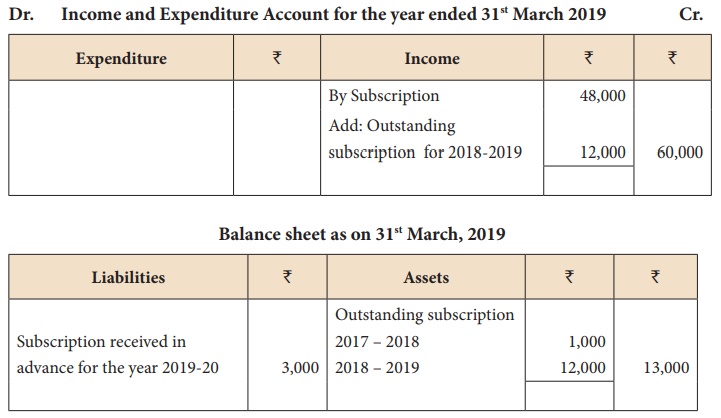

Illustration 10

How will the following

items appear in the final accounts of a club for the year ending 31st March

2017? A club received subscription of Ōé╣

25,000 during the year 2016-17. This includes subscription of Ōé╣ 2,000 for 2015-16 and Ōé╣ 1,500 for the year

2017-18. Subscription of Ōé╣

500 is still outstanding for the year 2016-17.

Solution

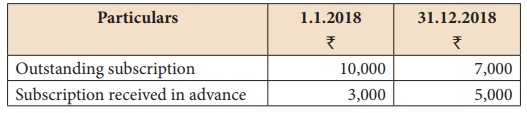

Illustration 11

Compute income from

subscription for the year 2018 from the following particulars relating to a

club.

Subscription received

during the year 2018: Ōé╣

1,50,000.

Solution

Calculation of income

from subscription for the year 2018

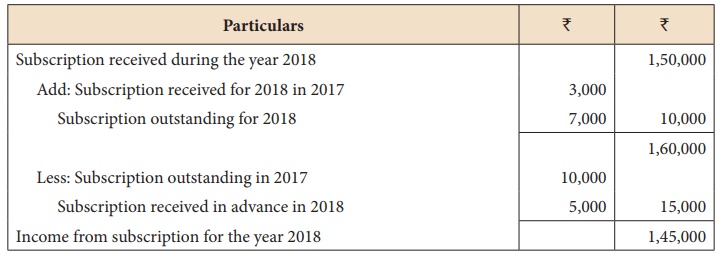

Illustration 12

From the following

particulars, show how the item ŌĆśsubscriptionŌĆÖ will appear in the Income and

Expenditure Account for the year ended 31-12-2018?

Subscription received in

2018 is Ōé╣ 16,000 which includes Ōé╣ 3,000 for 2017 and Ōé╣ 5,000 for 2019.

Subscription outstanding for the year 2018 is Ōé╣ 4,000. Subscription of Ōé╣ 2,000 was received in

advance for 2018 in the year 2017.

Solution

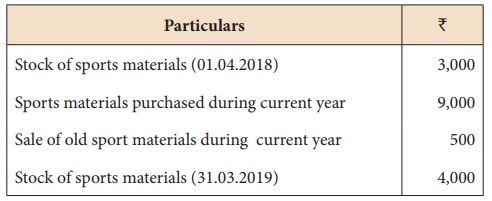

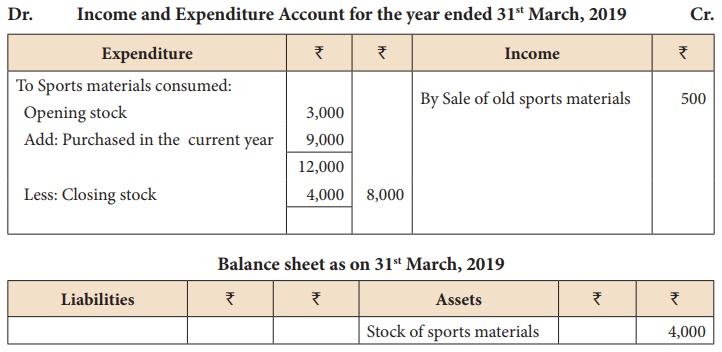

(b) Treatment of consumable items such as sports materials, stationery items, medicines, etc.

i.

Consumable items such as sports materials, stationery, medicines,

etc., consumed during the year will appear on the debit side of income and

expenditure account.

ii.

Consumption = Opening stock + Purchases during the current year -

Closing stock

iii.

Closing stock will appear on the assets side of the balance sheet

as at the end of the year.

iv.

If there is any sale of old sports materials, etc., that will be

shown on the credit side of income and expenditure account or can be subtracted

from the respective items consumed on the debit side of income and expenditure

account.

Illustration 13

How will the following

items appear in the final accounts of a sports club?

Solution

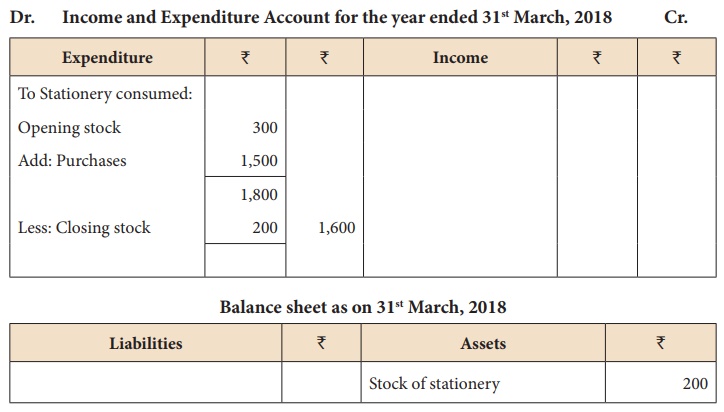

Illustration 14

From the following

details calculate the printing and stationery to be debited to Income and

Expenditure Account for the year ending 31st March, 2018 and also show how it

will appear in the Balance Sheet as on 31st March, 2018.

Amount paid for

stationery during 2017- 2018 = Ōé╣ 1,500

Stock of stationery on

1st April, 2017 = Ōé╣ 300

Stock of stationery on 31st March, 2018 = Ōé╣ 200

Solution:

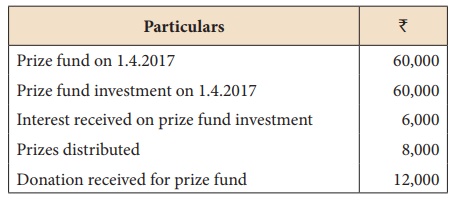

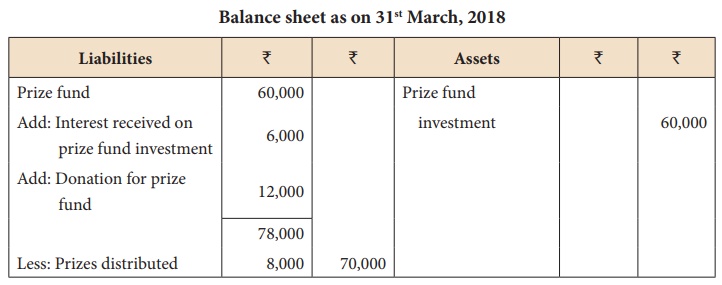

(c) Treatment of incomes and expenses pertaining to specific funds

i.

Specific fund is to be shown on the liabilities side and specific

fund investments account is to be shown on the assets side of the balance

sheet.

ii.

Incomes and expenses relating to the specific fund account should

not be recorded in income and expenditure account.

iii.

Incomes relating to the fund should be added to the fund account

and expenses relating to the fund should be subtracted from the fund account in

the balance sheet prepared as at the end of the year.

iv.

If interest is accrued on specific fund investments for the current

year, then it should be added along with the fund account on the liabilities

side and should also be shown on the assets side of the balance sheet as

accrued interest on investments.

Illustration 15

How will the following

appear in the final accounts of a club for the year 2017 ŌĆō2018?

Solution

Related Topics