Stages, Example Illustration, Solution - Rectification of errors | 11th Accountancy : Chapter 9 : Rectification of Errors

Chapter: 11th Accountancy : Chapter 9 : Rectification of Errors

Rectification of errors

Rectification of errors

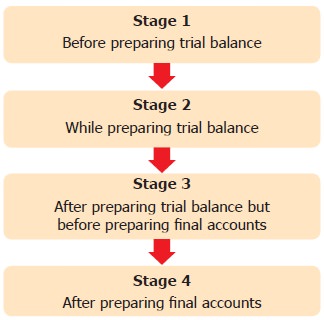

Depending on the stage at which errors are located, they are

subsequently rectified at the respective stage itself.

1. Stages of rectification of errors

The following are the various

stages of rectification of errors:

(i) Rectification of errors before preparing trial balance

If the accountant finds time before preparing trial balance to recheck

the entries made in the journal, postings in the ledger accounts, amounts

carried forward and balancing of ledger accounts with the intention of ensuring

their correctness, he/she will be able to locate and rectify the errors at that

stage itself.

(a) Rectification of one-sided errors before preparing trial balance

When one-sided error is detected before preparing the trial balance, no

journal entry is required to be passed in the books. In such cases, the error

can be rectified by giving an explanatory note in the account affected as to

whether the concerned account is to be debited or credited.

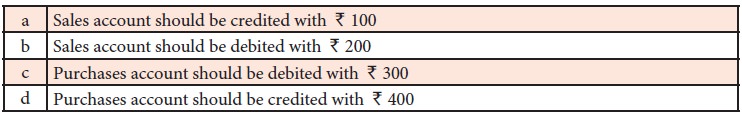

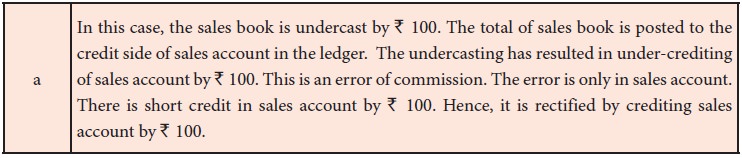

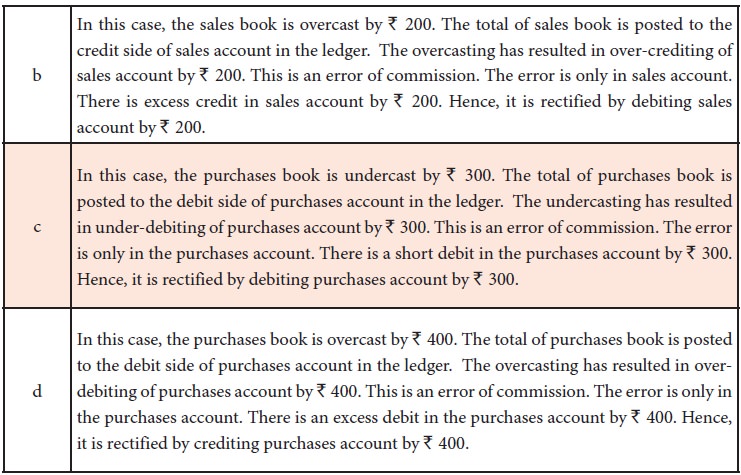

Illustration 1 (Errors in casting)

The following errors were detected before the preparation of trial

balance. Rectify them.

a. Sales book is undercast by

Rs. 100

b. Sales book is overcast by

Rs. 200

c. Purchases book is undercast by

Rs. 300

d. Purchases book is overcast by Rs. 400

Solution

Note

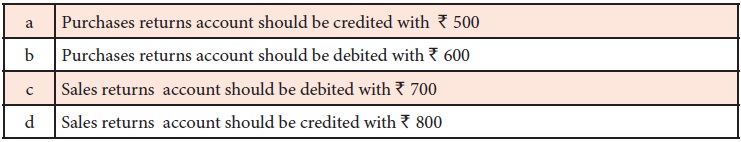

Illustration 2 (Errors in casting)

The following errors were

detected before preparation of trial balance. Rectify them.

a. Purchases returns book is undercast by Rs. 500.

b.

Purchases

returns book is overcast by Rs. 600.

c.

Sales

returns book is undercast by Rs. 700.

d.

Sales

returns book is overcast by Rs. 800.

Solution

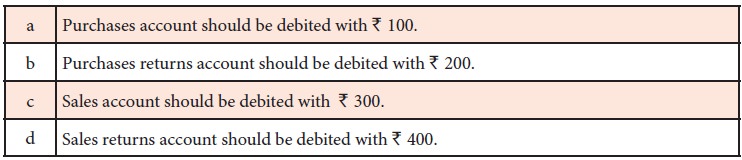

Illustration 3 (Errors in carry forward)

The following errors were detected before preparation of trial balance.

Rectify them.

a.

The total

of purchases book is carried forward to the next page Rs. 100 short.

b.

The total

of purchases returns book is carried forward to the next page Rs. 200 excess.

c.

The total

of sales book is carried forward to the next page Rs. 300 excess.

d.

The total

of sales returns book is carried forward to the next page Rs. 400 short.

Solution

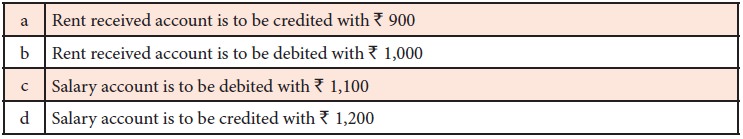

Illustration 4 (Errors in carry forward)

The following errors were

detected before preparation of trial balance. Rectify them.

a.

The total

of rent received account is carried forward Rs. 900 short.

b.

The total

of rent received account is carried forward Rs. 1,000 excess.

c.

The total

of salary account is carried forward Rs. 1,100 short.

d.

The total

of salary account is carried forward Rs. 1,200 excess.

Solution

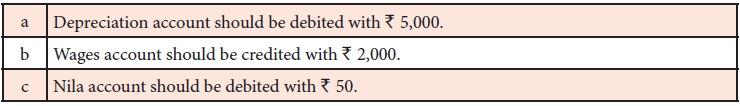

Illustration 5 (Errors in posting)

The following errors were

detected before preparation of the trial balance. Rectify them.

a.

A sum of Rs. 5,000 written off as depreciation

on buildings has not been posted to depreciation account.

b.

Payment

of wages Rs. 2,000 to

Venkat was posted twice to wages account.

c.

An amount

of Rs. 250 for a

credit sale of goods to Nila, although correctly entered in the sales book, has

been posted as Rs. 200.

Solution

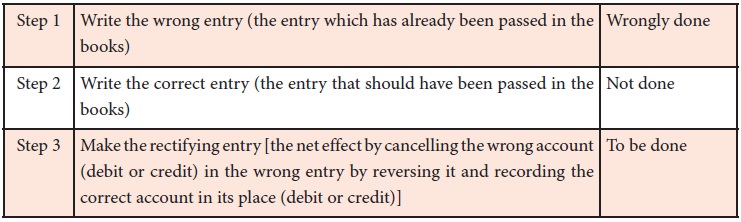

(b) Rectification of two-sided errors before preparing the trial balance

When a two-sided error is detected before preparing the trial balance,

it must be rectified by passing a rectifying journal entry in the journal

proper after analysing the error.

Practical steps to be followed in rectifying two-sided errors

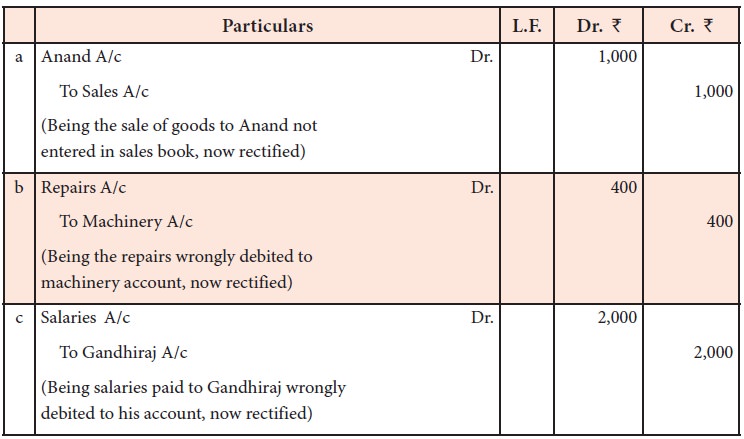

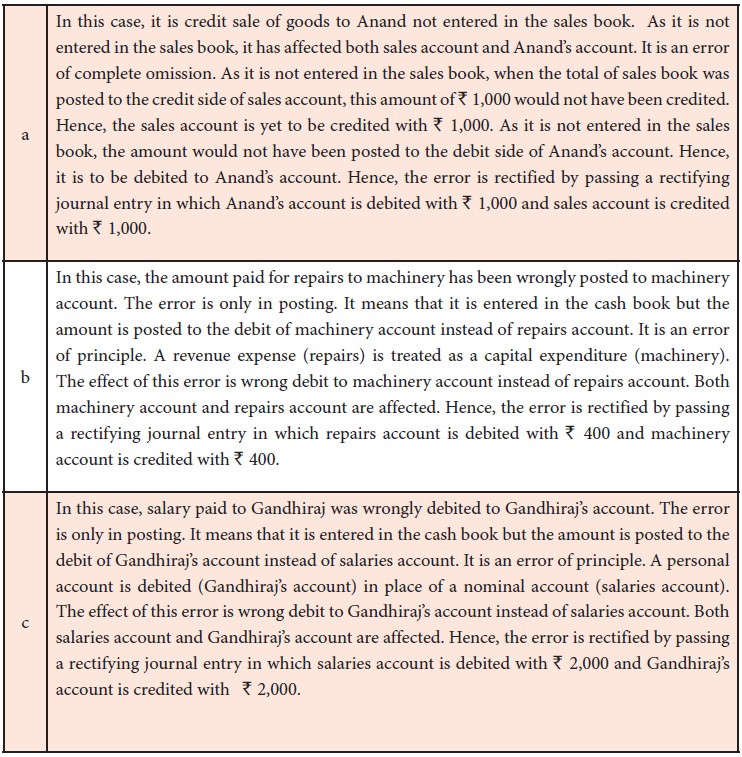

Illustration 6

The following errors were located

before the preparation of the trial balance. Rectify them.

a.

Goods

sold to Anand for Rs. 1,000 on

credit was not entered in the sales book.

b.

An amount

of Rs. 400 paid for

repairs to the machinery stands wrongly posted to machinery account.

c. Salaries Rs. 2,000 paid to Gandhiraj was wrongly debited to his personal account in the ledger.

Solution

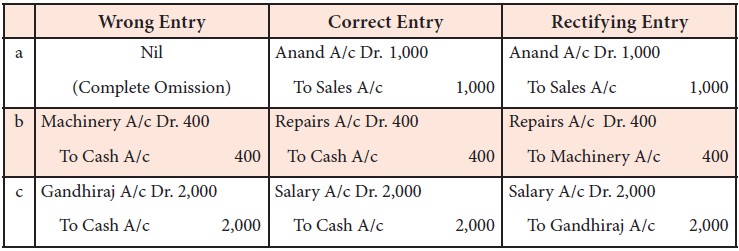

Method of deriving the rectifying entries

Note

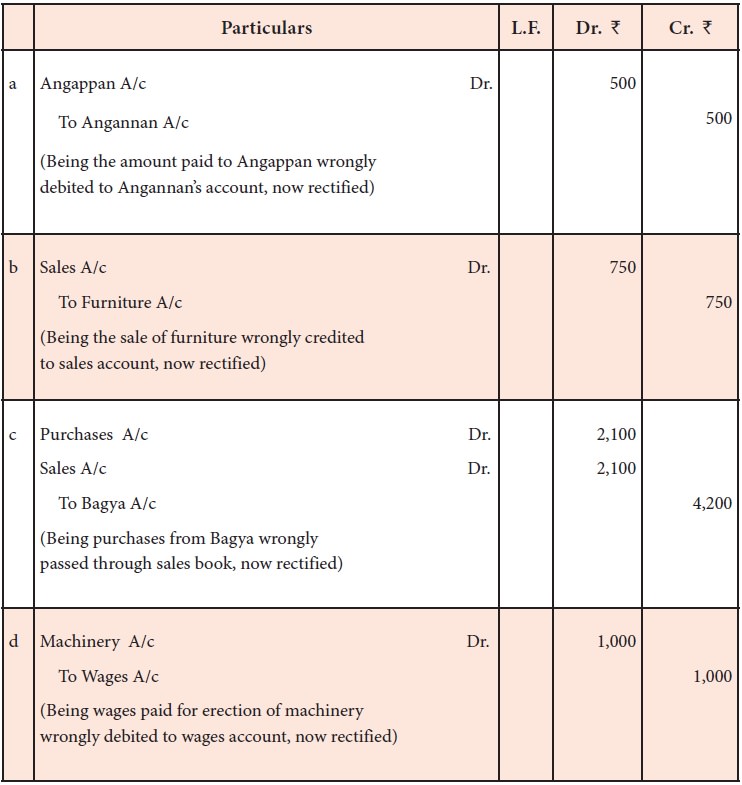

Illustration 7

The following errors were located

before the preparation of the trial balance. Rectify them.

a.

Paid Rs. 500 to Angappan were wrongly

debited to Angannan’s account.

b.

Sale of

furniture for Rs. 750 was

credited to sales account.

c.

Purchase

of goods from Bagya for Rs. 2,100 was wrongly passed through sales book.

d.

Wages Rs. 1,000 paid on erection of

machinery were debited to wages account.

Solution

Method of deriving the rectifying entries

(ii) Rectification of errors while preparing the trial balance

Errors can be rectified at the

time of preparing the trial balance as follows:

(a) Rectification of one-sided errors while preparing the trial balance

While preparing the trial balance, if the total of debit balances and

credit balances are not the same, there is disagreement of trial balance. It

shows that there are errors in the books of accounts. As a consequence, the

accountant may start locating errors before closing the trial balance. In such

cases, the errors are rectified at that stage itself. At this stage, the

rectification of one-sided errors is made in the same manner as in the case of

rectification before preparing trial balance. Rectifying journal entries are

not required to be passed in the books. In such cases, errors can be rectified

by giving an explanatory note in the account affected.![]()

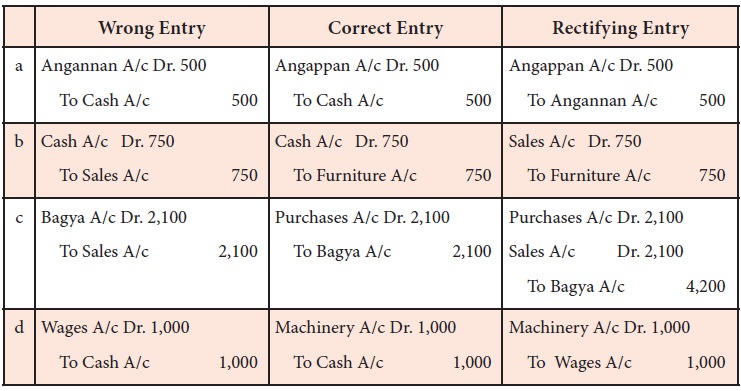

Illustration 8

The following errors were located at the time of preparation of the

trial balance. Rectify them.

a.

Sale of

goods to Akila on credit for Rs. 1,520 posted to her account as Rs. 1,250.

b.

Bought

goods from Narendran on credit for Rs. 5,500, credited to his account as Rs. 5,050.

c.

Purchase

of furniture from Ravivarman for Rs. 404 on credit were debited to furniture

account as Rs. 440.

d.

Purchased

machinery for cash Rs. 2,000 was

not posted to machinery account.

e.

The total

of purchases book Rs. 899 was carried

forward as Rs. 989.

Solution

(b) Rectification of two-sided errors while preparing the trial balance

Rectification of two-sided errors at the time of preparing the trial

balance is just similar to that of their rectification before preparation of

trial balance.

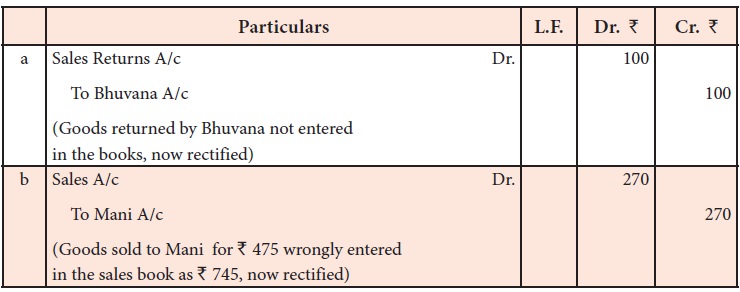

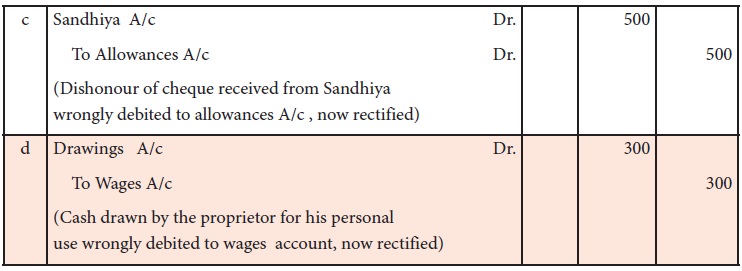

Illustration 9

The following errors were located at the time of preparation of the

trial balance. Pass rectifying entries.

a.

Goods of

the value of Rs. 100 returned

by Bhuvana were included in stock, but no entry was made in the books.

b.

Sale of

goods to Mani on credit for Rs. 475 has been wrongly entered in the sales book

as Rs. 745.

c.

A cheque

of Rs. 500 received

from Sandhiya was dishonoured and debited to allowances account.

d.

A sum of Rs. 300 drawn by the proprietor for

personal use was debited to wages account.

![]()

Solution

Method of deriving the rectifying entries

(iii) Rectification of errors

after preparing the trial balance but before preparing the final accounts

(a) Rectification of one-sided errors after preparing the trial balance

If there is disagreement of trial balance and if it is not possible

immediately to locate errors, the accountant may place the difference to

‘suspense account’. After that, before the preparation of final accounts, the

entries, postings, castings, balancing of accounts and amounts carried forward

are scrutinised to locate the errors.

At this stage, every one-sided

error is rectified by passing a rectifying journal entry with the respective

account (debited or credited) and suspense account (credited or debited). The

suspense account is used to rectify such errors so that the difference in trial

balance placed to that account gets adjusted. Once all the one-sided errors are

completely rectified, the balance in the suspense account gets eliminated.

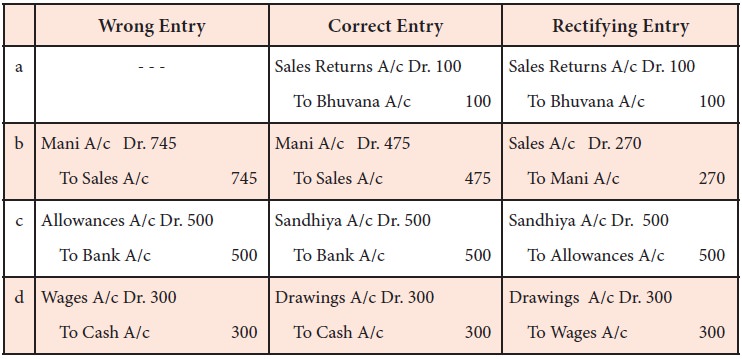

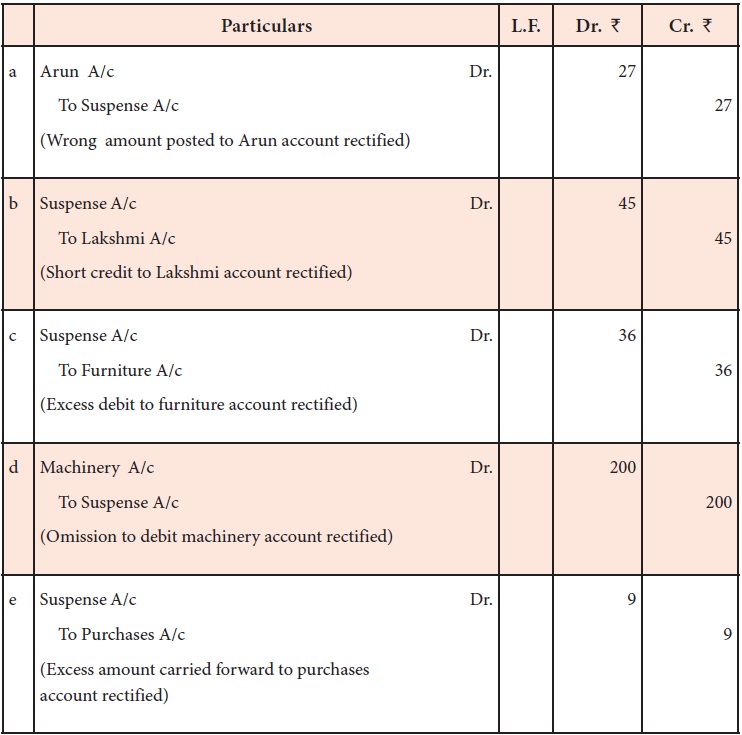

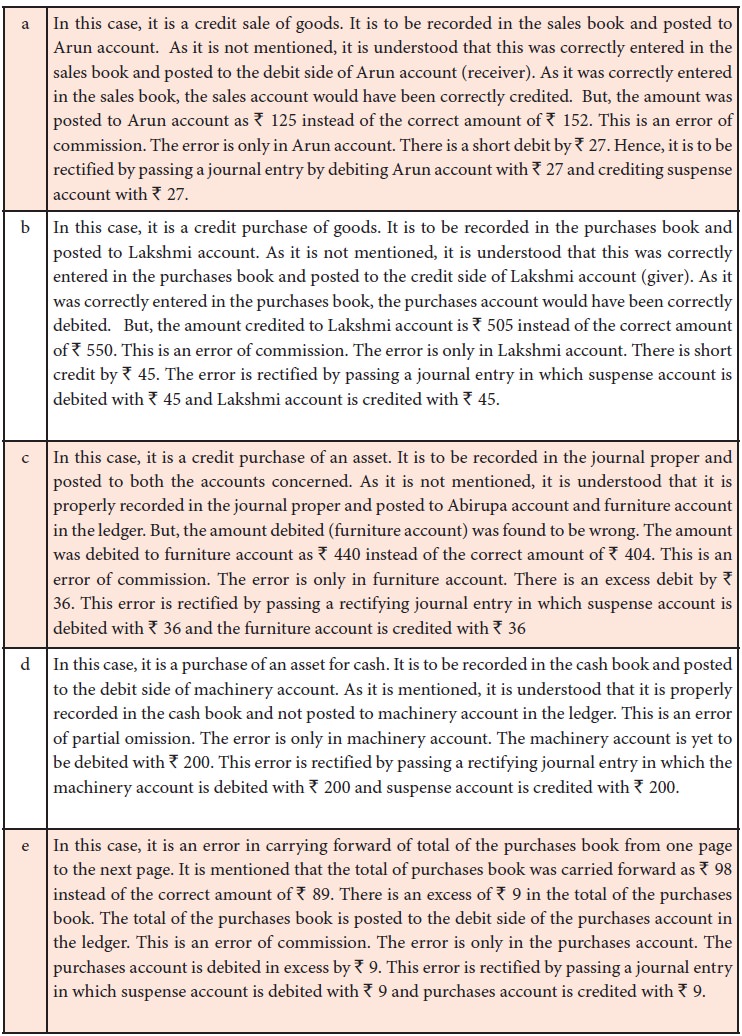

Illustration 10

The following errors were located after the preparation of the trial

balance. Assume that there exists a suspense account. Rectify them.

a.

Sale of

goods on credit to Arun for Rs. 152 posted to his account as Rs. 125.

b.

Bought

goods from Lakshmi on credit for Rs. 550, credited to her account as Rs. 505.

c.

Purchase

of furniture from Abirupa for Rs. 404 on credit was debited to furniture account

as Rs. 440.

d.

Purchased

machinery for cash Rs. 200 was not

posted to machinery account.

e.

The total

of purchases book Rs. 89 was

carried forward as Rs. 98.

Solution

Tutorial note

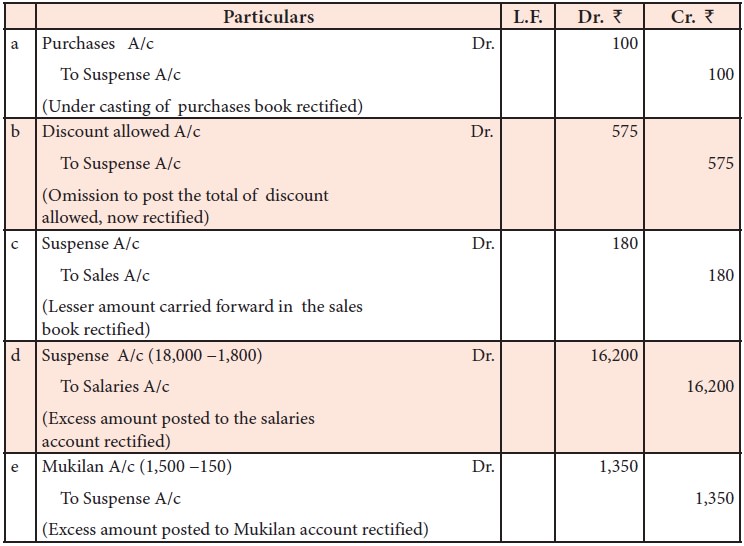

Illustration 11

The following errors were located after the preparation of the trial

balance. Assume that there exists a suspense account. Pass journal entries to

rectify them.

a.

The total

of purchases book was undercast by Rs. 100.

b.

The total

of the discount column on the debit side of cash book Rs. 575 were not posted.

c.

The total

of one page of the sales book for Rs. 5,975 were carried forward to the next page as

Rs. 5,795.

d.

Salaries Rs. 1,800 were posted as Rs. 18,000.

e.

Purchase

of goods on credit from Mukilan for Rs. 150 have been posted to his account as Rs. 1,500.

Solution

(b) Rectification of two-sided errors after preparing the trial balance

At this stage, every two-sided

error is rectified by passing a rectifying journal entry by debiting one of the

accounts affected and crediting the other account. As these errors do not cause

difference in trial balance, the suspense account is not used in the rectifying

journal entries. Therefore, the rectifying entries passed for rectifying

two-sided errors before preparation of trial balance and after preparation of

trial balance are the same.

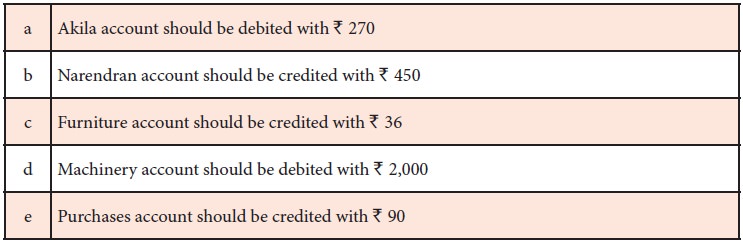

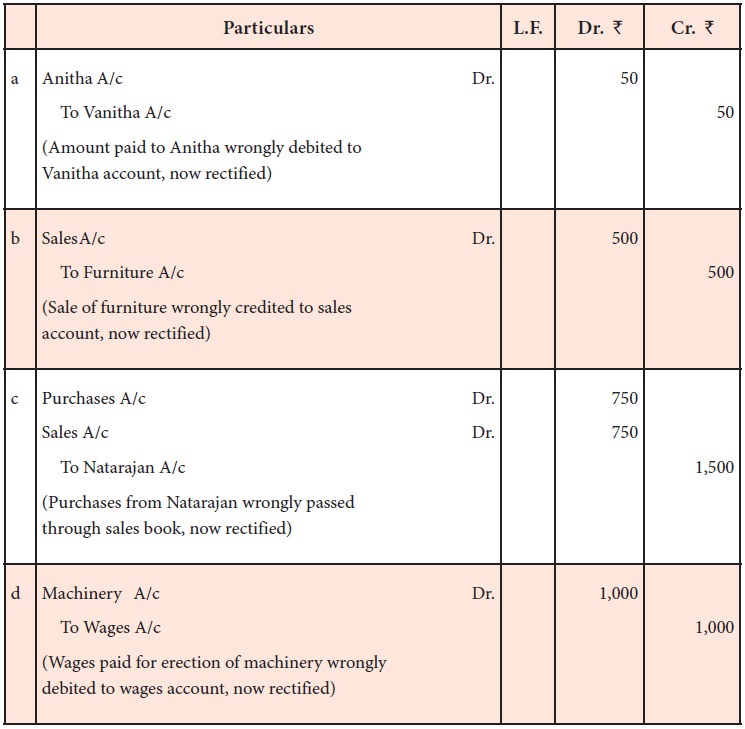

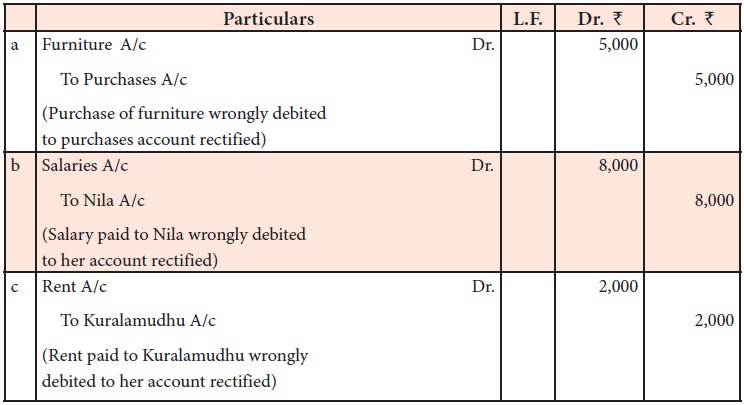

Illustration 12

The following errors were located after the preparation of the trial

balance. Rectify them.

a.

Paid Rs. 50 to Anitha was wrongly debited

to Vanitha account.

b.

Sale of

furniture for Rs. 500 was

credited to sales account.

c.

Purchased

goods from Natarajan on credit for Rs. 750 were wrongly passed through sales book.

d.

Wages Rs. 1,000 paid on erection of

machinery was debited to wages account.

Solution

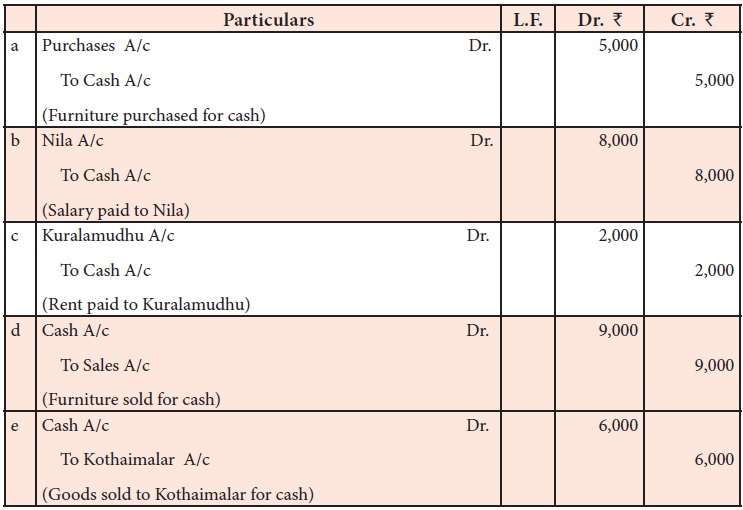

Illustration 13

Rectify the following journal

entries.

Solution

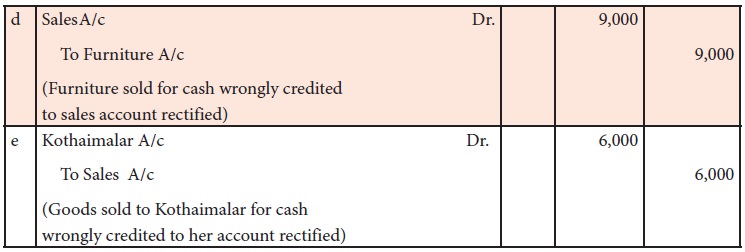

Illustration 14 (One-sided errors and two-sided errors)

Pass journal entries to rectify the following errors located after the

preparation of the trial balance. Assume that there exists a suspense account.

a.

The total

of sales book was undercast by Rs. 2,000.

b.

The

purchase of machinery for Rs. 3,000 was entered in the purchases book.

c.

A credit

sale of goods for Rs. 45 to Mathi

was posted in his account as Rs. 54.

d.

The

purchases returns book was overcast by Rs. 200.

e. The total of sales book Rs. 1,122 were wrongly posted in the ledger as Rs. 1,222.

Solution

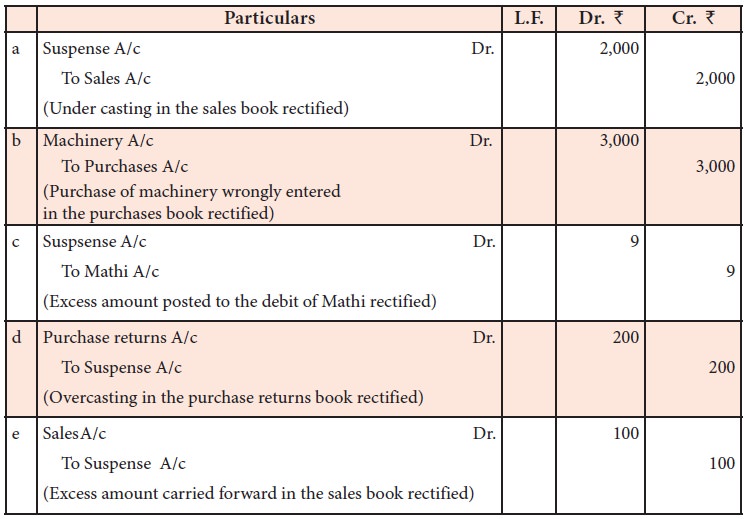

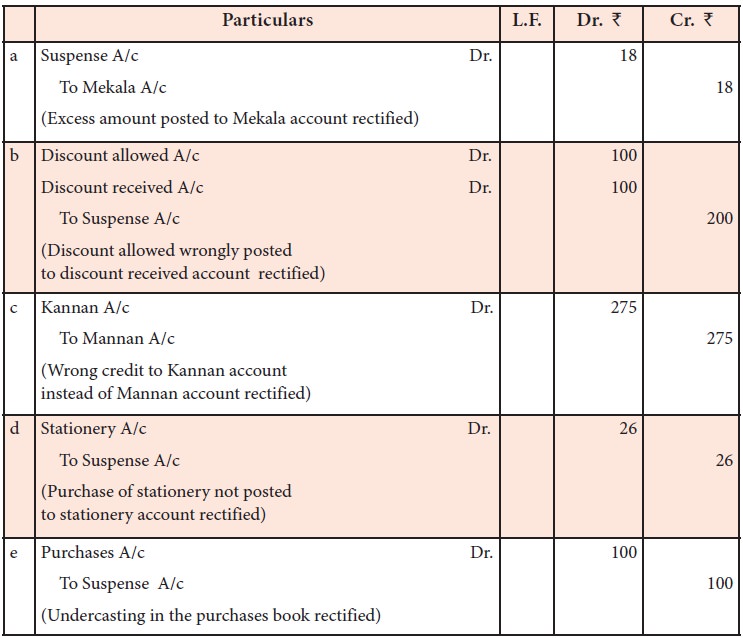

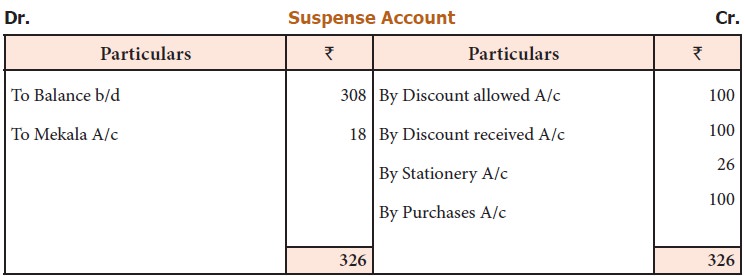

Illustration 15 (One-sided errors and two-sided errors with preparation of suspense account)

A book-keeper finds that the debit column of the trial balance is short

by Rs. 308 and the difference is put to a suspense

account. Subsequently, the following errors were located.

a.

An entry

for sale of goods on credit for Rs. 102 to Mekala was posted to her account as Rs. 120.

b.

Rs. 100 being the monthly total of discount allowed to

customers was credited to discount

received account in the ledger.

c.

Rs. 275 paid by Mannan was credited to Kannan account.

d.

Rs. 26 appearing in the cash book as paid for the

purchase of stationery for office use has not

been posted to ledger.

e.

The

purchases book was undercast by Rs. 100.

Rectify the errors and prepare

supense account.

Solution

(iv) Location and rectification of errors after preparing the final accounts

Sometimes, though there is disagreement of trial balance, due to lack of

time and urgency in the completion of final accounts, the accountant may not

locate and rectify the errors. Under such circumstances, the difference in

trial balance is placed to the suspense account, which may show either debit

balance or credit balance. If it shows a debit balance, it is shown on the

assets side. If it shows a credit balance, it is shown on the liabilities side.

The errors will be located and rectified by the accountant during the next

accounting period. If the error to be rectified is in a nominal account, it

affects the profit or loss of the business. Hence, instead of debiting or

crediting them for rectification, profit and loss adjustment account is debited

or credited. If the error to be rectified is in a real account or personal

account, the respective real account or personal account itself is debited or

credited for rectification. After all the errors are rectified, the net effect

on profit is calculated by preparing profit and loss adjustment account and the

balance is transferred to capital account.

Related Topics