Accountancy - Classification of errors | 11th Accountancy : Chapter 9 : Rectification of Errors

Chapter: 11th Accountancy : Chapter 9 : Rectification of Errors

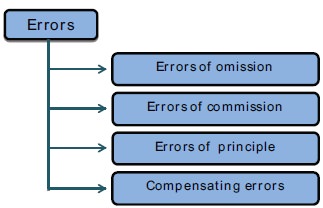

Classification of errors

Classification of errors

The errors can be classified into

four types as follows:

1. Error of omission

The failure of the accountant to record a transaction or an item in the

books of accounts is known as an error of omission. It can be complete omission

or partial omission.

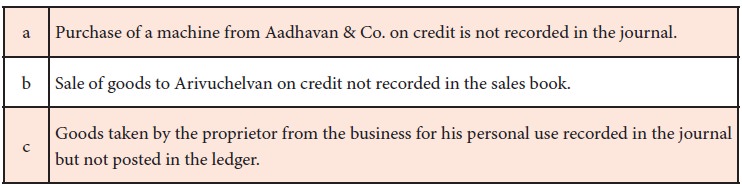

(i) Error of complete omission

It means the failure to record a transaction in the journal or subsidiary

book or failure to post both the aspects in ledger. This error affects two or

more accounts.

Examples

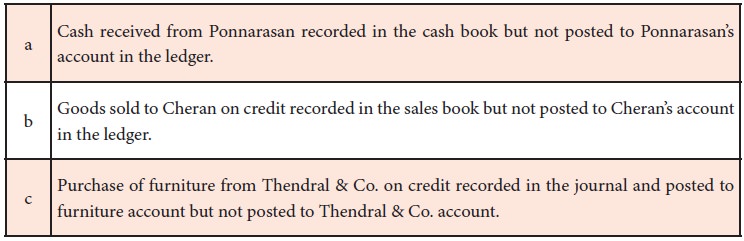

(ii) Error of partial omission

When the accountant has failed to record a part of the transaction, it is known as error of partial omission. This error usually occurs in posting. This error affects only one account.

Examples

2. Error of commission

When a transaction is incorrectly recorded, it is known as error of

commission. It usually occurs due to lack of concentration or carelessness of

the accountant.

The following are the

possibilities of error of commission:

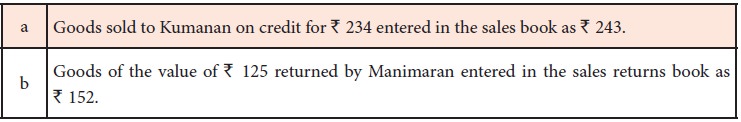

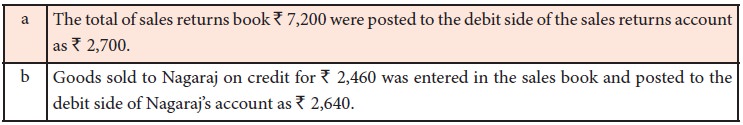

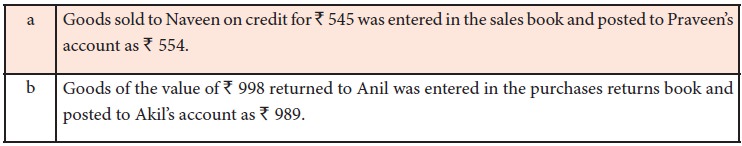

i. Entering a wrong amount in a correct subsidiary book

Examples

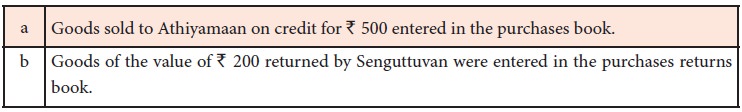

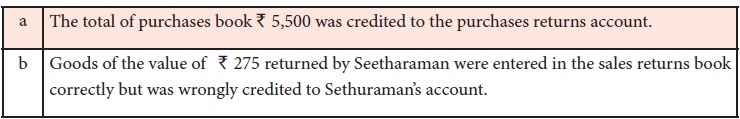

ii. Entering a correct amount in a wrong subsidiary book

Examples

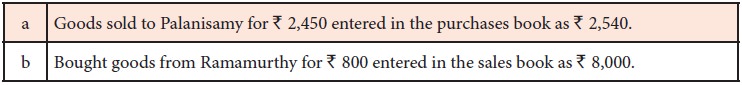

iii. Entering a wrong amount in a wrong subsidiary book

Examples

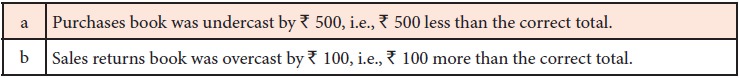

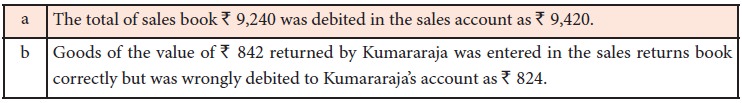

iv. Over-casting or under-casting in a subsidiary book

Examples

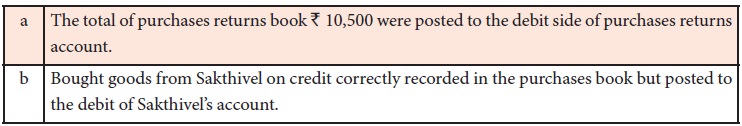

v. Posting a correct amount to the wrong side of an account in the Ledger

Examples

vi. Posting a wrong amount to the correct side of an account

Examples

vii. Posting a wrong amount to the wrong side of an account

Examples

viii. Posting a correct amount to a wrong account

Examples

ix. Posting a wrong amount to a wrong account

Examples

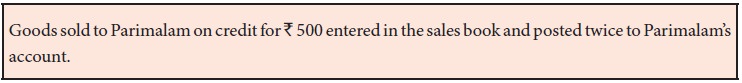

x. Double posting in an account

Example

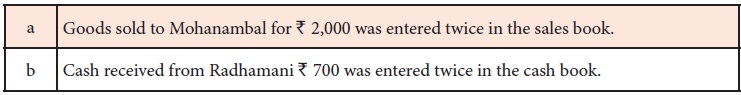

xi. Entering a transaction twice in the journal

Examples

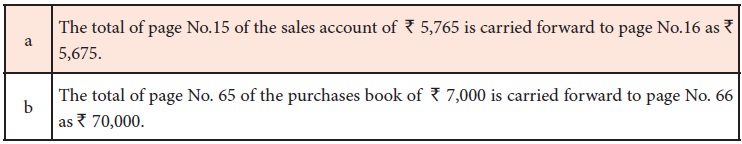

xii. Errors arising in carrying forward from one page to the next page of an account

While carrying forward the total of one page of a ledger account to the

next page, the wrong amount may be recorded

(xiii) Error arising in the balancing of an account

Sometimes, at the time of balancing a ledger account, the wrong balance

may be written.

3. Error of principle

It means the mistake committed in the application of fundamental

accounting principles in recording a transaction in the books of accounts.

The following are the

possibilities of error of principle:

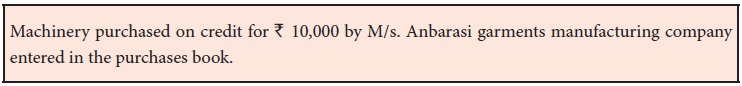

i. Entering the purchase of an asset in the purchases book

Example

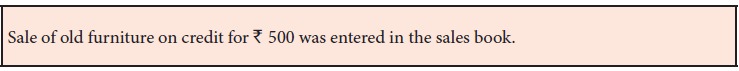

ii. Entering the sale of

an asset in the sales book

Example

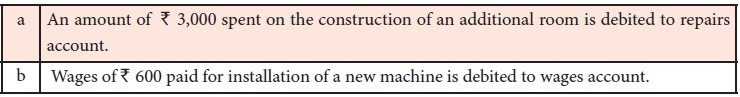

iii. Treating a capital expenditure as a revenue expenditure

Examples

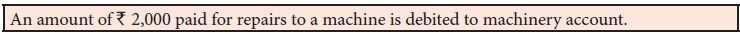

iv. Treating a revenue expenditure as a capital expenditure

Example

4. Compensating errors

The errors that make up for each other or neutralise each other are

known as compensating errors. These errors may occur in related or unrelated

accounts. Thus, excess debit or credit in one account may be compensated by

excess credit or debit in some other account. These are also known as

offsetting errors.

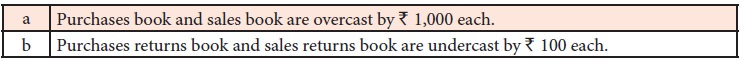

Examples

Related Topics