Chapter: 11th Accountancy : Chapter 8 : Bank Reconciliation Statement

Reasons why bank column of cash book and bank statement may differ

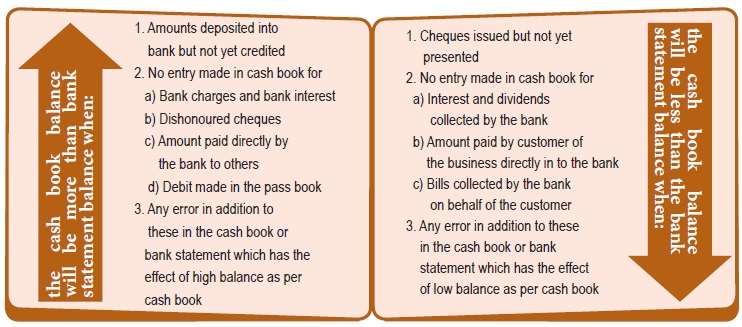

Reasons why bank column of cash book

and bank statement may differ

The need for

reconciliation arises only when there are differences in entries recorded in

the cash book and bank statement. Sometimes, the bank balance as per both the

records may be the same, but the entries may not match. In such cases also,

bank reconciliation statement is to be prepared. But, before preparing the bank

reconciliation statement, it is necessary to find out the reasons for the

disagreement.

Difference

between the two records (bank column of cash book and bank statement) generally

occur because of the following reasons:

·

Timing differences

– The different times at which the same items are entered

·

Errors in

recording - Difference arising due to errors in recording the entries

Timing differences

·

cheques

deposited into bank but not yet credited

·

bank

charges and interest on loan and overdraft

·

interest

and dividends collected by the bank

·

dishonour

of cheques and bills

·

amount

paid by parties directly into the bank

·

payment

made directly by the bank to others

·

bills

collected by the bank on behalf of its customer

Errors in recording

·

errors committed in recording the transactions by

the business in the cash book

·

errors

committed in recording the transactions by the bank.

1. Timing differences

(a) Cheques issued but not yet presented for payment

When the

cheques are issued by the business, it is immediately entered on the credit

side of the cash book by the business. But, this may not be entered in the bank

statement on the same day. It will be entered in the bank statement only after

it is presented with the bank.

For example, the balances as per cash book and bank

statement are Rs. 20,000 for X & Co. X & Co. issued a cheque

in favour of Y & Co for Rs. 10,000,

on 27th March 2017. So, X & Co’s cash book is credited with Rs. 10,000 on 27th March 2017. But, the cheque is presented to bank on 2nd

April 2017. In case, bank sends a statement to X & Co, upto 31st March

2017, it will not contain this transaction. As a result, there will be a

difference of Rs. 10,000, between balance shown as per cash book and

balance as per bank statement. As a result of this,

(b) Cheques deposited into bank but not yet credited

When the cheques are deposited into bank, the amount is debited in the cash book on the same day. But, these may not be shown in the bank pass book on the same day because these will be entered in the bank statement only after the collection of the cheques.

For example, the balances as per cash book and bank

statement are Rs. 20,000 for X & Co. X & Co. receives a

cheque on 25th March 2016, from ABC Limited for Rs. 5,000.

On the same day, X & Co, debits its cash book with Rs. 5,000.

But bank credits X & Co’s account only when the cheque is collected from

ABC Limited’s bank. This shows that is a time gap between depositing the cheque

by the customer (X & Co) and collection of cheque by the bank. As a result

of this,

(c) Bank charges and interest on loan and overdraft charged by the bank

The bank has

to cover the cost of running the customer’s account. So debit is given to the

account of the business towards bank charges. Also, if the business had taken

any loan or overdrawn, interest has to be paid by the business. These entries

for bank charges and interest are made in the bank statement. But, the entry is

made in the cash book only when the bank statement is received by the business.

Till then, the cash book shows more balance than bank statement.

For example, the opening balance as per cash book

and the bank statement as on 1st March 2017 is Rs. 7,000.

Bank debits for bank charges Rs. 300 as

on 27th March 2017. But there is no entry for the same in the cash book as on

such date. As a result of this,

(d) Interest and dividends collected by the bank

The bank may

collect dividends on its customer’s investment in shares and also interest on

any investment. The entry for this will be made in the bank statement on the

date of collection. But the entry is made in the cash book only when the bank

statement is received by the customer. Till then, the cash book shows less

balance than the bank statement.

For example, the balances as per cash book and bank

statement are Rs.15,000. The bank has collected dividends of Rs.1,000. As a result of this, the balance as per bank statement is

increased to Rs.16,000, whereas until the customer receives such

information and records the same, balance as per cash book is lesser by Rs.1000. As a result of this,

(e) Dishonour of cheques and bills

When the

cheque is received from outside parties, it is deposited with the bank and

debited in the cash book. If the cheque is dishonoured, the bank cannot collect

the amount of such cheque from outside parties’ bank. It is not credited in the

bank statement. As a result of this, the two records would differ.

While

discounting the bills receivables, in the cash book it is entered in the debit

side and in the bank statement it is credited. When the bill is presented by

the bank to the drawee of the bill and the payment is not received, the bank

debits the same to cancel the credit. But, credit is made in the cash book only

when the customer gets the entries made in the bank statement is received. The

bank may also charge some amount for such dishonour.

For example,

opening balance as per cash book and bank statement is Rs. 5,000 as on 1st January, 2017. A cheque for Rs. 1,000 deposited by the

business into bank on 25th January, 2017 is dishonoured and no entry for such

transaction is made in the cash book as on that date. As a result of this,

(f) Amount paid by parties directly into the bank

Sometimes, debtors or the customers of the business

may directly deposit the money into bank account of the business. It may be

done by directly visiting the branch of the bank by paying cash (including

NEFT, RTGS) or swiping debit or credit or business card or depositing the money

in cash deposit machine or transfer through online banking facility. This will

be credited in the banker’s book. But the entry is made in the cash book only

when the bank statement is received by the customer. Until then, the cash book

shows less balance than bank statement.

For example,

as on 1st January, 2017, the balance as per cash book and the balance as per

bank statement show the same balance of Rs. 10,000, but on 22nd January, a debtor directly

deposits 5,000 into the bank account of

the business. But no entry is made in the cash book as on that date. As a

result of this,

(g) Amount paid directly by the bank to others

Sometimes the

bank may be instructed to make payments such as, insurance premium, instalment

of loan, etc., as an agent of the customer on behalf of its customer. In all

such cases, debit is made in bank statement. But, the entry is made in the cash

book only when the bank statement is received by the customer. Till then, the

cash book shows more balance than bank statement.

For example, on 1st, March, 2017, balance as per

cash book and balance as per bank statement show the same amount of Rs.12,000. But, as per the standing instruction of its customer the bank pays

Rs. 2,000 as insurance premium as on 28th March, 2017.

But, no entry for such transaction is made in the cash book as on such date. As

a result of this,

(h) Bills collected by the bank on behalf of its customers

When goods are sold by the business, the documents

may be sent through the bank. When the bank collects the amount, it is credited

in bank records. But, the entry is made in the cash book only when the bank

statement is received by the business. Till then, the bank statement shows more

balance than cash book.

2. Errors in recording

(a) Errors committed in recording the transactions by the business in the cash book

Sometimes,

errors may be committed in the cash book. For example, omission or wrong

recording of transaction relating to cheques deposited or issued, wrong

balancing, etc. In these cases, obviously, there will be differences between

bank balance as per bank statement and bank balance as per cash book.

For example, the cheque received for Rs. 10, 000 is not entered in the cash book, but has been deposited with

the bank. As a result, on collecting the money the balance as per bank

statement will be more by Rs. 10, 000.

(b) Errors committed in recording the transactions by the bank

Sometimes

errors may be committed in the banker’s book. For example, omission or wrong

recording of transaction relating to cheques deposited and wrong balancing. In

these cases, obviously, there will be differences between bank balance as per

bank statement and bank balance as per cash book.

For example,

the cheque deposited for Rs. 50000, wrongly entered by the bank as Rs. 15, 000. This will lead

to a difference of Rs. 35, 000

between the cash book balance and the balance as per bank statement.

In a nutshell, based on the differences,

Related Topics