Accountancy - Bank statement or bank pass book | 11th Accountancy : Chapter 8 : Bank Reconciliation Statement

Chapter: 11th Accountancy : Chapter 8 : Bank Reconciliation Statement

Bank statement or bank pass book

Bank statement or bank pass book

It is very

common in business these days, to deposit cheques received and cash, with the

bank. Payments can also be made through

bank. Because, dealing cash through bank is always safe.

Also, it is legally necessary to operate the

transactions through bank beyond a certain limit.

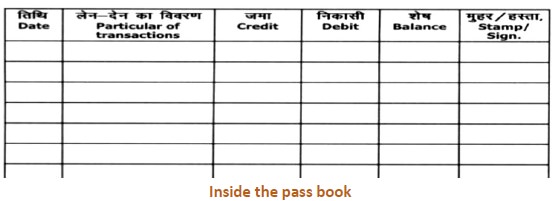

When any bank transaction is undertaken, two

records are kept of the transactions. One is kept by the business [customers to

the bank], which is the cash book. The other one is kept by the bank, which is

bank record [bank statement]. In other words, it can be said that the cash book

maintained by the business [customer of a bank] and the ledger accounts

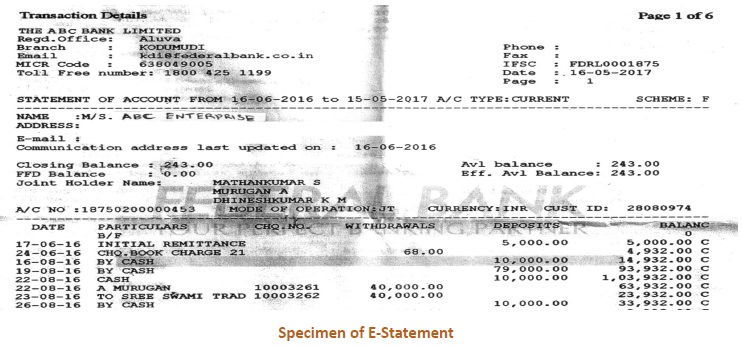

maintained by the bank, record the same transactions. Bank statement or bank

pass book is simply a copy of the customer’s account in the books of a bank. A

bank may send a statement at regular intervals to its customers. It shows all

the deposits, withdrawals and the balance available in its customer’s account,

on a particular date. In recent times, the copy of the records can be obtained

by the customer electronically, which is called E-statement.

Various types of accounts such as savings account,

fixed deposit account, current account, etc., can be opened with the bank by

different types of customers. But, current account is the most suitable for

business concerns. The facility of bank overdraft is not available to any

account other than current account.

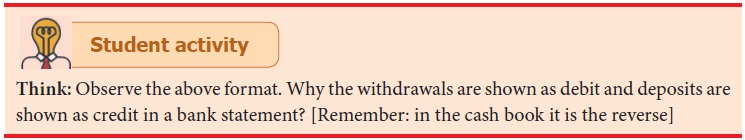

When the

entries in the bank statement are compared with the cash book, it will be found

that the accounting treatment is reverse in the cash book. This is because the

cash book is prepared from the point of view of business, whereas the bank

statement is prepared from the bank’s point of view.

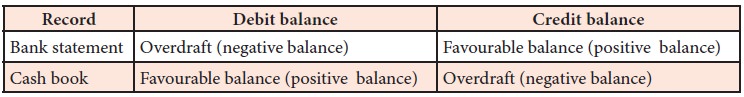

Following the double entry system, the credit

balance in the bank pass book represents the debit balance as per the cash book

and vice-versa. This is because, bank is a debtor for the business and business

unit (customer to the bank) is a creditor for the bank when there is a

favourable balance in the bank. When money is deposited by the business into

the bank, customers account is credited in the bank’s book, as this is the

amount owed by the bank to its customer. Similarly, when the money is withdrawn

or taken out of the bank by the business, customer’s account is debited as this

decreases the amount owed by the bank to the customer. As a result of this,

favourable balance, as per bank statement (bank pass book), will appear as a

credit balance and overdrawn balance as a debit balance.

Bank overdraft

It is not possible to have unfavourable cash

balance in the cash book. But, it is possible to have unfavourable balance in

the bank account. When the business is not having sufficient money in its bank

account, it can borrow money from the bank. As a result of this, amount is

overdrawn from bank.

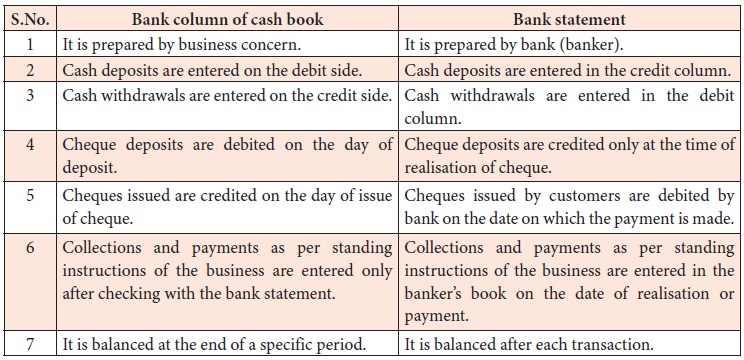

Differences between bank column of cash book and bank statement

Following are the differences between bank column

of cash book and bank statement:

Related Topics