Chapter: 11th Accountancy : Chapter 8 : Bank Reconciliation Statement

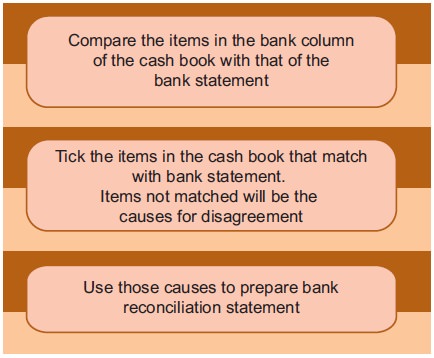

Preparation of bank reconciliation statement

Preparation of bank reconciliation

statement

After having

identified the causes of differences, the reconciliation may be done in the

following way:

Bank reconciliation statement can be prepared

either from the balance as per cash book or bank statement. If it is prepared

from the balance of cash book, the effect of the transaction will be studied on

the balance as per bank statement. If it is prepared from the balance as per

bank statement, the effect of the transaction will be studied on the balance as

per cash book.

Given the

causes of disagreement, the balance of one record (cash book or bank statement)

can be either more or less compared to the other record (cash book or bank

statement).

For example,

if the reconciliation is started with debit balance as per cash book and there

is a cheque deposited in the bank, but not cleared, the balance as per bank

statement will be less. In this case, the amount of cheque should be subtracted

from the cash book balance to arrive at the balance as per bank statement.

Similarly, after making all the adjustments the balance as per the other book

is obtained. It is important to note that the debit balance as per cash book

means the credit balance as per bank statement and vice-versa.

To illustrate it further, take an example of bank

charges. The balance as per bank statement will be lesser as compared to cash

book. This is because, the bank balance has already been reduced with the bank

charges, but, it has not yet been recorded in the cash book. In this case, if

balance as per cash book is taken to prepare the reconciliation statement, the

amount of bank charges has to be subtracted, because the balance as per bank

statement is lesser than cash book balance.

Bank

reconciliation statement can be prepared on the basis of ‘Balance’ presentation, or ‘Plus & Minus’ presentation

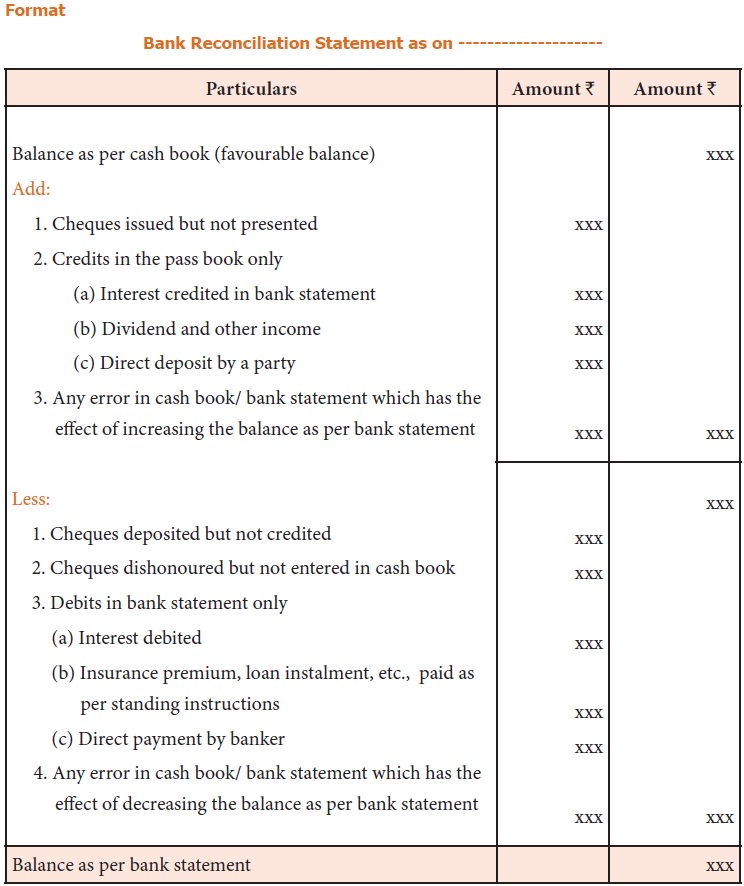

1. Balance presentation method

When balance

of cash book or bank statement is given:

Format

The abridged version of the above statement is

given below:

If

unfavourable balance as per cash book is the starting point, then reverse is

the procedure for preparing bank reconciliation statement. This means that,

items that are added are to be subtracted and items that are subtracted are to

be added.

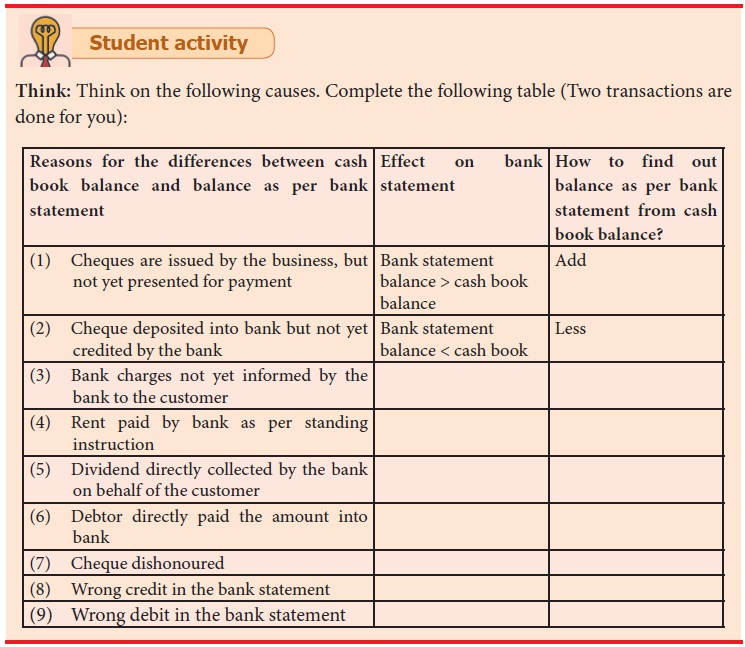

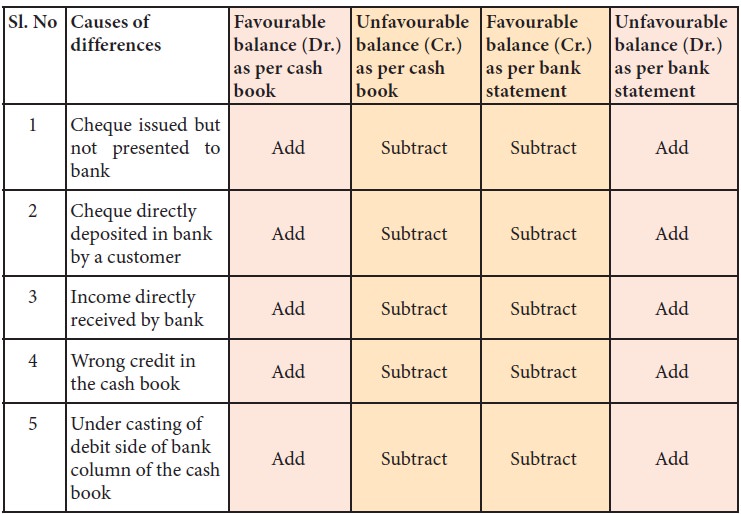

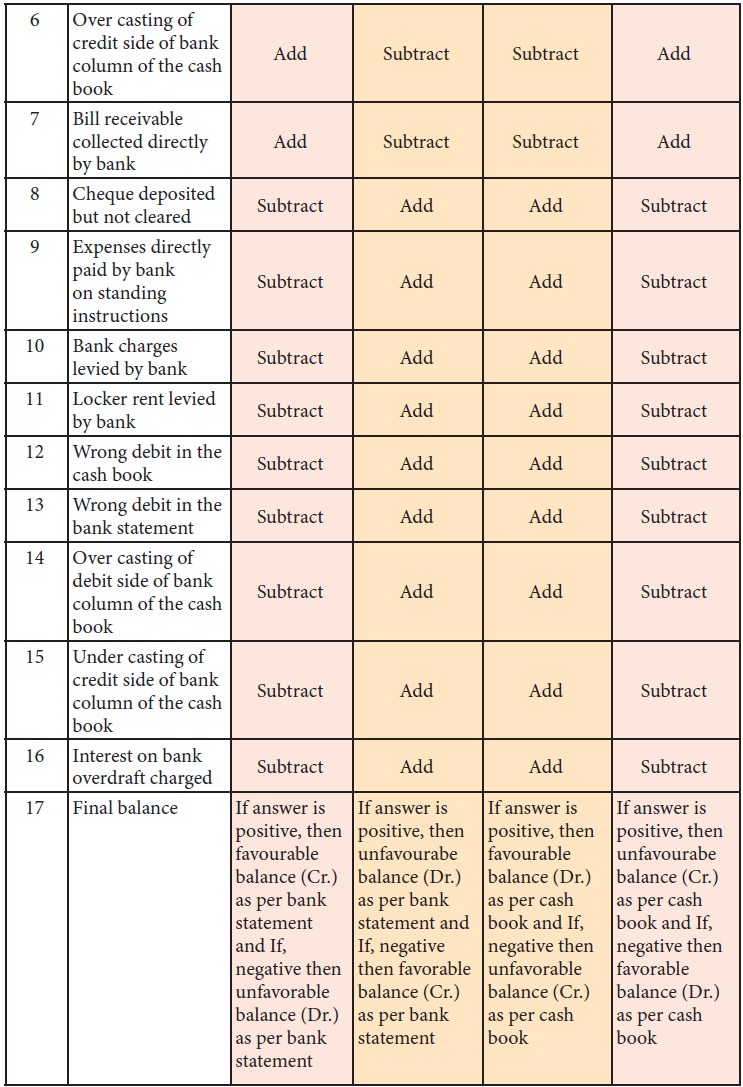

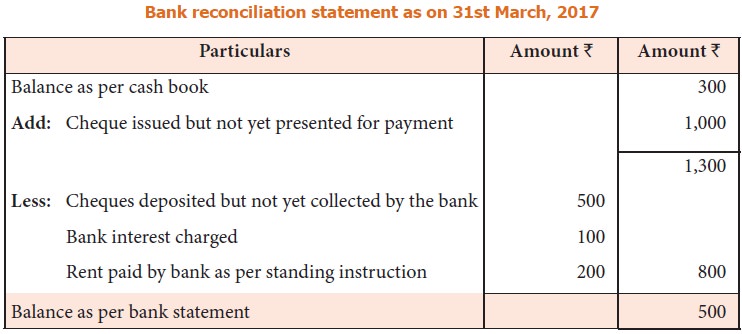

Based on the earlier explanation the following

table has been prepared for ready reference when reconciliation is done on the

basis of ‘balance presentation’. The final balance, which is obtained after

addition and subtraction, will be the balance as per the other book.

When balances of cash book and/or bank statement is given:

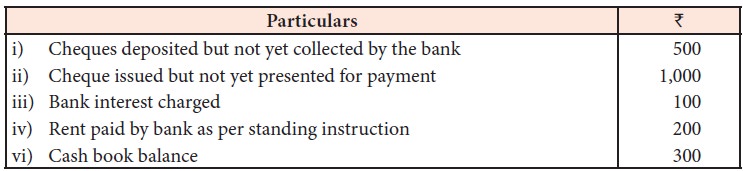

Illustration 1 (When balance as per cash book is favourable)

From the

following information, prepare bank reconciliation statement to find out

balance as per bank statement on 31st March, 2017.

Solution

Illustration 2

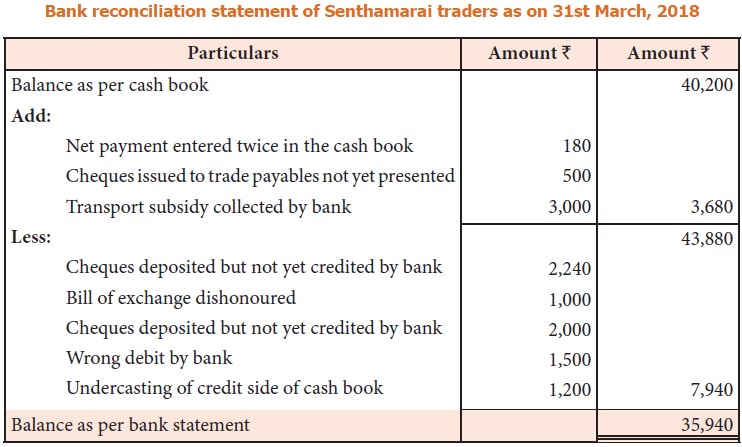

On 31st March, 2018, the bank column of the cash

book of Senthamarai Traders showed a debit balance of Rs. 40,200.

On examining the cash book and the bank statement, it was found that:

·

A cheque for Rs. 2,240 deposited on 29th March, 2018 was credited

by the bank only on 4th April, 2018.

·

A payment made through net banking for Rs. 180 has been entered

twice in the cash book.

·

A bill of exchange for Rs. 1,000 was discounted by Senthamarai Traders with

its bank. This bill was dishonoured on 30th March, 2018 but no entry had been

made in the books of Senthamarai Traders.

·

Cheques amounting to Rs. 500 which were issued to trade payables and

entered in the cash book before 31st March, 2018 were not presented for payment

until that date.

·

Cheque amounting to Rs. 2,000 had been recorded in the cash book as having

been deposited into the bank on 30th March, 2018, but was entered in the bank

statement on 3rd April, 2018.

·

Transport subsidy amounting to Rs. 3,000 received from the

Government of Tamilnadu directly by the bank, but not advised to the

Senthamarai Traders.

·

A sum of Rs. 1,500 was wrongly debited to Senthamarai Traders

by the bank, for which no details are available.

·

On 31st March, 2018 the payment side of the cash

book was undercast by Rs. 1,200![]()

Solution

Bank reconciliation statement of

Senthamarai traders as on 31st March, 2018

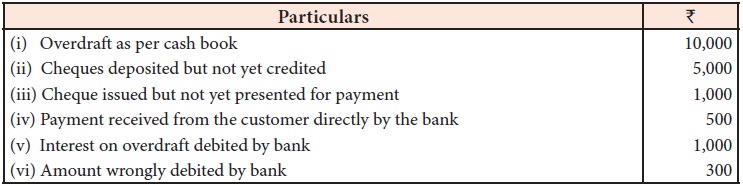

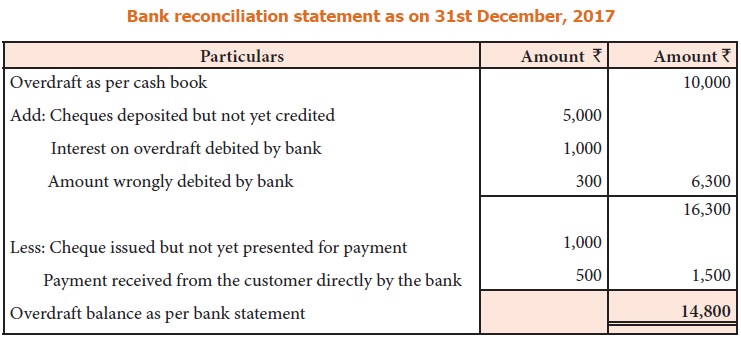

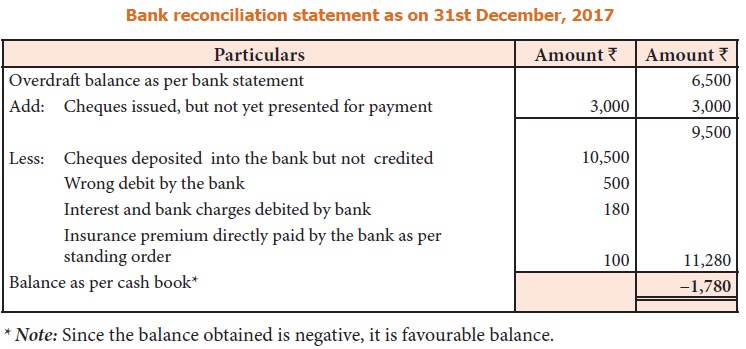

Illustration 3 (When balance as per cash book shows overdraft)

From the

following information, prepare bank reconciliation statement as on 31st

December,2017 to find out the balance as

per bank statement.

Solution

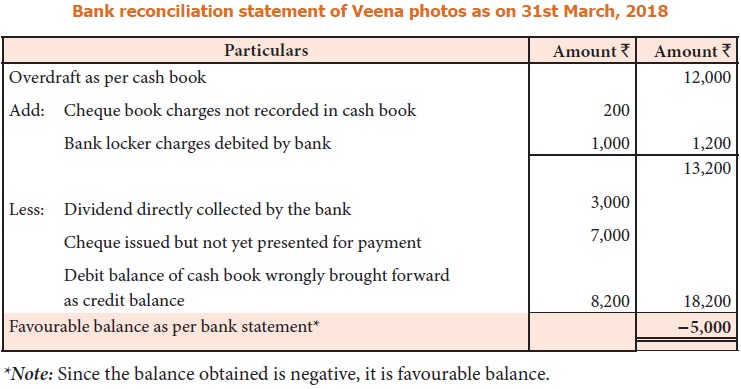

Illustration 4

Rony is the

proprietor of Veena photos. The bank column of cash account of his business was

balanced on 31st March 2018. It showed an overdraft of Rs. 12,000. The bank statement of Veena photos showed

a credit balance of Rs. 5,000.

Prepare a bank reconciliation statement taking the following into account.

·

The bank had directly collected dividend Rs. 3,000 but was not

entered in the cash book.

·

Cheques amounting to Rs. 9,000 were issued on 27th March, 2018, of which,

cheques amounting to Rs. 7,000 were not presented for payment before 31st

March 2018.

·

The debit

balance in the cash book of Rs. 4,100

was brought forward as a credit balance.

·

Cheque

book charges of Rs. 200 debited by the bank but not recorded in cash

book.

·

Bank

locker rent of Rs. 1,000 debited by the bank but not recorded in cash

book.

Solution

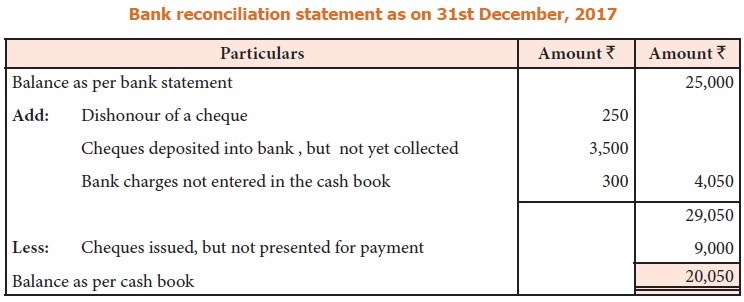

Illustration 5 (When balance as per bank statement is favourable)

Prepare bank reconciliation statement as on 31st December, 2017 from the following information:

i. Balance as per bank statement (pass book) is Rs. 25,000

ii.

No record

has been made in the cash book for a dishonour of a cheque for Rs. 250

iii.

Cheques

deposited into bank amounting to Rs. 3,500

were not yet collected

iv.

Bank

charges of Rs. 300 have not been entered in the cash book.

v. Cheques issued amounting to Rs. 9,000 have not been presented for payment

Solution

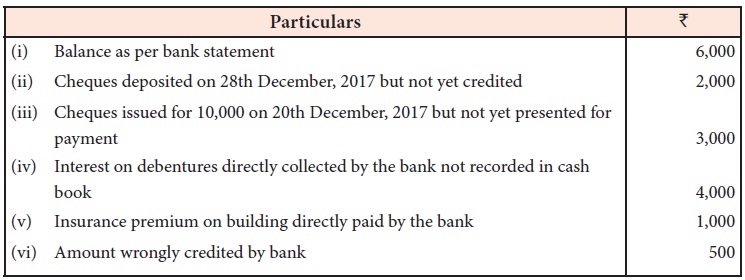

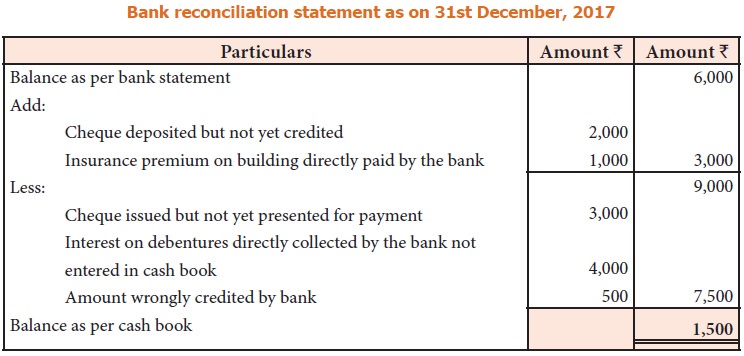

Illustration 6

From the following information, prepare bank

reconciliation statement as on 31st December, 2017 to find out the balance as

per bank statement.

Solution

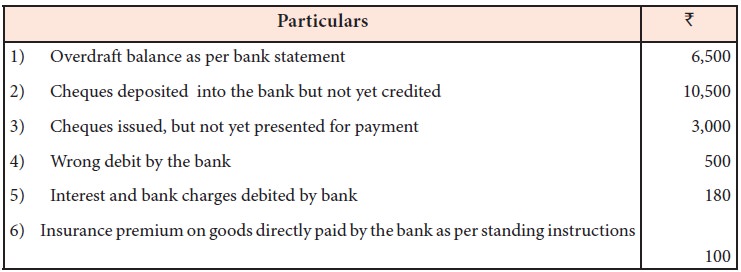

Illustration 7 (When balance as per bank statement is an overdraft)

From the following data, ascertain the cash book

balance as on 31st December, 2017.

Solution

Illustration 8

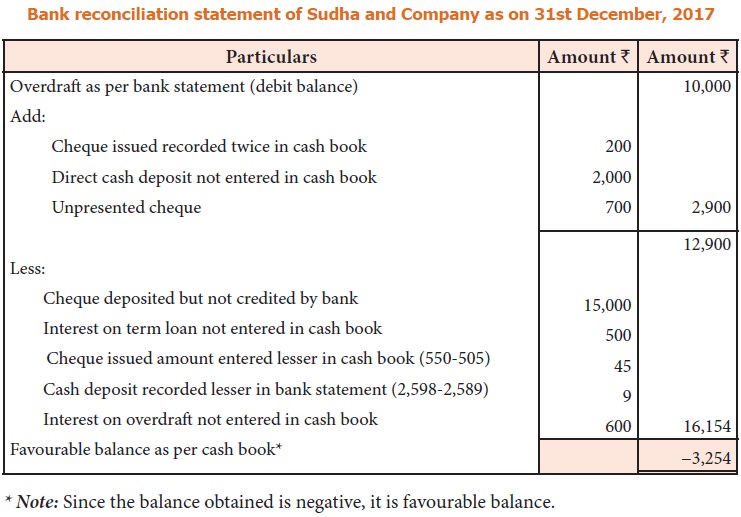

The bank statement of Sudha and Company showed an overdraft of Rs. 10,000 on 31st December, 2017, prepare a bank reconciliation statement.

i.

A cheque

deposited on 30th December 2017 for Rs. 15,000

was not credited by the bank.

ii.

Interest

on term loan Rs. 500 was debited by bank on 31st December, 2017 but

not accounted in the books of Sudha and Company.

iii.

A cheque

issued for Rs. 550 on 24th December, 2017, paid by the bank was

recorded as Rs. 505 in the bank column of the cash book.

iv.

One

outgoing cheque on 27th December, 2017 of Rs. 200 was

recorded twice in the cash book.

v.

Bank

recorded a cash deposit of Rs. 2,598 as

Rs. 2,589.

vi.

A sum of Rs. 2,000 deposited in cash deposit machine by a customer of the business

on 31st December, 2017 was not recorded in the books of Sudha and Company.

vii.

Interest

on overdraft of Rs. 600 was not recorded in the books of Sudha and

Company.

viii.

Two

cheques issued on 29th December, 2017 for Rs. 500 and Rs. 700, but only the first cheque was presented for payment before 31st

December, 2017.

Solution

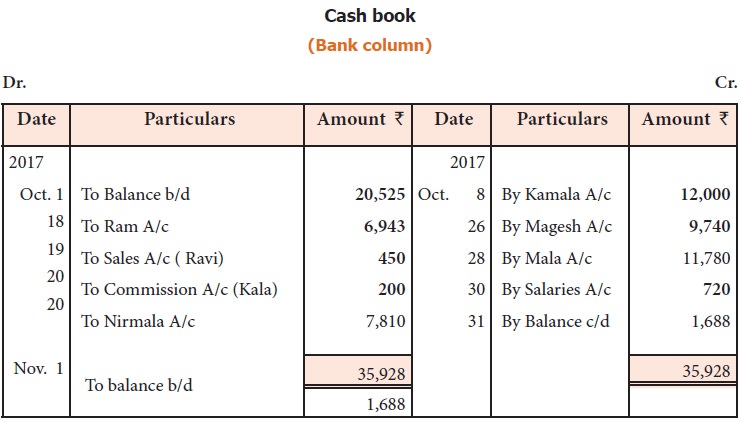

When an extract of cash book and bank statement is given

When an extract of the cash book and bank statement

is given, the following points are to be remembered:

Remember, the starting balance in the bank

reconciliation statement can be either cash book balance or balance as per bank

statement.

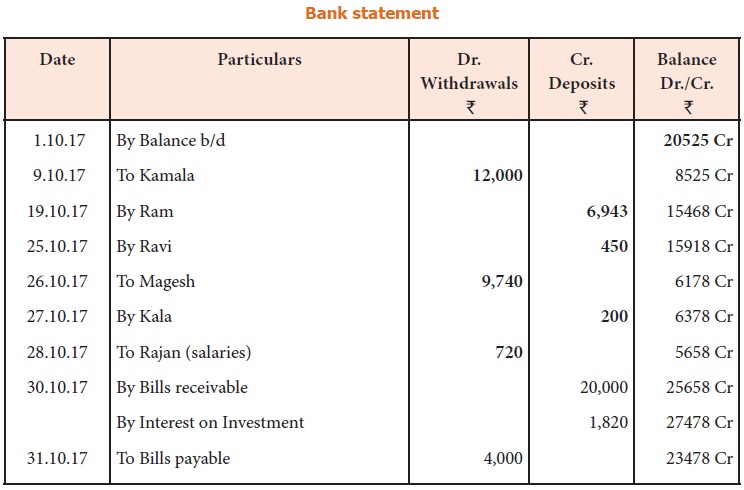

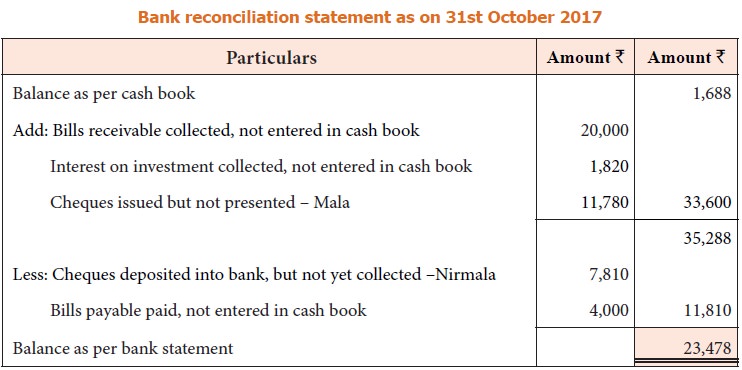

Illustration 9 (When an extract of cash book and bank statement is given)

Given below

are the entries in the bank column of the cash book and the bank statement.

Prepare a bank reconciliation statement as on 31st

October, 2017.

Solution

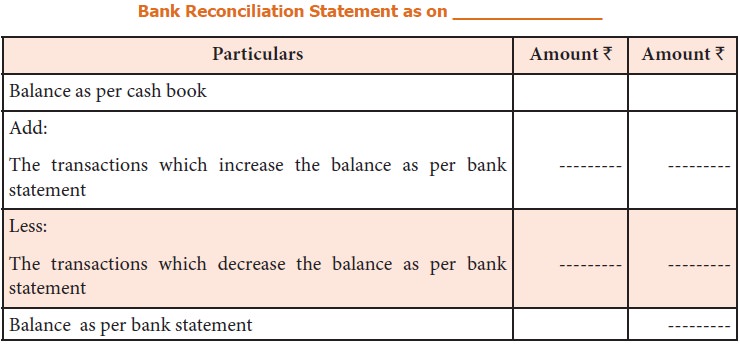

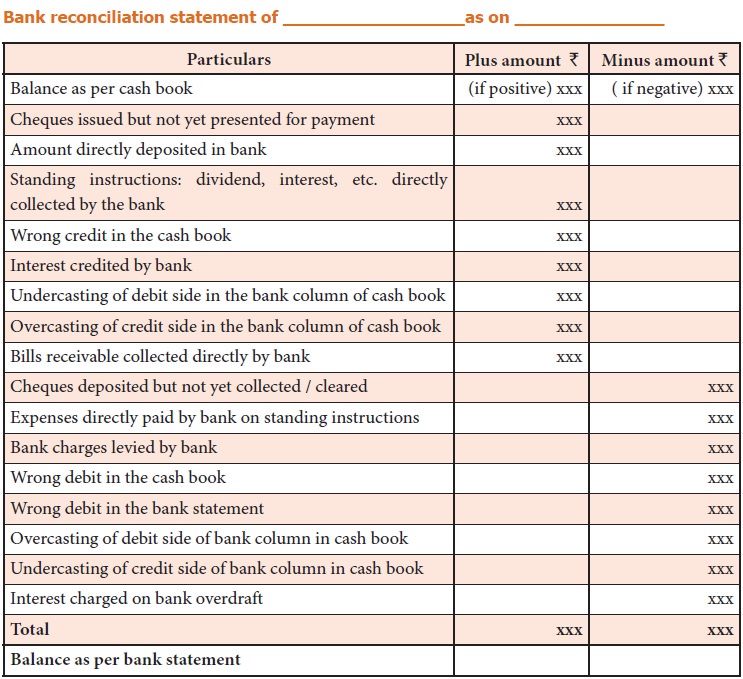

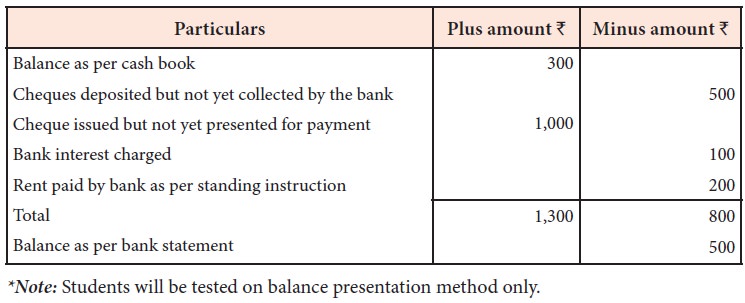

2. Plus or Minus presentation

Bank

reconciliation statement can also be presented in an alternative method. In

such presentation, two columns are given, one to record items that increase the

balance (plus items) and the other one to record items that decrease the

balance (minus items). Balances as per the cash book or bank statement are

written as the starting balance.

Points to be noted:

·

Debit

balance of cash book is written in the “Plus” column.

·

Credit

balance of cash book (overdraft) is written in the “Minus” column.

·

Debit

balance as per bank statement (overdraft) is written in the “Minus” column.

·

Credit

balance as per bank statement is written in the “Plus” column.

After the

causes of difference are written, the two columns (plus column and minus

column) are totalled and the difference is ascertained. The difference is the

balance/ overdraft as per cash book / bank statement, as per the given starting

point.

Balance as

per bank statement is arrived by comparing the total of plus amount and the

minus amount. If the plus amount is more than the minus amount, then show the

difference amount in minus column. This represents favourable balance as per

bank statement.

If the plus

amount is less than the minus amount, then show the difference amount in plus

column. This represents bank overdraft (unfavourable balance) as per bank

statement.

Format of Plus or minus presentation of bank reconciliation statement:

Related Topics