Auditing - Principles of Good Internal Control System | 12th Auditing : Chapter 2 : Internal Control

Chapter: 12th Auditing : Chapter 2 : Internal Control

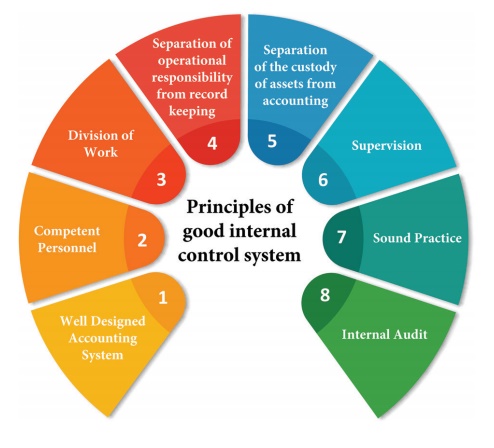

Principles of Good Internal Control System

Principles of Good Internal Control System

An

effective or good system of internal control should have the following

principles: -

1. Well-designed Accounting System: Internal

control should provide for a well designed accounting system. The financial and

accounting activities must be separated. For example, person who is responsible

in handling cash (cashier) and the person who accounts cash (accountant) should

be done by two different persons.

2. Competent Personnel: In any

internal control system, personnel

are the most important element. When the employees are competent and efficient

in their assigned work, the internal control system can be worked and operated

efficiently and effectively even if some of the other elements of the internal

control system are absent.

3. Division of Work: This

refers to the procedure of division

of work properly among the employees of the organization. Each and every work

of the organization should be divided in different stages and should be

allocated to the employees in accordance with their skill and expertise.

4. Separation of operational responsibility

from record keeping: If each department of an organization is being assigned to prepare its own records

and reports, there may be a tendency to manipulate results for showing better

performance. In order to ensure reliable records and information,

record-keeping function is separated from the operational responsibility of the

concerned department.

5. Separation of the custody of assets from

accounting: To protect against

misuse of assets and their misappropriation, it is required that the custody of

assets and their accounting should be done by separate persons. When a

particular person performs both the functions, there is a chance of utilizing

the organisation’s assets for his personal interest and adjusting the records

to relieve himself from the responsibility of the assets.

6. Supervision: Directors should review the company’s financial operations and

position at regular and frequent intervals. Comparison with results for

previous periods indicates discrepancies that call for further examination.

Where budgetary control is in use, attention will be drawn to material

variances and explanations required. From time to time, special reviews of

particular items such as stocks, or the operation of the wages department,

should be undertaken.

7. Sound Practice: Sound practices of administration require that

established procedures, policies and delegation of responsibility should be

open to all employees of the organisation. This helps in avoiding questions,

attempts to shift responsibility for unsatisfactory performance etc.

8. Internal

Audit: Internal audit is a

part of the

whole system of internal

control. It should

operate independently of the internal check and in no circumstances; it

should divert any one

of responsibilities placed on

him. It is the examination of accounts of a business concern

by its employees specially appointed for the purpose. It is an independent

appraisal of activity

within an organization for

the review of accounting, financial and other business practices.

Related Topics