Chapter: 11th Commerce : Chapter 15 : Insurance

Miscellaneous Insurance and its Types

Miscellaneous Insurance

i. Motor Vehicle Insurance

This is also known as ‘Auto Insurance’. This policy comes under General Insurance. This insurance has become very popular and is gaining importance. In motor insurance the owner’s liability to compensate people who were killed or injured through an accident is passed on to the insurance company. The premium rate under this policy is standardized.

ii. Burglary Insurance

This policy comes under the category of insurance of property. Any loss of damage due to theft, larceny, burglary, house- breaking and acts of such nature are covered by this policy. Compensation of actual loss is done.

· Insurable interest need not exist at the time of policy but should be present at the time of theft.

· The principle of causa proxima is also applied to it. The insurance company would pay only if the proximate cause falls under the policy

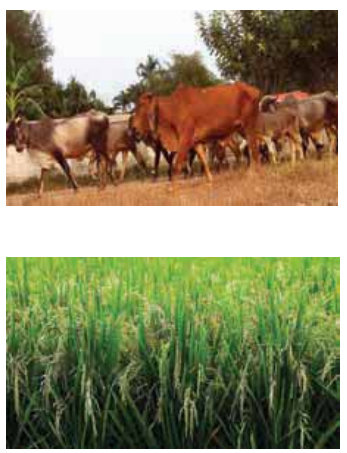

iii. Cattle Insurance

This is a bond in which a sum of money is secured to the insured in case of an event of death of animals like bulls, buffaloes, cows and heifers. The cause of death may be an accident, disease or pregnant condition, etc. The insurer normally agrees to pay excess in case of loss.

iv. Crop Insurance

This policy is to provide financial support to farmers in case of a crop failure due to drought or flood. It generally covers all risks of loss or damages relating to production of rice, wheat, millets, oil seeds and pulses etc.

v. Sports Insurance

This policy is a comprehensive cover for amateur sports persons regarding their sporting equipment, personal effects, legal liability and personal accident risks. If desired it can also be extended to a named member of the insured’s family but it is not available to professional sports person. The cover is generally for following sports or more: Angling, badminton, cricket, golf, lawn tennis, squash and use of sporting guns.

vi. Amartya Sen SikshaYojana

The General Insurance Company offers to secure the education of dependent children under this policy. If the assured parent/legal guardian goes through any bodily injury resulting solely and directly from accident due to external, violent and visible means and if such injury shall within twelve calendar months of its occurrences be the only direct cause of his/her death or permanent total disablement, the insurer shall indemnify the insured student in respect of all covered expenses to be incurred from the date of occurrence of such accident till the expiry of policy or completion of the duration of covered course whichever occurs first and such indemnity shall not exceed the sum assured as stated in the policy schedule.

vii. Rajeswari Mahila Kalyan Bima Yojana

This policy envisages to provide relief to the family members of insured women in case of their death or disablement due to any kinds of accidents and/or death and / or disablement arising out of other factors incidental to women only.

Related Topics