Chapter: Security in Computing : The Economics of Cybersecurity

Making a Business Case

Making a Business Case

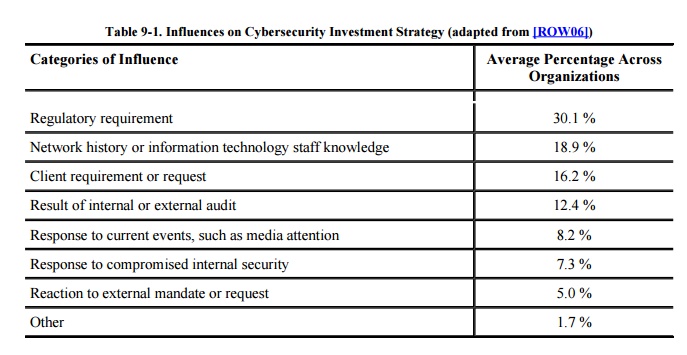

There are many reasons why

companies look carefully at their investments in cybersecurity. Table 9-1 shows the results of a series of

in-depth interviews with organizations in the U.S. manufacturing industry,

health care companies, universities, Internet service providers, electric

utilities, nonprofit research institutions, and small businesses. It shows that

various pressures, both internal and external, drive organizations to

scrutinize the amount and effectiveness of their cybersecurity practices and

products.

But how do companies decide

how much to invest in cybersecurity, and in what ways? Typically, they use some

kind of benchmarking, in which they learn what other, similar companies are

spending; then they allocate similar amounts of resources. For example, if

Mammoth Manufacturing is assessing the sufficiency of its cybersecurity

investments, it may determine (through surveys or consultants) that other

manufacturing companies usually spend x percent of their information technology

budgets on security. If Mammoth's investment is very different, then Mammoth's

executives may question what is different about Mammoth's needs, practices, or

risk tolerance. It may be that Mammoth has a more capable support staff, or

simply that Mammoth has a higher tolerance for risk. Such analysis helps

Mammoth executives to decide if investments should increase, decrease, or stay

the same.

Notice that this approach

supports only decisions about an appropriate level of spending. Then,

intelligent, detailed decisions must be made about specific expenditures: what

capabilities are needed, which products should be purchased and supported, and

what kind of training may be helpful, for instance. The chief information

security officer at a large, multinational company describes the

decision-making this way: "I am not suggesting this be done slavishlyyou

do not have to follow the herdbut it is important to know in what direction the

herd is going, and at what speed. When we talk about adhering to 'industry

norms and best practices,' these types of things become very important."

But such investment decisions

are not made in a vacuum. Requests for cybersecurity resources usually have to

compete with other types of requests, and the final decisions are made based on

what is best for the business. Thus, there has always been keen interest in how

to make a convincing argument that security is good for business. When

companies have to balance investments in security with other business

investments, it is difficult to find data to support such decision-making.

Because of the many demands on an organization's finite resources, any request

for those resources must be accompanied by a good business case. A business case for a given expenditure

is a proposal that justifies the use of resources. It usually includes the

following items:

·

a description of the problem or need to be addressed by the

expenditure

·

a list of possible solutions

·

constraints on solving the problem

·

a list of underlying assumptions

·

analysis of each alternative, including risks, costs, and benefits

·

a summary of why the proposed investment is good for the

organization

Thus, the business case sets

out everything a manager needs for making an informed decision about the

proposal.

In many instances, several

proposals are considered at once, some competing with others. For example, one

group may propose to implement new network security while another prefers to

focus on physical security. No matter what the proposal, it must be framed as a

business opportunity.

Respected business

publications often address the problem of technology investment. For example,

Kaplan and Norton [KAP92] suggest that

any evaluation of an existing or proposed investment in technology be reported

in several ways at once to form a "balanced scorecard":

from a customer view,

addressing issues such as customer satisfaction

from an operational view,

looking at an organization's core competencies

from a financial view,

considering measures such as return on investment or share price

from an improvement view,

assessing how the investment will affect market leadership and added value

It is typical for companies

to focus exclusively on return on investment, in part because the other views

are less tangible.

Determining Economic Value

Favaro and Pfleeger [FAV98] suggest that economic value can be a unifying

principle in considering any business opportunity. That is, we can look at each

investment alternative in terms of its potential economic value to the company

or organization as a whole. In fact, maximizing economic value can very well

lead to increases in quality, customer satisfaction, and market leadership.

However, there are many

different ways to capture economic value. For example, Gordon and Loeb [GOR06a] present several ways of thinking about

the economic benefit of cybersecurity, including net present value, internal

rate of return, and return on investment. We must decide which investment

analysis approach is most appropriate for security-related investment

decision-making based on economic value.

Investment analysis is

concerned only with the best way to allocate capital and human resources. Thus,

it is distinctly different from cost estimation or metrics; it weighs several

alternatives, including the possibility of retaining earnings to provide an

expected annual rate of return. In other words, from a high-level corporate

perspective, management must decide how a proposed technology investment

compares with simply letting the money earn interest in the bank.

Not all investment analysis

reflects this reality. Gordon and Loeb [GOR06]

describe how organizations actually budget for information security

expenditures. They show that economic concepts are beginning to gain acceptance

from senior information security managers in preparing information security

budgets.

Gordon and Loeb [GOR02b] also point out conceptual and practical

problems with many of the common accounting approaches. They note that managers

often use accounting rules to measure return on investment, but that the

accounting measure is inappropriate for evaluating information security

projects both before the fact and after they are concluded. To see why,

consider how difficult it would be to evaluate the return on investment in

introducing electronic mail at an organization. We know there is a clear

benefit, but it can be daunting to find a good way to measure the benefit.

Gordon and Loeb recommend that companies focus instead on selecting a profit

goal by optimizing their level of information security investment, rather than

by maximizing a measure of return on investment.

Net Present Value

Taking the perspective of a

financial analyst, Favaro and Pfleeger [FAV98]

look critically at the most commonly used approaches: net present value,

payback, average return on book value, internal rate of return, and

profitability index. Favaro and Pfleeger explain why net present value (NPV)

makes the most sense for evaluating software-related investments. For this

reason, we explore NPV in some detail here.

When proposing technology,

you must be sure to consider all costs. For example, to invest in a new

security tool, a company may spend money for training and learning time, as

well as for the tool itself. The NPV calculation subtracts these initial

investment costs from the projected benefits.

More formally, the net present value is the present value

of the benefits minus the value of the initial investment. That is, NPV

compares the value of a dollar (or euro or yuen) today to the value of that

same dollar (or euro or yuen) in the future, taking into account the effects of

inflation and returns on investment. NPV expresses economic value in terms of

total project life, regardless of scale or time frame. Since investment

planning involves spending money in the future, we can think of the present value of an investment as the

value today of a predicted future cash flow.

Suppose, for example, that

the rationale for spending 100 units today on a proposed project suggests that

the project might yield a benefit (profit) of 200 units five years from now. To

assess the overall project benefit to the company, we must adjust the 200 units

both for inflation and for the interest or growth the firm would otherwise gain

on the 100 units over five years if it were instead to invest the money in a

traditional financial vehicle, such as a bank account. Suppose 100 units

invested traditionally (and wisely) today might yield 170 units in five years.

Then the present value of the proposed project is only 30 units (200 - 170),

although the 30 units of profit represent a net benefit for the company.

In general, if the NPV of a

prospective project is positive, it should be accepted. However, if NPV is

negative, the project should probably be rejected; the negative NPV means that

cash flows from the project will be less than from a safer, more traditional

investment. If our example calculation had yielded a future benefit of only 120

units that, when discounted to present value, yielded 90 units, the proposed

project would likely lead to a net loss of 10 units. In other words, investing

in the project would require 100 units to derive only 90 units of benefitnot a

very savvy business strategy.

Adjusting Future Earnings Against Investment Income

As noted before, if a company

has disposable or uncommitted money on hand today that it wants to invest, it

has several choices: it can spend it now or save it for the future. If the

company decides to save it, the earnings compound so that the value of that

money in the future is greater than it is today (not considering inflation).

Suppose corporate savings generate a 5 percent annual return; then by investing

today's 100 units, the firm can expect to have almost 128 units in five years.

Calculations of this kind suggest a threshold that must be met if a proposed

project is considered by the company to be worthwhile. Thus, if a proposed

cybersecurity (or any other) project requires an up-front investment of 100

units, its profit by the fifth year has to be at least 128 units to be

economically viable. In this way, net present value calculations give companies

a way to compare and contrast several investment strategies and pick the most

economically desirable one(s).

Moreover, an advantage of

using net present value to assess a security project is that it evaluates the

effects of the proposed investment over the life of the project. For example,

if the proposed project loses money for the first two years but then proceeds

to be highly profitable in all succeeding years, it may be a wise long-term

investment. NPV provides a fair comparison for projects that turn profitable at

different times in the future; the hard part is knowing how far in the future

to perform the calculation.

Our example used a five

percent return on savings. In general, the NPV calculation uses a discount rate or opportunity cost, corresponding to the rate of return expected from

an equivalent investment in capital markets; this rate may change over time

and, of course, is difficult to predict for the future. In other words, the

discount rate reflects how much money an organization could make if it invested

its money in the bank or a financial vehicle instead of in software technology.

Companies often use NPV to evaluate proposed projects; for instance,

Hewlett-Packard used NPV to evaluate investment in two multiyear corporate

reuse projects.

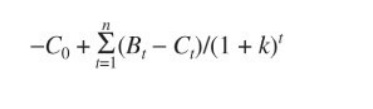

The formal equation for

calculating NPV is

where Bt and Ct are the benefits and costs

anticipated from the investment in each time period t. C0 is the initial investment,

the discount

rate (expected rate of return

on investment) is k, and n is the number of time periods over which the

investment's costs and benefits are considered.

Net Present Value Example

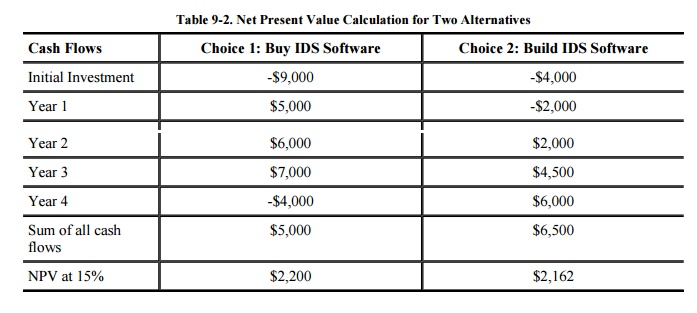

To see how NPV works,

consider the situation at Acme Corporation, where the chief security officer is

considering protecting its networks in one of two ways:

Buy an off-the-shelf intrusion detection system (IDS). This choice

involves a large initial procurement cost, with subsequent high returns (based

on avoided work), but the off-the-shelf product will be outdated and must be

replaced after three years.

Build a customized intrusion detection system with a reusable

design. The reuse requires considerable up-front costs for design and

documentation, but the long-term costs are less because the product's life will

be longer.

In each case, the direct

savings from the software are the same: finding and stopping malicious

behavior. The net present value calculation may resemble Table 9 -2. In this example, suppose it costs

$9,000 to purchase an intrusion detection system, and $4,000 to build one.

Thus, initial investments for each choice are $ 9,000 and $4,000, respectively.

Using a time period of one year, we can assess the cash flows for each choice.

For the purchased IDS, no additional development is likely to be required by

the end of year 1, and we estimate that avoided costs (that is, the benefit of

not having to deal with intrusions) are $5,000. For the home-grown IDS, we

estimate that we will avoid intrusions but will be correcting and perfecting

the software in the first year; hence, we estimate that $7,000 of development

cost will offset the $5,000 in benefit, for a net cost of $2,000 at the end of

year 1. By year 2, we reap benefits for both choices, but maintenance and

documentation still offset the benefits of the home-grown software. In year 3,

we expect more benefit from each choice. By year 4, we must upgrade the

purchased IDS, resulting in a negative cash flow, while the home-grown software

continues to provide positive benefit. Using a discount rate of 15 percent, we

see that the purchased intrusion detection system has a slightly higher NPV and

is therefore preferred.

Notice that, even though the

home-grown software has a higher total cash flow, the NPV suggest that Acme

should invest in an off-the-shelf IDS. This result reflects the fact that the

NPV approach is sensitive to the timing of the cash flows; the later the

return, the more the overall value is penalized. Thus, time to market is

essential to the analysis and affects the outcome. The size or scale of a

project is also reflected in the NPV.

Because NPV is additive, we

can evaluate the effects of collections of projects simply by summing their

individual NPVs. On the other hand, significant gains from one technology can

mask losses from investment in another; for this reason, it is useful to

evaluate each type of investment separately. In real-world practice, NPV is not

used for naive single-project evaluation, but rather in the context of a more

comprehensive financial and strategic framework [FAV96].

Internal Rate of Return

The internal rate of return (IRR) is derived from the net present

value; it is equal to the discount rate that makes the NPV equal to zero. In

other words, it is the expected rate of return from this investment. If the

internal rate of return is 4 percent and the discount rate is 12 percent, we

have a poor proposal, because we could do better investing money elsewhere. If,

however, the internal rate of return is 18 percent versus a discount rate of 12

percent, our proposal is wise because it generates a higher rate of return than

we would be able to earn in other ways.

Return on Investment

Return on investment (ROI) calculations are closely related to IRR

and NPV. The ROI is generated by dividing the last period's accounting profits (calculated from revenues and costs) by the

cost of the investments required to generate those profits. Thus, ROI looks

back at how a company or organization has performed, whereas NPV and IRR

project likely future performance of new investments.

According to the CSI/FBI

Computer Security Survey administered in 2005, 38 percent of respondents use

ROI to assess the value of cybersecurity, 19 percent use IRR, and 18 percent

use NPV.

Estimating Costs Fairly

Davidson [DAV05] describes how Oracle evaluated two

different intrusion detection systems. The value and accuracy of each system

were assessed as contributions to how well the company could do its job:

"The old system had a ridiculously high number of alarms every week, and

an extraordinary amount of them70 to 80 percentwere false positives. We looked

at what it was costing us to track down the alarms that we really needed to do

something about, including the costs for people to sort through the alarms and

analyze them. The new product had a much lower alarm rate as well as a lower

false positive rate. The information provided by the new product was better, at

a lower cost. Economic analysis, specifically return on investment, helped us

choose the new supplier over the old one."

In this example Davidson

tries to put a value on the time it takes her staff to investigate alarms.

Although there were many false alarms (that is, not real incidents), the time

invested still represents a cost associated with using the old system.

In general, businesses need

to know whether and how investing one more unit buys them more security. The

effects on security depend on various perspectives, such as effects on the

global economy, the national economy, and corporate supply chains. Sidebar 9-1 illustrates how an organization can

generate a business case for a security technology.

A business case is an

argument for doing something: investing in new technology, training people,

adding a security capability to a product, or maintaining the status quo. As we

have seen, because many management arguments are made in terms of money,

computer security business cases are often framed in economic terms: amount

saved, return for taking an action, or cost avoided. Sometimes it is difficult

to separate the security effects from the more general effects, such as

improved functionality or better access to assets. This separation problem

makes it harder to answer the question, "How much more security does that

investment buy me?" Moreover, these arguments beg the question of how to

derive sound numbers in computer security. In the next section we analyze

sources of quantitative data.

Related Topics