Accountancy - Items peculiar to notÔÇôforÔÇôprofit organisations | 12th Accountancy : Chapter 2 : Accounts of-Not-For Profit Organisation

Chapter: 12th Accountancy : Chapter 2 : Accounts of-Not-For Profit Organisation

Items peculiar to notÔÇôforÔÇôprofit organisations

Items

peculiar to notÔÇôforÔÇôprofit organisations

Distinction between

revenue and capital items will be helpful while preparing the final accounts of

notÔÇôforÔÇôprofit organisations. Revenue items will be recorded in income and

expenditure account while capital items will be recorded in the balance sheet.

Items peculiar to notÔÇôforÔÇô profit organisations and their accounting treatment

in that context is given below:

(i) Subscription

NotÔÇôforÔÇôprofit

organisations usually collect subscriptions periodically from their members.

These may be collected monthly, quarterly, half-yearly or yearly. In addition,

some special subscriptions, for example, subscription for tennis, billiards,

etc., are collected from the concerned members playing tennis or billiards as

the case may be. All these subscriptions are revenue receipts.

(ii) Interest on investment

For investments made,

the organisation may receive interest. It is a revenue receipt.

(iii) Sale of old sports materials

The sale proceeds of old

sports materials like balls, bats, etc. are revenue receipts.

(iv) Sale of old newspapers

The sale proceeds of old

newspapers are revenue receipts.

(v) Life membership fee

Amount received towards

life membership fee from members is a capital receipt as it is non-recurring in

nature.

(vi) Legacy

A gift made to a notÔÇôforÔÇôprofit

organisation by a will, is called legacy. It is a capital receipt.

(vii) Admission fee or Entrance fee

It is a fee collected

from every member only once at the time of his or her admission into the

organisation. It may be treated as a revenue receipt as it is a recurring

income from new members admitted every year and may be used to meet the

expenses at the time of admission. It may also be treated as a capital receipt.

(viii) Grants from government and other organisations

NotÔÇôforÔÇôprofit organisations

may receive different forms of grant from government and other organisations.

Grants received towards

construction of buildings, acquisition of assets, etc., are treated as capital

receipts as they are non-recurring in nature.

Grants received towards

maintenance of assets, payment of salaries, etc., are treated as revenue

receipts as they are recurring in nature.

(ix) Donations

These are the amounts

received by notÔÇôforÔÇôprofit organisations as a gift. It may be general donation

or specific donation.

General donation: If the

donation is received without any specific condition, then it is a general

donation. It is a revenue receipt.

Specific donation: If

the donation is received with a specific condition for a particular purpose

like donations for sports fund, prize fund etc., it is known as specific

donation. It is a capital receipt.

(x) Honorarium

It is the remuneration

paid to a person who is not a regular employee of the organisation. It is a

revenue expenditure.

(xi) Purchase of sports materials

Sports materials such as

balls, bats, nets, etc. are consumable items. Amount of consumed sports

materials are taken as revenue expenditure and value of unconsumed sports

materials (stock) are shown as asset in the balance sheet.

(xii) Purchase of sports equipment

It is a capital

expenditure. Examples: Purchase of Table tennis table, Billiards table, etc.

(xiii) Purchase of books for library

Books purchased for

library is a capital expenditure.

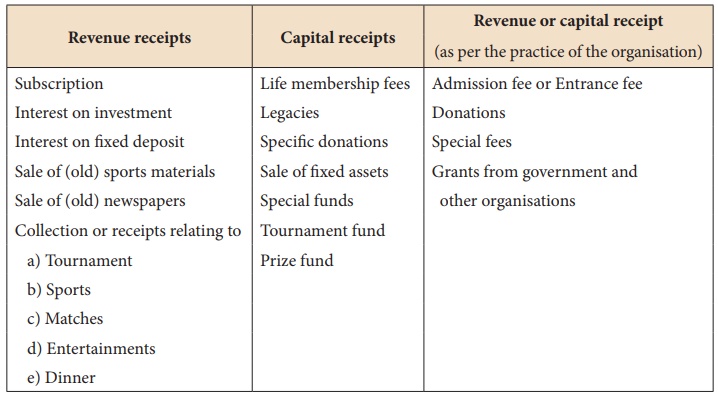

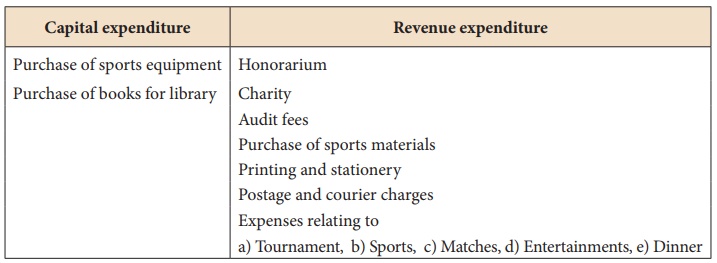

Few examples of capital

and revenue items peculiar to notÔÇôforÔÇôprofit organisations are given below:

Note: In this unit, entrance

fees or admission fees, donations, special fees and grants from government

and other organisations have been treated as revenue receipts eventhough these

may also be treated as capital receipts.

Related Topics