Company Accounts | Accountancy - Issue of shares for cash in instalments | 12th Accountancy : Chapter 7 : Company Accounts

Chapter: 12th Accountancy : Chapter 7 : Company Accounts

Issue of shares for cash in instalments

Issue

of shares for cash in instalments

The share capital may be

received through instalments as below:

·

First instalment called application money

·

Second instalment called allotment money

·

Third instalment called first call money

·

The last instalment called final call money

After allotment,

whenever the need arises call can be made. Call is a demand by a company to the

shareholders holding partly paid up shares to pay further instalments towards

the purchase price of shares. There may be more than one call. These calls can

be differentiated by serial numbers such as first call, second call, third call

and so on. The last instalment will be the final call. The words ‘and final’

will also be added to the last call. Example, if third call is the final call,

it will be termed as ‘third and final call’.

Equity shares may be

issued for cash at par or at premium. When a company issues shares at a price

equal to the face value (nominal value), it is known as issue at par. When a

company issues shares at a price more than the face value, the shares are said

to be issued at premium. The excess is called as premium.

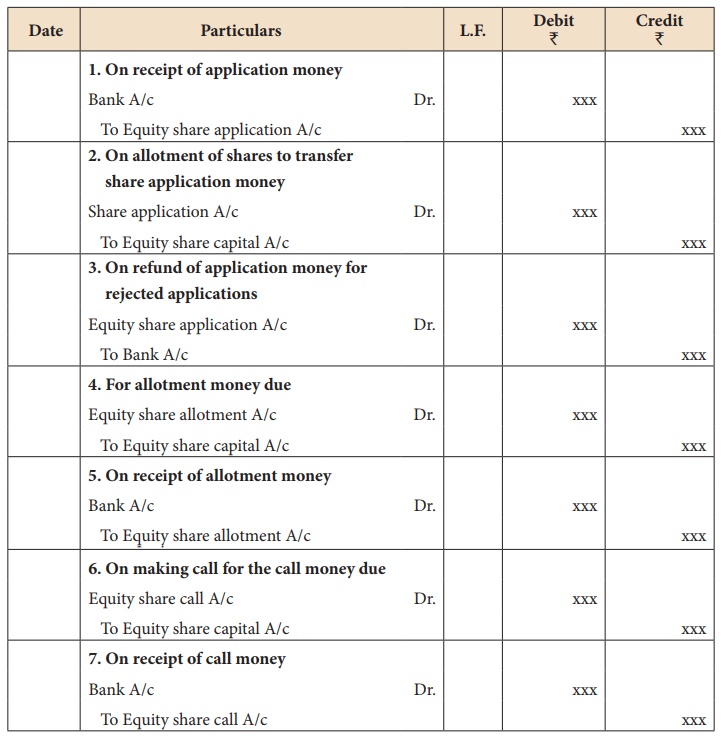

(i) When shares are issued for cash at par:

Following are the

journal entries to be passed:

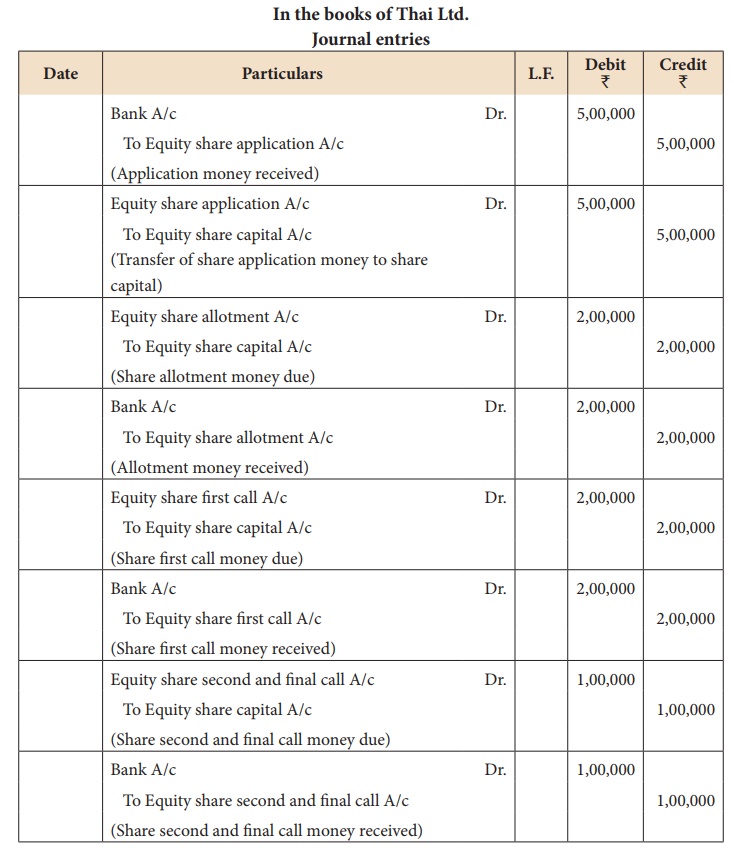

Illustration 1

Thai Ltd. issued

1,00,000 equity shares of ₹

10 each, payable ₹

5 on application, ₹

2 on allotment, 2 on first call and ₹

1 on final call. All the shares are subscribed and amount was duly received.

Pass journal entries.

Solution

1. Under subscription

All the shares offered

to the public may not be subscribed in full. When the number of shares

subscribed is less than the number of shares offered, it is known as under

subscription. Under such circumstance, all those who have duly applied will

obtain allotment provided minimum subscription as mentioned in the prospectus

has been subscribed.

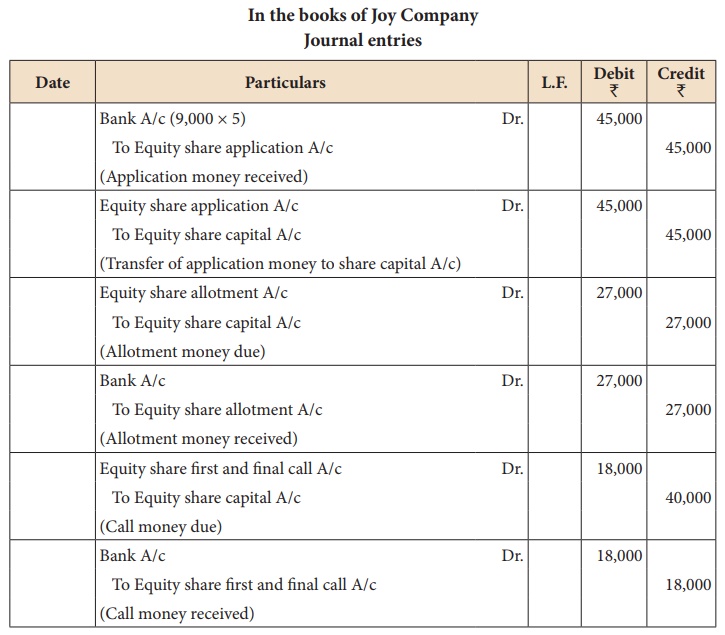

Illustration 2

Joy Company issued

10,000 equity shares at ₹

10 per share payable ₹

5 on application, ₹

3 on allotment and ₹

2 on first and final call. The public subscribed for 9,000 shares. The

directors allotted all the 9,000 shares and duly received the money. Pass the

necessary journal entries.

Solution

2. Over subscription

When the number of

shares applied for is more than the number of shares offered for subscription,

it is said to be over subscription. This situation can be dealt with as per any

of the following three alternatives:

a.

Some applications are accepted in full and others are totally

rejected. Application money is returned to the applicants for rejected

applications.

b.

All applications are allotted in proportion of shares applied for.

This is called pro rata allotment. Excess application money may be returned or

may be retained for adjustment towards allotment money and call money.

c.

A combination of the above two may be applied.

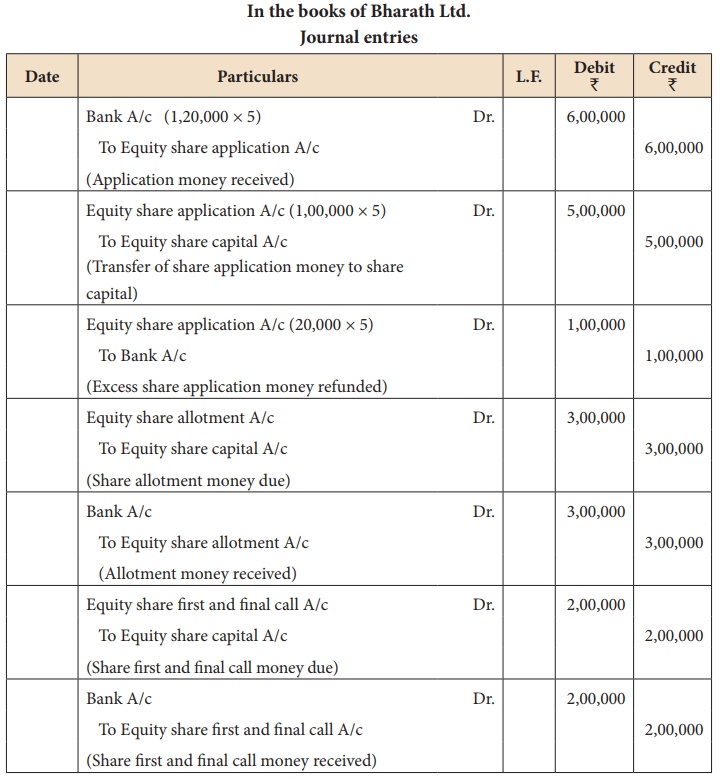

Illustration 3

Bharath Ltd. issued

1,00,000 equity shares of ₹

10 each to the public at par. The details of the amount payable on the shares

are as follows:

On application ₹

5 per share

On allotment ₹ 3 per

share

On first and final call ₹ 2 per share

Application money was

received for 1,20,000 shares. Excess application money was refunded

immediately. Pass journal entries to record the above.

Solution

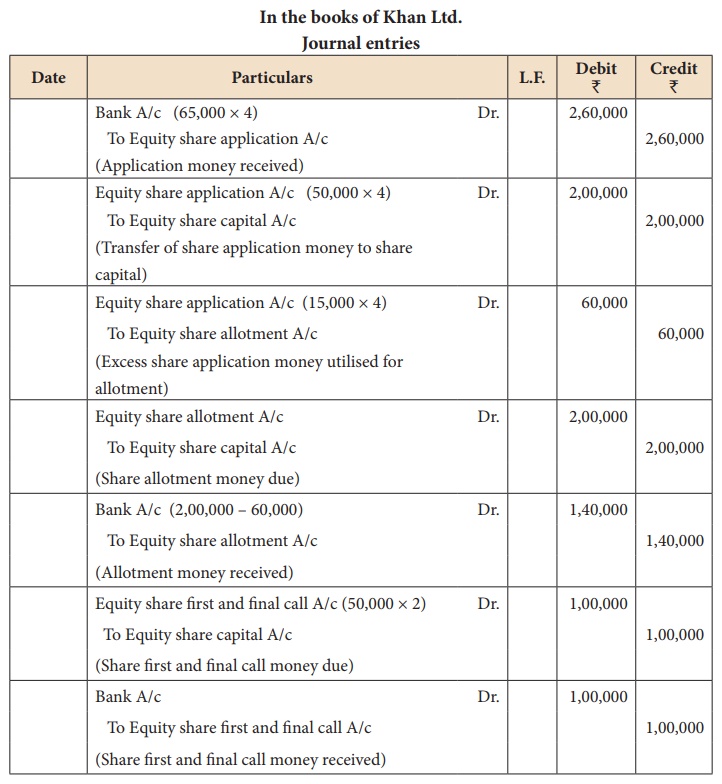

Illustration 4

Khan Ltd. issued 50,000

shares of ₹ 10 each to the public

payable ₹ 4 on application, ₹ 4 on allotment and ₹ 2 on first and final

call. Applications were received for 65,000 shares. The directors decided to

allot 50,000 shares on pro rata basis and surplus application money was

utilised for allotment. Pass journal entries assuming that the amounts due were

received.

Solution

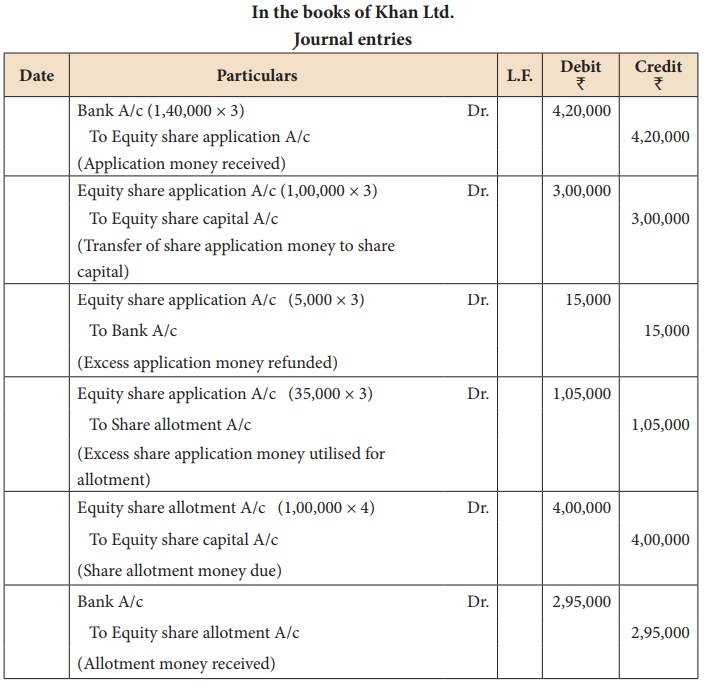

Illustration 5

Sudha Ltd. offered

1,00,000 shares of ₹

10 each to the public payable ₹

3 on application, ₹

4 on share allotment and the balance when required. Applications for 1,40,000

shares were received on which the directors allotted as:

Applicants for 60,000

shares - Full

Applicants for 75,000

shares - 40,000 shares (excess money will be utilised for allotment)

Applicants for 5,000

shares - Nil

All the money due was

received. Pass journal entries upto the receipt of allotment.

Solution

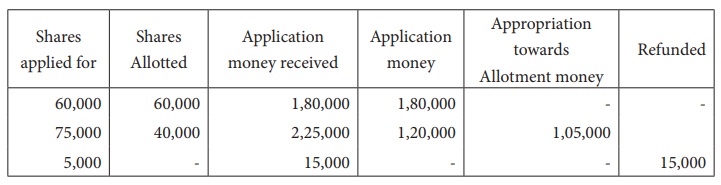

Working note:

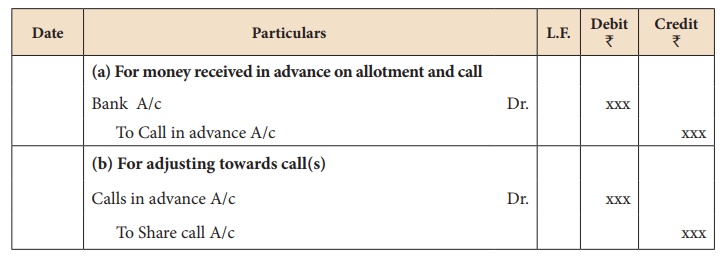

3. Calls in advance

The excess amount paid

over the called up value of a share is known as calls in advance. It is the

excess money paid on application or allotment or calls. Such excess amount can

be returned or adjusted towards future payment. If the company decides to

adjust such amount towards future payment, the excess amount may also be

transferred to a separate account called calls in advance account.

Calls in advance does

not form part of the company’s share capital and no dividend is payable on such

amount. In the balance sheet, it should be shown under current liabilities.

As per Section 50 of the

Indian Companies Act, 2013, the company can accept calls in advance only if it

is authorised by its Articles of Association. As per Table F of the Indian

Companies Act, 2013, interest may be paid on calls in advance if Articles of

Association so provide not exceeding 12% per annum.

Tutorial note

The excess application

money on allotted shares after adjustment for allotment money should be

transferred to calls in advance account.

Following are the

journal entries to be passed:

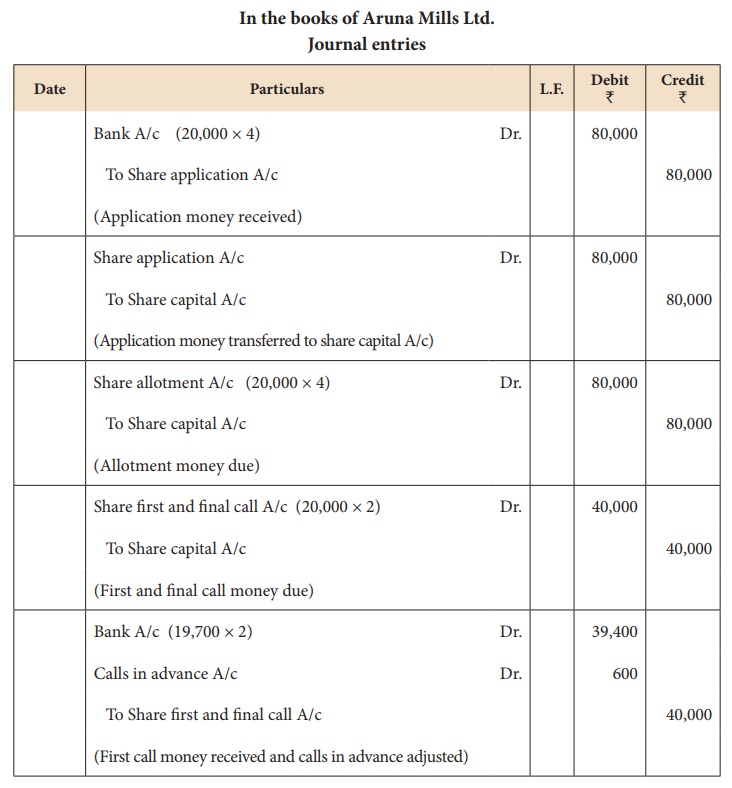

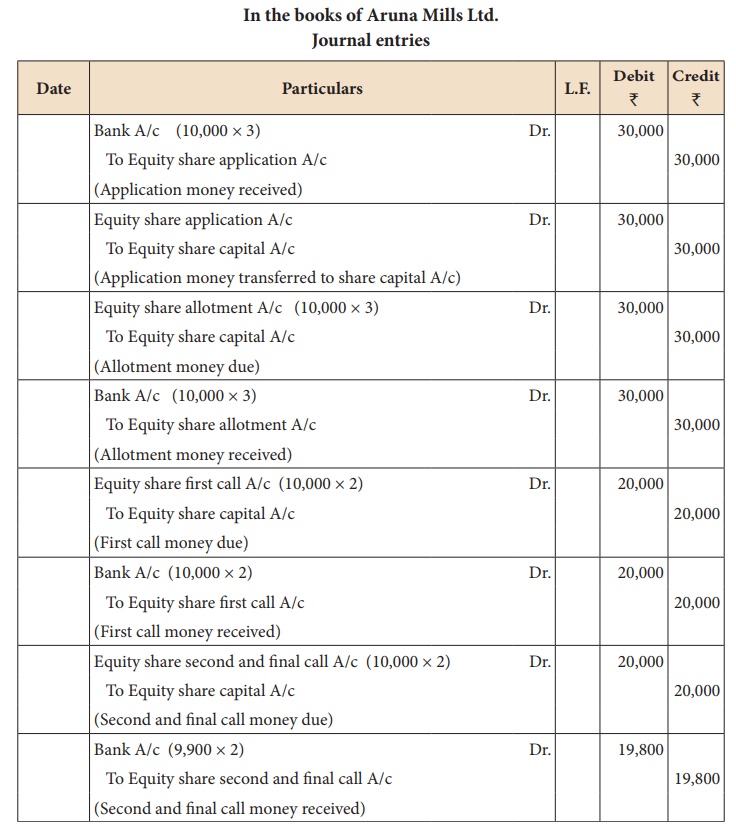

Illustration 6

Aruna Mills Ltd. with a

registered capital of ₹

5,00,000 in equity shares of ₹

10 each, issued 20,000 of such shares payable as follows; ₹ 4 per share on

application, ₹ 4 per share on

allotment and ₹ 2 per share on first

and final call. The issue was duly subscribed.

All the money payable

was duly received. But on allotment, one shareholder paid the entire balance on

his holding of 300 shares.

Give journal entries to

record the above.

Solution

4. Calls in arrear

When a shareholder fails

to pay the amount due on allotment or on calls, the amount remaining unpaid is

known as calls in arrears. In other words, the amount called up but not paid is

calls in arrear.

As per Table F of the

Indian Companies Act, 2013, interest may be charged on calls in arrear if

Articles of Association so provide not exceeding 10% per annum. There are two

methods of accounting of calls in arrear.

(i) By not opening calls in arrear account

Under this method,

amount unpaid by the shareholders remains in the respective call account until

the amount is collected or the shares are forfeited.

(ii) By opening calls in arrear account

Under this method,

amount unpaid by the shareholders is transferred by debiting it to a separate

account called calls in arrear account. When calls in arrear is collected or

when the share is forfeited, the calls in arrear account is credited.

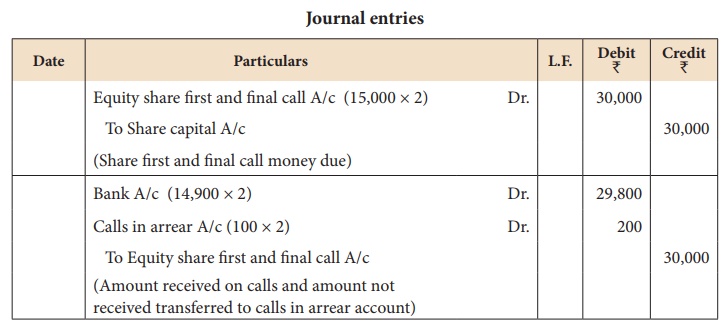

Illustration 7

Jeyam Tyres issued

15,000 ordinary shares of ₹

10 each payable as follows:

₹ 3 on application; ₹ 5 on allotment; ₹ 2 on first and final

call. All money were duly received except one shareholder holding 100 shares

failed to pay the call money. Pass the necessary journal entries for call

(using calls in arrear account).

Solution

5. Forfeiture of shares

When a shareholder

defaults in making payment of allotment and/or call money, the shares may be

forfeited. On forfeiture, the share allotment is cancelled and to that extent,

share capital is reduced. The person ceases to be a shareholder of the company

after the shares are forfeited.

On forfeiture, the

amount so far paid by the shareholder is forfeited which is a gain to the

company and is credited to forfeited shares account. Forfeited shares account

is shown under share capital as a separate head in the Note to Accounts to the

balance sheet.

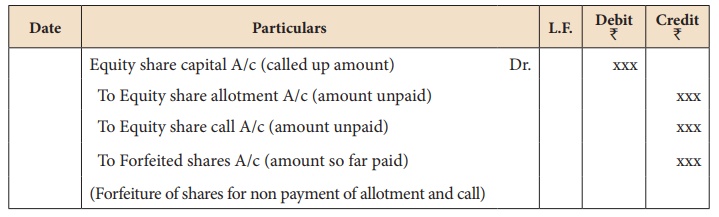

The following journal

entry is to be passed in the books of the company:

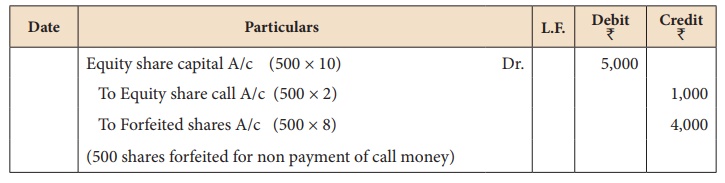

Illustration 8

Anitha was holding 500

equity shares of ₹

10 each of Thanjavur Motors Ltd, issued at par. She paid 3 on application, ₹ 5 on allotment but

could not pay the first and final call of ₹

2. The directors forfeited the shares for nonpayment of call money. Give

Journal entry for forfeiture of shares.

Solution

Illustration 9

Muthu was holding 20

equity shares of ₹

10 each on which he paid ₹

2 on application but could not pay ₹

3 on allotment and ₹

1 on first call. Directors forfeited the shares after the first call. Give

journal entry for recording the forfeiture of shares.

Solution

Tutorial note

Equity share capital is

debited with the called up amount of ₹

6.

6. Re-issue of forfeited shares

Shares forfeited can be

reissued by the company. The shares can be reissued at any price. But, the

reissue price cannot be less than the amount unpaid on forfeited shares.

Example: If a share of ₹ 10 on which ₹ 4 has already been paid

as application money is forfeited and reissued as fully paid up, then a minimum

of ₹ 6 must be fixed as the

new price (10 – 4

= 6). When forfeited shares are reissued at a loss,

such loss is to be debited to forfeited shares account. When forfeited shares

are reissued at a premium, the amount of such premium will be credited to

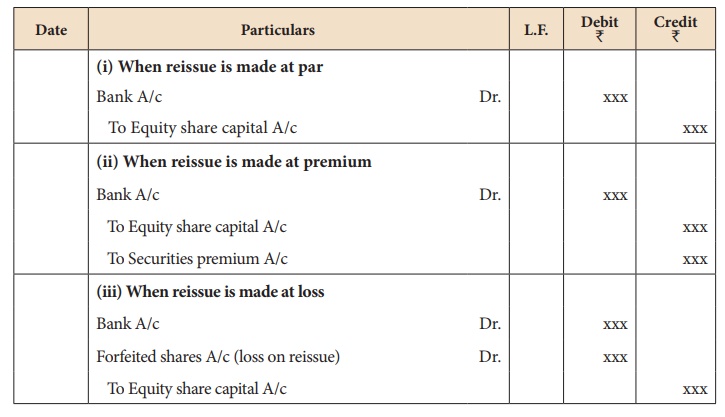

securities premium account. The following journal entries are passed on

reissue:

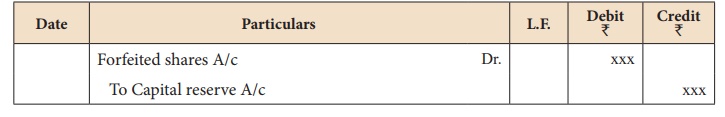

If the reissue price is

more than the amount unpaid on forfeited shares, it results in profit on

reissue which is treated as capital profit and is transferred to capital reserve

account. The following journal entry is passed:

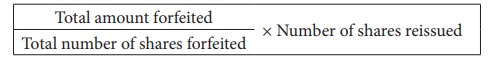

When only a part of the

forfeited shares are reissued, the proportionate amount of profit on the shares

reissued should be transferred to capital reserve account. Proportionate amount

of profit is computed as follows:

The remaining amount in

the forfeited shares account is shown under share capital as a separate head

under share capital in the Note to Accounts to the balance sheet.

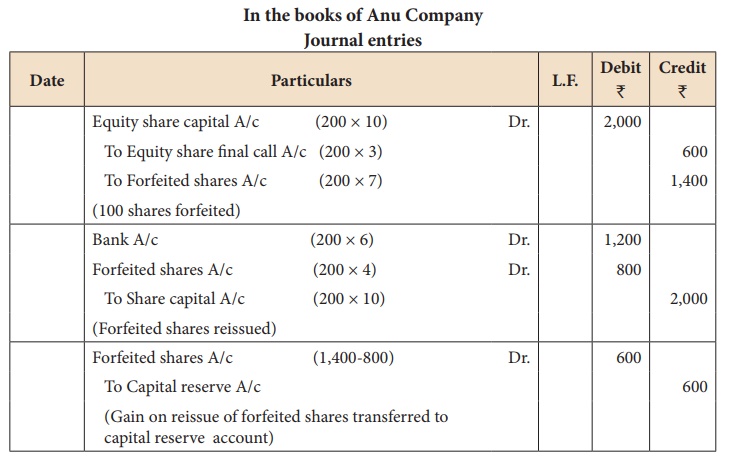

Illustration 10

Anu Company forfeited 200

equity shares of ₹

10 each issued at par held by Thiyagu for nonpayment of the final call of ₹ 3 per share. The shares

were reissued to Laxman at ₹

6 per share. Show the journal entries for forfeiture and reissue.

Solution

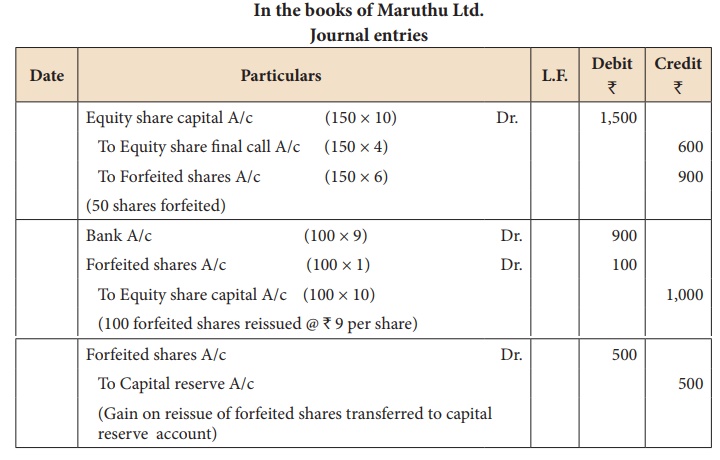

Illustration 11

Maruthu Ltd. forfeited

150 equity shares of ₹

10 each for non payment of final call of ₹

4 per share.

Of these 100 shares were

reissued @ ₹ 9 per share. Pass

journal entries for forfeiture and reissue.

Solution

Working note:

Forfeited amount for 150

shares = ₹ 900

Forfeited amount for 100

shares = 900/150 x 100 =₹ 600

Gain or loss = Amount

forfeited– loss on reissue

= 600 – 100

Net gain = ₹ 500

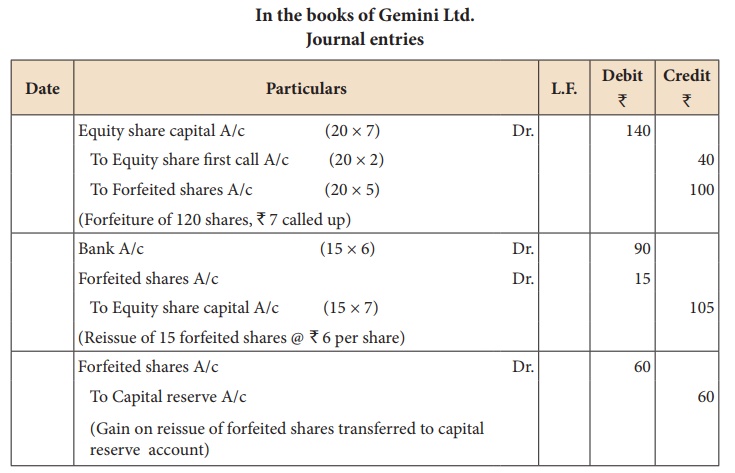

Illustration 12

Gemini Ltd. forfeited 20 equity shares of ₹ 10 each, ₹ 7 called up, on which Mahesh had paid application and allotment money of ₹ 5 per share. Of these 15 shares were reissued to Naresh by receiving ₹ 6 per share paid up as ₹ 7 per share. Pass journal entries for forfeiture and reissue.

Solution

Note: Computation of transfer to

capital reserve

Forfeited amount for reissued shares

of 15 = 100/20 × 15 = 75

Less: Loss on reissue = 15

Transfer to capital reserve = 60

Remaining balance in shares forfeited account ₹ 25 will appear in the balance sheet.

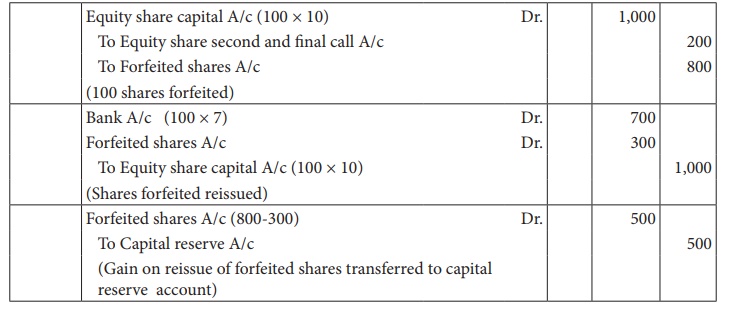

Illustration 13

Jenifer Ltd. issued

10,000 equity shares of ₹

10 each at par payable on application ₹

3 per share, on allotment ₹

3 per share, on first call ₹

2 per share and on second and final call ₹

2 per share. The issue was fully subscribed and all the amounts were duly

received with the exception of 100 shares held by Subbu, who failed to pay the

second and final call. His shares were forfeited and reissued to Hema at ₹ 7 per share. Journalise

the above transactions.

Solution

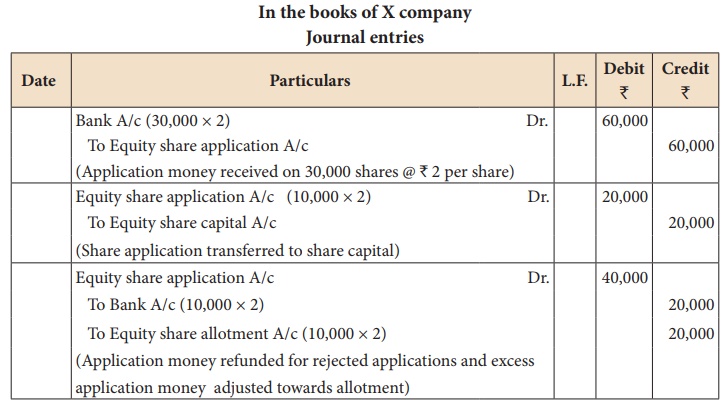

Illustration 14

X company issued 10,000

equity shares of ₹ 10 each payable as under:

On application ₹ 2

On allotment ₹ 4

On first call ₹ 2

On final call ₹ 2

Applications were

received for 30,000 shares. Applications for 10,000 shares were rejected and

allotment was made proportionately towards remaining applications and the

excess application money is adjusted towards allotment money. The directors

made both the calls and the all the amount were received except the final call

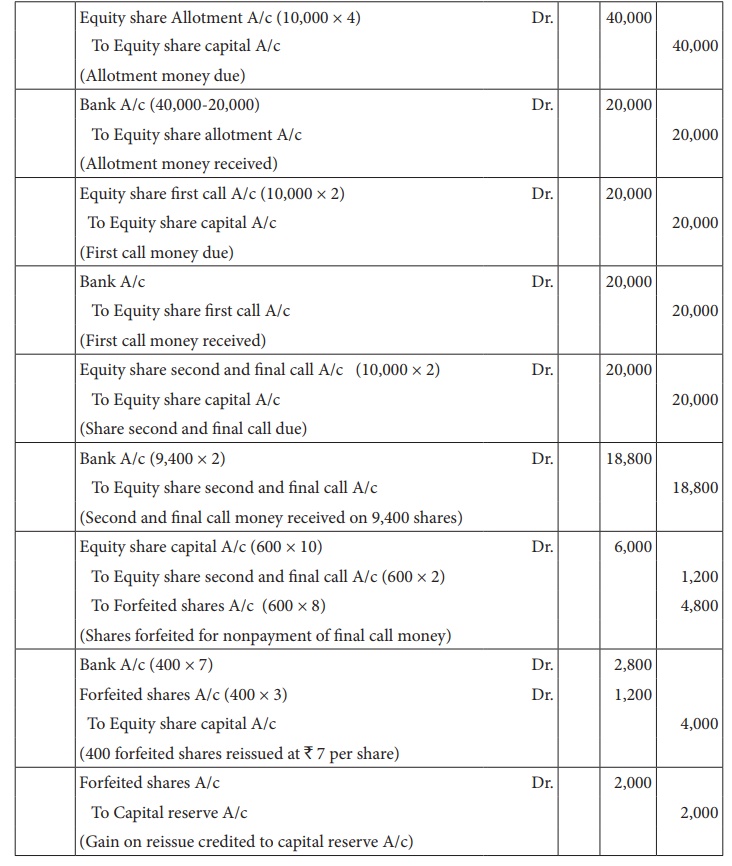

on 600 shares which were subsequently forfeited. Later 400 forfeited shares

were reissued as fully paid by receiving ₹

7 per share. Give journal entries.

Solution

In the books of X company

Journal entries

Working note:

Amount forfeited for 600 shares = ₹

4,800

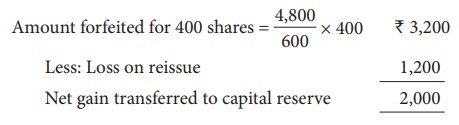

7. Shares issued at premium

When a company issues

shares at a price more than the face value (nominal value), the shares are said

to be issued at premium. The excess is called as premium amount and is

transferred to securities premium account. The amount of securities premium may

be included in application money or allotment money or in a call. Securities

premium account is shown under reserves and surplus as a separate head in the

Note to Accounts to the balance sheet. Following are the journal entries for

recording securities premium:

Tutorial note While forfeiting shares

for which premium had already been received, securities premium account should

not be debited.

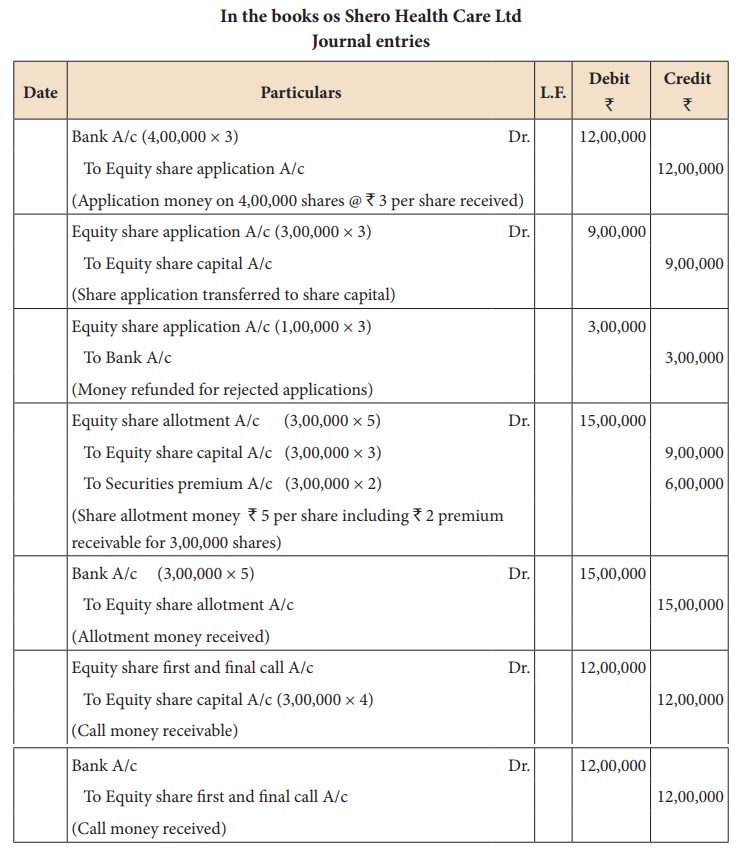

Illustration 15

Shero Health Care Ltd.

invited applications for 3,00,000 equity shares of ₹ 10 each at a premium of

₹ 2 per share payable as

follows:

₹ 3 on application

₹ 5 (including premium) on

allotment

₹ 4 on first and final

call

There was over

subscription and applications were received for 4,00,000 shares and the excess

applications were rejected by the directors. All the money due were received.

Pass the journal entries.

Solution

Note: Number of shares

rejected = 4,00,000 - 3,00,000 = 1,00,000

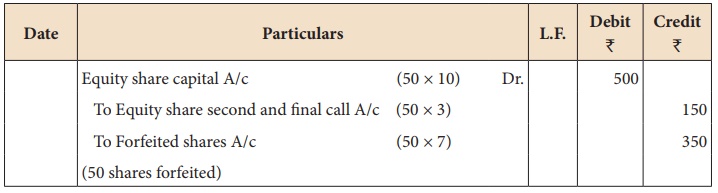

Illustration 16

Keerthiga Company issued

shares of ₹ 10 each at 10% premium,

payable ₹ 2 on application, ₹ 3 on allotment (including premium), ₹ 3 on first call and ₹ 3 on second and final

call. Journalise the transactions relating to forfeiture of shares for the

following situations:

(i) Mohan who holds 50

shares failed to pay the second and final call and his shares were forfeited.

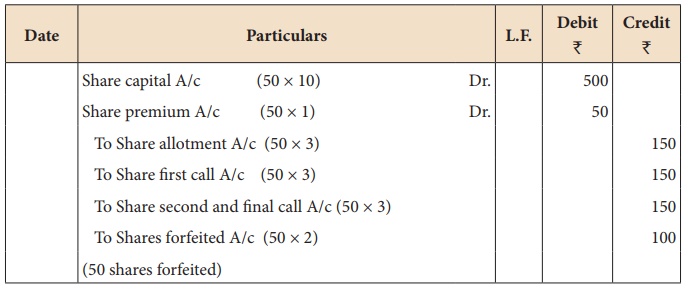

(ii) Mohan who holds 50

shares failed to pay the allotment money, first call and second and final call

money and his shares were forfeited.

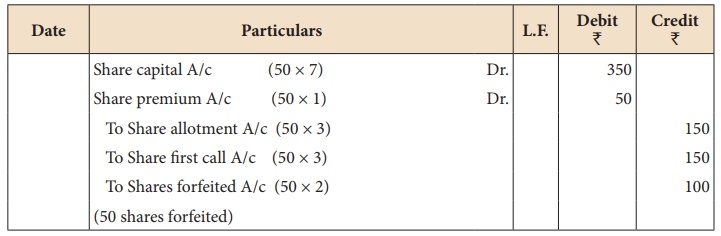

(iii) Mohan who holds 50

shares failed to pay the allotment money and first call and his shares were

forfeited after the first call.

Solution

In

the books of Keerthiga Company

Journal

entries

(i)

When final call money is not paid

Note: Since the premium amount is

received by the company, premium should not be cancelled.

(ii)

When allotment, first call money and second and final call money is not paid

(iii)

When allotment and first call money is not paid

Illustration 17

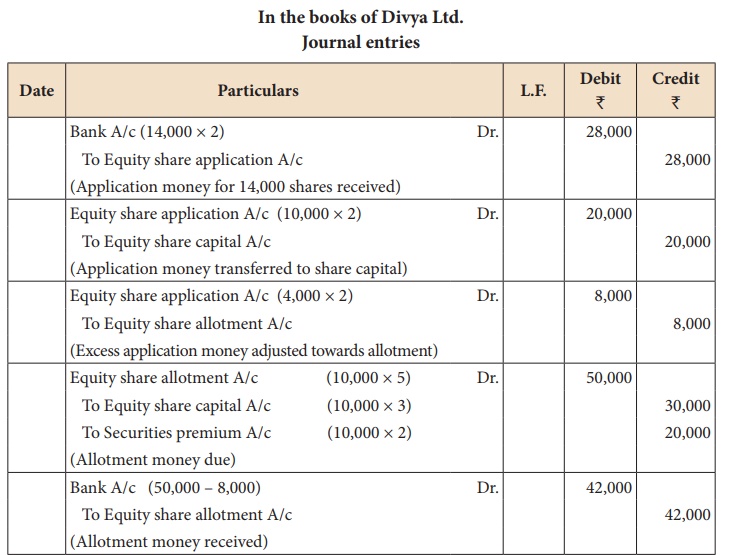

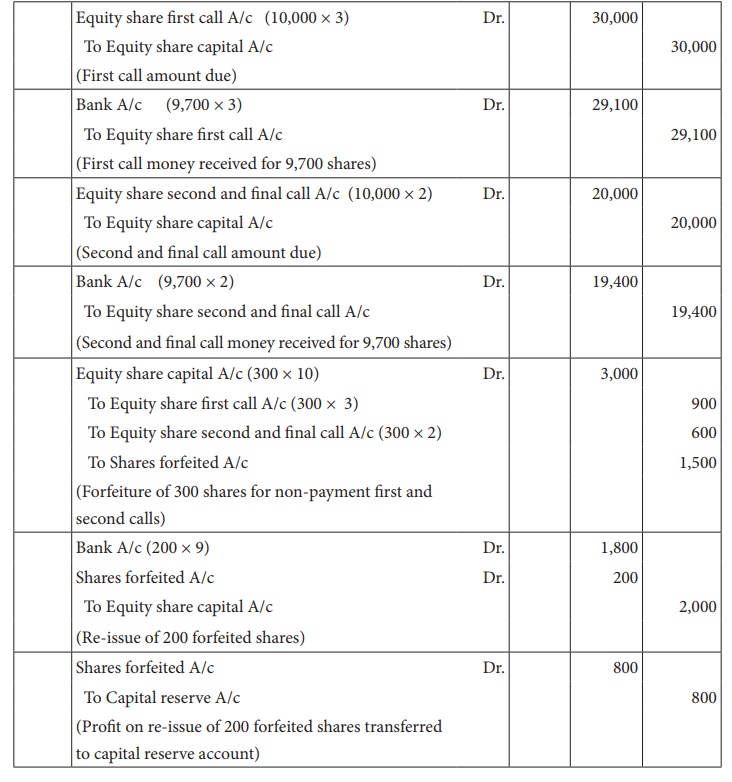

Divya Ltd. allotted

10,000 equity shares of ₹

10 each at a premium of ₹

2 per share to applicants of 14,000 shares on a pro rata basis. The excess

application money will be adjusted towards allotment money. The amount payable

was ₹ 2 on application, ₹ 5 on allotment

(including premium of ₹

2 each) and ₹ 3 on first call and ₹ 2 on final call. Vikas,

a shareholder failed to pay the first call and final call on his 300 shares.

All the shares were forfeited and out of them 200 shares were reissued @ ₹ 9 per share. Pass the

necessary journal entries.

Solution

In the books of Divya Ltd.

Journal entries

Working note:

Amount forfeited for 300 shares = ₹

1,500

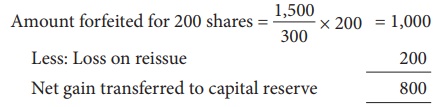

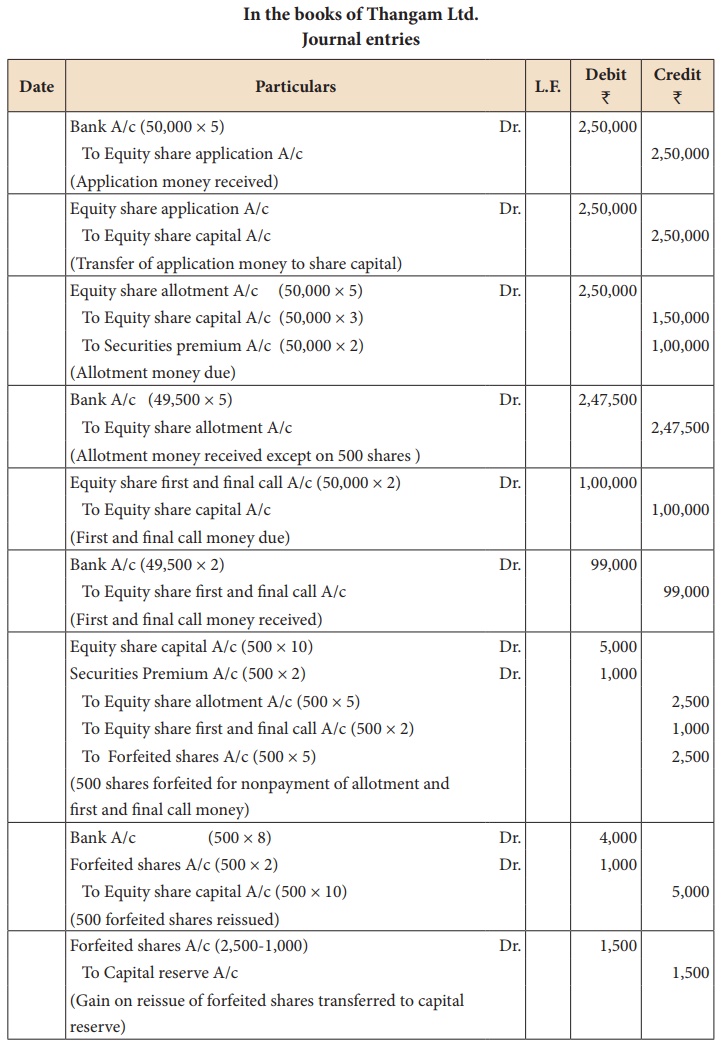

Illustration 18

Thangam Ltd. issued

50,000 shares of ₹ 10 each at a premium of ₹ 2 per share payable as follows:

On application ₹ 5

On allotment ₹ 5 (including premium)

On first and final call ₹ 2

Issue was fully

subscribed and the amounts due were received except Priya to whom 500 shares

were allotted who failed to pay the allotment money and fist and final call

money. Her shares were forfeited. All the forfeited shares were reissued to

Devi at ₹ 8 per share. Pass

journal entries.

Solution

Related Topics