Chapter: Business Science : Financial Management : Investment Decision

Investment Decision

INVESTMENT DECISION

1 Capital Budgeting

1.1 Need Of Capital Budgeting

1.2 Principles

2 Need and importance/Nature

3 Identifying Relevant Cash Flows

4 Evaluation Techniques

4.1 Pay-back period method

4.2 Average Rate of Return method (ARR)

4.3 Net present value method(NPV)

4.4 Internal Rate of Return Method (IRR)

4.5 Profitability index method or Benefit cost

ratio (P.I)

5 Project Selection Under Capital Rationing

5.1 Capital Rationing

6 Inflation and capital budgeting

7 Concept And Measurement Of Cost Of Capital

7.1 Computation of cost of capital

7.2 Computation of specific source of finance

7.3 Measurement of cost of capital(specific cost

and overall cost)

1 Capital Budgeting

It is the process of making investment decision in

capital expenditures. Capital expenditure defined as an expenditure the benefits

of which are expected to be received more than one year. It is incurred in one

point of time and the benefits are received in different point of time in

future.

Ø Cost of

acquisition of permanent asset as land and building, plant and machinery, goodwill

Ø Cost of

addition, expansion and improvement or alteration in fixed assets

Ø Cost of

replacement of permanent assets

Ø Research

and development project cost etc.

1.1 Why the

capital budgeting is

considered as most important

decision ove r the others?

Ø The

capital budgeting is the decision of long term investments, which mainly

focuses the acquisition or improvement on fixed assets.

Ø The

capital budgeting decision is a decision of capital expenditure or long term

investment or long term commitment of funds on the fixed assets.

1.2Principles

v Decisions

are based on cash flow not accounting income

v The

capital budgeting decisions are based on the cash flow forecasts instead of

relying on the accounting income.these are the incremental cash flows that is

additional cash

flows

that will occur if the project undertaken compare to if the project is not

undertaken

v Timing of

cash flows

v To

estimate the timing of cash flows as accurately as possible. it is used the

concept of time value of money, the time at which the cash flows occur

significantly impacts at the present value of the project.

v Financing

cost should be ignored

v Cash flow

should be considered

v Opportunity

cost are also considered

2 Need and importance/Nature

(1) Large investment

- Involve

large investment of funds

- Fund

available is limited and the demand for funds exceeds the existing resources

- Important

for firm to plan and control capital expenditure

(2) Long term commitment of funds

-

Involves not only large amount of fund but also

long term on permanent basis.

-

It increases financial risk involved in investment

decision.

-

Greater the risk greater the need for planning

capital expenditure.

(3) Irreversible Nature

- Capital

expenditure decision are irreversible

-

Once decision for acquiring permanent asset is

taken, it become very difficult to dispose of these assets without heavy

losses.

(4) Long-term effect on

profitability

-

Capital expenditure decision are long-term and have

effect on profitability of a concern

-

Not only present earning but also the future growth

and profitability of the firm depends on investment decision taken today

-

Capital budgeting is needed to avoid over

investment or under investment in fixed assets.

(5) Difficulties of investment

decision

-

Long term investment decision are difficult to take

because (i) decision extends to a series of year beyond the current accounting

period

-

(ii) uncertainties of future

-

(iii) higher degree of risk

(6) National importance

-

Investment decision taken by individual concern is

of national importance because it determines employment, economic activities

and economic growth.

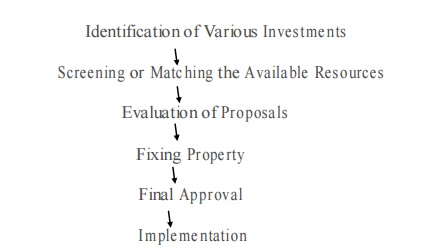

3 Identifying Relevant Cash Flows

&Capital budgeting Process

Capital

budgeting is a difficult process to the investme nt of available funds. The

benefit will attained only in the near future but, the future is uncerta in.

However, the following steps followed for capital budgeting, then the process

may be easier are

Identification

of Various Investments

-- >

Screening

or Matching the Available Resources

-- >

Evaluation of Proposals

-- >

Fixing Property

-- >

Final Approval

-- >

Implementation

1.Identification of various

investments proposals : The capital budgeting may have various investment

proposals. The proposal for the investment opportunities may be defined from

the top manage me nt or may be even from the lower rank. The heads of various

department analyse the various investment decisions, and will select proposals

sub mitted to the planning committee of competent authority.

2. Screening or matching the

proposals : The planning committee will analyse the various

proposals and screenings. The selected proposals are considered with the

available resources of the concern. Here resources referred as the financial

part of the proposal. This reduces the gap between the resources and the

investment cost.

3.Evaluation: After screening, the proposals are evaluated with the help of

various methods, such as pay back

period proposal, net discovered present value method, accounting rate of return

and risk analysis.

4. Fixing property: After

the evolution, the planning committee will predict which proposals will give

more profit or economic consideration. If the projects or proposals are not

suitable for the concern‘s financial condition, the projects are rejected

without considering other nature of the proposals.

5.Final approval: The planning committee approves the final proposals, with the help of the following:

(a)

Profitability,

(b) Economic

(c)Financial

6. Implementing: The competent authority spends

the money and implements the proposals. While implementing the proposals,

assign responsibilities to the proposals, assign responsibilities for

completing it, within the time allotted and reduce the cost for this purpose.

The network techniques used such as PERT and CPM. It helps the management for

monitoring and containing the implementation of the proposals.

7. Performance review of feedback: The final

stage of capital budgeting is actual results compared with the standard

results. The adverse or unfavourable results identified and removing the

various difficulties of the project. This is helpful for the future of the

proposals.

4 Evaluation Of Investment Proposals

Traditional methods or Non-Discounted method

2.1Net

Present Value method

2.2Internal

Rate of Return method

2.3 Rate

of return method or accounting method

Time-adjusted method or discounted methods

(i) Net

Present Value method

(ii) Internal

Rate of Return method

(iii)Profitability

Index method

4.1 Pay-back period method

This method

represent the period in which total investment in permanent asset pays back

itself. It measure the period of time for the original cost of a project to be

recovered from the additional earning of a project itself.

Investment

are ranked according to the length of the payback period, investment with

shorter payback period is preferred.

How the payback period is calculated?

The

payback period is ascertained in the following manner

·

Calculate annual net earnings(profit) before

depreciation and after taxes, these are called annual cash inflow

·

Divide the initial outlay(cost) of the project by

the annual cash inflow, where the project generates constant annual cash inflow

Payback

period = cash outlay of the project or original cost of the asset

Annual cash

inflows

·

Where the annual cash inflows (profit before

depreciation and after taxes) are unequal the

payback

period is found by adding up the cash inflows until the total is equal to the

initial cash outlay of the project.

Selection criterion

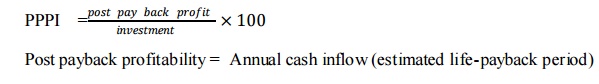

Improvement of Traditional

Appraoch To Payback Period:

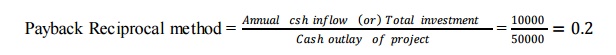

Payback Reciprocal Method

Discounted payback period : -

(time value of money in consider)

Merits

v It is a

simple method to calculate and understand

v It is a

method in terms of years for easier appraisal

Demerits

v It is a

method rigid

v It has

completely discarded the principle of time value of money

v It has

not given any due weight age to cash inflows after the payback period

v It has

sidelined the profitability of the project.

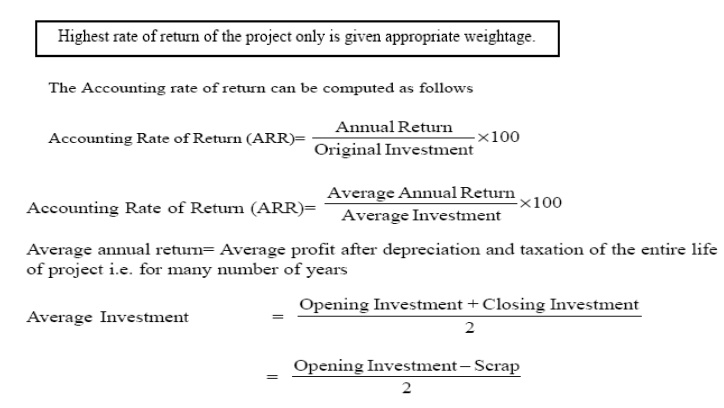

4.2Average Rate of Return method (ARR)

This method takes in to account the earnings

expected from the investment over their whole life. It is known as accounting

rate of return.

The project which gives the higher rate of return

is selected when compared to one with lower rate of return.

Selection criterion of the

projects:

Merits

v It is

simple method to compute the rate of return

v Average

return is calculated from the total earnings of the enterprise through out the

life of the firm

v The entire

rate of return is being computed on the basis of the available accounting data

Demerits

v Under

this method, the rate of return is calculated on the basis of profits extracted

from the books but not on the basis of cash inflows

v The time

value of money is not considered

v It does

not consider the life period of the project

v The

accounting profits are different from one concept to another which leads to

greater confusion in determining the accounting rate of return of the projects

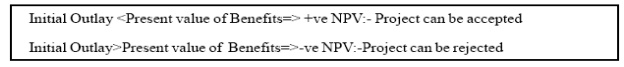

4.3 Net present value method(NPV)

It is a modern method of evaluating investment

proposals. It takes into consideration time value of money and calculates the

return on investment by introducing the factor of time element.

v

First determine the rate of interest that should be

selected as the minimum required rate of return

v

Compute the present value of total investment

outlay

v

Compute the present value of total cash inflows

v

Calculate Net Present Value by subtracting the

present value of cash inflow by present value of cash outflow.

v

NPV = is positive or zero the project is accepted

v

NPV= is negative then reject the proposal

v

In order for ranking the project the first

preference is given to project having maximum positive net present value

NPV= Present value of cash inflow – present value

of cash outflow/Initial investment Selection criterion of Net present value

method

4.4 Internal Rate of Return Method (IRR)

Under the

internal rate of return method, the cash flows of a project are discounted at a

suitable rate by hit and trial method, which equates the net present value so

calculated to the amount of investment.

v

Determine the future net cash flows during the

entire economic life of the project. The cash inflows are estimated for future

profits before depreciation but after taxes

v

Determine the rate of discount at which the value

of cash inflow is equal to the present value of cash outflows

v

Accept the proposal if the internal rate of return

is higher than or equal to the cost of capital or cut off rate.

v

In case of alternative proposals select the

proposal with the highest rate of return.

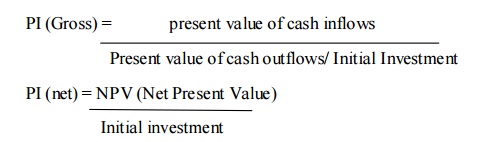

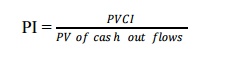

4.5 Profitability index method or Benefit cost

Ratio (P.I)

It is

also called Benefit cost ratio is the relationship between present value of

cash inflow and present value of cash outflow

The

proposal is accepted if the profitability index is more than one and is

rejected the profitability index is less than one

The

various projects are ranked; the project with higher profitability index is

ranked higher than other.

Profitability Index Method (or) Benefit cost Ratio:

-

5 Project Selection Under Capital Rationing

5.1 Capital Rationing

Capital rationing refers to a situation where the

firm is constrained for external, or self imposed, reasons to obtain necessary

funds to invest in all investment projects with positive net present value

(NPV). Under capital rationing, the management has not simply to determine the

profitable investment opportunities, but it has also to decide to obtain that combination

of the profitable projects which yields highest net present value (NPV) within

the available funds.

Why capital rationing?

Capital rationing may rise due to external factors

or internal constraints imposed by the management. Thus there are two types of

capital rationing.

v External

capital rationing

v Internal

capital rationing

External capital rationing

External capital rationing mainly occurs on account

of the imperfections in capital markets. Imperfections may be caused by

deficiencies in market information, or by rigidities of attitude that hamper

the free flow of capital. The net present value (NPV) rule will not work if

shareholders do not have access to the capital markets. Imperfections in

capital markets alone do not invalidate use of the net present value (NPV)

rule. In reality, we will have very few situations where capital markets do not

exist for shareholders.

Internal capital rationing

Internal capital rationing is caused by self

imposed restrictions by the management. Various types of constraints may be

imposed. For example, it may be decide not to obtain additional funds by

incurring debt. This may be a part of the firm‘s conservative financial policy.

6 Inflation and capital budgeting

v Inflation

is the increase in the general level of prices for all goods and services in an

economy

v Nominal

values are the actual amount of money making up cash flows

v real

values reflect the purchasing power of the cash flows

v real

values are found by adjusting the nominal values for the rate of inflation

Inflation

effects two aspects of capital budgeting

o projected cash flows

o discount rate

if

projected cash flows are in nominal terms (with inflation considered) the

discount rate used should be a nominal rate

Is it

better to use real or nominal values?

v Using

nominal values is more common.

v Market

interest rates are nominal values that already contain a premium for

anticipated inflation.

v Income

tax obligations are based on nominal values.

v Therefore,

it is usually easier to use nominal values.

v However,

if a nominal discount rate is used, projected cash flows should reflect

anticipated inflation.

Risk And

Capital Budgeting

Risk

pertains to the possibility that the projected cash flows will be less than

estimated adjusting the discount rate

Discount

rate components include:

– time preference

– inflation expectations

– risk premium

Risk

premium is the cost of risk bearing

•

increasing the discount rate adds a cost for taking

risk by requiring a higher rate of return for risk bearing.

Certainty

equivalent approach

•

adjusts the cash flows to a level with a higher

―certainty‖ that they will be received.

• conceptually

similar to a risk premium.

.

7 Concept And Measurement Of Cost Of Capital

The cost

of capital of a firm is the minimum rate of return expected by its investors.

It is the weighted average cost of various sources of finance used by the firm.

The capital used may be debt, preference shares, retained earnings and equity

shares.

v The

decision to invest in particular project depends on cost of capital or cut off

rate of the firm,.

v To

achieve the objective of wealth maximization, a firm must earn a rate of return

more than its cost of capital.

v Higher

the risk involved in the firm, higher is the cost of capital.

Factors Affecting The Cost Of Capital Of A Firm

1) Risk Free Interest Rate:

The risk

free interest rate, If , is the interest rate on the risk free and

default- free securities. Theoretically speaking, the risk free interest rate

depends upon the supply and demand consideration in financial market for long

term funds. The market sources of demand and supply determines the If

, which is consisting of two components:

a) Real interest Rate:

The real

interest rate is the interest rate payable to the lender for supplying the

funds or in other words, for surrendering the funds for a particular period.

b)

Purchasing

power risk premium:

Investors,

in general, like to maintain their purchasing power and therefore, like to be

compensated for the loss in purchasing power over the period of lending or

supply of funds. So, over and above the real interest rate, the purchasing

power risk premium is added to find out the risk free interest rate. Higher the

expected rate of inflation, greater would be the purchasing power risk premium

and consequently higher would be the risk free interest rate.

2) Business Risk:

Another

factor affecting the cost of capital is the risk associated with the firm‘s

promise to pay interest and dividends to its investors. The business risk is

related to the response of the firm‘s Earnings Before Interest and Taxes, EBIT,

to change in sa les revenue. Every project has its effect on the business risk

of the firm. If a firm accepts a proposal which is more risky than average

present risk, the investors will probably raise the cost of funds so as to be

compensated for the increased risk. This premium is added for the business risk

compensation is also known as Business Risk Premium.

3) Financial Risk:

The

financial risk is a type of risk which can affect the cost of capital of the

firm. The particular composition and mixing of different sources of finance,

known as the financial plan or the capital structure, can affect the return

available to the investors. The financial risk is affected by the capital

structure or the financial plan of the firm. Higher the proportion of fixed

cost securities in the overall capital structure, greater would be the

financial risk.

4) Other Consideration:

The

investors may also like to add a premium with reference to other factors. One

such factor may be the liquidity or marketability of the investment. Higher the

liquidity available with an investment, lower would be the premium demanded by

the investor. If the investment is not easily marketable, then the investors

may add a premium for this also and consequently demand a higher rate of

return.

7.1 Computation Of Cost Of Capital

A.

Computation of cost of specific source of finance

B.

Computation of cost of weighted average cost of

capital

7.2Computation of specific source of finance

(i)

Cost of

debt

It is the

rate of interest payable on debt.

Debenture before tax

Ø Issued at

par

Ø Issued at

premium or discount

Debenture after tax

(ii) Cost of

redeemable debt

The debt

is to be redeemed after a certain period during the life time of the firm. Such

debt issued is known as redeemable debt.

Ø Before

tax cost of redeemable debt

Ø After tax

cost of redeemable debt

(iii) Cost of preference capital

A fixed

rate of dividend is payable on preference shares. Dividend is payable at the

discretion of the board of directors and there is no legal binding to pay

dividend. In case dividend are not paid, it will affect the fund raising

capacity of the firm. Hence dividends are paid regularly except when there is

no profit

Ø Issued at

par

Ø Issued at

premium or discount

Cost of redeemable preference

shares

Redeemable

preference shares are issued which can be redeemed or cancelled on maturity

date.

(iv) Cost of equity share capital

The cost

of equity is the maximum rate of return that the company must earn on equity

financed position of its investments in order to leave or unchanged the market

price of its stock.It may or may not be paid. Shareholders invest money in

equity shares on the expectation of getting dividend and the company must earn

this minimum rate so that the market price of the shares remains unchanged.

(a)

Dividend

yield method or dividend / price ratio method

(b)

Dividend

yield plus growth in dividend method

(c)

Earnings

yield method

(v) Cost of

retained earnings

The

retained earnings do not involve any cost because a firm is not required to pay

dividend on retained earnings. But shareholder expects return o n retained

earnings.

Computation Of Cost Of Capital

Co

mputation of cost of capital consists of

two important parts:

1.

Measureme nt of specific costs

2.

Measureme nt of overall cost of

capital

7.3Measurement of Cost of Capital

It

refers to the cost of each specific

sources of finance like:

•

Cost of equity

•

Cost of debt

• Cost of

prefere nce share

• Cost of

retained earnings

Cost of

Equity

Cost of

equity capital is the rate at which investors discount the expected dividends

of the firm to deter mine its share value.

Conceptually the cost of equity capital (Ke) defined

as the ―Minimum rate of

retur n

that a firm must earn on the equity financed portion of an investme nt project in

order to leave unc hanged the market price of the shares‖.

Cost of

equity can be calculated from the following approach:

•

Dividend price (D/P) approach

•

Dividend price plus growth (D/P + g) approach

• Earning

price (E/P) approach

•

Realized yield approach.

Dividend Price Approach

The cost of equity capital will be

that rate of expected

dividend which will ma

inta in the present market price

of equity shares.

Dividend price approach can be measured with the

help of the following formula:

Ke=D/Np

Where,

Ke = Cost of equity

capital

D =

Dividend per equity share

Np = Net proceeds of

an equity share

Related Topics