Chapter: Business Science : Financial Management : Investment Decision

Identifying Relevant Cash Flows and Capital budgeting Process

Identifying Relevant Cash Flows &Capital budgeting Process

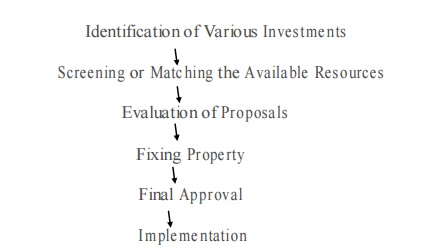

Capital budgeting is a difficult process to the investme nt of available funds. The benefit will attained only in the near future but, the future is uncerta in. However, the following steps followed for capital budgeting, then the process may be easier are

Identification of Various Investments

-- >

Screening or Matching the Available Resources

-- >

Evaluation of Proposals

-- >

Fixing Property

-- >

Final Approval

-- >

Implementation

1.Identification of various investments proposals : The capital budgeting may have various investment proposals. The proposal for the investment opportunities may be defined from the top manage me nt or may be even from the lower rank. The heads of various department analyse the various investment decisions, and will select proposals sub mitted to the planning committee of competent authority.

2. Screening or matching the proposals : The planning committee will analyse the various proposals and screenings. The selected proposals are considered with the available resources of the concern. Here resources referred as the financial part of the proposal. This reduces the gap between the resources and the investment cost.

3.Evaluation: After screening, the proposals are evaluated with the help of various methods, such as pay back period proposal, net discovered present value method, accounting rate of return and risk analysis.

4. Fixing property: After the evolution, the planning committee will predict which proposals will give more profit or economic consideration. If the projects or proposals are not suitable for the concern‘s financial condition, the projects are rejected without considering other nature of the proposals.

5.Final approval: The planning committee approves the final proposals, with the help of the following:

(a) Profitability,

(b) Economic

(c)Financial

6. Implementing: The competent authority spends the money and implements the proposals. While implementing the proposals, assign responsibilities to the proposals, assign responsibilities for completing it, within the time allotted and reduce the cost for this purpose. The network techniques used such as PERT and CPM. It helps the management for monitoring and containing the implementation of the proposals.

7. Performance review of feedback: The final stage of capital budgeting is actual results compared with the standard results. The adverse or unfavourable results identified and removing the various difficulties of the project. This is helpful for the future of the proposals.

Related Topics