Chapter: Mechanical : Engineering Economics & Cost Analysis : Value Engineering

Interest rate Formulas

Interest Formulas

Interest Formulas

Interest rate can be classified into simple interest rate and

compound interest rate.

ü In simple interest, the interest is calculated, based on the

initial deposit for every interest period. In this case, calculation of

interest on interest is not applicable.

ü In compound interest, the interest for the current period is

computed based on the amount (principal plus interest up to the end of the

previous period) at the beginning of the current period.

The notations which are used in

various interest formulae are as follows: P = principal amount

n =

No. of interest periods

i = interest rate

(It may be compounded monthly, quarterly, semiannually or annually)

F =

future amount at the end of year n

A =

equal amount deposited at the end

of every interest period

G = uniform

amount which will be added/subtracted period after period to/from the

amount of deposit A1 at the end of period 1

Time Value

of Money - . It represents the growth of

capital per unit period. The period may be a month, a quarter,

semiannual or a year.

An interest rate

15% compounded annually means that for every hundred rupees invested now, an

amount of Rs. 15 will be added to the account at the end of the first year. So,

the total amount at the end of the first year will be Rs. 115.

At the end of the

second year, again 15% of Rs. 115, i.e. Rs. 17.25 will be added to the account.

Hence the total

amount at the end of the second year will be Rs. 132.25. The process will

continue thus till the specified number of years.

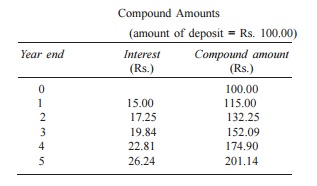

If an investor

invests a sum of Rs. 100 in a fixed deposit for five years with an interest

rate of 15% compounded annually, the accumulated amount at the end of every

year will be as shown in Table

Compound Amounts

(amount

of deposit = Rs. 100.00)

Year end Interest Compound

amount

(Rs.) (Rs.)

0 100.00

1 15.00 115.00

2 17.25 132.25

3 19.84 152.09

4 22.81 174.90

5 26.24 201.14

The formula to find the future worth in the third column is

F = P (1 + i)n

where

P = principal

amount invested at time 0, F = future amount,

i = interest

rate compounded annually, n = period of deposit.

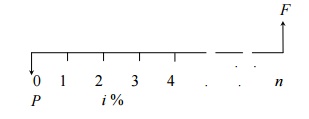

The maturity value at the end of the

fifth year is Rs. 201.14. This means that the amount Rs. 201.14 at the end of

the fifth year is equivalent to Rs. 100.00 at time 0 (i.e. at present). This is

diagrammatically shown in Fig. 3.1. This explanation assumes that the inflation

is at zero percentage.

Single-Payment

Compound Amount - Here, the objective is to find the

single future sum (F) of the initial payment (P) made at

time 0 after n periods at an interest rate i compounded every

Cash flow diagram of single-payment compound amount.

The formula to obtain the single-payment compound amount is

F = P(1 + i)n

= P(F/P, i, n)

where

(F/P, i, n) is called as

single-payment compound amount factor.

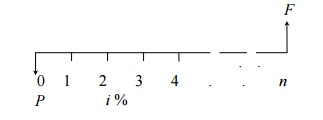

Single-Payment

Present Worth Amount - Here, the objective is to find the present worth amount (P)

of a single future sum (F) which will be received after n periods

at an interest rate of i compounded at the end of every interest period.

Cash flow diagram of single-payment present worth amount.

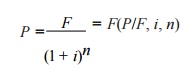

The formula to

obtain the present worth is

Where

(P/F, i, n) is termed as single-payment

present worth factor.

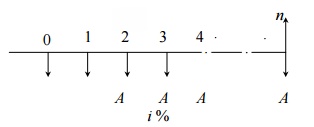

Equal-Payment Series Sinking Fund

In this type of investment mode, the

objective is to find the equivalent amount (A) that should be deposited

at the end of every interest period for n interest periods to realize a

future sum (F) at the end of the nth interest period at an

interest rate of i.

A = equal

amount to be deposited at the end of each interest period n = No. of

interest periods

i = rate of interest

F = single future amount at the end of

the nth period

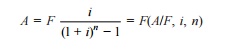

The formula to get F is

Where

(A/F, i, n) is called as equal-payment

series sinking fund factor.

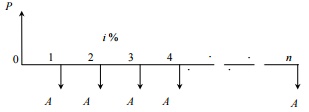

Equal-Payment

Series Present Worth Amount The objective of this mode of investment is to find the

present worth of an equal payment made at the end of every interest period for

n interest periods at an interest rate of i compounded at the end of every

interest period.

The corresponding cash flow diagram is shown in Fig. 3.8. Here,

P = present worth

A = annual

equivalent payment i = interest rate

n = No. of interest periods

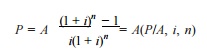

The formula to

compute P is

Where

(P/A, i, n) is

called equal-payment series present worth factor

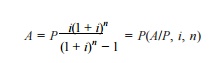

Equal-Payment Series

capital recovery The objective of this

mode of investment

is to find the

annual equivalent amount (A) which is to be recovered at the end of

every interest period for n interest periods for a loan (P) which is sanctioned

now at an interest

Cash flow diagram of equal-payment series capital recovery

amount.

P = present worth (loan amount)

A = annual

equivalent payment (recovery amount) i = interest rate

n = No. of interest periods

The formula to

compute P is as follows:

Where,

(A/P, i, n) is called equal-payment

series capital recovery factor.

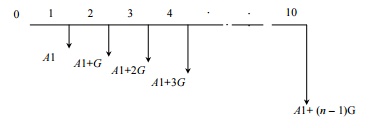

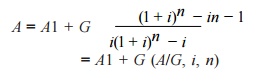

Uniform Gradient series annual equivalent The objective of this mode of investment is to find the annual equivalent amount of a series with an amount A1

at the end of the first year and with an equal increment (G) at the end

of each of the following n – 1 years with an interest rate i compounded annually.

The corresponding

cash flow diagram is shown in Fig

Cash flow diagram of uniform gradient series annual equivalent

amount.

The formula to

compute A under this situation is

here Where

(A/G,

i, n) is called uniform gradient series factor

Effective Interest rate Let i be the nominal interest rate compounded annually. But, in practice, the compounding may occur less than a year. For

example, compounding may be monthly, quarterly, or semi-annually. Compounding

monthly means that the interest is computed at the end of every month. There

are 12 interest periods in a year if the interest is compounded monthly. Under

such situations, the formula to compute the

effective interest rate, which is compounded annually, is Effective interest rate,

R = 1 + i/C C − 1

where,

i = the nominal interest rate

C = the number of interest periods in a year.

Related Topics