Chapter: Engineering Economics and Financial Accounting : Production Function and Cost Anaysis

Important Questions and Answers: Production Function and Cost Analysis

1.

Say some

of the main cost concepts.

1) Actual

costs and opportunity costs

2) Incremental

costs and sunk costs

3) Explicit

costs and implicit costs

4) Past

costs and future costs

5) Accounting

costs and economic costs

6) Direct

cost and indirect cost

7) Private

costs and social costs

8) Controllable

costs and non controllable costs

9) Replacement

costs and original costs

10)

Shutdown costs and abandonment costs

11)

Urgent costs and postponable costs

12)

Bussiness costs and full sosts

13)

Fixed costs and variable costs

14)

Short run and long run costs

15)

Incremental costs and marginal costs

2.

What are

actual costs and opportunity costs ?

Actual

costs which a firm incurs for producing or acquiring a product or a service. As

example for this is

the cost

on raw materials, labor, rent, interest.

3.

What are

incremental costs and sunk costs ?

Incremental

cost is the additional cost due to change in the level of nature or business

activity. Sunk costs are the costs that are not altered by a change in quantity

produced and cannot be recovered.

4.

What are

Explicit costs and implicit costs ?

Explicit

or paid out costs are those expenses which are actually paid by the firm.

Implicit costs are the theoretical costs in the sense that they go unrecognized

by the accounting system.

5.

What are

past costs and future costs ?

Past

costs are the actual costs incurred in the past are generally contained in the

financial accounts. Future costs are costs that are expected to occur in some

future period or periods.

6.

What are

accounting costs and economic costs ?

Accounting

costs are the actual outlay costs. Economic cost relate to the future,

7.

What is

direct and indirect cost ?

Direct

cost are traceable cost or assignable cost are the ones that have direct

relationship with a unit of operation like a product, a process or a product,

or a department of the firm. On the otherhand, indirect costs or non traceable

costs or common or non assignable costs are the costs whose course cannot be

easily and definitely traced to the plant.

8.

What are

private costs and social costs ?

Private

costs are those which are actually incurred or provided for the business

activity by an individual or the business firm. Social costs on the otherhand

are the total costs to the society on account of production of a good.

9.

What are

controllable and non controllable costs ?

Controllable

costs are those which are capable of being controlled or regulated by the

managers ant = d it can be used to assess the managerial efficiency in

controlling the cost in his department. Non controllable costs are those which

cannot be subjected to administrative controls and supervision.

10.What are

replacement costs and original costs ?

Original

costs or the historical costs are the costs paid for assets such as land,

building, cost of plant, equipment and materials. Replacement costs are the

costs that the firm incurs if it wants to replace or acquire the same assets

now.

11.What is

shut down cost and abandonment cost ?

Shutdown

costs are costs in which the firm incurs if it temporarily stop its operation.

Abandonment costs are the costs of retiring altogether a fixed asset from use.

16)what are incremental cost and

marginal cost?

Incremental cost is important when dealing with

decisions where discrete alternatives are to be compared.marginal cost deals

with unity unit output.

17)what are the determinants of

cost?

1) level of

output

2) price of

inputs.

3) size of

plant

4) output

stability

5) production

lot size

6)level

of capability utilization

7) technology

8) learning

effect

9) breadth

of product range.

10)geographical

location

18)what are

the two aspects in cost output relationships?

1) cost

output relationship in short run.

2)cost

output relationship in long run.

19)what are

the terms involved in cost output relationship?

1) Average

fixed cost.

2) Average

variable cost.

3) Average

total cost.

20)what is

level of capacity utilization?

The

higher the capacity utilization fixed cost per unit of output in bound to be

low.

21) what is output stability?

Stability

of output leads to savings in various kinds of hidden cost interruption and

learning.

22)what is size of plants?

Production

costs are usually lower in bigger plants than smaller plants.

23)what is cost?

Cost is

the money spent on producing and selling a product to the customers.the cost of

a product starts from the raw materials through production costs till selling costs

include the cost in maintaining outlets.

24)what is the significance of cost in managerial

decision making?

Study of

costs is essential for making a choice from among the competing production

plans.production decisions are not possible without their respective cost

considerations.

25)what is price of input?

If the

price of the raw materials labor,power increases then naturally the cost of

production goes up.this cost of productions varies directly with the prices of

inputs.

PART B

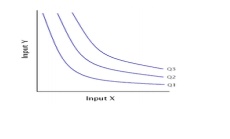

1. Briefly explain about types of production

function with illustration

production function with one

variable input

Ø Increasing

return

Ø Negative

return

Ø Decrasing

return

production function with two

variable input

Ø iso quants

Ø 2 factors

of production vs capital & labour

Ø It slope

downwards from left to right

Ø It can’t

be horizontal or vertical

Ø Iso

quants all convex to the origin

Ø Never

touch x axis

Ø Never

touch y axis

production function with all

variable input

Ø increasing

return to scale

Ø Decreasing

return to scale

Ø constant

return to scale

• Production function with 2 variable input Iso quant

curve:

It

represent the different combination of inputs producing a particular quantity

of output.

Assumption

Ø Two factor of production vs capital &labour

Ø Two

factor can substitute each other up to a certain limit

Ø Shape of

ISO quant depends upon the extent of substitutability of 2 inputs

Ø Technology

is given over a period of time

Isoquant map

An

isoquant map is a set of isoquants that shows the maximum attainable output

from any given combination inputs.

Types of iso quants

Linear Isoquant:

This type assumes perfect substitutability of factors of production: a

given commodity may be produced by using only capital, or only labour, or by an

infinite combination of K and L.

Input-Output Isoquant:

This assumes strict complement [that is, zero substitutability] of the

factors of production. The isoquant take the shape of a right angle. This type

of isoquant is also called 'Leontief isoquant' after Leontief, who invented the

input-output analysis.

Smooth , Convex Isoquant:

This form assumes continuous substitutability of K and L only over a

certain range, beyond which factors cannot substitute each other. The isoquant

appears as a smooth curve convex to the origin.

Long run

production function with all variable (Laws of return to scale)

Return to scale refers to the relationship between changes in output and

proportionate changes in all factors of production

Assumptions

·

All factors are variable

·

Workers work with given tools and implementation

·

Technical changes are absent

·

There is perfect competition

·

Product is measured in quantities.

Increasing Returns to Scale

Increasing

returns to scale is closely associated with economies of scale.

It occurs

when a firm increases its inputs, and a more-than-proportionate increase in production

results

For example, in year one a firm employs 200 workers, uses 50 machines,

and produces 1,000 products. In year two it employs 400 workers, uses 100

machines (inputs doubled), and produces 2,500 products (output more than

doubled).

Decreasing Returns to Scale

Decreasing returns to scale is closely associated with diseconomies of

scale. Decreasing returns to scale happens when the firm's output rises

proportionately less than its inputs rise.

For example, in year one, a firm employs 200 workers, uses 50 machines,

and produces 1,000 products. In year two it employs 400 workers, uses 100

machines (inputs doubled), and produces 1,500 products (output less than

doubled).

Constant Returns to Scale

Constant

returns to scale occurs when the firm's output rises proportionate to the

increase in

inputs.

Constant

or same output.

2. Briefly

explain about the types of cost concepts.

Types of

cost concepts

Actual costs and Opportunity Costs

Actual

costs are also called as outlay costs, absolute costs and acquisition costs.

They are

those costs that involve financial expenditures at some time and hence are

recorded in the books of accounts.

o They

are the actual expenses incurred for producing or acquiring a commodity or

service by a firm.

o For

example, wages paid to workers, expenses on raw materials, power, fuel and

other types of inputs. They can be exactly calculated and accounted without any

difficulty.

Opportunity cost of a good

or service is measured in terms of revenue which could have been earned by employing that good or service in some

other alternative uses.

Direct costs are those costs which can be

specifically attributed to a particular product, a department, or a process of production.

indirect costs are those costs, which are not

traceable to any one unit of operation. They cannot be attributed to a product, a department or a process

Explicit costs are those costs which are in the

nature of contractual payments and are paid by an entrepreneur to the factors of production [excluding

himself] in the form of rent, wages, interest and profits, utility expenses,

and payments for raw materials etc.

Implicit or imputed costs are

implied cost.They do not take the form of cash outlays and as such do not

appear in the books of accounts. They are the earnings of owner

employed resources.

Accounting costs are those costs which are already

incurred on the production of a particular commodity.It includes only the acquisition costs.

Economic costs are those costs that are to be

incurred by an entrepreneur on various alternative programs.

It

involves the application of opportunity costs in decision makin

ii). How

to estimate the cost?

Ø accounting

concept

Ø engineering

concept

Ø statistical

cost

3. Explain

about cost out put relation in short run &long run with neat sketch.

Ø Short-run

cost curves are normally based on a production function with one variable

factor of production that displays first increasing and then decreasing

marginal productivity.Increasing marginal productivity is associated with the

negatively sloped portion of the marginal cost curve, while decreasing marginal

productivity is associated with the positively sloped portion. The average

fixed cost (AFC) curve is the cost of the fixed factor of production divided by

the quantity of units of the output, while the average variable cost (AVC)

curve cost traces out

Ø the per

unit cost of variable factor of production.The U-shaped average total cost

(ATC) curve is derived by adding the average fixed and variable costs. The

marginal cost (MC) intersects both the AVC and ATC curves at their minimum

points. Declining average total costs are explained as the result of spreading

the fixed costs over greater quantities and, at low quantities, the result of

the increasing marginal productivity, in addition. Increasing average costs

occur when the effect of declining marginal productivity overwhelms the effect

of spreading the fixed costs.

LONG RUN:

Ø The

long-run cost curves, usually presented in a separate diagram, are also

expressed most commonly in their average, or per unit, form, represented here

in Figure 2. The long-run average

Ø cost

(LRAC) curve is shown to be an envelope of the short-run average cost (SRAC)

curves, lying everywhere below or tangent to the short-run curves.

Ø The firm

is constrained in the shortrun in selecting the optimal mix of factors of

production and so will never be able to find a cheaper mix than can be found in

the long-run when there are no constraints. If there are a discrete number of

plant sizes available, the LRAC will be the scalloped curve obtained by joining

those parts of the SRAC curves that represent the lowest cost of production for

a given quantity.

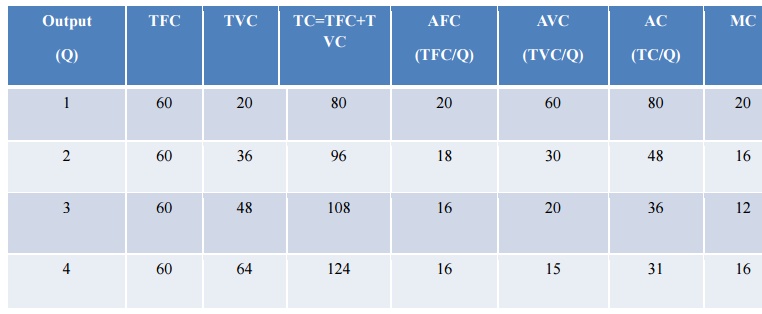

4.

Explain

in detail about Total, Average & Marginal Costs.

The cost concepts made use of in the cost behavior

are Total cost, Average cost, andMarginal cost. TC=TFC+TVC

AC=TC/Q

Marginal

Cost is the addition to the total cost due to the production of an additional

unit of product. -If both AFC and

'AVC' fall, 'ATC' will also fall.

Ø 'ATC'

will fall where the drop in 'AFC' is more than the raise in 'AVC'.

Ø 'ATC'

remains constant is the drop in 'AFC' = rise in 'AVC'

Ø 'ATC'

will rise where the drop in 'AFC' is less than the rise in 'AVC'

Long Run Costs

The long run is a planning and implementation stage

for producers. They analyze the current and projected state of the market in

order to make production decisions.

Examples

: changing the quantity of production, decreasing or expanding a company, and

entering or leaving a market.

Estimation of costs

Accounting approaches

It is

classified as fixed, variable and semi variable on the basis of judgment and

inspection Fluctuation in output

Maintenance

of proper accounts

Engineering Approaches

It

includes the physical units of various inputs as plant size, materials etc.,

Statistical

Approaches

It

includes

Ø multiple

correlations

Ø Queuing

theory

Ø Input and

output analysis

5. Calculate

the Total, Average and Marginal Costs for the following data.

Related Topics