Chapter: Business Science : Merchant Banking and Financial Services : Other Fund Based Financial Services

Factoring And Forfaiting

FACTORING AND FORFAITING

1 INTRODUCTION

An important development in the Indian factoring services took place with the RBI setting up a Study Group under the chairmanship of Shri C.S. Kalyanasundaram in January, 1988. The study group aimed at examining the feasibility and mechanism of organizing factoring business in India. The group submitted its report in January 1989.

2 FACTORING AND FORFAITING

Peter M. Biscose defines the term Factoring‗in his treatise Law and Practice of Credit Factoring as a continuing legal relationship between a financial institution (the factor) and a business concern (the client) selling goods or providing services to trade customers, whereby the factory purchases the clients‗ book debts, either with or without recourse to the client, and in relation thereto, controls the credit extended to customers, and administers the sales ledger.

C.S. Kalyansundaram, in his report (1988) submitted to the RBI defines factoring as, ―a continuing arrangement under which a financing institution assumes he credit and collection functions for its client, purchases receivables as they arise (with or without recourse for credit losses, i.e., the customer‗s financial inability to pay), maintains the sales ledger, attends to other book-keeping duties relating to such accounts, and performs other auxiliary functions.

According to the study Group appointed by the International Institute for the Unification of Private Law (UNIDROTT), Rome, 1988". ―A domestic factoring means an arrangement between a Factor and his client, which includes at least two of the following services to be provided by the Factor. a. Finance b. Maintenance of accounts c. Collection of debts d. Protection against credit risk.

Factoring is a receivables management and financing mechanism which is designed to improve cash flows and cover the credit risk of the seller. Unlike other forms of receivables financing, like bills discounting and forfeiting; factoring involves a continuous relationship between a factor and a seller, to finance and administer the receivables of the latter. Factors are financial companies which pay cash against the credit sales of the client, and obtain the right to receive the future payments on those invoices from the debtors of the client.

3 Functions of a factor

Factoring constitutes a suite of financial services offered under a factoring agreement, which includes receivables financing, credit protection, accounts receivables collection and management, sales ledger administration and advisory services.

I. Receivables financing: The factoring institution advances a proportion of the value of the book debts immediately to the client and the balance is paid on maturity of the book debts. This improves the cash flow position of the client, by replacing the credit sales for cash.

II. Credit protection: The factoring institution takes over the credit risk of the client, and agrees to bear the loss in case of default by the debtor. Credit protection is provided by the factor only in case of non-recourse factoring.

III. Accounts receivables collection and management: The factoring company collects the receivables of the client and also manages the credit collection schedule. By reducing the time invested by the client in such activities, it allows the client to focus on business development.

IV. Sales Ledger management: The factor undertakes sales ledger management, including maintenance of credit records, collection schedules, discounts allowed and ascertainment of balance due from all debtors.

V. Advisory Services: A factoring company advises the client on its export and import potential, and also helps the client in identification and selection of potential trade debtors, based on the credit information available with it. The factor also advises on the prevailing business trends, Policies, impending developments in the commercial and industrial sector etc.

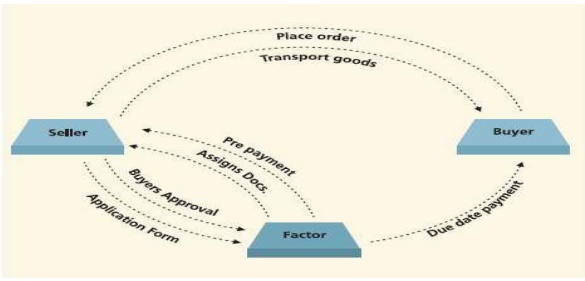

4 Factoring mechanism

The parties involved in a factoring arrangement are:

1. The Client, or the seller

2. The Debtor, or the buyer

3. The Factor (International factoring may have a correspondent factor in addition to the domestic factor)

Detailed Steps:

Client approaches Factor Company and requests for factoring facility.

1. Client approaches Factor Company and requests for factoring facility.

2. Factor asks for Client‘s financial statements (last three years‘ balance sheet).

3. Client fills the application form and submits his last three years‘ financial statements.

4. Factor company conducts Client appraisal by conducting his credit assessment on the quantitative (this includes analysis of current ratios, gearing ratios, profitability ratios, etc.) and qualitative parameters such as integrity, management etc and approves/ disapproves client request.

5. Once approved, the Factor Company assigns overall factoring limit to the client. The client is required to submit sales ledger of his customers to the factor, who assesses the customers to determine limit of sanction according to the quality of customers.

6. Bank NOC / Letter of Disclaimer (LOD) are called for after sanction of limit but before Operationalisation of the account.

7. In case of approval of client request, client is asked to submit following documents:

a. documents for collateral, if any

b. Personal guarantee of directors, etc

8. Factor Company examines the sales ledgers of client‘s customers and conducts Buyers‘ due diligence. For this, it seeks bank reports, credit reports from credit bureaus, D&B report, etc.

9. Based on the credit assessment of each customer of the client, Factor company sets credit limits for each customer.

10. Factor Company grants in-house approval.

11. Factoring Company is required to send letter of notification to the client‘s buyers and the buyers are required to accept the same and send it to the factor company.

12. A factoring agreement is signed between the client and the factoring company.

13. Client is required to submit original invoices with assignment clause written on these and proof of delivery of these invoices.

14. Factor Company makes advance prepayment (Up to 80% of invoice value).

15. Factoring company manages client‘s ledger, sends due date reminders to client‘s customers and collects payments as and when due.

16. Factoring company uses appropriate software to manage the above processes.

17. Factoring company pays balance due to the client upon receipt of full payment.

Detailed Steps in International Factoring (Two Factor Model)

1. The importer places the order for purchase of goods with the exporter

2. The exporter approaches the export factor (in the exporter‘s country) for limit approval on the importer. Export Factor in turn requests the import factor in the Importer's country for the arrangement

3. The import factor assesses the importer and approves/rejects the arrangement and accordingly conveys to the export factor

4. Exporter is informed of the commencement or otherwise, of the factoring arrangement

5. The exporter delivers the goods to the importer

6. Exporter produces the documents to the export factor

7. The export factor disburses funds to the exporter up to the prepayment amount and forwards the documents to the Import factor as well as the Importer8. On the due date of the invoice, the Importer pays the Import Factor, who in turn remits the payment to the export factor.

9. The exporter receives the balance payment from the export factor.

Charges applicable

Usually, a onetime setup fee, a service fee and an interest charge is levied for a factoring transaction.

The service fee is levied for the additional services of the factor, besides financing. It is calculated as a percentage of the gross value of the invoices factored, and is based on:

I. The gross sales volume

II. The number of customers/debtors of the client

III. The number of invoices and credit notes

IV. The credit risk involved

5 Features of Factoring

The characteristics of Factoring are as follows:

1. The Nature The nature of the Factoring contract is similar to that of a bailment contract. Factoring is a specialized activity whereby a firm converts its receivables into cash by selling them to a factoring organization. The Factor assumes the risk associated with the collection of receivables, and in the event of non-payment by the customers/debtors, bears the risk of a bad debt loss.

3. The Form Factoring takes the form of a typical Invoice Factoring‗since it covers only those receivables which are not supported by negotiable instruments, such as bills of exchange, etc. This is because, the firm resorts to the practice of bill discounting with its banks, in the event of receivables being backed by bills. Factoring of receivables helps the client do away with the credit department, and the debtors of the firm become the debtors of the Factor.

2. The Assignment Under factoring, there is an assignment of debt in favor of the Factor. This is the basic requirement for the working of a factoring service.

3. Fiduciary Position The position of the Factor is fiduciary in nature, since it arises from the relationship with the client firm. The factor is mainly responsible for fulfilling the terms of the contract between the parties.

4. Professionalism Factoring firms are professionally competent, with skilled persons to handle credit sales realizations for different clients in different trades, for better credit management.

5. Credit Realizations Factors assist in realization of credit sales. They help in avoiding the risk of bad debt loss, which might arise otherwise.

6. Less Dependence Factors help in reducing the dependence on bank finance towards working capital. This greatly relieves the firm of the burden of finding financial facility.

7. Recourse Factoring: Factoring may be non-recourse, in which case the Factor will have no recourse to the supplier on non-payment from the customer. Factoring may also be with recourse, in which case the Factor will have recourse to the seller in the event of non-payment by the buyers.

8. Compensation A Factor works in return for a service charge calculated on the turnover. Actor pays the net amount after deducting the necessary chares, some of which may be special terms to handle the accounts of certain customers.

6 Types of Factoring

Factors take different forms, depending upon the type of specials features attached to them. Following are the important forms of factoring arrangements:

1. Domestic Factoring: Factoring that arises from transactions relating to domestic sales is known as Domestic Factoring‗. Domestic Factoring may be of three types, as described below.

2. Disclosed factoring: In the case of disclosed factoring‘ the name of the proposed actor is mentioned on the face of the invoice made out by the seller of goods. In this type of factoring, the payment has to be made by the buyer directly to the Factor named in the invoice. The arrangement for factoring may take the form of recourse‗, whereby the supplier may continue to bear the risk of non-payment by the buyer without passing it on to the Factor. In the case of nonrecourse factoring, Factor, assumes the risk of bad debt arising from non-payment.

3. Undisclosed factoring: Under undisclosed factoring‗, the name of the proposed Factor finds no mention on the invoice made out by the seller of goods. Although the controls of all monies remain with the Factory, the entire realization of the sales transaction is done in the name of the seller. This type of factoring is quite popular in the UK.

4. Discount factoring: Discount Factoring‘s a process where the Factor discounts the invoices of the seller at a pre-agreed credit limit with the institutions providing finance. Book debts and receivables serve as securities for obtaining financial accommodation.

5. Export Factoring: When the claims of an exporter are assigned to a banker or any financial institution, and financial assistance is obtained on the strength of export documents and guaranteed payments, it is called export factoring'. An important feature of this type of factoring is that the Factor bank is located in the country of the exporter. If the importer does not honor claims, exporter has to make payment to the Factor. The Factor-bank admits a usual advance of 50 to 75 percent of the export claims as advance. Export factoring is offered both as a re-course' and as a non-recourse' factoring.

6. Cross-border Factoring: Cross-border Factoring' involves the claims of an exporter which are assigned to a banker or any financial institution in the importers' country and financial assistance is obtained on the strength of the export documents and guaranteed payments. International factoring essentially works on a non-recourse factoring model. They handle exporter's overseas sales on credit terms. Complete protection is provided to the clients (exporter against bad debt loss on credit-approved sales. The Factors take requisite assistance and avail the facilities provided for export promotion by the exporting country. When once documentation is complete, and goods have been shipped, the Factor becomes the sole debtor to the exporter.

7. Full-service Factoring: Full-service factoring, also known as Old-line factoring, is a type of factoring whereby the Factor has no recourse to the seller in the event of the failure of the buyers to make prompt payment of their dues to the Factor, which might result from financial inability/ insolvency/bankruptcy of the buyer. It is a comprehensive form of factoring that combines the features of almost all factoring services, especially those of non-recourse and advance factoring.

8. With Recourse Factoring: The salient features of the type of factoring arrangement are as follows 1. The Factor has recourse to the client firm in the event of the book debts purchased becoming irrecoverable

2. The Factor assumes no credit risks associated with the receivables

3. If the consumer defaults in payment, the resulting bad debts loss shall be met by the firm

4. The Factor becomes entitled to recover dues from the amount paid in advance if the customer commits a default on maturity

5. The Factor charges the client for services rendered to the client, such as maintaining sales ledger, collecting customer‘s debt, etc.

9. Without Recourse Factoring: The salient features of this type of factoring are as follows : 1. No right with the Factor to have recourse to the client 2. The Factor bears the loss arising out of irrecoverable receivables 3. The Factor charges higher commission called del credere commission‗ as a compensation for the said loss 4. The Factor actively involves in the process of grant of credit and the extension of line of credit to the customers of the client

10. Advance and Maturity Factoring: The essential features of this type of factoring are as follows : 1. The Factor makes an advance payment in the range of 70 to 80 percent of the receivables factored and approved from the client, the balance amount being payable after collecting from customers 2. The Factor collects interest on the advance payment from the client 3. The Factor considers such conditions as the prevailing short-term rate, the financial standing of the client and the volume of turnover while determining the rate of interest

11. Bank Participation Factoring: It is variation of advance and maturity factoring. Under this type of factoring, the Factor arranges a part of the advance to the clients through the banker. The net Factor advance will be calculated as follows: (Factor Advance Percent x Bank Advance Percent)

12. Collection / Maturing Factoring: Under this type of factoring, the Factor makes no advancement of finance to the client. The Factor makes payment either on the guaranteed payment date or on the date of collection, the guaranteed payment date being fixed after taking into account the previous ledger experience of the client and the date of collection being reckoned after the due date of the invoice.

Related Topics