Chapter: Business Science : Merchant Banking and Financial Services : Other Fee Based Management Introduction

Distinction between Mergers vs. Takeovers

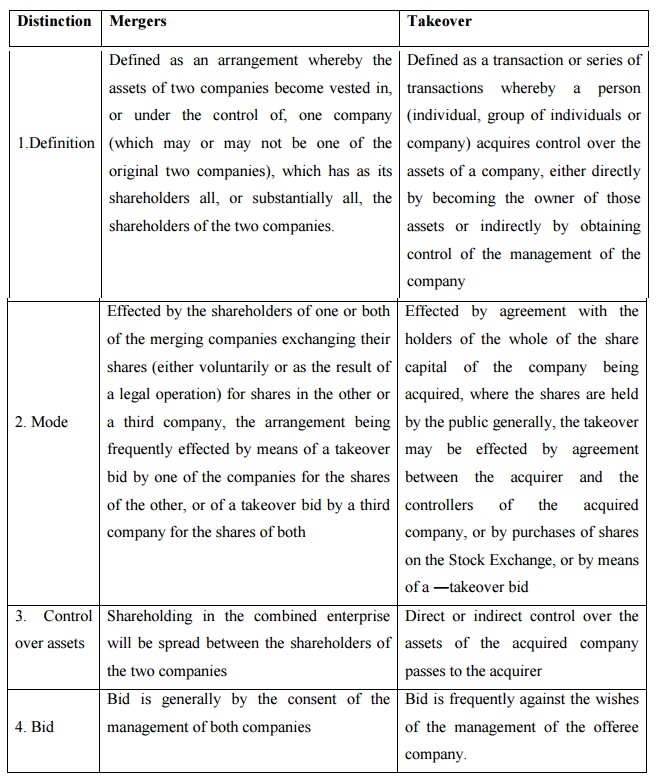

Distinction between

Mergers vs. Takeovers

The

following are the differences between Mergers and Takeover:

Distinction

Mergers Vs Takeover

1.Definition

Mergers: Defined as

an arrangement whereby

the assets of two companies

become vested in, or under

the control of,

one company (which may or may

not be one

of the original two companies), which has as

its shareholders all,

or substantially all,

the shareholders of the two

companies.

Takeover: Defined

as a transaction or series of transactions whereby a person (individual, group of individuals or

company) acquires control over the assets of a company, either directly by becoming

the owner of

those assets or indirectly

by obtaining control of the management

of the company

2. Mode

Mergers: Effected

by the shareholders of one or both of

the merging companies exchanging their

shares (either voluntarily or as the result of a legal operation) for shares in the other or

a third

company, the arrangement

being frequently effected by

means of a takeover bid by one of the

companies for the shares of the other,

or of a takeover bid by a third company

for the shares of both

Takeover: Effected by

agreement with the holders of the whole of the share capital of

the company being acquired, where the shares are held by

the public generally, the takeover may

be effected by

agreement between the acquirer

and the controllers of the

acquired company, or by purchases of shares on the Stock Exchange, or by means

of a

―takeover

3. Control over assets

Mergers: Shareholding in

the combined enterprise

will be spread between the shareholders of the two companies

Takeover: Direct

or indirect control over the assets

of the acquired

company passes to the acquirer

4. Bid

Mergers: Bid is

generally by the

consent of the management of both companies

Takeover: Bid

is frequently against the wishes of

the management of

the offeree company.

Related Topics