Chapter: Mechanical : Engineering Economics & Cost Analysis : Depreciation

Depreciation

DEPRECIATION

Introduction

ü Any equipment which is purchased today will not work for ever.

This may be due to wear and tear of the equipment or obsolescence of

technology.

ü Hence, it is to be replaced at the proper time for continuance

of any business.

ü The replacement of the equipment at the end of its life involves

money. This must be internally generated from the earnings of the equipment.

ü The recovery of money from the earnings of an equipment for its

replacement purpose is called depreciation fund since we make an assumption

that the value of the equipment decreases with the passage of time.

ü Thus the word “depreciation” means decrease in value of any physical asset with the passage

of time.

Methods of

Depreciation

There are several

methods of accounting depreciation fund. These are as follows:

1. Straight line method of depreciation

2. Declining balance method of depreciation

3. Sum of the years—digits method of depreciation

4. Sinking-fund method of depreciation

5. Service output method of depreciation

1.Straight Line

Method of Depreciation

In this method of depreciation, a

fixed sum is charged as the depreciation amount throughout the lifetime of an

asset such that the accumulated sum at the end of the life of the asset is

exactly equal to the purchase value of the asset.

Here, we make an important assumption that inflation is absent.

Let

P = first

cost of the asset,

F = salvage

value of the asset

n = life of the asset,

Bt = book value of the

asset at the end of the period t,

Dt = depreciation

amount for the period t.

The formulae for depreciation and book value are as follows:

Dt = (P – F)/n

Bt = Bt–1

– Dt = P – t

[(P – F)/n]

EXAMPLE

A company has

purchased an equipment whose first cost is Rs. 1,00,000 with an estimated life

of eight years. The estimated salvage value of the equipment at the end of its

lifetime is Rs. 20,000. Determine the depreciation charge and book value at the

end of various years using the straight line method of depreciation.

Solution

P = Rs.

1,00,000 F = Rs. 20,000 n = 8 years

Dt = (P – F)/n

= (1,00,000 – 20,000)/8

= Rs. 10,000

In this method of depreciation, the value of Dt

is the same for all the years. The calculations pertaining to Bt

for different values of t are summarized in Table .

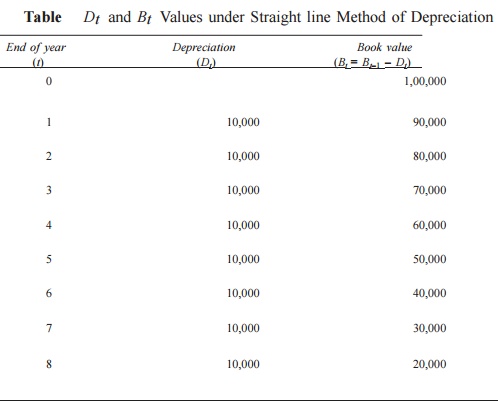

Table Dt and Bt

Values under Straight line Method of Depreciation

If we are interested in computing Dt and Bt for a specific

period (t), In the formulae can be used.

this approach, it should be noted that the all the depreciation is the

same for periods.

EXAMPLE

Consider Example and compute the depreciation and the book value

for period 5.

P = Rs. 1,00,000

F = Rs. 20,000

n = 8 years

D5 = (P – F)/n

= (1,00,000 – 20,000)/8

= Rs. 10,000 (This is independent of the time period.)

Bt = P – t

(P – F)/n

B5 = 1,00,000 – 5 (1,00,000 – 20,000)/8

= Rs. 50,000

2.Declining Balance Method of

Depreciation

ü In this method of depreciation, a constant percentage of the

book value of the previous period of the asset will be charged as the

depreciation amount for the current period.

ü This approach is a more realistic approach, since the

depreciation charge decreases with the life of the asset which matches with the

earning potential of the asset.

ü The book value at the end of the life of the asset may not be

exactly equal to the salvage value of the asset. This is a major limitation of

this approach.

Let

P = first cost of the asset,

F = salvage value of the asset,

n = life of the asset,

Bt = book value of the

asset at the end of the period t,

K = a fixed percentage, and

Dt = depreciation

amount at the end of the period t.

The formulae for depreciation and book value are as follows:

Dt = K Bt-1

Bt = Bt–1

– Dt = Bt–1

– K Bt–1

= (1 – K) Bt–1

The formulae for

depreciation and book value in terms of P are as follows:

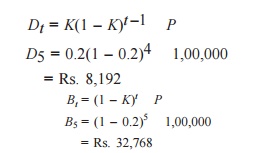

Dt = K(1 – K)t–1

P Bt = (1 – K)t

P

While availing

income-tax exception for the depreciation amount paid in each year, the rate K

is limited to at the most 2/n. If this rate is used, then the

corresponding approach is called the double declining balance method of

depreciation.

EXAMPLE

Consider Example 9.1 and demonstrate the calculations of the

declining balance method of depreciation by assuming 0.2 for K.

Solution

P = Rs.

1,00,000

F = Rs.

20,000

n = 8

years

K = 0.2

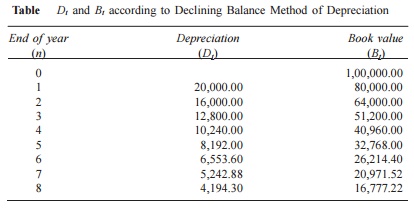

The calculations pertaining to

Dt and Bt

for different values

of t

are summarized in Table 9.2 using the following formulae:

Dt = K

Bt–1

Bt = Bt–1 – Dt

Table Dt

and Bt according to Declining

Balance Method of Depreciation

If we are

interested in computing Dt and Bt for a

specific period t, the respective formulae can be used.

EXAMPLE Consider Example 9.1 and calculate the depreciation and the

book value for period 5 using the declining balance method of

depreciation by assuming 0.2 for K.

Solution

P = Rs. 1,00,000

F = Rs. 20,000

n = 8 years

K = 0.2

= Rs. 32,768

3.Sum-of-the-Years-Digits

Method of Depreciation

In this method of depreciation also,

it is assumed that the book value of the asset decreases at a decreasing rate.

If the asset has a life of eight years, first the sum of the years is computed

as

Sum of the years = 1 + 2 + 3 + 4 + 5

+ 6 + 7 + 8 = 36 = n(n + 1)/2

The rate of depreciation charge for the first

year is assumed as the highest and then it decreases. The rates of depreciation

for the years 1–8, respectively are as follows: 8/36, 7/36, 6/36, 5/36, 4/36,

3/36, 2/36, and 1/36.

For any year, the depreciation is

calculated by multiplying the corresponding rate of depreciation with (P

– F).

Dt = Rate (P – F)

Bt = Bt–1 – Dt

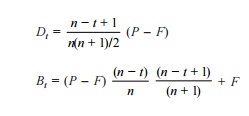

The formulae for Dt and Bt

for a specific year t are as follows:

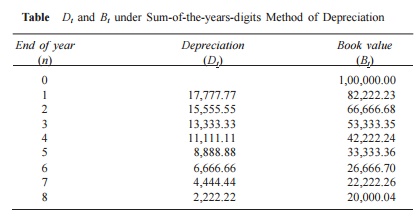

EXAMPLE

Consider Example 9.1 and demonstrate

the calculations of the sum-of-the-years-digits method of depreciation.

Solution

P = Rs.

1,00,000

F = Rs.

20,000 Sum = n (n + 1)/2 = 8 9/2 = 36

n = 8 years

The rates for years 1–8, are respectively 8/36, 7/36,

6/36, 5/36, 4/36, 3/36,2/36 and 1/36.

The calculations of Dt and Bt for different values of t are

summarized in

Table using the following formulae:

Dt = Rate (P – F)

Bt = Bt–1 – Dt

Table Dt and Bt under

Sum-of-the-years-digits Method of Depreciation

If we are

interested in calculating Dt and Bt for a

specific t, then the usage of the formulae would be better.

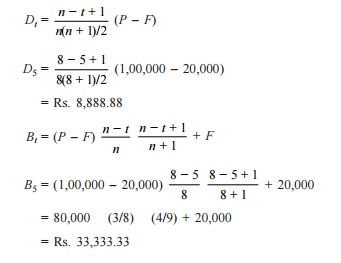

EXAMPLE 9.6 Consider Example 9.1 and find the depreciation and book value

for the 5th year using the sum-of-the-years-digits method of depreciation.

Solution

P = Rs. 1,00,000

F = Rs. 20,000

n = 8 years

4.

Sinking Fund Method of Depreciation

In this method of depreciation, the book value

decreases at increasing rates with respect to the life of the asset

Let

P = first cost of the asset,

F = salvage

value of the asset, n = life of the asset,

i = rate of return compounded

annually,

A = the annual equivalent amount,

Bt = the book value of the asset at the end of the period t,

and

Dt = the depreciation amount at the end of the period t.

The loss in value of the asset (P

– F) is made available an the

form of cumulative depreciation amount at the end of the life of the asset by

setting up an equal depreciation amount (A) at the end of each period

during the lifetime of the asset.

A = (P – F) [A/F, i, n]

The fixed sum depreciated at the end

of every time period earns an interest at the rate of i% compounded

annually, and hence the actual depreciation amount will be in the increasing

manner with respect to the time period. A generalized formula for Dt

is

Dt = (P – F) (A/F, i, n)

(F/P, i, t – 1) The formula to calculate

the book value at the end of period t is

Bt = P – (P – F) (A/F,

i, n) (F/A, i, t)

The above two formulae are very

useful if we have to calculate Dt and Bt for

any specific period.

If we calculate Dt and Bt

for all the periods, then the tabular approach would be better.

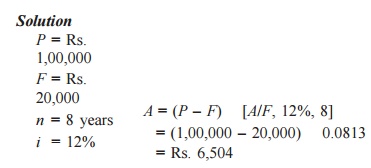

EXAMPLE

Consider Example and give the calculations regarding the sinking

fund method of depreciation with an interest rate of 12%, compounded annually.

In this method of

depreciation, a fixed amount of Rs. 6,504 will be depreciated at the end of

every year from the earning of the asset.

The depreciated

amount will earn interest for the remaining period of life of the asset at an

interest rate of 12%, compounded annually.

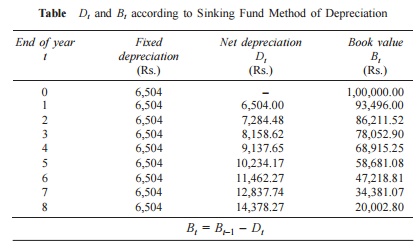

For example, the

calculations of net depreciation for some periods are as follows:

Depreciation at the end of year 1 (D1) = Rs. 6,504.

Depreciation at the end of year 2 (D2)

= 6,504 + 6,504 0.12 = Rs. 7,284.48

Depreciation at the end of the year 3 (D3)

= 6,504 + (6,504 + 7,284.48) .12

= Rs. 8,158.62

Depreciation at the end of year 4 (D4)

= 6,504 + (6,504 + 7,284.48 + 8,158.62) 0.12 = Rs. 9,137.65

These calculations along with book values are summarized in

Table .

Table Dt and Bt

according to Sinking Fund Method of Depreciation

EXAMPLE

Consider Example and compute D5 and B7 using the sinking fund

method of depreciation with an interest rate of 12%, compounded annually.

Solution

P = Rs. 1,00,000

F = Rs. 20,000 n = 8 years

i = 12%

Dt = (P – F) (A/F, i,

n) (F/P, i, t – 1)

D5 = (P – F) (A/F, 12%,

8) (F/P, 12%, 4)

= (1,00,000 –

20,000) 0.0813 1.574

= Rs. 10,237.30

This is almost the same as the corresponding value given in the

table. The minor difference is due to truncation error.

Bt = P – (P – F) (A/F, i, n) (F/A, i, t)

B7 = P – (P – F)

(A/F, 12%, 8) (F/A, 12%, 7)

= 1,00,000 –

(1,00,000 – 20,000) 0.0813 10.089

= 34,381.10

5. Service Output Method

of Depreciation

In some situations, it may not be realistic to

compute depreciation based on time period. In such cases, the depreciation is

computed based on service rendered by an asset. Let

P = first cost of the asset

F = salvage value of the asset

X = maximum capacity of service of the

asset during its lifetime

x = quantity of service rendered in a

period.

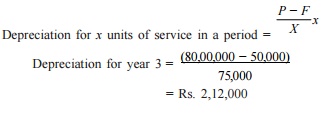

Then, the depreciation is defined per unit of service rendered:

Depreciation/unit of service = (P – F)/X

Depreciation for x units of service in a period =

P-F(x)/X

EXAMPLE

The first coat of a road laying

machine is Rs. 80,00,000. Its salvage value after five years is Rs. 50,000. The

length of road that can be laid by the machine during its lifetime is 75,000

km. In its third year of operation, the length of road laid is 2,000 km. Find

the depreciation of the equipment for that year.

Solution

P = Rs. 80,00,000

F = Rs. 50,000

X = 75,000 km

Evaluation Of

Public Alternatives

In evaluating alternatives of private

organizations, the criterion is to select the alternative with the maximum

profit.

ü The profit maximization is the main goal of private

organizations while providing goods/services as per specifications to their

customers.

ü But the same criterion cannot be used while evaluating public

alternatives. Examples of some public alternatives are

ü constructing bridges,

ü roads, dams,

ü establishing public utilities, etc.

The main objective of any public

alternative is to provide goods/services to the public at the minimum cost. In

this process, one should see whether the benefits of the public activity are at

least equal to its costs.

Inflation Adjusted Decisions

Inflation is the rate of increase in

the prices of goods per period. So, it has a compounding effect. Thus, prices

that are inflated at a rate of 7% per year will increase 7% in the first year,

and for the next year the expected increase will be 7% of these new prices.

If economic decisions are taken

without considering the effect of inflation into account, most of them would

become meaningless and as a result the organizations would end up with

unpredictable return.

Procedure To Adjust Inflation

A procedure to deal with this situation is

summarized now.

1. Estimate all the costs/returns associated with an investment

proposal in terms of today’s rupees.

2. Modify the costs/returns estimated in step 1 using an assumed

inflation rate so that at each future date they represent the costs/returns at

that date in terms of the rupees that must be expended/received at that time,

respectively.

3. As per our requirement, calculate either the annual equivalent

amount or future amount or present amount of the cash flow resulting from step

2 by considering the time value of money.

Related Topics