The Negotiable Instruments Act 1881 - Crossing of Cheque | 12th Commerce : Chapter 22 : The Negotiable Instruments Act 1881

Chapter: 12th Commerce : Chapter 22 : The Negotiable Instruments Act 1881

Crossing of Cheque

Crossing of Cheque

Crossing a cheque refers to the practice of drawing

two parallel transverse lines across the face of a cheque with or without the

words ‘and Co’. The effect of this crossing is that the drawee bank will pay

the amount of a cheque only to the banker.

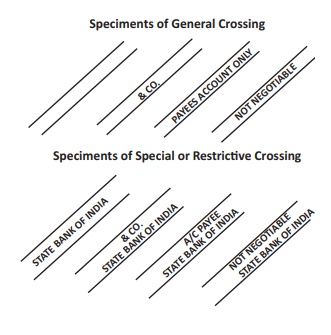

Crossing is of two types

• General Crossing and

• Special Crossing

Types of Crossing

• General Crossing

According to section 123 of the Negotiable

Instruments Act, 1881,

“Where a cheque bears across its face an addition

of the words “and company” or any abbreviation thereof, between to parallel

transverse lines or of two paralleltransverse lines simply, either with or

without the words “not negotiable” that addition shall be deemed a crossing and

the cheque shall be deemed to be crossed generally”.

The lines should be drawn across the face of a

cheque and not on the reverse thereof. Further, they must by parallel and

transverse. Cross marks such as ‘X’ does not constitute crossing. The words

‘and company’ or any abbreviation thereof are not an integral part of a

crossing and their omission does not affect the validity of crossing.

Significance of General Crossing

A crossed cheque should not be paid across the

counter. Even if the payee of a crossed cheque is well-know, the paying banker

is directed to make payment only through another banker. If the payee does not

have a bank account, he can collect it only through someone who is having a

bank account. As a result, even if a crossed cheque has been stolen and

collected for party not entitled to it, the person for whom it has been

collected can be easily traced. Thus crossing ensures safety and prevents

payment intro wrong hands.

• Special Crossing

Section 124 defines special crossing as follows:

“Where a cheque bears across its face an addition

of the name of a banker with or without the words “not negotiable”, that

addition shall be deemed a crossing and the cheque shall be deemed to be

crossed specially and to be crossed to that banker”.

Here that parallel transverse lines are not

essential. But the name of banker to whom the payment should be made is to be

necessarily written on the face of the cheque. Thus it must be noted that while

drawing of two parallel transverse lines is a ‘must’ for a general crossing,

the addition of the name of a banker constitutes the essential part of special

crossing.

Significance of Special Crossing

Here the paying banker should make payment only to

the particular banker named as a part of special crossing or to his agent for

collection. Thus special crossing is safer than general crossing.

Not Negotiable Crossing

The words not negotiable are sometimes included in

the general crossing or special crossing. Even with these words, the cheques

are transferable, but they are deprived of the special feature of

negotiability. “Such a cheque is like a stolen fountain pen or a watch, the

transferee of which does not get a better title than that of their”. It must be

clearly understood if there is no defect in the tile of the transferor, the

transferee for value of a cheque with the words ‘not negotiable’ gets good

title to it. The words ‘Not negotiable” have no effect unless they are put on a

crossed cheque.

Account Payee Crossing

Words such as “Account Payee” or Payee’s account

are also added to general or special crossing. Even though the addition of these

words has not legal sanctity, it has gained significance because of trade usage

and banking practice. These words constitute a direction to the collecting

banker to collect the amount of the cheque for the benefit of the payee’s

account only. If he credits negligently proceeds of the cheque to a wrong

account he loses the statutory protection given to him as a collecting banker.

Paying banker need not satisify himself that it is collected only for the

payee’s account. Though usually a banker will not collect an “Account Payee”

cheque for a person other than the payee, he does it in exceptional cases to

trusted customers.

Payee’s Position when Crossing is obliterated

Since crossing is a material part of the cheque,

crossing cannot be obliterated (removed) by a holder. But if the obliteration

has been done by dishonest persons so skillfully that its detection is

impossible and if payment has been made in due course, though at the counter,

the paying banker is discharged from liability.

Related Topics