Definition, Features, Characteristics, Distinction between - Bills of Exchange, Cheque, Promissory Note - Comparison | 12th Commerce : Chapter 22 : The Negotiable Instruments Act 1881

Chapter: 12th Commerce : Chapter 22 : The Negotiable Instruments Act 1881

Bills of Exchange, Cheque, Promissory Note - Comparison

Bills of Exchange, Cheque, Promissory Note - Comparison

Bill of Exchange – Definition

According to section 5 of the Negotiable

Instruments Act, “a bill of exchange is an instrument in writing containing an

unconditional order, signed by the maker, directing a certain person to pay a

certain sum of money only to, or to the order of a certain person or to the

bearer of the instrument”.

Characteristics of a Bill of Exchange

i. A bill of exchange is a document in writing.

ii. The document must contain an order to pay.

iii. The order must be unconditional.

iv. The instrument must be signed by the person who

draws it.

v. The name of the person on whom the bill is drawn

must be specified in the bill itself.

vi. The drawer, drawee and payee must all be

certain. A bill cannot be drawn on two or more drawees in the alternative

because where liability lies, ‘no ambiguity must lie’. However, alternative

payees are permitted in the law.

vii. The amount that is required to be paid must

also be specified in the bill.

viii. The bill may be payable on demand or after a

specified period.

ix. It must comply with formalities regarding date,

consideration, stamps etc.,

A bill of exchange can be made payable on demand to

a person. It can be made payable after a specified period. But it cannot be

payable to bearer on demand.

Cheque - Definition

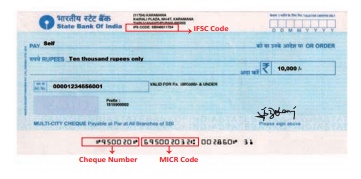

According to section 6 of the Negotiable

Instruments Act, 1881 defines a cheque as “a bill of exchange drawn on a

specified banker and not expressed to be payable otherwise than on demand”.

Features of a Cheque

(i) Instrument in Writings

A cheque or a bill or a promissory note must be an

instrument in writing. Though the law does not prohibit a cheque being written

in pencil, bankers never accept it because of risks involved. Alternation is

quite easy but detection impossible in such cases.

(ii) Unconditional Orders

The instrument must contain an order to pay money.

It is not necessary that the word ‘order’ or its equivalent must be used to

make the document a cheque. It does not cease to be a cheque just because the

world ‘please’ is used before the word pay. Further the order must be unconditional.

In other words, payment of money is made dependent on the happening of an event

or on a fulfilment of a condition, the instrument loses the characteristics of

a cheque.

(iii) Drawn on a Specified Banker Only

The cheque is always drawn on a specified banker. A

cheque vitally differs from a bill in this respect as latter can be drawn on

any person including a banker. The customer of a banker can draw the cheque

only on the particular branch of the bank where he has an account.

(iv) A Certain Sum of Money Only

The order must be for payment of only money. If the

banker is asked to deliver securities, the document cannot be called a cheque.

Further, the sum of money must be certain.

(v) Payee to be Certain

The cheque must be made payable to a certain person

or to the order of a certain person or to the bearer of the instrument. The

word, person includes bodies corporate, local authorities, associations,

holders of office of an institution etc.,

(vii) Signed by the Drawer

The cheque is to be signed by the drawer. Further,

it should tally with specimen signature furnished to the bank at the time of

opening the account.

(vi) Payable Always on Demand

A cheque is always payable on demand. The words on

demand are not used when the drawee bank is asked to pay and the time for its

payment is not specified, it is considered to be payable on demand.

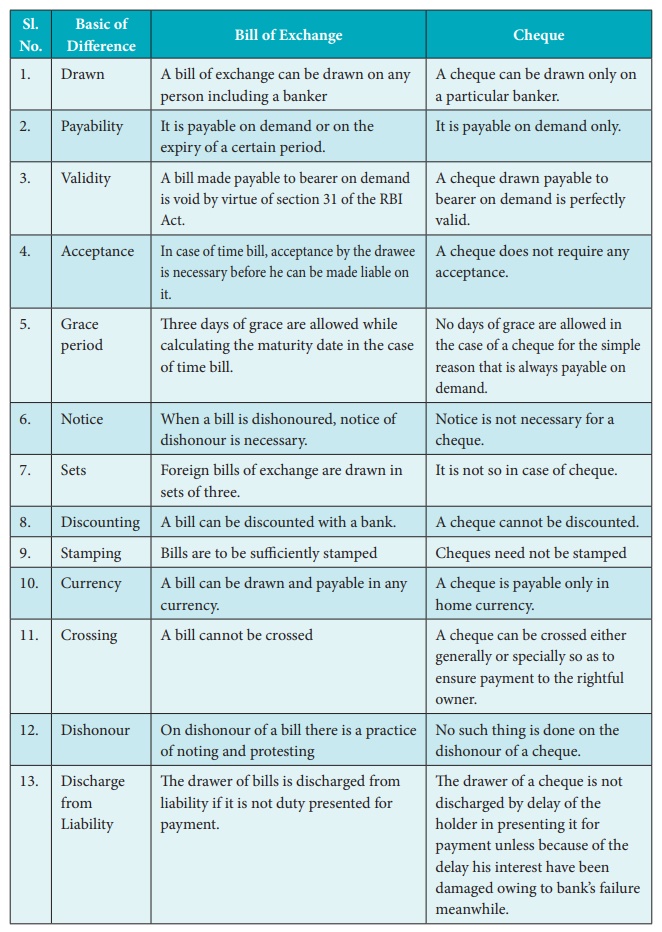

Difference between a Bill of Exchange and a Cheque

Promissory Note

According to Section 4 of the Negotiable

Instruments Act, “a promissory note is an instrument in writing (not being a

bank note or a currency note) containing an unconditional undertaking singed by

the maker, to pay a certain sum of money only to or to the order of, a certain

person or to the bearer of the instrument.

Characteristics of a Promissory Note

1. A promissory note must be in writing. An oral

promise to pay does not constitute a promissory note.

2. It must contain a promise or undertaking to pay

a mere acknowledgement of indebtedness will not make it a promissory note.

3. The promise to pay must be unconditional. In

other words, the promise to pay must not depend upon the happening of any

uncertain event.

4. It must be signed by the maker. The signature

must be in any part of the instrument and it need not be at the bottom.

5. The maker of the note must be a certain person.

Where there are two or more makers, they

may bind themselves jointly or jointly and severability. But alternative

promissors are not permitted in law because where liability lies no ambiguity

must lie.

6. The payee must be certain. A note is valid even

if the payee is misnamed or indicated by his official designation only.

Alternative payees are permissible in law. But is must be made payable to order

originally.

7. A promissory note originally made payable to

bearer is illegal.

8. The promise must be for payment of money only.

For eg. a note containing a promise to deliver 50 bags of rice is not a

promissory note.

9. The sum payable must be certain and must be

specified in the note itself.

10. The amount payable must be in legal tender

money of India and a note containing a promise to pay a certain amount of

foreign money is not a promissory note.

11. A bank note or a currency note is not a

promissory note.

12. A promissory note must be sufficiently stamped.

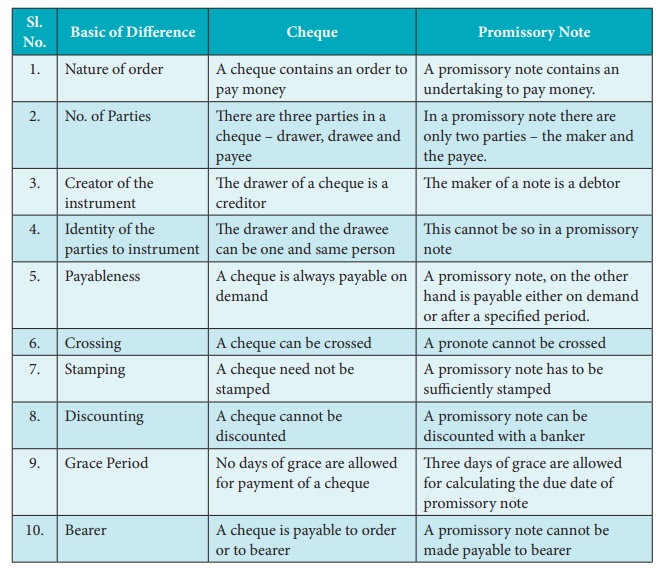

Distinction between a Cheque and Promissory note

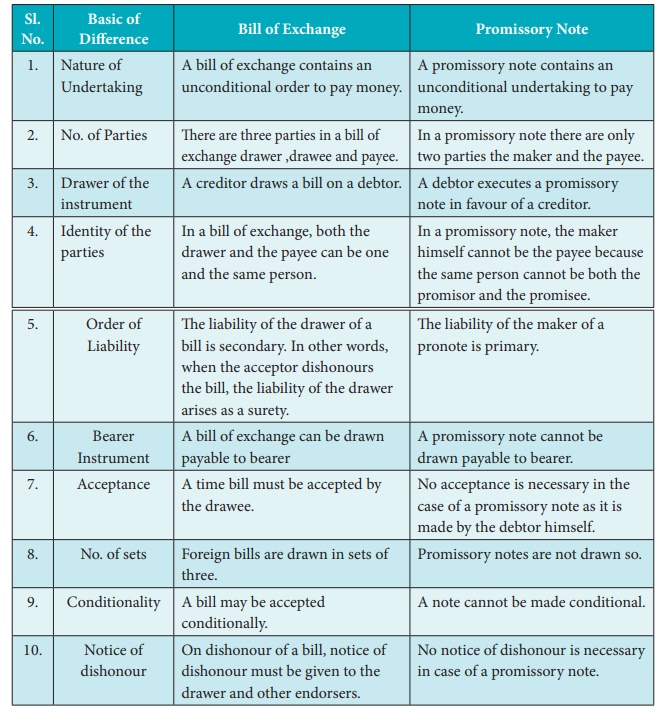

Distinction between a Bills of Exchange and Promissory note

Related Topics