Auditing - Classification of Reserves | 12th Auditing : Chapter 8 : Reserves and Provisions

Chapter: 12th Auditing : Chapter 8 : Reserves and Provisions

Classification of Reserves

Classification of Reserves

1. GENERAL RESERVE

A

reserve which is created out of the profits or surplus of a business for

meeting any unknown liability is called as ŌĆśGeneral ReserveŌĆÖ or ŌĆśFree ReserveŌĆÖ

or ŌĆśRevenue Reserve.ŌĆÖ It is an appropriation of profit. According to Companies

Act, creation of general reserve is not compulsory; it is to be created only

when the company has sufficient profit. However, if the Articles of Association

of the company state that a specific amount is to be set aside out of profit

before distribution of dividend, then the amount should be transferred to

General Reserve account.

Objects of creating General Reserve

It is

created with an object to:

┬Ę

Provide additional working capital,

┬Ę

Strengthen the liquid resources of the

business,

┬Ę

Meet any unknown contingency or liability,

┬Ę

Equalize dividend in the years in which profits

are inadequate, and

┬Ę

Expand business etc.

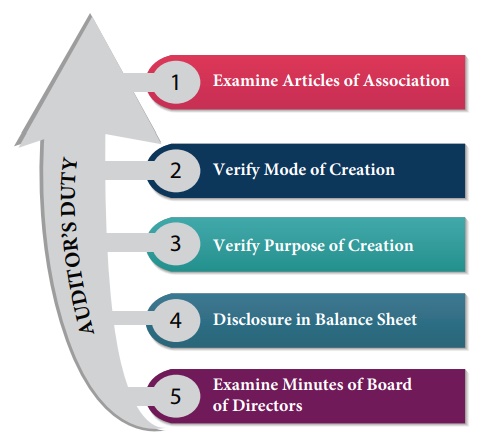

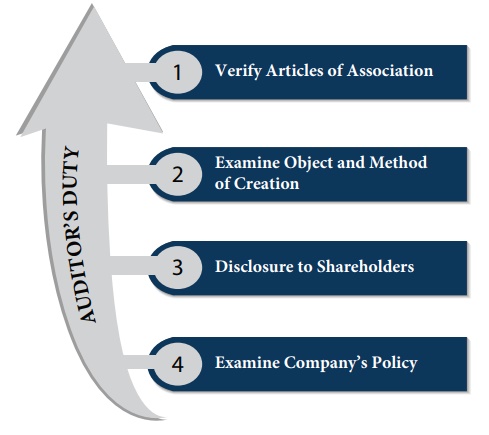

AUDITOR'S DUTY

1. Examine Articles of Association: The auditor should examine the Articles of

Association to see whether provision regarding creation of general reserve has

been complied with.

2. Verify Mode of Creation: It is

the duty of the auditor to ensure

that reserve is created only out of profits of the company.

3. Verify Purpose of Creation: Auditor should ensure that general reserve is

created for the best interest of the company.

4. Disclosure in Balance Sheet: He

should examine that reserve amount

is properly shown in the Balance Sheet. When reserve amount is invested in

securities, he should verify that investments are shown on the assets side of

the Balance Sheet.

5. Examine Minutes of Board of Directors: Auditor

should examine Minutes of Board of Directors meeting to verify directors

approval for utilizing the reserve amount.

2. SPECIFIC RESERVE

A

reserve which is created for the purpose of providing for losses and

contingencies which are known or expected to occur at a future date is called

as a Specific Reserve. In simple words, it is a reserve created out of profit

or loss of a company for a specific purpose. For example, Dividend Equalization

Reserve, Investment Fluctuation Reserve, Reserve for redemption of Debentures,

Plant Replacement Reserve etc.

Specific

Reserve is not represented by any asset and therefore it is not available for

distribution amongst the shareholders. The reserve must be created irrespective

of profit or loss involved in the business.

Objects of creating Specific Reserve The

reserve is created with a definite object to:

┬Ę

Meet a known loss, such as depreciation, heavy

repairs and renewals etc.

┬Ę

Meet an expected contingency, such as, doubtful

debts, discount on debtors, liability for a disputed claim, contingency under

WorkmenŌĆÖs Compensation Act, etc.

┬Ę

Meet an outstanding liability for expenses

already incurred, such as, salaries and wages, commission, income tax and other

accrued expenses.

![]()

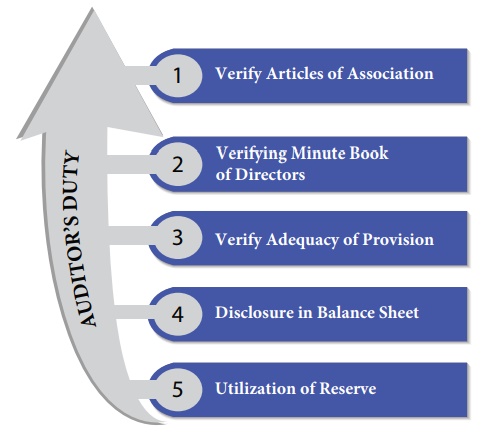

AUDITOR'S DUTY

1.

Verify

Articles of Association: It is the duty of the auditor to verify the

Articles of Association to check whether the amount appropriated from profit to

specific reserve is duly complied.

2. Verifying Minute

Book of Board meeting: The auditor should ensure that profits are appropriated according to the board of directors

decision by verifying the Minutes book of the Board meeting.

3. Verify Adequacy of Provision: Auditor

should ensure that adequate provision has been created. In case if the amount

created is not adequate, he should insist the management to increase the

provision. Otherwise, he should disclose the same in the audit report.

4. Disclosure in

Balance Sheet: The auditor should see

whether provisions are properly shown on the liabilities side of the Balance

Sheet.

5. Utilization of Reserve: Lastly,

the auditor has to ensure that

reserve is utilized for the special purpose for which they are created.

3. CAPITAL RESERVE

A

reserve which is created out of capital profits of a company is called as a

Capital Reserve. It is defined in Part III of Schedule VI of the Companies Act

as, ŌĆ£any reserve which cannot legally be distributed amongst the shareholdersŌĆØ.

Capital profit refers to the following:

┬Ę

Profits on sale of fixed assets

┬Ę

Profits on revaluation of fixed assets and

liabilities

┬Ę

Profits earned prior to incorporation of a

company

┬Ę

Profits made in purchasing a business

┬Ę

Profits on redemption of debentures at a

discount

┬Ę

Premium received on issue of shares or

debentures

┬Ę

Profits earned from forfeited shares and

re-issue of forfeited shares

┬Ę

Exceptional profits not earned during regular

course of business.

Capital

profits should not be utilized in distributing dividend to the shareholders but

should be kept aside to strengthen the financial position of the

company and to meet capital or abnormal revenue losses.

Objects of creating Capital Reserve Capital

Reserve are utilised for the following purpose:

┬Ę

To issue bonus shares to the shareholders

subject to the Articles of Association of the company.

┬Ę

To write off intangible assets of the company,

like goodwill, preliminary expenses etc.

┬Ę

To provide for premium payable on the

redemption of debentures or redeemable preference shares.

┬Ę

To write off discount allowed, commission paid

or expenses incurred on the issue of shares and debentures of the company.

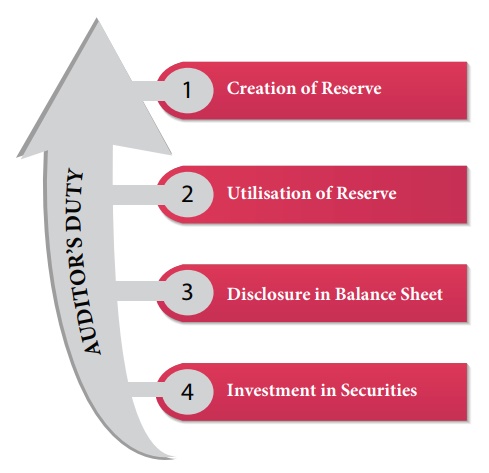

AUDITOR'S DUTY

1. Creation of Reserve: The

auditor should ensure that the

reserve is created only out of the capital profits of the company.

2. Utilisation of Reserve: He

should verify that the reserve is

utilized according to the provisions of the Companies Act and the Articles of

Association of the company.

3. Disclosure in Balance Sheet: Auditor should examine whether capital reserve

has been shown separately from the revenue reserve in the Balance Sheet.

Any

addition or deduction from the previous year balance sheet should be clearly

shown.

4. Investment in Securities: The

auditor should check whether capital

reserve is invested in easily realizable securities or may be invested in the

business itself.

4. SECRET RESERVE

It is a

reserve, the existence of which is not apparent on the face of the Balance

Sheet. It is also called as ŌĆ£Hidden ReserveŌĆØ or ŌĆ£Internal ReserveŌĆØ or ŌĆ£Inner

ReserveŌĆØ. The reserve represents the surplus of assets over liabilities and

capital. Secret Reserves are usually created by banking companies, insurance

companies and electricity supply companies. When secret reserve exist, the

financial position of the company is better than what it would appear from the

balance sheet. However, the existence of such a reserve is found only by a

close and intelligent scrutiny of the account of the company.

Objects of creating Secret Reserve Secret

Reserve is created for the following purpose:

┬Ę

To meet any extraordinary loss without

disclosing the fact to the shareholders or outsiders.

┬Ę

To increase the working capital and to

strengthen the financial position of the company.

┬Ę

To withhold information of the progress of the

company from trade competitors.

┬Ę

To equalize the payment of dividend during the

period of loss.

┬Ę

To meet unexpected financial losses in future.

Methods of Creating Secret Reserve

┬Ę

Undervaluing the assets below cost or market

value.

┬Ę

Not recording the appreciated value of an

asset.

┬Ę

Providing excess reserve for bad and doubtful

debts or discount on debtors.

┬Ę

Providing excess depreciation on fixed assets.

┬Ę

Writing down goodwill to a nominal value

┬Ę

Omitting some of the assets in the Balance

Sheet.

┬Ę

Undervaluing the assets by charging capital

expenditure to revenue account.

┬Ę

Overvaluing the liabilities.

┬Ę

Inclusion of fictitious liabilities

┬Ę

Showing contingent liabilities as real

liabilities.

┬Ę

Grouping dissimilar items on the liabilities

side of the Balance Sheet.

AUDITOR'S DUTIES

1. Verify Articles of Association: The

auditor should study the Articles of

Association of the company to ascertain the legal implications of creating the

reserve.

2. Examine Object and Method of Creation: Auditor

should examine carefully the object and method of creating a secret reserve if

he is fully satisfied, he should disclose the facts in his report.

3. Disclosure to Shareholders: It is

the duty of the auditor to disclose

the fact to the shareholders that secret reserve has been created. If he fails

to do so, he will certify a false statement which will not exhibit a true and

fair view of the state of affairs of the company.

4. Examine CompanyŌĆÖs Policy: When secret reserve is created by

undervaluing the assets or overvaluing the liabilities, the auditor should make

a detailed enquiry with the directors and examine the companyŌĆÖs policy.

5. RESERVE FUND

It is a

reserve created out of the surplus of the company and is invested in outside

securities. It is similar to general reserve, which is created out of surplus

but is retained in the business. In other words, reserve fund is appropriations

of profits which is invested in safe securities and are easily realizable.

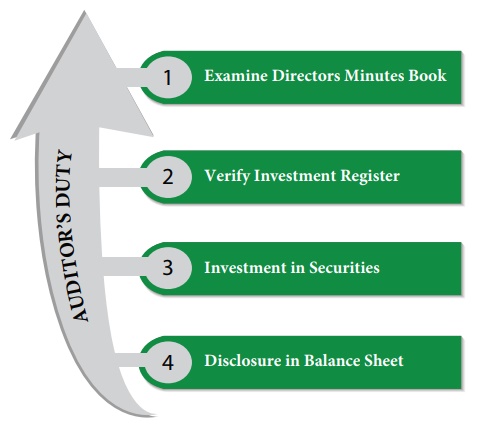

AUDITOR'S DUTY

1. Examine Directors meeting Minutes Book: Auditor

should examine the Minutes of Board

of Directors meeting to verify that all investments are made with the consent of the Board.

2. Verify Investment Register: The auditor should physically verify the

securities with the Investment Register.

3. Investment in Securities: The

auditor should ensure that the

reserve fund is invested in easily realizable securities.

4. Disclosure in Balance Sheet: He should verify that the reserve fund is

shown distinctly on the liabilities side of the Balance Sheet.

6. SINKING FUND

The fund

which is created to have a certain sum of money accumulated for a future date

by setting aside a certain sum of money every year is called as Sinking Fund.

It is defined as, ŌĆ£a form of specific reserve set aside for redemption of a

long debt or replacement of a wasting or a depreciable assetŌĆØ.

Objects of Creating Sinking Fund

The

objects of creating Sinking Fund are as follows:

┬Ę

To reduce a liability, for example, redemption of

debentures or repayment of a loan.

┬Ę

To replace a wasting asset.

┬Ę

To replace a depreciating asset.

┬Ę

To renew a lease.

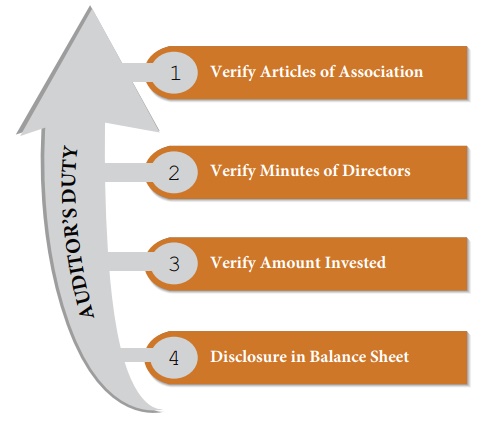

AUDITOR'S DUTY

1. Verify Articles of Association: Auditor should verify Articles of Association

and examine the creation and utilisation of the fund.

2. Verify Minutes of Directors: He

should verify the Minutes of the

Board of Directors to ensure the correctness of the amount transferred to

Sinking Fund.

3. Verify amount Invested: He

should ensure that the amount set

aside is invested in guilt-edged securities known as Sinking Fund Investment

which earns a reasonable rate of return.

4. Disclosure in Balance Sheet: The auditor should verify that sinking

fund and Sinking Fund Investment is separately and properly disclosed in the

Balance Sheet.

Related Topics