Auditing - Classification of Provisions | 12th Auditing : Chapter 8 : Reserves and Provisions

Chapter: 12th Auditing : Chapter 8 : Reserves and Provisions

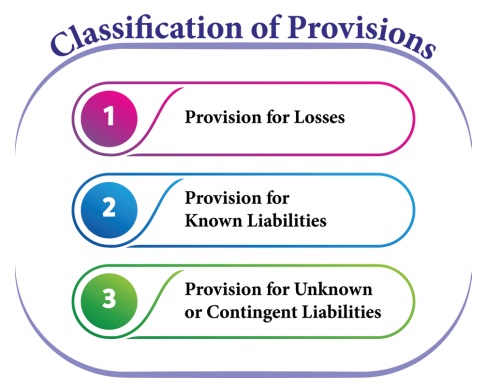

Classification of Provisions

Classification of Provisions

Provisions

can be broadly classified as follows:

1. Provision for Losses: An

amount which is set aside out of the

earnings of the company to meet losses, for example, (1) loss on account of depreciation on fixed assets, (2) loss on account

of repairs and renewals etc.

2. Provision for Known Liabilities: Provision

which is created for known liabilities or expenses which arise in future, for

example, (1) Provision for Income Tax, (2) Provision for Dividend, (3) Provision for discount on Debtors

and Creditors, (4) Provision for outstanding expenses such as outstanding

salaries and wages, payment on retirement such as pension, provident fund,

gratuity etc.

3. Provision for Unknown or Contingent

Liabilities

Provision

created for unknown or contingent liabilities, for example, (1) Provision for

bad and doubtful debts, (2) Provision against disputed claims, (3) Provision

against guarantee, (4) Provision

against compensation, (5) Provision

against payment of arrears of dividend.

Related Topics