Accountancy - Book-keeping: An introduction | 11th Accountancy : Chapter 2 : Conceptual Framework of Accounting

Chapter: 11th Accountancy : Chapter 2 : Conceptual Framework of Accounting

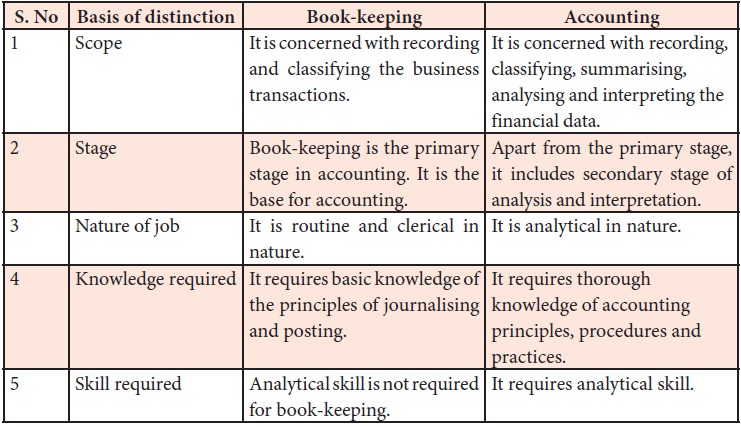

Book-keeping: An introduction

Book-keeping-An introduction

The first

step in the accounting process is identifying and recording of transactions in

the books of accounts. This is necessary for any business as the transactions

happening in a business entity must be recorded so that the information is

available for further analysis.

Book-keeping

forms the base for the preparation of financial statements and interpretation

which are the important functions of accounting. In a broad sense, accounting

includes book-keeping also. In a small business, the entire accounting work may

be performed by a single accountant. In a large firm, there may be a separate

person or department for book-keeping work.

Meaning of book-keeping

Book-keeping

is the process of recording financial transactions in the books of accounts. It

is the primary stage in the accounting process. It includes recording the

transactions and classifying the same under proper heads. Book-keeping work is

of routine nature. Transactions may be recorded in the accounting note books

and ledgers or may be recorded in a computer.

Definition of book-keeping

“Book-keeping is an art of recording business

dealings in a set of books”. - J.R.Batliboi.

“Book-keeping is the science and art of recording correctly in the books of account all those business transactions of money or money’s worth”. -R.N.Carter.

Features of book-keeping

Following are

the features of book-keeping:

i.

It is the

process of recording transactions in the books of accounts.

ii.

Monetary

transactions only are recorded in the accounts.

iii.

Book-keeping

is the primary stage in the accounting process.

iv.

Book-keeping

includes journalising and ledger processing.

Objectives of book-keeping

Following are the objectives of book-keeping:

i.

To have a

complete and permanent record of all business transactions in chronological

order and under appropriate headings.

ii.

To

facilitate ascertainment of the profit or loss of the business during a

specific period.

iii.

To

facilitate ascertainment of financial position.

iv.

To know

the progress of the business.

v.

To find

out the tax liabilities.

vi.

To fulfil

the legal requirements.

Advantages of Book-keeping

Book-keeping has the following advantages:

i.

Transactions

are recorded systematically in chronological order in the book of accounts.

Thus, book-keeping provides a permanent and reliable record for all business

transactions.

ii.

Book-keeping

is useful to get the financial information.

iii.

It helps

to have control over various business activities.

iv.

Records

provided by business serve as a legal evidence in case of any dispute.

v.

Comparison

of financial information over the years is possible. Also comparison of

financial information of different business units is facilitated.

vi.

Book-keeping

is useful to find out the tax liability.

Limitations of book-keeping

Book-keeping has the following limitations:

i.

Only

monetary transactions are recorded in the books of accounts.

ii.

Effects

of price level changes are not considered.

iii. Financial data recorded are historical in nature, i.e., only past data are recorded.

Related Topics