Accountancy - Accounting Principles | 11th Accountancy : Chapter 2 : Conceptual Framework of Accounting

Chapter: 11th Accountancy : Chapter 2 : Conceptual Framework of Accounting

Accounting Principles

Accounting Principles

Accounting

principles are the basic norms and assumptions developed and established as the

basis for accounting system. These principles are adopted by the accountants

universally. These accounting principles provide uniformity and consistency in

the accounting methods and process. Such accounting principles are known as

Generally Accepted Accounting Principles (GAAP).

Accounting

principles provide the basic framework within which the accounting records and

accounting reports are to be prepared. Accounting standards have been issued by

national and international regulatory authorities to ensure uniformity of

accounting procedure and accounting results. These accounting standards and

GAAPs provide the theoretical base of accounting. Accounting principles may be

accounting concepts or accounting conventions. Accounting concepts are the

basic assumptions whereas conventions are the guidelines based upon practice or

usage.

Accounting

concepts are the basic assumptions or conditions upon which accounting has been

laid. Accounting concepts are the results of broad consensus. The word concept

means a notion or abstraction which is generally accepted. Accounting concepts

provide unifying structure to the accounting process and accounting reports.

The word

convention refers to traditions or usage. The accounting conventions are the

usage or practices which are followed as a guide to the preparation of

accounting statements.

The utility

of these accounting conventions have been recognised by regulatory authorities

of accountancy in making financial statements more realistic, reliable, and

useful to all concerned parties.

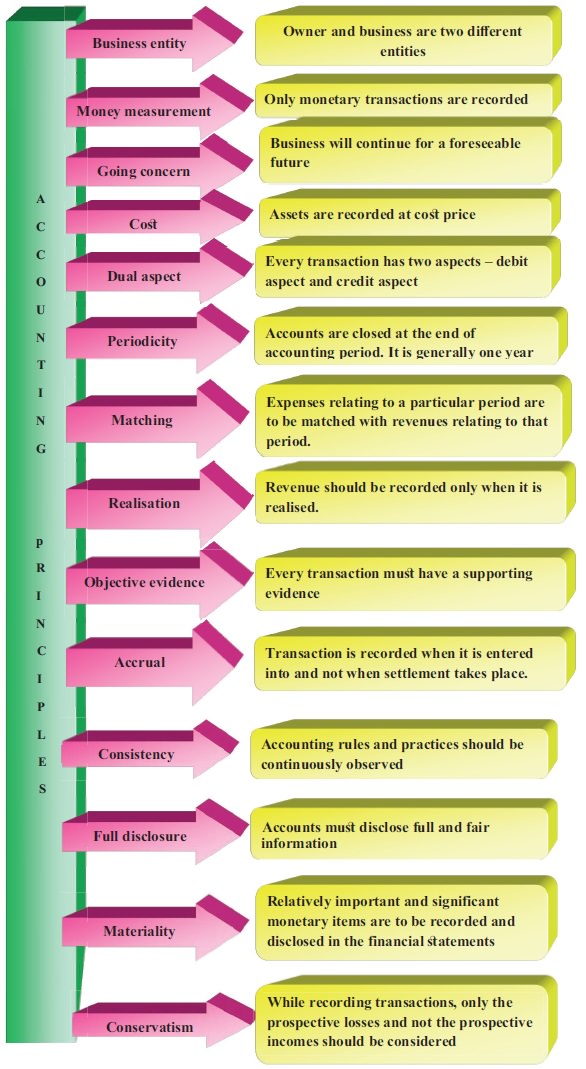

The important

accounting concepts and conventions are discussed below:

(i) Business entity concept

This concept

implies that a business unit is separate and distinct from the owner or owners,

that is, the persons who supply capital to it.

Based on this

concept, accounts are prepared from the point of view of the business and not

from the owner’s point of view. Hence, the business is liable to the owner for

the capital contributed by him/her.

According to

this concept, only business transactions are recorded in the books of accounts.

Personal transactions of the owners are not recorded. But, their transactions

with the business such as capital contributed to the business or cash withdrawn

from the business for the personal use will be recorded in the books of

accounts. It implies that the business itself owns assets and owes liabilities.

(ii) Money measurement concept

This concept

implies that only those transactions, which can be expressed in terms of money,

are recorded in the accounts. Since, money serves as the medium of exchange transactions

expressed in money are recorded and the ruling currency of a country is the

measuring unit for accounting.

Transactions

which do not involve money will not be recorded in the books of accounts. For

example, working conditions in the work place, strike by employees, efficiency

of the management, etc. will not be recorded in the books, as they cannot be

expressed in terms of money.![]()

It helps in

understanding of the state of affairs of the business as money serves as a

common measure by means of which heterogeneous facts about the business are

recorded. For example, if a business has 5 computers, 2 tables and 3 chairs,

the assets cannot be added to give useful information, unless, they are

expressed in monetary terms Rs.1,00,000 for computers, Rs. 10,000 for tables and Rs. 1,500 for chairs.

(iii) Going concern concept

It is the

basic assumption that business is a going concern and will continue its

operations for a foreseeable future. Going concern concept influences

accounting practices in relation to valuation of assets and liabilities,

depreciation of the fixed assets, treatment of outstanding and prepaid expenses

and accrued and unearned revenues. For example, assets are generally valued at

historical cost. Any increase or decrease in the value of assets in the short

period is ignored.

(iv) Cost concept

An asset is

recorded in the books on the basis of the historical cost, that is, the

acquisition cost. Cost of acquisition will be the base for all further

accounting. It does not mean that the asset will always be shown at cost. It is

recorded at cost at the time of its purchase, but is systematically reduced in

its book value by charging depreciation.

The cost concept has the following limitations:

a. In an inflationary situation, when prices of

commodities increase, valuing the assets at historical cost may not represent

the true position of the business.

b. The results of business units established at

different dates are not comparable if assets are recorded on historical basis.

c.

Assets

which do not have acquisition cost such as human resources are not recognised

under this concept.

(v) Dual aspect concept

According to

this concept, every transaction or event has two aspects, i.e., dual effect.

For example, when Arun starts a business with cash Rs. 5,00,000, on the one hand, the business gets cash of Rs. 5,00,000 and on the other hand, a liability arises, that is, the business has to pay Arun a sum of Rs. 5,00,000.

This is the

concept which recognises the fact that for every debit, there is a corresponding

and equal credit. This is the basis of the entire system of double entry

book-keeping.

From this concept arises the basic accounting

equation, that is,

Capital + Liabilities = Assets

(vi) Periodicity concept

This concept

deals with preparing accounts for a particular period. As the proprietors,

investors, creditors, employees and the government are interested in knowing

the performance of the business unit periodically, it becomes necessary to

select a particular period, normally one year for measuring performance. Hence,

financial statements are prepared after every accounting period and not at the

end of its life.

This concept

helps the business in distribution of income to the owners and comparing and

evaluating performance of different periods.

(vii) Matching concept

According to

this concept, revenues during an accounting period are matched with expenses

incurred during that period to earn the revenue during that period. This

concept is based on accrual concept and periodicity concept. Periodicity

concept fixes the time frame for measuring performance and determining

financial status.

All expenses

paid during the period are not considered, but only the expenses related to the

accounting period are considered.

On the basis

of this concept, adjustments are made for outstanding and prepaid expenses and

accrued and unearned revenues. Also due provisions are made for depreciation of

the fixed assets, bad debt, etc., relating to the accounting period. Thus, it

matches the revenues earned during an accounting period with the expenses

incurred during that period to earn the revenues before sharing any profit or

loss.

(viii) Realisation concept

According to

realisation concept, any change in value of an asset is to be recorded only

when the business realises it. When assets are recorded at historical value,

any change in value is to be accounted only when it realises.

(ix) Objective evidence concept

Objective

evidence concept requires that all accounting transactions recorded should be

based on objective evidence. The objective evidence includes documentary

evidence like cash receipts, invoices, etc. It ensures authenticity, accuracy

and reliability of transactions entered in the books of accounts.

(x) Accrual concept

According to

accrual concept, the effects of the transactions are recognised on mercantile

basis, i.e., when they occur and not when cash is paid or received. Revenue is

recognised when it is earned and expenses are recognised when they are

incurred. All expenses and revenues related to the accounting period are to be

considered irrespective of the fact that whether revenues are received in cash

or not and whether expenses are paid in cash or not. For example, i) Credit

sale is recognised as sale though the amount has not been received immediately.

ii) Rent for the month of March-2018 has not been paid and if the accounting

period is 1.4.2017 to 31.3.2018, it will still be recorded as an expense for

the accounting year 2017-2018 because it had become due.

(xi) Convention of consistency

The consistency

convention implies that the accounting policies must be followed consistently

from one accounting period to another. The results of different years will be

comparable only when same accounting policies are followed from year to year.

For example, if a firm follows the straight line method of charging

depreciation since its purchase or construction, the method should be followed

without any change. However, it does not mean that changes are not possible.Change in accounting policy can be incorporated in

the following circumstances:

a. To comply with the provision of law

b. To comply with accounting standards issued and

c. To reflect true and fair view of state of affairs

of the business.

(xii) Convention of full disclosure

It implies

that the accounts must be prepared honestly and all material information should

be disclosed in the accounting statement. This is important because the

management is different from the owners in most of the organisations.

The disclosure should be full, fair and adequate so

that the users of the financial statements can make correct assessment about

the financial position and performance of the business unit.

(xiii) Convention of materiality

According to

this convention, financial statements should disclose all material items which

might influence the decisions of the users of financial statements. Hence, any

item which is not significant and is not relevant to the users need not be

disclosed in the financial statements.

This

principle is basically an exception to the full disclosure principle. The term

materiality is subjective in nature. Materiality depends on the amount involved

in the transaction, size of the business, nature of information, requirements

of the person making decision, etc. An item material to one person may be

immaterial to another person.

(xiv) Convention of conservatism or prudence

It is a policy of caution or playing safe. While recording the business transactions one has to anticipate no income but provide for all possible losses.

For example,

the closing stock in the factory is valued at Rs. 35,000 at cost price and Rs. 25,000 at its realisable price. But while

recording in the books the value of Rs. 25,000 will be considered being the lower of the

two. According to realisation concept, any increase in value is not to be

accounted unless it has materialised. The conservatism convention puts further

restriction on it. Any unrealised gain is not to be anticipated but provision

can be made against all possible losses.

Related Topics