Chapter: Civil : Construction Planning And Scheduling : Organization and Use of Project Information

Accuracy and Use of Information

Accuracy and Use of Information

Numerous sources of error are expected for project

information. While numerical values are often reported to the nearest cent or

values of equivalent precision, it is rare that the actual values are so

accurately known. Living with some uncertainty is an inescapable situation, and

a prudent manager should have an understanding of the uncertainty in different

types of information and the possibility of drawing misleading conclusions.

We have already discussed the uncertainty inherent

in making forecasts of project costs and durations sometime in the future.

Forecast uncertainty also exists in the short term. For example, consider

estimates of work completed. Every project manager is familiar with situations

in which the final few bits of work for a task take an inordinate amount of

time. Unforeseen problems, inadequate quality on already completed work, lack

of attention, accidents, or postponing the most difficult work problems to the

end can all contribute to making the final portion of an activity actually

require far more time and effort than expected. The net result is that

estimates of the actual proportion of work completed are often inaccurate.

Some inaccuracy in reports and estimates can arise

from conscious choices made by workers, foremen or managers. If the value of

insuring accuracy is thought to be low or nonexistent, then a rational worker

will not expend effort or time to gather or to report information accurately.

Many project scheduling systems flounder on exactly this type of non-reporting

or mis-reporting. The original schedule can quickly become extremely misleading

without accurate updating! Only if all parties concerned have specific mandates

or incentives to report accurately will the data be reliable.

Another

source of inaccuracy comes from transcription errors of various sorts.

Typographical errors, incorrect measurements from reading equipment, or other

recording and calculation errors may creep into the sets of information which

are used in project management. Despite intensive efforts to check and

eliminate such errors, their complete eradication is virtually impossible.

One method of indicating the relative accuracy of

numerical data is to report ranges or expected deviations of an estimate or

measurement. For example, a measurement might be reported as 198 ft. + 2

ft. There are two common interpretations of these deviations. First, a range

(such as + 2) might be chosen so that the actual value is certain to be

within the indicated range. In the case above, the actual length would be

somewhere between 196 and 200 feet with this convention. Alternatively, this

deviation might indicate the typical range of the estimate or measurement. In

this case, the example above might imply that there is, say, a two-thirds

chance that the actual length is between

196 and

200.

When the

absolute range of a quantity is very large or unknown, the use of a statistical

standard deviation as a measure of uncertainty may be useful. If a quantity is

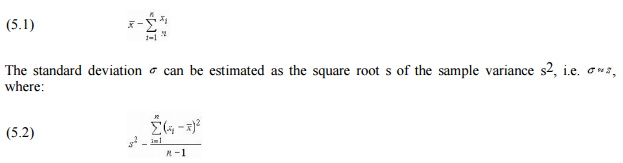

measured n times resulting is a set of values xi (i = 1,2,...,n),

then the average or mean value then the average or mean value is given by:

The standard deviation is a direct indicator of the spread or

variability in a measurement, in the same units as the measurement itself.

Higher values of the standard deviation indicate greater and greater

uncertainty about the exact value of the measurement. For the commonly

encountered normal distribution of a random variable, the average value plus or

minus one standard deviation, ![]() +

+ ![]() , will include about two-thirds

ofx the actual occurrences. A related measure of random variability is the

coefficient of variation, defined as the ratio of the standard deviation to the

mean:

, will include about two-thirds

ofx the actual occurrences. A related measure of random variability is the

coefficient of variation, defined as the ratio of the standard deviation to the

mean:

(5.3)

Thus, a coefficient of variation indicates the

variability as a proportion of the expected value. A coefficient of variation

equal to one (c = 1) represents substantial uncertainty, whereas a value such

as c = 0.1 or ten percent indicates much smaller variability.

More generally, even information which is gathered

and reported correctly may be interpreted incorrectly. While the actual

information might be correct within the terms of the data gathering and

recording system, it may be quite misleading for managerial purposes. A few

examples can illustrate the problems which may arise in naively interpreting

recorded information without involving any conceptual understanding of how the

information is actually gathered, stored and recorded or how work on the project

actually proceeds.

Example

5-1: Sources of Delay and Cost Accounts

It is common in construction activity information to make

detailed records of costs incurred and work progress. It is less common to keep

detailed records of delays and their causes, even though these delays may be

the actual cause of increased costs and lower productivity.Paying exclusive

attention to cost accounts in such situations may be misleading. For example,

suppose that the accounts for equipment and material inventories show cost

savings relative to original estimates, whereas the costs associated with

particular construction activities show higher than estimated expenditures. In

this situation, it is not necessarily the case that the inventory function is

performing well, whereas the field workers are the cause of cost overrun

problems. It may be that construction activities are delayed by lack of

equipment or materials, thus causing cost increases. Keeping a larger inventory

of materials and equipment might increase the inventory account totals, but

lead to lower overall costs on the project. Better yet, more closely matching

demands and supplies might reduce delay costs without concurrent inventory cost

increases. Thus, simply examining cost account information may not lead to a

correct diagnosis of a problem or to the correct managerial responses.

Example

5-2: Interest Charges

Financial

or interest charges are usually accumulated in a separate account for projects,

while the accounts associated with particular activities represent actual

expenditures. For example, planning activities might cost $10,000 for a small

project during the first year of a two year project. Since dollar expenditures

have a time value, this $10,000 cost in year 1 is not equivalent in value to a

$10,000 cost in year 2. In particular, financing the early $10,000 involves

payment of interest or, similarly, the loss of investment opportunities. If the

borrowing rate was 10%, then financing the first year $10,000 expenditure would

require $10,000 x 0.10= $1,000 and the value of the expenditure by the end of

the second year of the project would be $11,000. Thus, some portion of the

overall interest charges represents a cost associated with planning activities.

Recognizing the true value of expenditures made at different periods of time is

an important element in devising rational planning and management strategies.

Related Topics