Finishing Entrepreneurship - Accounting and Book Keeping | 12th Textiles and Dress Designing : Chapter 13 : Finishing Entrepreneurship

Chapter: 12th Textiles and Dress Designing : Chapter 13 : Finishing Entrepreneurship

Accounting and Book Keeping

Accounting and Book Keeping

Every enterprise irrespective of whether it is large or small,

public or private, sole or partnership has financial concern and wish to make

profits. It is humanly impossible to remember all the transactions. So there is

a need to record them. Accounting is said to be the language of business as it

communicates or reports the results of business operations. Accounting is

described as the art of recording, classifying and summarising in a significant

manner and in terms of money, transactions and events which are in part of

financial character and interpreting the results thereof.

The scope of accounting comprises of the following heads :

Data Creation and Collection

Every transaction related to some financial activity is noted and

recorded into books. This may be done in manual, mechanical or electronic way.

Years back it was done manual and books or physical files were maintained. But

in the recent years computers are used and electronic files are maintained.

Important files are locked with suitable password.

Data Evaluation

Data Evaluation controls the activities of business, evaluating

the performance of the business and analysing the accounting information for

decision making purposes. This activity helps the company to start new product

production or modify the existing product.

Data Reporting

Data Reporting consists of two parts namely external and

internal reporting. External reporting is the communication of financial

information to the outside portion. Eg. : Shareholders and government agencies.

Internal reporting is concerned with the communication of results of financial

analysis to the management for decision making purposes.

Accounting

Accounting is carried out in four steps or stages namely recording the

transactions, classifying the transactions, summarizing the transactions and

interpreting the transactions.

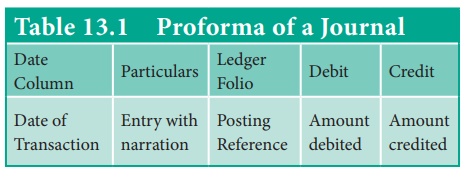

Recording the Transactions

All business transactions are first recorded in the book of

original entry with the help of cash memos, cash receipts and invoices. This

book is known as “The Journal”. All the business transactions are entered in a

chronological order. Books of primary entry are Journal and subsidiary books

and books of final entry is the “ledger”.

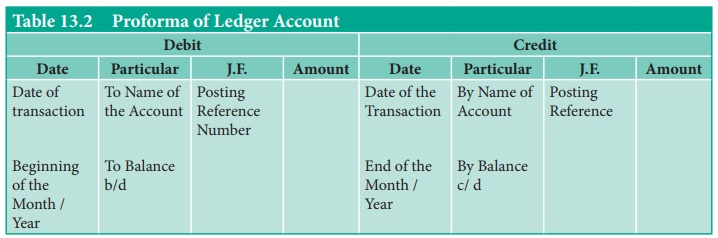

Classifying the Transactions

Transactions of similar native are grouped together and posted

into another book called “The Ledger”. The purpose of classifying the

transactions of similar nature is to understand their combined effect. For this

purpose all such ledger accounts are balanced for a particular period of time.

Summarising the Transactions

Summarising the Transaction is the preparation of the year end

summary known as “Final Accounts”. Before preparing final accounts, a list of

all ledger balances are prepared in the form of a statement known as “Trial

Balance”. Final accounts consist of trading and profit and loss, Account and

Balance Sheet”. Trading, profit and loss account reveals the net result of the

business. The balance sheet depicts the financial position of the business.

Interpreting the Results

The final stage is to analyse and interpret the results as per the

final accounts. This includes computation of various accounting ratios to

assess the liquidity, solvency and profitability of the business. This helps

the entrepreneur understand all the activities of the company, financial status

and plan for the future of the company.

The accounting system has two stages namely book-keeping and

accounting. Book Keeping is a process of maintaining routine

records in prescribed form and according to set rules, of all events which

affect the financial state of the organisation. Accounting is the

summarisation from time to time of the information contained in the

records, its presentation in a significant form to interested parties, and its

interpretation as an aid to decision making by these parties.

Trial Balance

It is a statement containing the balances of all ledger accounts

as on given date. It is prepared to check the arithmetical accuracy of the

ledger postings.

Financial Statements

The purpose of financial accounting is to keep records of all the

financial transactions so that profit earned or loss incurred can be worked

out. Financial position of the business can be ascertained and the financial

information required can be provided. The financial statements primarily

include trading and profit and loss account balance sheet and Generally

Accepted Accounting Principles (GAAP) state that a complete set of financial

statements must include:

·

Profit and Loss Account or Income Statement,

·

Statement of Retained Earnings,

·

Balance Sheet, and

·

Statement of changes in Financial Position.

Fund Flow Statement

It is an important analytical tool in hands of the management

useful for analysing the past and planning for the future. It is useful in

following and many more aspects;

·

It serves as a control device

·

It helps in proper allocation of resources

·

It helps in the management to formulate financial policies

·

It communicates valuable information regarding concerns financial

position to outside world It enables the investors and creditors in assessing

the degree of risk involved in granting credit or associating with the

business.

Related Topics