Chapter: Mechanical : Engineering Economics & Cost Analysis : Value Engineering

Value Engineering

VALUE ENGINEERING

INTRODUCTION

Value analysis is one of the major techniques of

cost reduction and cost prevention. It is a disciplined approach that ensures

necessary functions for minimum cost without sacrificing quality, reliability, performance,

and appearance. According to the Society of American Value Engineers (SAVE),

Value Analysis is the systematic application of

recognized techniques which identify the function of a product or service,

establish a monetary value for the function and provide the necessary function

reliably at the lowest overall cost.

It is an organized approach to identify

unnecessary costs associated with any product, material part, component, system

or service by analysing the function and eliminating such costs without

impairing the quality, functional reliability, or the capacity of the product

to give service

1 WHEN TO APPLY VALUE ANALYSIS

One can definitely expect very good results by

initiating a VA programme if one or more of the following symptoms are present:

1. Company’s products show decline in sales.

2. Company’s prices are higher than those of its competitors.

3. Raw materials cost has grown disproportionate to the volume of

production.

4. New designs are being introduced.

5. The cost of

manufacture is rising disproportionate to the

volume of production.

6. Rate of return on investment has a falling trend.

7. Inability of the firm to meet its delivery commitments.

2.Value

The term ‘value’ is used in different ways and, consequently, has different meanings. The designer equates the

value with reliability; a purchase person with price paid for the item; a

production person with what it costs to manufacture, and a sales person with

what the customer is willing to pay.

Example

Cost value. It is the summation of the labour, material, overhead and all

other elements of cost required to produce an item or provide a service

compared to a base.

Exchange value. It is the measure

of all the properties, qualities and features of the product, which make

the product possible of being traded for another product or for money.

Value

analysis/value engineering

It is a special type of cost reduction technique.

It critically investigates and analyses the different aspects of materials,

design, cost and production of each and every component of the product in

produce it economically without decreasing its utility, function or

reliability.

Applications

The various application areas of value engineering

are machine tool industries, industries making accessories for machine tools,

auto industries, import substitutes, etc.

INTRODUCTION

In the process of carrying out business activities

of an organization, a component/product can be made within the organization or

bought from a subcontractor. Each decision involves its own costs.

So, in a given situation, the organization should

evaluate each of the above make or buy alternatives and then select the

alternative which results in the lowest cost. This is an important decision

since it affects the productivity of the organization

In the long run, the make or buy decision is not

static. The make option of a component/product may be economical today; but

after some time, it may turn out to be uneconomical to make the same.

Thus, the make or buy decision should be reviewed

periodically, say, every 1 to 3 years. This is mainly to cope with the changes

in the level of competition and various other environmental factors.

Make or Buy Decisions - is a

determination whether to produce a component part internally or to buy

it from an outside supplier. The Organization should evaluate the costs and

benefits of manufacturing a product or product component against purchasing it

and then select the alternative which results in the lower cost.

1 CRITERIA FOR MAKE OR BUY

In this section the criteria for make or buy are discussed.

1. Criteria for make

The following are the criteria for make:

1.The finished product can be made cheaper by the firm than by

outside suppliers.

2. The finished product is being manufactured only by a limited

number of outside firms which are unable to meet the demand.

3. The part has an importance for the firm and requires extremely

close quality control.

4. The part can be manufactured with the firm’s existing facilities and similar to

other items in which the company has manufacturing experience.

2. Criteria for buy

The following are the criteria for buy:

1. Requires high investments on facilities which are already

available at suppliers plant.

2. The company does not have facilities to make it and there are

more profitable opportunities for investing company’s capital.

3. Existing facilities of the company can be used more economically

to make other parts.

4. The skill of personnel employed by the company is not readily

adaptable to make the part.

5. Patent or other legal barriers prevent the company for making

the part.

6. Demand for the part is either temporary or seasonal.

APPROACHES FOR MAKE

OR BUY DECISION

Types of analysis followed in make or buy decision are as

follows:

1. Simple cost analysis

2. Economic analysis

3. Break-even analysis

1. Simple Cost Analysis

The concept is illustrated using an example problem.

EXAMPLE

A company has extra capacity that can be used to produce a

sophisticated fixture which it has been buying for Rs. 900 each. If the company

makes the fixtures, it will incur materials cost of Rs. 300 per unit, labour

costs of Rs. 250 per unit, and variable overhead costs of Rs. 100 per unit. The

annual fixed cost associated with the unused capacity is Rs. 10,00,000. Demand

over the next year is estimated at 5,000 units. Would it be profitable for the

company to make the fixtures?

Solution

We assume that the unused capacity has alternative use.

Cost to make

Variable cost/unit = Material + labour + overheads

= Rs. 300 + Rs. 250 + Rs. 1 0 0

= Rs. 650

Total variable cost = (5,000 units) (Rs. 650/unit)

=

Rs. 32,50,000

Add fixed cost associated

with unused capacity +

Rs. 10,00,000

Total cost = Rs.

42,50,000

Cost to buy

Purchase cost =

(5,000 units) (Rs. 900/unit)

Add fixed cost associated =

Rs. 45,00,000

with unused capacity +

Rs. 10,00,000

Total cost = Rs.

55,00,000

The cost of making fixtures is less than the cost of buying

fixtures from outside. Therefore, the organization should make the fixtures.

2. Economic Analysis

The following

inventory models are considered to illustrate this concept:

Purchase model

Manufacturing model

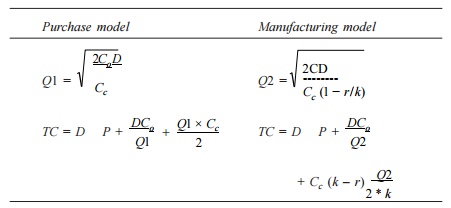

The formulae for EOQ and total cost (TC) for each model are

given in the following table:

where

D = demand/year

P = purchase price/unit

Cc = carrying cost/unit/year

Co = ordering cost/order or set-up cost/set-up

k = production rate (No. of units/year)

r = demand/year

Q1 = economic order size

Q2 = economic production size

TC = total cost per year

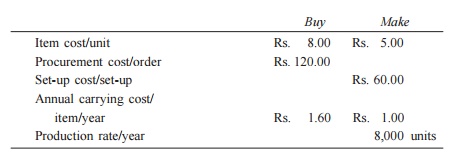

EXAMPLE

An item has a yearly demand of 2,000 units. The different costs

in respect of make and buy are as follows. Determine the best option.

Buy Make

Item cost/unit Rs. 8.00 Rs. 5.00

Procurement cost/order Rs.

120.00

Set-up cost/set-up Rs.

60.00

Annual carrying cost/

item/year Rs. 1.60 Rs. 1.00

Production rate/year 8,000 units

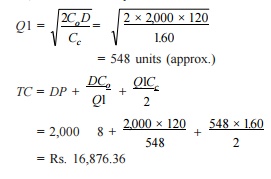

Solution

Buy option

D = 2,000 units/year

Co = Rs. 120/order

Cc = Rs. 1.60/unit/year

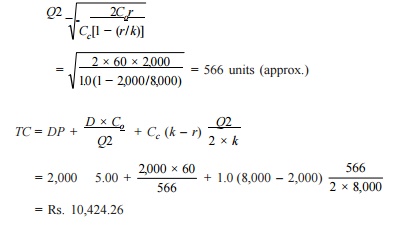

Make option

Co = Rs. 60/set-up

r = 2,000 units/year

Cc = Re 1/unit/year

k = 8,000 units/year

= Rs. 10,424.26

Result: The cost of making is less than

the cost of buying.

Therefore, the firm should go in for the making option.

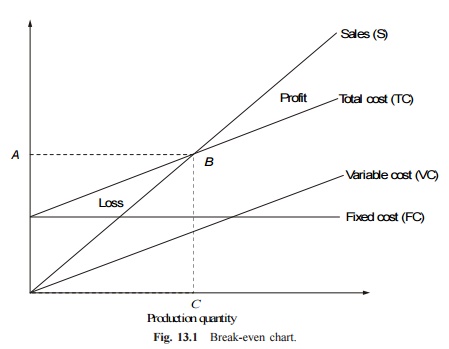

3. Break-even Analysis

The break-even analysis chart is shown in Fig

TC = total cost FC = fixed cost

TC = FC + variable cost

B = the intersection of TC and

sales (no loss or no gain situation)

A = break-even sales

= break-even quantity/break-even point (BEP)

The formula for the break-even point (BEP) is

BEP = FC / Selling price / unit − Variable

cost / unit

EXAMPLE

There are three alternatives

available to meet the demand of a

particular product. They are

as follows:

(a) Manufacturing the product

by using process

A (b)

Manufacturing the product

by using

process B (c) Buying the

product

The details are as given in

the following table:

Cost elements Manufacturing ManufacturingBuy

the

product by the product by

process

A process B

Fixed cost/year (Rs.) 5,00,000 6,00,000

Variable/unit (Rs.) 175 150

Purchase price/unit (Rs.) 125

The annual demand of the

product is 8,000 units. Should the company make the

product using process A or

process B or buy it?

Solution

Annual cost of process A = FC + VC Volume

= 5,00,000 + 175 8,000

=

Rs. 19,00,000

Annual cost of process B = FC + VC Volume

= 6,00,000 + 150 8,000

=

Rs. 18,00,000

Annual cost of buy = Purchase price/unit Volume

= 125 8,000

=

Rs. 10,00,000

Since the

annual cost of buy option is

the minimum among

all the alternatives, the company

should buy the product .

Related Topics