Chapter: Business Science : Merchant Banking and Financial Services : Other Fund Based Financial Services

Forfeiting

FORFAITING

A form of financing of receivables arising from international trade is known as forfeiting. Within this arrangement, a bank/financial institutions undertakes the purchase of trade bills/ promissory notes without recourse to the seller. Purchase is through discounting of the documents covering the entire risk of non-payment at the time of collection. All risks become the full responsibility of the purchaser. Forfeiter pays cash to the seller after discounting the bills/notes.

1 Forfeiting Mechanism:

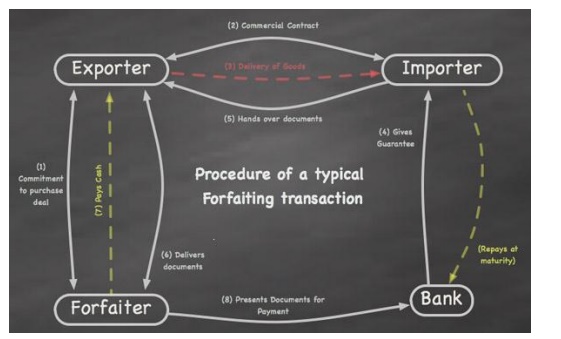

In order to illustrate how forfeiting takes place in practice, the following is a typical forfeiting transaction where the buyer and the seller of goods are located in different countries.

1. During the course of negotiations between an exporter and an importer for the supply of goods, the importer asks for credit terms.

2. The exporter approaches a forfeiter and asks for an indication of whether the forfeiter is willing to provide this credit and how much it is likely to cost. At this stage the forfeiter will need to know:

1. The country of the importer

2. The importer‘s name

3. The type of goods

4. The value of the goods

5. The expected shipment date

6. The repayment terms sought by the importer

7. Whether the importer‘s obligations will be guaranteed by a bank, and if so, who?

The forfeiter provides the exporter with an indication of the costs involved. At this stage neither party is committed in any way.

When the details of the commercial contract have been agreed, but usually before it has been signed, the exporter asks the forfeiter for a commitment to purchase the debt obligations (bills of exchange, promissory notes etc) created under the export transaction.

The information required for this is the same as for an indication.

The forfeiter issues a commitment which is accepted by the exporter and which is binding

on both parties This commitment will contain the following points:

0. The details of the underlying commercial transaction.

1. The nature of the debt instruments to be purchased by the forfeiter.

2. The discount (interest) rate to be applied, together with any other charges

3. The documents that the forfeiter will require in order to be satisfied that the debt being purchased is valid and enforceable

4. The latest date that the exporter can deliver these documents to the forfeiter The exporter signs the commercial contract with the importer and delivers the goods.

In return, if required, the importer obtains a guarantee from his bank (4) provides the documents that the exporter requires in order to complete the forfaiting (5). This exchange of documents is usually handled by a bank, often using a Letter of Credit, in order to minimise the risk to the exporter.

The exporter delivers the documents to the forfaiter who checks them and pays for them as agreed in the commitment (6+7).

Since this payment is without recourse, the exporter has no further interest in the

transaction. It is the forfeiter who collects the future payments due from the importer (8)and it is the forfeiter who runs all the risks of non-payment.

2 Benefits to Exporter

· 100 per cent financing: Without recourse and not occupying exporter's credit line That is to say once the exporter obtains the financed fund, he will be exempted from the responsibility to repay the debt.

· Improved cash flow: Receivables become current cash inflow and its is beneficial to the exporters to improve financial status and liquidation ability so as to heighten further the funds raising capability.

· Reduced administration cost: By using forfeiting, the exporter will spare from the management of the receivables. The relative costs, as a result, are reduced greatly.

· Advance tax refund: Through forfeiting the exporter can make the verification of export and get tax refund in advance just after financing.

· Risk reduction: forfeiting business enables the exporter to transfer various risk resulted from deferred payments, such as interest rate risk, currency risk, credit risk, and political risk to the forfeiting bank.

· Increased trade opportunity: With forfeiting, the export is able to grant credit to his buyers freely, and thus, be more competitive in the market.

3. Benefits to Banks

Forfeiting provides the banks following benefits:

· Banks can offer a novel product range to clients, which enable the client to gain 100% finance, as against 8085% in case of other discounting products.

· Bank gain fee based income.

Lower credit administration and credit follow up.

Related Topics