Auditing - Vouching of Debit Side of Cash Book (or) Cash Receipts | 11th Auditing : Chapter 6 and 7 : Vouching of Cash Transactions

Chapter: 11th Auditing : Chapter 6 and 7 : Vouching of Cash Transactions

Vouching of Debit Side of Cash Book (or) Cash Receipts

Vouching of Debit Side of Cash

Book (or) Cash Receipts

Cash book is one of the most important books of accounts.

The auditor has to ensure that all receipts have been accounted for. Errors and

frauds usually arise in connection with cash receipts. Hence, the auditor

should vouch all the cash transactions as far as possible and should ensure

that all receipts have been accounted. He has to ensure that there are no

omissions of cash receipts and the auditor has to rely considerably on the

internal check system in operation. Some of the important cash receipts which

usually appear on the debit side of the cash book and the duty of an auditor in

that connection are given below:

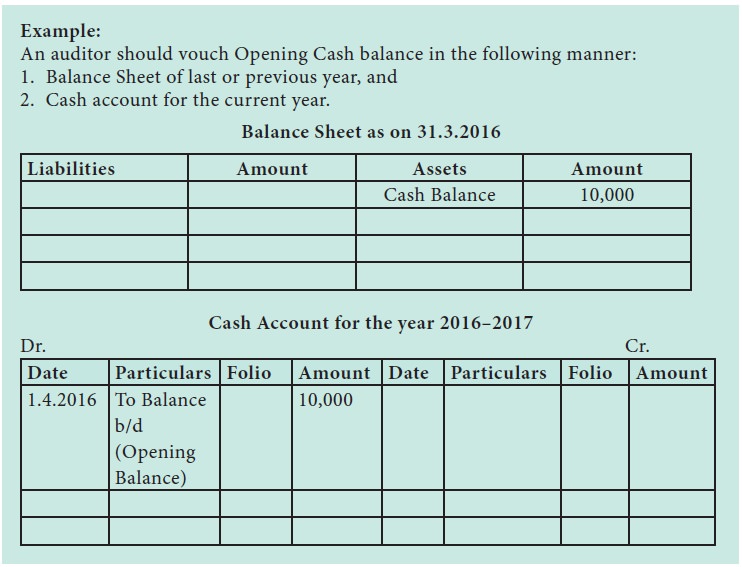

Opening balance

Opening balance of the current year refers to the

closing balance of last year. It should be compared with the balance shown in

the duly audited balance sheet of the previous year. This is done to ensure

that actual balance has been brought down.

Documents to be Vouched: Audited Balance Sheet of last year.

Example:

An auditor should vouch Opening Cash

balance in the following manner:

1. Balance Sheet of last or previous

year, and

2. Cash account for the current year.

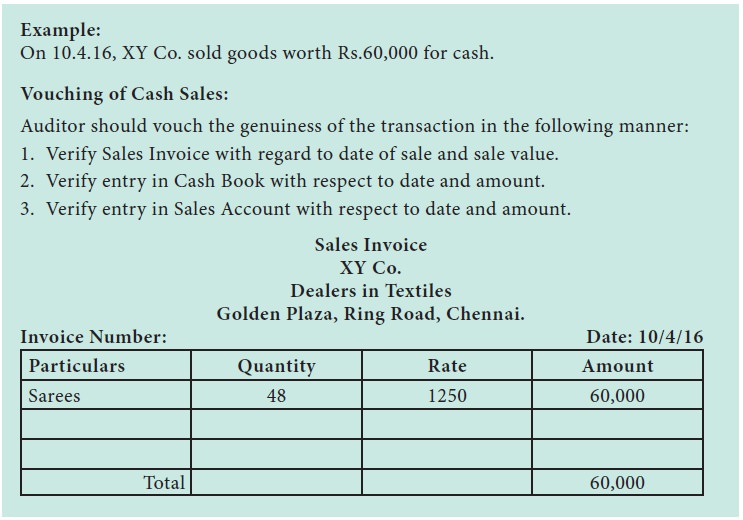

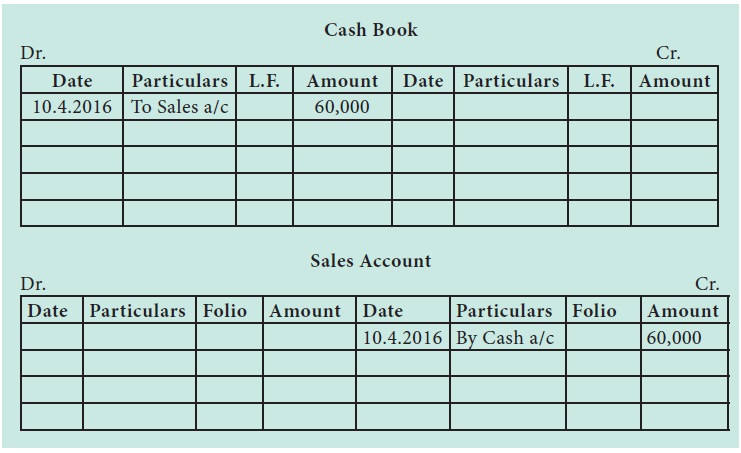

Cash Sales

The auditor should be very careful in verifying

cash sales as there are greater chances of fraud. Firstly, the auditor should

verify the system of internal check in operation with regard to cash sales.

Secondly, he should verify cash sales invoices with the entries in the summary

of daily cash sales with regard to name of the customer, date, quantity, rate,

discount, tax, rounding off etc. Thirdly, the summary of daily cash sales

should be compared and tallied with the sales which are accounted in the cash

book. Fourthly, the auditor should counter check the entries of cash sales in

the cash book with the carbon copies of cash memos. Lastly, the auditor should

ensure that all cash received on account of cash sales is deposited in the bank

on the next day itself. Fraud may take place in respect of cash sales, when

salesmen sell goods and do not make entries in the cash book and misappropriate

the money. In order to overcome such type of fraud, salesmen should be

instructed not to receive cash from customers. The auditor should compare the

dates on the cash memos and the cash book. If cash discount has been allowed on

sales, he should see that a uniform policy and rate of discount has been

followed.

Documents to be Vouched: Sales Invoice, Duplicate cash Memo, Summary

of daily cash sales, Rough cash book and main cash book.

Example:

On 10.4.16, XY Co. sold goods worth

Rs.60,000 for cash.

Vouching of Cash Sales:

Auditor should vouch the genuiness of

the transaction in the following manner:

1. Verify Sales Invoice with regard

to date of sale and sale value.

2. Verify entry in Cash Book with

respect to date and amount.

3. Verify entry in Sales Account with

respect to date and amount.

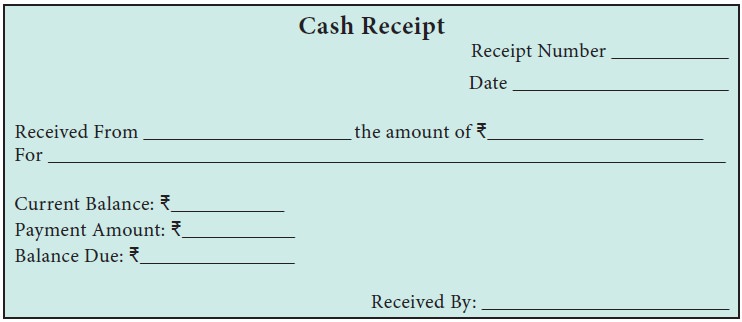

Receipts from Debtors

When cash is received from customers, a cash memo is issued to the customer and a carbon copy of cash memo is retained by the clerk. Fraud can take place by accounting lesser amount than what is actually received. Sometimes, fraud may occur when payment received from a customer is misappropriated without making entry in the account and later on when cash is received from another customer. This practice is called as “Teeming and Lading of Fraud.”

Auditor to overcome such type of fraud, he should

verify the sales invoices and counterfoils of the receipt to ensure the amount

received against the invoice.

Cash received from a customer should be compared

with the entries in the cash book and in the customers account. At frequent

intervals, the auditor should obtain statement of accounts and confirmation of

balances from the debtors and cross check with the entries and balances in the

debtors account. He should also ensure that all cash received on account of

cash sales should be deposited in the bank on the next day.

Documents to be Vouched: Sales invoices, Counterfoils of cash

receipts, Statement of accounts from debtors, Correspondences and confirmations

from the debtors and bank statement.

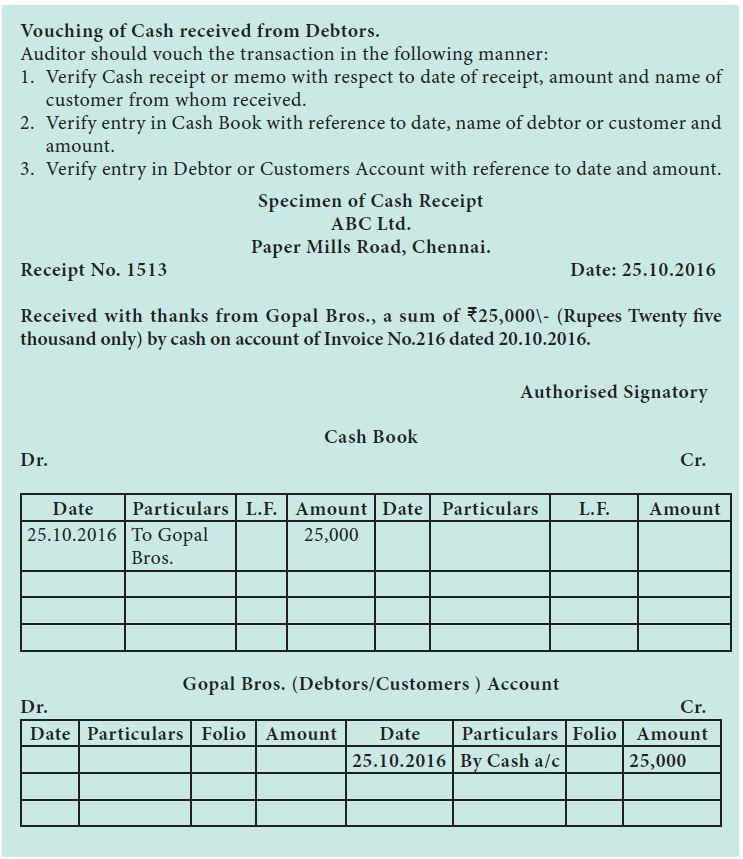

Example:

On 25.10.2016, Received cash from

Gopal Bros. for Rs.

25,000 towards sale made on 20.10.2016.

Vouching of Cash received from Debtors.

Auditor should vouch the transaction

in the following manner:

1. Verify Cash receipt or memo with

respect to date of receipt, amount and name of customer from whom received.

2. Verify entry in Cash Book with

reference to date, name of debtor or customer and amount.

3. Verify entry in Debtor or

Customers Account with reference to date and amount.

Income from Interest and Dividend

Interest income may arise from loans granted, bills

of exchange accepted by customers, debentures, deposits, bonds and other

investment securities. Vouching of interest received should be from instruments

carrying interest bearing obligation. The auditor should ensure that

accrual/receipt of interest is in accordance with terms of the instrument

concerned, and properly recorded in the books of accounts. For example, interest

received on account of Fixed Deposits in the bank should be vouched with the

Bank Pass book.

He should also verify the accuracy of the interest

calculation. Vouching of interest received on securities should be vouched from

the securities or from the Investment ledger as to the date of the receipt of

interest, amount, rate of interest etc. Interest received for any particular

fund like Provident Fund should be credited to that fund and not to the revenue

account. Further, the auditor should obtain confirmations from the parties

owing interest payment and should check with the entries in the interest

received account and cash book.

Documents to be Vouched: Loan agreement or Fixed deposit receipts,

Counterfoil of cash receipts, Bank pass book.

Vouching of dividends should be done by referring

the relevant dividend warrants, shares, and securities. The auditor should

ensure that the client has indeed received and properly recorded all dividends

that are due to it. When dividend is collected through bank, amount received

should be verified with the bank pass book. He should check the rate of

dividends, amount of gross and net dividends and the tax deducted at source. He

should also check the actual receipts either from the cash book or bank pass

book.

Documents to be Vouched: Dividend warrants, Counterfoils of cash

receipts and Passbook.

Sale Of Investments

Sale of investments should give rise to capital

receipt except in the case of broking or investment firms for whom the proceeds

will be revenue receipts. The amount received on account of the sale of

investments should be vouched with broker’s sold note. When investments are

sold through bank, then bank advice should be verified. At frequent intervals,

the auditor should compare the securities on hand with the amount realised on

sale of securities with investment accounts.

Documents to be Vouched: Bank advice and Broker’s Sold note.

Sale of Fixed Assets

The auditor should examine the minutes book of

directors to ensure that the sale of fixed assets is properly approved by the

Board of Directors in the meeting. He should verify the sale agreement and

correspondences and ascertain the sale value of fixed assets. He should check

the entry in the cash book for sale consideration received and cross check the

entry in the bank statement to confirm that the amount received is deposited in

bank. When investments are sold through broker, auditor should vouch Brokers

sold Note and auctioneers statement should be verified when sold in an auction.

He should verify the calculation of profit or loss on sale of fixed assets and

that the amount is treated as capital profit and is transferred to capital

reserve.

Documents to be Vouched: Sale Deed or Agreement, Minutes book of directors,

Fixed Assets Register, Bank statement, Auctioneer’s sold note or Broker’s sold

note and correspondences.

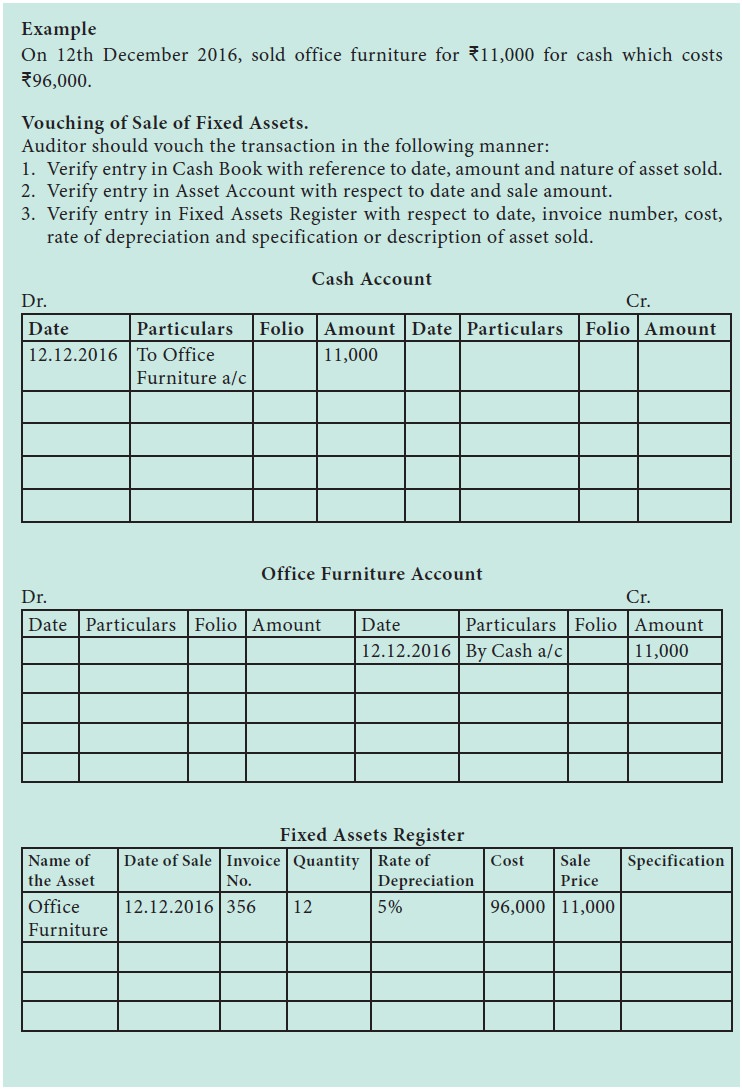

Example

On 12th December 2016, sold office

furniture for Rs. 11,000 for cash which costs Rs. 96,000.

Vouching of Sale of Fixed Assets.

Auditor should vouch the transaction

in the following manner:

1. Verify entry in Cash Book with

reference to date, amount and nature of asset sold.

2. Verify entry in Asset Account with

respect to date and sale amount.

3. Verify entry in Fixed Assets

Register with respect to date, invoice number, cost, rate of depreciation and

specification or description of asset sold.

Related Topics