Vouching of Cash Transactions | Auditing - Cash Paid To Creditors | 11th Auditing : Chapter 6 and 7 : Vouching of Cash Transactions

Chapter: 11th Auditing : Chapter 6 and 7 : Vouching of Cash Transactions

Cash Paid To Creditors

Cash Paid To Creditors

While vouching cash payment to creditors, the

auditor should examine the system of Internal control in existence. He should

check the entries in the cash book with the receipts issued by creditors or

counterfoils of cheque book and bank statement. He should compare the ledger

balances of creditors with statement of accounts sent by them. Further, the

auditor should ensure that all payments made to creditors are properly

authorized by a responsible official. When payment was made as full and final

settlement, auditor should verify whether the company has been availed any

discount and is accounted as discount received.

Documents to be Vouched: Receipts issued by

creditors, Invoices, Statement of accounts

of creditors, Bank statement.

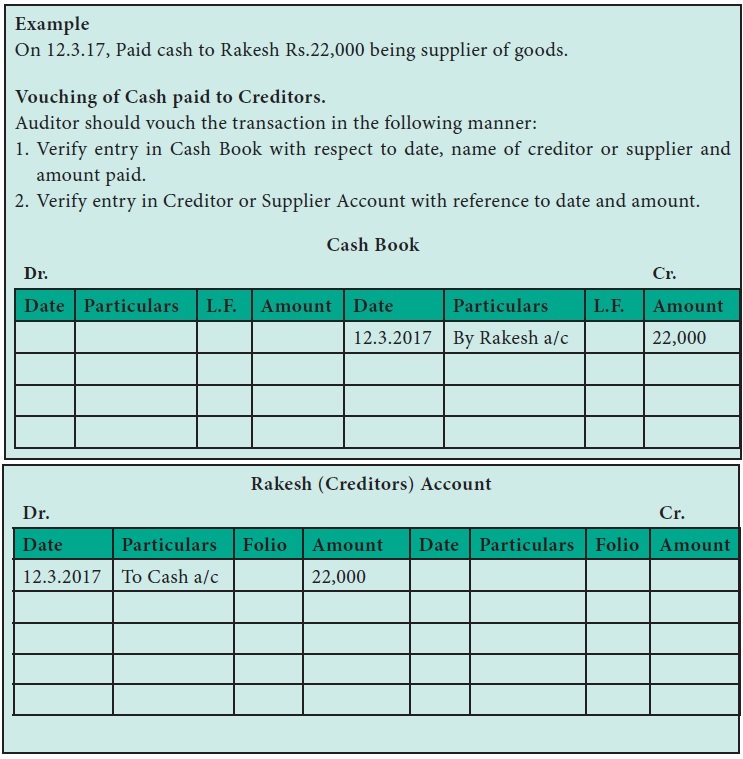

Example

On 12.3.17, Paid cash to Rakesh

Rs.22,000 being supplier of goods.

Vouching of Cash paid to Creditors.

Auditor should vouch the transaction

in the following manner:

1. Verify entry in Cash Book with

respect to date, name of creditor or supplier and amount paid.

2. Verify entry in Creditor or

Supplier Account with reference to date and amount.

Related Topics