Chapter: Business Science : Rural Marketing : Trends in Rural Marketing

Trends in Rural Marketing

TRENDS IN RURAL MARKETING

Introduction

Product –Developing

relevant products to meet the specific needs of rural consumers will

exercise the minds of marketers. For eg. We know that voltage fluctuation is a

major problem in our villages, because of which bulbs last but a few days.

Companies will put their R & D teams to develop filaments that can

withstand violent fluctuations, thereby extending the life of the bulb.

Price –As

rural incomes continue to rise in the coming years, we may see the share

of low unit packs coming down somewhat and economy packs gaining share. Also as

the reach of media and awareness level improve, we are likely to see companies

shift their focus from trade to consumers.

Distribution –Challenge

of reach will be addressed through innovation. Project

Shakti of HUL is one such successful exampl model

through haats being piloted by MART for Colgate, is another such new model.

Amway is already selling bio-fertilizers in rural India, through its famous

multi-layer distribution model.

Communication –Indian

advertising industry has to be firmly grounded in rural perception,

values and traditions. It has to drown itself in local colors, customs and

modes of communication, to make itself relevant to rural society. It has to

gain the trust of masses, by undercutting excessive dependency on western

advertising.

Market Research

Rural consumers are

fundamentally different from their urban counterparts. The lower levels of

literacy and limited exposure to product and services are well-known, but there

are also differences in occupation options, with a direct impact on income

levels and income flows, and a high level of inter-dependency affecting the

dynamics of rural community behavior. All contribute to make rural consumer

behavior starkly distinct from the urban. As any consumer research study must

understand the consumer in the context of his environment and society, Rural

Market Research must overcome the challenge of respondents with lower literacy

and exposure levels, where conventional market research tools may not be easily

comprehended by villagers. MART, a specialist organization in rural, has

innovated tools to overcome these limitations in conducting rural consumer

research.

Consumer Finance

•

The term consumer finance refers to the

activities involved in granting credit to consumers to enable them to possess

goods meant for everyday use.

Types of Consumer

Credit

Revolving credit: it is an ongoing credit

arrangement whereby the financier on a revolving basis grants credit. The

consumer is entitled to avail credit to the extent sanctioned as credit limit ex:

Credit Card

•

Fixed credit: it is like a term loan

where by the financier provides loans for a fixed period of time. The credit

has to be repaid within a stipulated period ex: monthly installment loan, hire

purchase.

•

Cash Loan: Under this type of credit

banks and financial institutions provide money with which the consumers buy

goods for personal consumption here the lender and seller are different and

lender does not have the responsibility of seller.

•

Secured Finance: when the credit granted

by financial institutions is secured by collateral it takes the form of secured

finance. The collateral is taken by the creditor in order to satisfy the debt

in the event of default by the borrower. The collateral may be in the form of

personal property, real property or liquid assets.

•

Unsecured Finance: When there is no

security offered by the consumer against which money is granted by financial

institutions, it is called unsecured finance.

Sources of Consumer

Finance

•

Traders: The predominant agencies that

are involved in consumer finance are traders. They include sales finance

companies, hire purchase and other such financial institutions.

•

Commercial Banks: Commercial Banks

provide finance for consumer durables. Banks lend large sum of money at

wholesale rate to commercial or sales finance companies, hire purchase concerns

and other such finance companies. Banks also provide consumers personal loans

meant for purchasing consumer durable goods.

•

Credit Card Institutions: These

institutions arrange for credit purchase of consumer goods through respective

banks which issue the credit cards. The credit card system enables a person to

buy credit card services on credit. On presentation of credit card by the

buyer, the seller prepares 3 copies of the sales voucher, one for seller,

bank/credit card company and 3rd for the buyer. The seller forwards

a copy to the bank for collection. The seller‘s bank forwards company. The bank

debits theThe amountbuyer to receives monthly statement from the card issuing

bank or company and the amount is to be paid within a period of 20 to 45 days

without any additional charges.

(NBFC‘s):Non-bankingFinancial companies constitute

an important source of consumer finance. Consumer finance companies also known

as small loan companies or personal finance companies are non-saving

institutions whose prime assets constitute sale finance receivables, personal

cash loans, short and medium term receivables. These companies charge

substantially higher rate of interest than the market rates.

•

Credit Unions: A credit union is an

association of people who agree to save their money together and in turn

provide loans to each other at a relatively lower rate of interest. These are

caller co-operative credit societies. They are nonprofit deposit taking and low

cost credit institutions.

Products covered

•

Consumers financing covers a wide range

of products such as cars, Televisions, washing machines, refrigerators, Air

conditioners, computers etc. The products covered possess some distinct feature

such as durability, sustainability, salability and serviceability etc.

Rural Vertical

The CEO would need to articulate a strong commitment

to rural marketing, only then will the marketing team give its focused

attention and sustained support to this growing market segment.

HUL has already created a separate rural vertical

with a team of RSMs, ASMs, SOs and RSPs committed exclusively to servicing the

rural market. Rural has been given separate

sales targets and the company is in the process of

allocating separate sales promotion and advertising budgets for this market.

Retail and IT models

IT and connectivity impact the way

business is done. Today with STD facility, the retailer can dial the town

distributor instantly and fresh stocks would reach him in just a couple of days,

because of better road connectivity.

Benefits of IT Driven business strategy

Ease of access

Up-to-date content

Layout, design, consistent themes Easy navigation

Higher interactivity

Access through multiple media

Higher use of non-textual information Multiple

languages

Lower transaction cost.

Rural managers

•

As the rural market is already bigger

than its urban counterpart, there is need to develop a good understanding about

it among corporate managers. For this to happen rural marketing should be

taught as a subject in every business school.

5 Glamorize rural marketing

•

Rural is considered as unglamorous.

Industry seminars on these subjects also evoke a similar response. This must

change as the rural market in size is bigger than any of the other markets

mentioned here.

•

Industries associations (CII, FICCI,

ASSOCHAM) government agencies and academic institutions should take upon

themselves to give due importance to rural marketing.

Public-Private Partnership

Companies would join

hands with the government in self-interest to increase the size of the pie, by

creating economic activity in villages through micro-enterprises and mainstream

these efforts, by linking them with large industry.

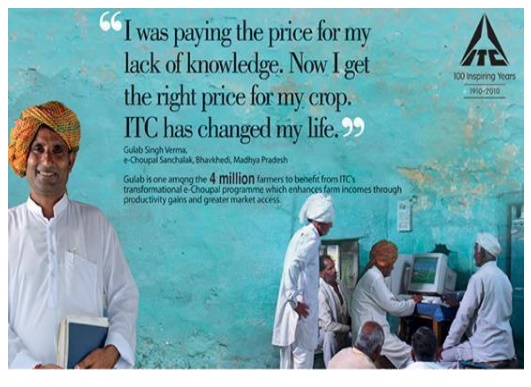

ICT Initiatives in Rural Markets

ITCs

e-choupa

N-Logue communications –Business of providing

Internet, voice, e-governance and other rural services through a network of

Local service providers.

E-Rural Marketing

Related Topics