Accountancy - Trading account | 11th Accountancy : Chapter 12 : Final Accounts of Sole Proprietors - I

Chapter: 11th Accountancy : Chapter 12 : Final Accounts of Sole Proprietors - I

Trading account

Trading account

Trading refers to buying and selling of goods with the intention of making profit. The trading account is a nominal account which shows the result of buying and selling of goods for an accounting period. According to J. R. Batliboi, “The trading account shows the results of buying and selling of goods. In preparing this account, the general establishment charges are ignored and only the transactions in goods are included."

Trading account is prepared to find out the difference between the

revenue from sales and cost of goods sold. Cost of goods sold refers to

directly related cost. Direct cost includes the purchase price of goods

purchased and all other expenses which are incurred to bring the goods to the

business premises or godown and to make these ready for sale. All the goods

purchased during the accounting period may not be sold during the same

accounting period. Hence, it is necessary to calculate the cost of goods sold

during the period. Matching principle is applied here. Hence, the cost of stock

not sold must be deducted, i.e., value of closing stock must be deducted. But

if there is any opening stock of goods that will be sold during the accounting

period, it is to be added to the cost of purchases made during the period. If

there is cost of goods manufactured, it must also be added to find out the cost

of goods sold.

Cost of goods sold = Opening stock + Net purchases + Direct expenses –

Closing stock

If the amount of sales exceeds the cost of goods sold, the difference is

gross profit. On the other hand, the excess of cost of goods sold over the

amount of sales results in gross loss.

Sales – Cost of goods sold =

Gross profit

Sales – Gross profit = Cost of goods sold

Need for preparation of trading account

Preparation of trading account serves the following purposes:

(i) Provides information about gross profit or gross loss

It shows the gross profit or gross loss of the business for an

accounting year. This helps the business persons to find out gross profit ratio

by expressing the gross profit as a percentage of sales. It helps to compare

and analyse with the ratios of the previous years. Thus, it provides data for

comparison, analysis and planning for a future period.

(ii) Provides an opportunity to safeguard against possible losses

If the ratio of gross profit has decreased in comparison to the

preceding years, effective measures can be taken to safeguard against future

losses. For example, the sale price of goods may be increased or steps may be

taken to analyse and control the direct expenses.

(iii) Provides information about direct expenses and direct incomes

All the expenses incurred on the purchase of goods are direct expenses. They are recorded in the trading account. Trading account also shows sales revenue, which is a direct income. With the help of trading account, percentage of such expenses on sales revenue can be calculated and compared with similar ratios of the previous years. Thus, it enables the management to have control over the direct expenses.

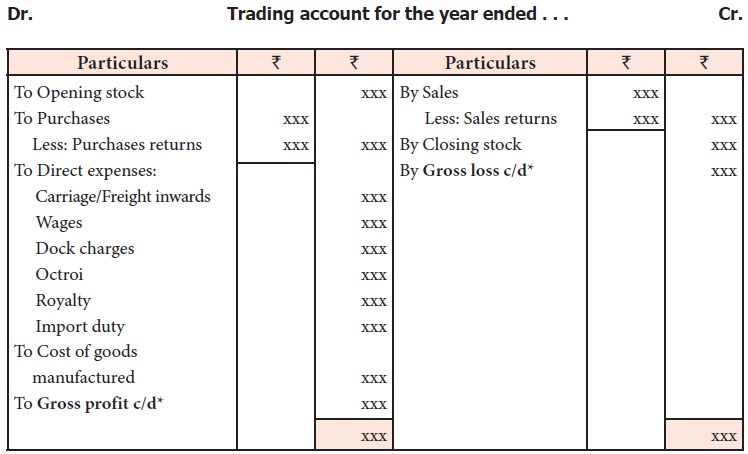

Preparation of trading account

Trading account is a nominal account. The opening stock, net purchases

and all expenses relating to purchase of goods are shown on the debit side and

the net sales and closing stock are shown on the credit side of it.

A) Items shown on the debit side of the trading account

The following are the items shown on the debit side of the trading

account:

(i) Opening stock

The stock of goods remaining unsold at the end of the previous year is

the opening stock of the current year. This item will not be there in a newly

started business. It will not appear if it is adjusted with purchases. As

opening stock would have been sold during the year, the cost of opening stock

is included in trading account.

(ii) Purchases and purchases returns

Goods which have been bought for

resale are termed as purchases. Goods purchased which are returned to suppliers

are termed as purchases returns or returns outward. Purchases include both cash

purchases and credit purchases. Net purchases, i.e., purchases minus purchases

returns are shown in the debit side of the trading account.

(iii) Direct expenses

All the expenses incurred on the purchase of goods and for bringing the

goods to the go down or place of business and to make them to saleable

condition are known as direct expenses. They are debited to trading account.

Direct expenses include the following:

(a) Carriage inwards or Freight

inwards

Amount paid for transporting the goods purchased to the godown or

business premises is called carriage inwards or carriage on purchases or

freight inwards.

(b) Wages

Amount paid to workers who are directly engaged in loading, unloading

and handling of goods purchased is known as wages.

(c) Dock Charges

These are the charges levied for shipping the cargo while entering or

leaving docks. When they are paid on import of goods, they are treated as

direct expenses.

(d) Octroi

This is a tax levied by the local authority when the purchased goods

enter the municipal limits.

(e) Import duty

Taxes paid on import of goods are known as import duties.

(f) Royalty

This is the amount paid to the owner of a mine or a patent for using owner’s right. When the royalty is based on cost of production or output, it is treated as a direct expense.

(g) Coal, gas, fuel and power

Cost incurred towards coal, gas and fuel to make the goods saleable is

also considered as direct expenses.

(iv) Cost of goods manufactured

If the sole proprietor is also engaged in manufacture of goods, a

separate account, namely, manufacturing account is to be prepared in which

expenses incurred for manufacture of goods will be entered. Examples of such

expenses are raw materials, coal, gas, fuel, water, power, factory rent,

packaging, factory lighting, royalty on manufactured goods, etc. The total cost

of goods manufactured is transferred to the debit side of trading account.

B) Items shown on the credit side of the trading account

Following are the items shown on the credit side of the trading account:

(a) Sales and Sales returns

Both cash and credit sales of

goods will be included in sales. The sales account will show credit balance

whereas the sales returns account will show debit balance. The amount of net

sales is shown on the credit side of the trading account by deducting sales

returns from sales.

(b) Closing stock

The goods remaining unsold at the

end of the accounting period are known as closing stock. They are valued at

cost price or net realisable value (market price) whichever is lower as per

Accounting Standard 2 (Revised).

3. Closing of trading account

The difference between the totals of two sides of the trading account

indicates either gross profit or gross loss. If the total of the credit side is

more, the difference represents gross profit. On the other hand, if the total

of the debit side is higher, the difference represents gross loss. The gross

profit or gross loss is transferred to profit and loss account.

4. Format of trading account

The heading of the trading account contains the words ‘for the year

ended……’ as it discloses the sales

and cost of goods sold of the business for the whole accounting year.

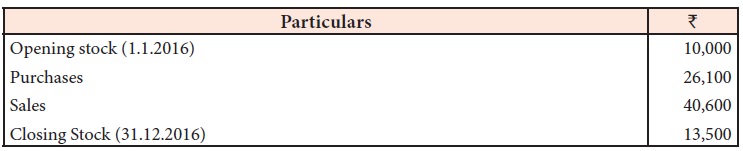

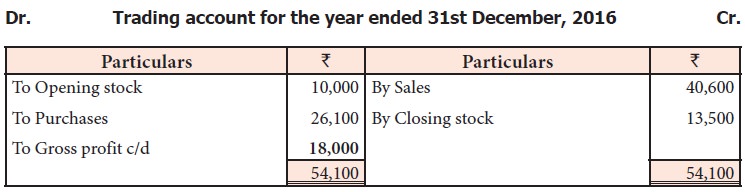

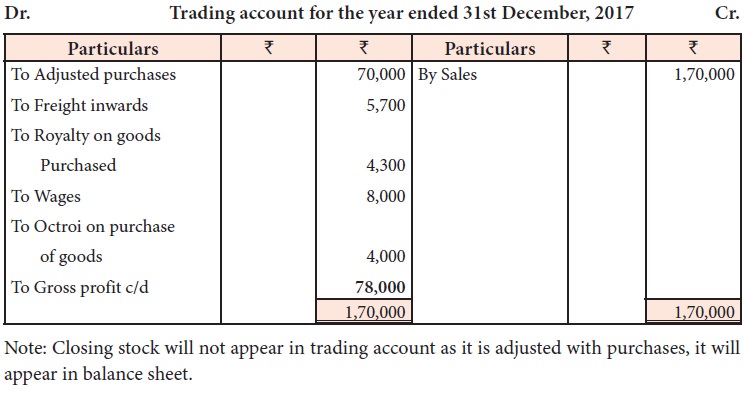

Illustration 1

From the following information,

prepare trading account for the year ended 31.12.2016.

Solution

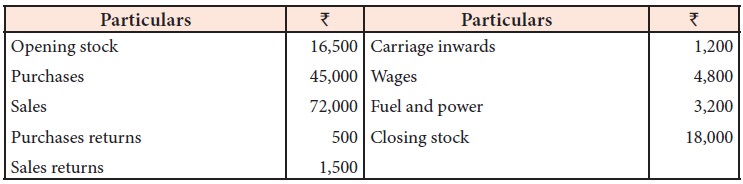

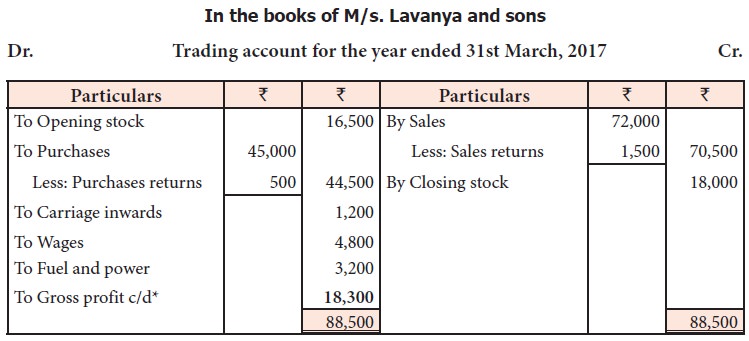

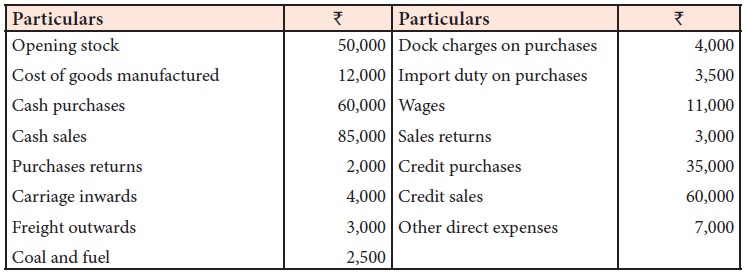

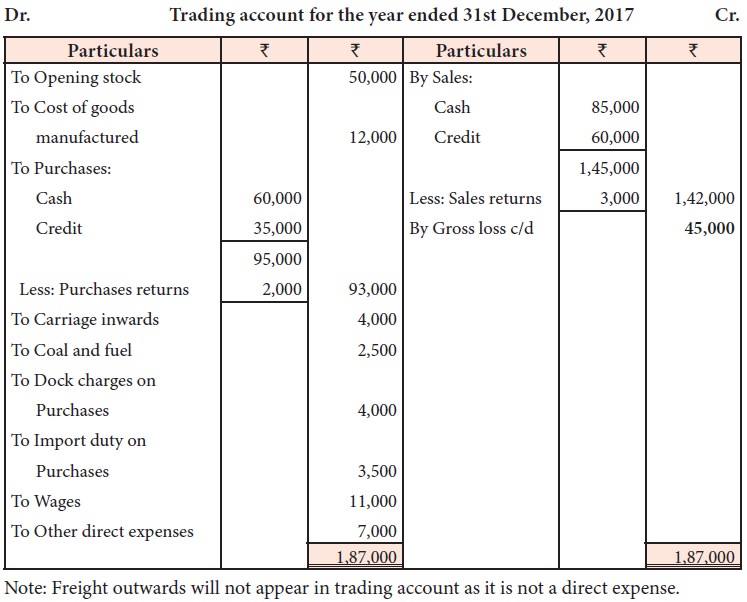

Illustration 2

From the following balances extracted

from the books of M/s. Lavanya and sons, prepare trading account for the year

ended 31st March, 2017:

Solution

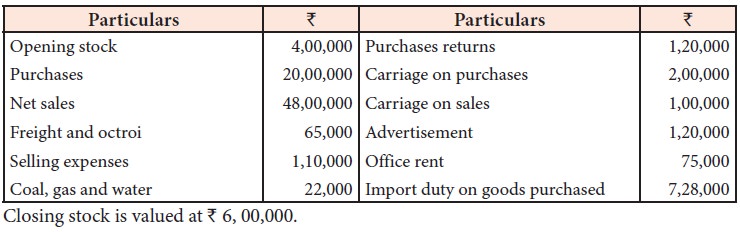

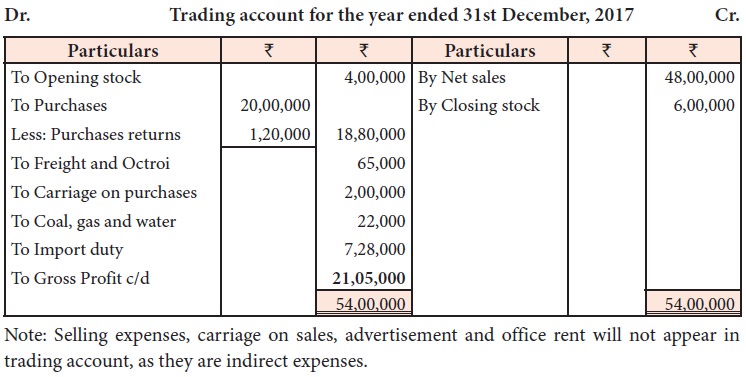

Illustration 3

Prepare trading account for the

year ended 31st December, 2017, from the following balances:

Solution

Note: Selling expenses, carriage on sales, advertisement and office rent

will not appear in trading account, as

they are indirect expenses.

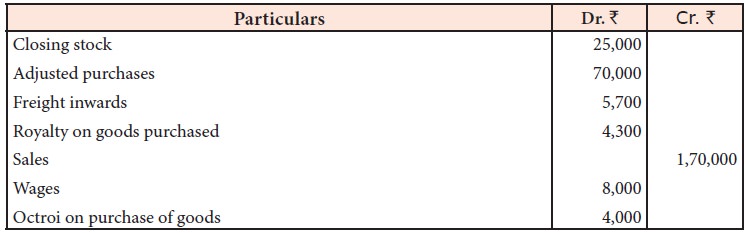

Illustration 4

Following is the extract of a trial balance as on 31st December, 2017.

Prepare trading account.

Solution

Illustration 5

From the following information, prepare trading account for the year

ending 31st December, 2017.

Solution

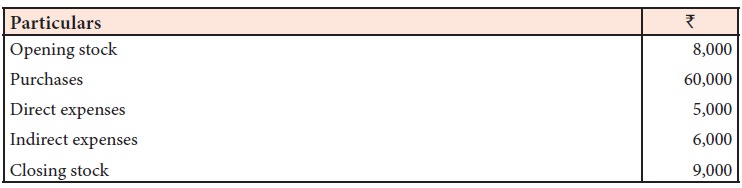

Illustration 6

Compute cost of goods sold from

the following information:

Solution

Cost of goods sold =

Opening stock + Net purchases + Direct expenses – Closing stock

= 8,000 + 60,000 + 5,000 – 9,000

= Rs. 64,000

Note: Indirect expenses do not form

part of cost of goods sold.

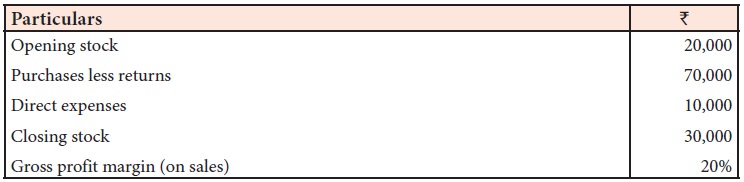

Illustration 7

Find out the amount of sales from

the following information.

Solution

Cost of goods sold =

Opening stock + Net purchases + Direct expenses – Closing stock

=20,000 +

70,000 + 10,000-30,000

Related Topics