Need for preparing, Methods of drafting, Preparation, Classification, Tutorial note | Accountancy - Balance sheet | 11th Accountancy : Chapter 12 : Final Accounts of Sole Proprietors - I

Chapter: 11th Accountancy : Chapter 12 : Final Accounts of Sole Proprietors - I

Balance sheet

Balance sheet

Balance sheet is a statement which gives the position of assets and

liabilities on a particular date. Assets are the resources owned by the

business. Liabilities are the claims against the business. After ascertaining

the net profit or net loss of the business enterprise, a business person would

like to know the financial position of the business. For this purpose, balance

sheet is prepared which contains amounts of all the assets and liabilities of

the business enterprise as on a particular date. The statement so prepared is

called ‘balance sheet’ because it gives the balances of ledger accounts which

are still there, after the closure of all nominal accounts by transferring to

the trading and profit and loss account. Balances of all the personal and real

accounts are grouped into assets and liabilities. In the balance sheet, liabilities

are shown on the left hand side and assets on the right hand side.

According to J.R. Batliboi, “A Balance Sheet is a statement prepared

with a view to measure the exact financial position of a business on a certain

fixed date.”

Need for preparing a balance sheet

The purposes of preparing a balance sheet are as follows:

i.

The main purpose of preparing a balance sheet is to

ascertain the true financial position of the business at a particular point of

time.

ii.

It helps in comparing the cost of various assets of

the business such as the amount of closing stock, amount due from debtors,

amount of fictitious assets, etc. Moreover as assets and liabilities of similar

nature are grouped and presented in balance sheet, a comparative study of these

assets and liabilities is facilitated. It helps in comparing the various

liabilities of the business.

iii.

It helps in finding out the solvency position of

the firm. The firm’s solvency position is favourable if the assets exceed the

external liabilities. The firm’s solvency position is not favourable it the

external liabilities exceed the assets.![]()

Characteristics of balance sheet

The following are the characteristics of a balance sheet:

i.

A balance sheet is a part of the final accounts.

However, the balance sheet is a statement and not an account. It has no debit

or credit sides and as such the words ‘To’ and ‘By’ are not used before the

names of the accounts shown therein.

ii.

A balance

sheet is a summary of the personal and real accounts, which have balances.

Personal and real accounts having debit balances are shown on the right hand

side known as assets side, whereas personal and real accounts having credit

balances are shown on the left hand side known as liabilities side.

iii.

The totals of the two sides of the balance sheet

must be equal. If the totals are not equal, it indicates existence of error. It

must satisfy the accounting equation, ie., Assets = Capital + Liabilities,

following the dual aspect concept.

iv.

Balance sheet is prepared on a particular date and

not for a fixed period. It discloses the financial position of a business on a

particular date. It gives the balances only for the date on which it is

prepared.

v.

It shows the financial position of the business

according to the going concern concept.

Grouping and Marshalling of assets and liabilities in a balance sheet

The assets and liabilities shown in the balance sheet are grouped and

presented in a particular order. The term ‘grouping’ means showing the items of

similar nature under a common heading. For example, the amount due from various

customers will be shown under the head ‘Sundry debtors.’ Similarly, under the

head ‘Current assets’, the balance of cash, bank, debtors, stock and other

current assets will be shown.

‘Marshalling’ is the arrangement of various assets and liabilities in a

proper order. Marshalling can be made in one of the following two ways:

(a) In the order of liquidity

According to this method, an asset which is most easily convertible into cash, i.e., cash in hand is shown first and then will follow those assets which are comparatively less easily convertible, so that the least liquid asset i.e., goodwill is shown last. In the same way, the liabilities which are to be paid at the earliest will be shown first. In other words, current liabilities are shown first, then fixed or long-term liabilities and finally the proprietor’s capital.

(b) In the order of permanence

This method is exactly the reverse of the first method. Asset which is

more permanent, i.e., goodwill is shown first followed by assets which are less

permanent. Similarly, those liabilities which are to be paid last will be shown

first. In other words, the proprietor’s capital is shown first, then fixed or

long-term liabilities and lastly the current liabilities. Joint stock companies

are required under the Companies Act to prepare their balance sheet in the

order of permanence.

Methods of drafting a balance sheet

The balance sheet of business concern can be presented in the following

two forms.

a.

Horizontal

form

b.

Vertical

form

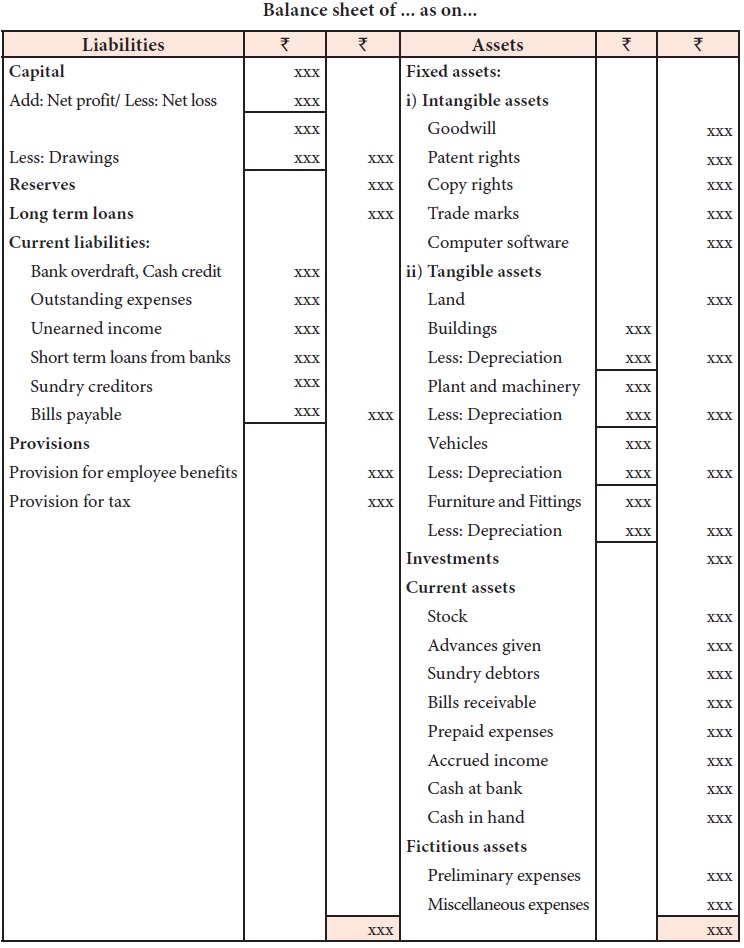

a) Horizontal form of balance sheet

In the horizontal form, assets are shown on right hand side of the

balance sheet and the liabilities are shown on the left hand side of the

balance sheet.

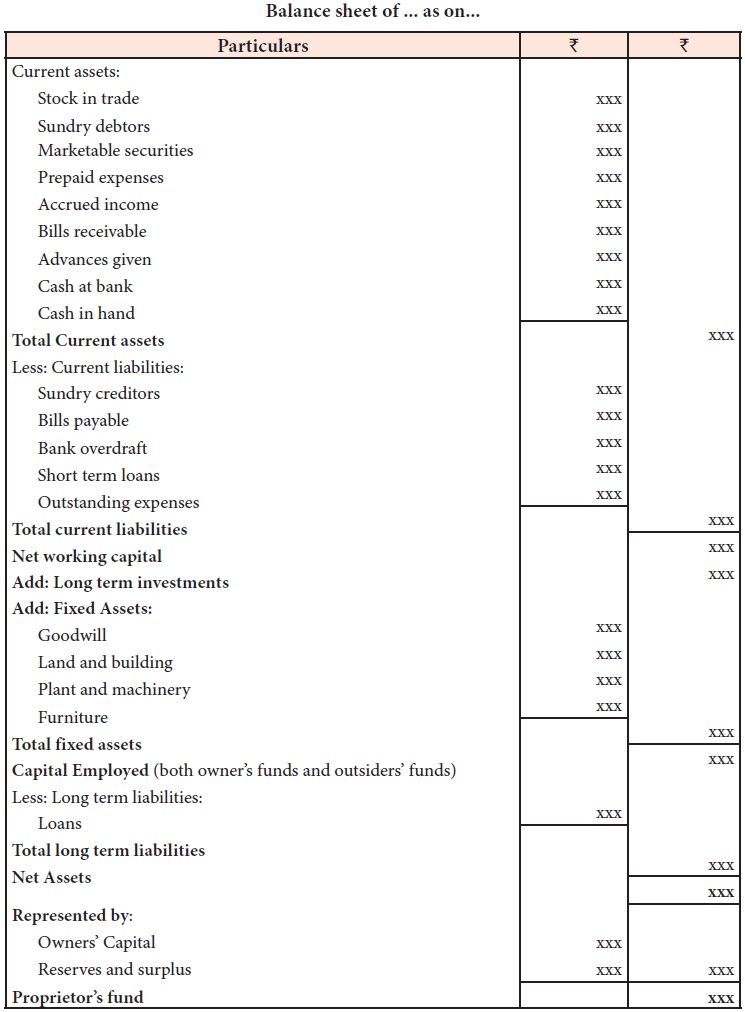

b) Vertical form of balance sheet

The balance sheet of a sole proprietor

can be presented in a vertical statement form as given below:

Preparation of Balance Sheet

There is no prescribed format for preparing the balance sheet of sole

proprietor and partnership. For Joint Stock Company, the format of preparing

balance sheet is given under Schedule III of Indian Companies Act, 2013. After

transferring all nominal accounts, the items left out in trial balance are real

account and personal accounts. These are grouped under assets (debit balance)

and liabilities (credit balance) and presented in a balance sheet.

Classification of assets and liabilities

The resources acquired by the business entity out of funds provided by

owners or creditors are called assets. These are the resources owned by the

business. Assets of a business include cash, stock, plant and machinery, etc.

A) Classification of assets

According to the nature of assets, they may be classified into the

following:

a) Fixed assets

Fixed assets are those assets which are acquired or constructed for

continued use in the business and last for many years such as land and

building, plant and machinery, motor vehicles, furniture, etc. According to

Finney and Miller, “Fixed assets are assets of a relatively permanent nature

used in the operations of business and not intended for sale.” As the purpose

of keeping such assets is not to sell but to use them, changes in their

realisable values are ignored and these are always shown in the balance sheet

at cost less depreciation. Fixed assets can be classifed into i) Tangible fixed

assets ii) Intangible fixed assets.![]()

i) Tangible fixed assets

Tangible fixed assets are those which have physical existence or which

can be seen and felt.

Examples: plant and machinery,

building and furniture.

ii) Intangible fixed assets

Intangible fixed assets are those which do not have any physical

existence or which cannot be seen or touched. Examples: goodwill, trade-marks,

copy rights and patents. Intangible assets are as much valuable as tangible

assets because they also help the firm in earning profits. For example,

goodwill helps in attracting customers and patents represent the know-how which

helps in producing the goods.

b) Current assets

Current assets are those assets which are either in the form of cash or

can be easily converted into cash in the normal course of business or within

one year. In the words of Hovard and Upton, “The current assets are usually

defined as those assets which are convertible into cash through the normal

course of business within a short time, ordinarily in a year.” Current assets

include cash in hand, cash at bank, short-term investments, bills receivable,

debtors, prepaid expenses, accrued income, closing stock, etc. Among these,

closing stock is valued at cost or realisable value whichever is lower and

debtors are shown after deducting a reasonable provision for bad and doubtful

debts.

Tutorial note

Prepaid expenses are treated as current assets. Though cash cannot be

realised from prepaid expenses, the service will be available against these

without further payment.

c) Liquid assets

Liquid assets are the assets which are either in the form of cash or

which can be immediately converted into cash within a very short period of

time, such as cash at bank, bills receivable, short-term investments, debtors

and accrued incomes. In other words, if prepaid expenses and closing stock are

excluded from current assets, the balance is known as liquid assets.

d) Investments

Amount invested outside the business in shares, debentures, bonds and other securities is called investments. If it is invested for a period more than a year they are called long-term investments. If they are invested for a period less than a year they are short term investments and shown under current assets.

e) Wasting assets

These are the assets which get exhausted gradually in the process of

excavation. Examples:mines and

quarries.

f) Fictitious or Nominal assets

These are assets only in name but not in reality. These assets are not

really assets but are shown on the assets side only for the purpose of writing

off by transferring them to the profit and loss account gradually over a period

of time in future. Such assets include the expenditures, the benefit of which

lasts for more than a year, not yet written off, such as advertisement expenses,

preliminary expenses, etc.

B) Classification of liabilities

Liabilities or equities are claims against the business entity. These

are the amounts owed by a business entity to the outsiders (outsiders equity)

and owners (owners equity).

Liabilities may be classified

according to their nature as follows:

(a) Fixed or long-term liabilities

The liabilities which are to be repaid after one year or more are termed

as long-term liabilities.

Example: Long-term loans.

(b) Current or short-term liabilities

The liabilities which are expected to be paid within the normal

operating cycle or one year are termed as current or short-term liabilities.

These include bank overdraft, creditors, bills payable, outstanding expenses,

etc.

(c) Contingent liabilities

These are the liabilities which are not certain at the time of

preparation of balance sheet. These liabilities may or may not occur. These are

the liabilities which will become payable only on the happening of some

specific event which itself is not certain, otherwise these need not be paid.

Such liabilities are as follows:

Liabilities for bills discounted

In case a bill discounted with the bank is dishonoured by the acceptor

on the due date, the firm will become liable to the bank.

Liability in respect of a suit pending in a court of law

This would become an actual liability if the suit is decided against the

firm.

Liability in respect of a guarantee given for another person

The firm would be liable to pay the amount if the person for whom the

guarantee is given fails to meet his obligation.![]()

Tutorial note

·

Contingent liabilities are not shown in the balance

sheet. They are, however, shown as a foot note just below the balance sheet so

that the existence of such liabilities may be revealed.

·

Capital: Capital is money or money’s worth

contributed by the owner to the business for the purpose of carrying on

business. The difference between assets and liabilities is owner’s equity =

capital contributed + accumulated profits.

Related Topics