Meaning, Applicability, Benefits (or) Advantages, Disadvantages | Auditing - Test Checking | 11th Auditing : Chapter 4 : Audit Planning

Chapter: 11th Auditing : Chapter 4 : Audit Planning

Test Checking

Test Checking

Meaning

Test checking is a process of selecting and

checking of a few transactions from a large volume of transactions. If the

entries checked are found to be correct then the auditor assumes that the

remaining entries are also correct. The technique is based on the theory of

sampling which is commonly used as a statistical method. Checking each and every

transaction that occurs during the year is both redundant and uneconomical for

the auditor. Therefore, the auditor verifies and examines a few representative

transactions in order to obtain sufficient appropriate audit evidence to base

his opinion. Test checking reduces the volume of work of the auditor, if in

test checking, the auditor finds that the records checked by him are correct

then no further detailed checking is carried out.

Applicability of Test Checking

Test checking can be applied in the following

situations:

1. When there are large volumes of identical or

routine transactions.

2. When transactions are large.

3. When the auditor has to certify the accounts

quickly after the close of the accounting period.

4. When the auditor has past experience about the

nature of transactions of the clients organisation.

5. When a satisfactory system of internal control

and check system exist.

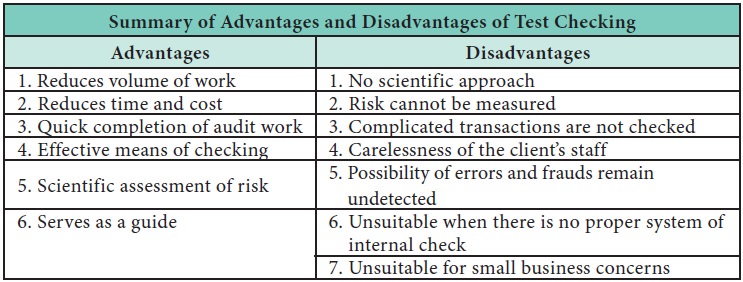

Advantages of Test Checking

Test checking can give the following advantages:

1.

Reduces

Volume of Work: The work of an

auditor is reduced considerable as he checks only few transactions, extra time

available can be utilised for concentrating on areas of considerable

importance.

2.

Reduces

Time and Cost: Test checking

is one of the technique which reduces time, cost and energy of both the

auditor and the client.

3.

Quick

Completion of Audit Work: Test check

enables the auditor to complete the work quickly as the auditor checks only a

few or limited transactions.

4.

Effective

Means of Checking: Test checking

can be effective if the auditor selects the transaction to be checked

carefully.

5.

Scientific

Assessment of Risk: The risk of

material misstatement in the financial statement is assessed by the auditor in

a scientific manner by drawing samples and studying them in detail.

6.

Serves as

a Guide: It serves as a guide for the

auditor to arrive at conclusion regarding the true and fair view of the state

of affairs of business.

Disadvantages of Test Checking

Test checking can give the following dsiadvantages:

1. No Scientific Approach: It is a traditional auditing technique where

no scientific approach is used in selecting the samples, hence the results

drawn on it tends to be incorrect.

2. Risk cannot be measured: It is not

possible to measure the amount of

risk involved.

3. Complicated Transactions are not Checked: The audit

assistants select only simple

transactions for checking and complicated transactions are left omitted.

4. Carelessness of the Client’s Staff: The client’s staff is aware that the

auditor will not check all their work hence they become careless.

5. Possibility of Errors and Frauds Remain Undetected:

When test

check is adopted by the auditor

there are possibility of errors and frauds left undetected.

6. Unsuitable when there is no System of Internal

Check: The auditor cannot adopt test

check when there is no proper system of Internal check and control in

operation.

7. Unsuitable for Small Business Concerns: Test checking is not suitable for small business concerns as the number of transactions involved is not large.

Auditor’s Duty Regarding Test Checking

The following are the auditor’s duty or precautions

to be taken by an auditor while adopting test check:

1.

Entries selected for test checking must be

representative of all transactions and entries on random basis should be

selected for checking.

2.

Auditor should select the test independently

without regard to the suggestions of the client’s staff.

3.

Entries selected for test check should be chosen by

the auditor cautiously by applying his intelligence and professional skill.

4. Test

check should not be adopted in vouching the entries in the cash Book and bank

Pass book.

5. The

auditor should not adopt test check while checking the entries of first and

last month of the year and all the entries must be thoroughly checked.

6. Test

check should be so devised that a sizeable portion of the work done by each

employee is checked.

7.

Auditor should consider his past experiences in

selecting the nature and size of the samples for checking.

Related Topics