Chapter: Business Science : Strategic Management : Strategy Implementation and Evaluation

Strategy Implementation and Evaluation

Strategic Evaluation

Strategy

Evaluation is as significant as strategy formulation because it throws light on

the efficiency and effectiveness of the comprehensive plans in achieving the

desired results. The managers can also assess the appropriateness of the current

strategy in today‘s dynamic world with socio-economic, political and

technological innovations. Strategic Evaluation is the final phase of strategic

management.

The

significance of strategy evaluation lies in its capacity to co-ordinate the

task performed by managers, groups, departments etc, through control of

performance. Strategic Evaluation is significant because of various factors

such as - developing inputs for new strategic planning, the urge for feedback,

appraisal and reward, development of the strategic management process, judging

the validity of strategic choice etc.

The process of

Strategy Evaluation consists of following steps-

1. Fixing benchmark of performance - While fixing the benchmark, strategists encounter

questions such as - what benchmarks to set, how to set them and how to express

them. In order to determine the benchmark performance to be set, it is

essential to discover the special requirements for performing the main task.

The performance indicator that best identify and express the special

requirements might then be determined to be used for evaluation. The

organization can use both quantitative and qualitative criteria for

comprehensive assessment of performance. Quantitative criteria includes

determination of net profit, ROI, earning per share, cost of production, rate

of employee turnover etc. Among the Qualitative factors are subjective

evaluation of factors such as - skills and competencies, risk taking potential,

flexibility etc.

Analyzing Variance - While

measuring the actual performance and comparing it with standard performance there may be variances which must be

analyzed. The strategists must mention the degree of tolerance limits between

which the variance between actual and standard performance may be accepted. The

positive deviation indicates a better performance but it is quite unusual

exceeding the target always. The negative deviation is an issue of concern because it indicates a shortfall

in performance. Thus in this case the strategists must discover the causes of

deviation and must take corrective action to overcome it.

3. Taking Corrective Action - Once the deviation in performance is identified, it is essential to plan for a corrective action. If the performance is

consistently less than the desired performance, the strategists must carry a

detailed analysis of the factors responsible for such performance. If the

strategists discover that the organizational potential does not match with the

performance requirements, then the standards must be lowered. Another rare and

drastic corrective action is reformulating the strategy which requires going

back to the process of strategic management, reframing of plans according to

new resource allocation trend and consequent means going to the beginning point

of strategic management process.

Characteristics/Features of Strategic Decisions and

Tactics

Strategic

decisions are the decisions that are concerned with whole environment in which

the firm operates, the entire resources and the people who form the company and

the interface between the two.

a. Strategic

decisions have major resource propositions for an organization. These decisions

may be concerned with possessing new resources, organizing others or

reallocating others.

b. Strategic

decisions deal with harmonizing organizational resource capabilities with the

threats and opportunities.

c. Strategic

decisions deal with the range of organizational activities. It is all about

what they want the organization to be like and to be about.

d. Strategic

decisions involve a change of major kind since an organization operates in

ever-changing environment.

Strategic

decisions are complex in nature.

f. Strategic

decisions are at the top most level, are uncertain as they deal with the

future, and involve a lot of risk.

g. Strategic

decisions are different from administrative and operational decisions.

Administrative decisions are routine decisions which help or rather facilitate

strategic decisions or operational decisions. Operational decisions are

technical decisions which help execution of strategic decisions. To reduce cost

is a strategic decision which is achieved through operational decision of

reducing the number of employees and how we carry out these reductions will be

administrative decision.

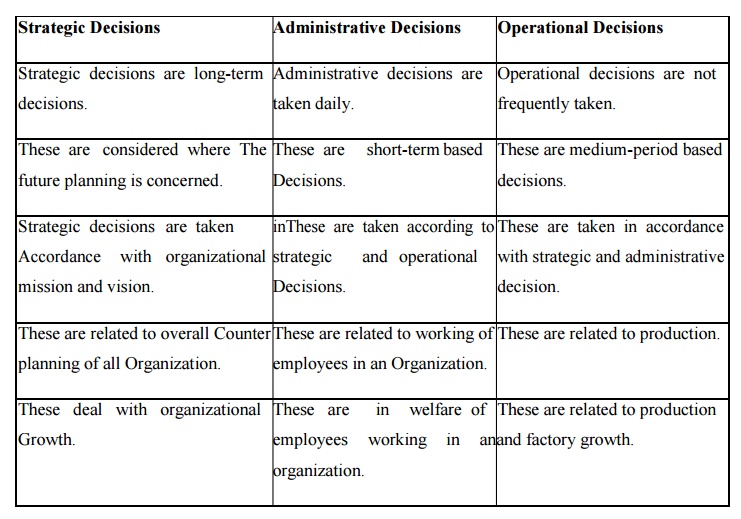

The

differences between Strategic, Administrative and Operational decisions can be summarized as follows-

Boston Consulting Group (BCG) Matrix is a four

celled matrix (a 2 * 2 matrix)

developed

by BCG, USA. It is the most renowned corporate portfolio analysis tool. It

provides a graphic representation for an organization to examine different

businesses in it‘s portfolio on the basis of their related market share and

industry growth rates. It is a two dimensional analysis on management of SBU‘s

(Strategic Business Units). In other words, it is a comparative analysis of

business potential and the evaluation of environment.

According

to this matrix, business could be classified as high or low according to their

industry growth rate and relative market share.

Relative Market Share = SBU

Sales this year leading competitors sales this year.

Market Growth Rate =

Industry sales this year - Industry Sales last year.

The

analysis requires that both measures be calculated for each SBU. The dimension of business strength, relative

market share, will measure comparative advantage indicated by market dominance.

The key theory underlying this is existence of an experience curve and that

market share is achieved due to overall cost leadership.

BCG matrix has four cells, with the

horizontal axis representing relative market share and the vertical axis

denoting market growth rate. The mid-point of relative market share is set at

1.0. if all the SBU‘s are in same industry, the average growth rate of the industry

is used. While, if all the SBU‘s are located in different industries, then the

mid-point is set at the growth rate for the economy.

Resources are allocated to the business

units according to their situation on the grid. The four cells of this matrix

have been called as stars, cash cows, question marks and dogs. Each of these

cells represents a particular type of business.

Figure: BCG Matrix

1. Stars-

Stars represent business units having large market share in a fast growing industry. They may

generate cash but because of fast growing market, stars require huge

investments to maintain their lead. Net cash flow is usually modest. SBU‘s

located in this cell are attractive as they are located in a robust industry

and these business units are highly competitive in the industry. If successful,

a star will become a cash cow when the industry matures.

2. Cash Cows- Cash Cows represents business units

having a large market share in a

mature, slow growing industry. Cash cows require little investment and generate

cash that can be utilized for investment in other business units. These

SBU‘s are the corporation‘s key source of

cash, and are specifically the core business. They are the base of an

organization. These businesses usually follow stability strategies. When cash

cows loose their appeal and move towards deterioration, then a retrenchment

policy may be pursued.

3. Question Marks- Question marks represent business

units having low relative market

share and located in a high growth industry. They require huge amount of cash

to maintain or gain market share. They require attention to determine if the

venture can be viable. Question marks are generally new goods and services which have a good commercial

prospective. There is no specific strategy which can be adopted. If the firm

thinks it has dominant market share, then it can adopt expansion strategy, else

retrenchment strategy can be adopted. Most businesses start as question marks

as the company tries to enter a high growth market in which there is already a

market-share. If ignored, then question marks may become dogs, while if huge

investment is made, then they have potential of becoming stars.

4. Dogs-

Dogs represent businesses having weak

market shares in low-growth markets.

They neither generate cash nor require huge amount of cash. Due to low market

share, these business units face cost disadvantages. Generally retrenchment

strategies are adopted because these firms can gain market share only at the

expense of competitor‘s/rival firms. These business firms have weak market

share because of high costs, poor quality, ineffective marketing, etc.

Unless a dog has some other strategic

aim, it should be liquidated if there is fewer prospects for it to gain market

share. Number of dogs should be avoided and minimized in an organization.

Limitations of BCG Matrix

The BCG Matrix produces a framework for

allocating resources among different business units and makes it possible to

compare many business units at a glance. But BCG Matrix is not free from

limitations, such as-

1. BCG matrix classifies businesses as

low and high, but generally businesses can be medium also. Thus, the true nature of business may

not be reflected.

2. Market is

not clearly defined in this model.

3. High market share does not always

leads to high profits. There are high costs also involved with high market share.

4. Growth rate and relative market

share are not the only indicators of profitability. This model ignores

and overlooks other indicators of profitability.

5. At times,

dogs may help other businesses in gaining competitive advantage. They can earn even more than cash

cows sometimes.

6. This

four-celled approach is considered as to be too simplistic.

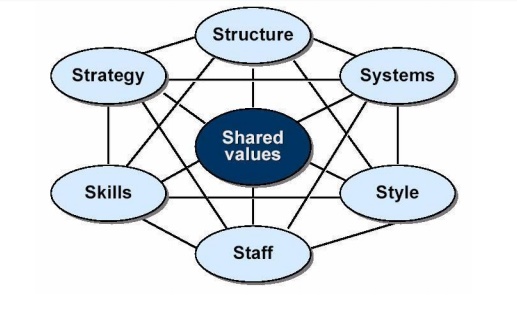

The 7-S framework of McKinsey is a Value Based

Management (VBM)

Model that describes how one can holistically

and effectively organize a company. Together these factors determine the way in

which a corporation operates.

Shared Value

The

interconnecting center of McKinsey's model is: Shared Values. What does the organization stands for and what

it believes in. Central beliefs and attitudes.

Strategy

Plans for

the allocation of firms scarce resources, over time, to reach identified goals.

Environment,

competition, customers.

Structure

The way the organization's units relate

to each other: centralized, functional divisions

(top-down); decentralized (the trend in larger organizations); matrix, network,

holding, etc.

System

The

procedures, processes and routines that characterize how important work is to

be

done: financial systems; hiring, promotion and performance appraisal systems;

information systems.

Staff

Numbers

and types of personnel within the organization.

Style

Cultural

style of the organization and how key managers behave in achieving the

organization‘s goals.

Skill

Distinctive capabilities of personnel or of the organization as a whole. Core

Competences

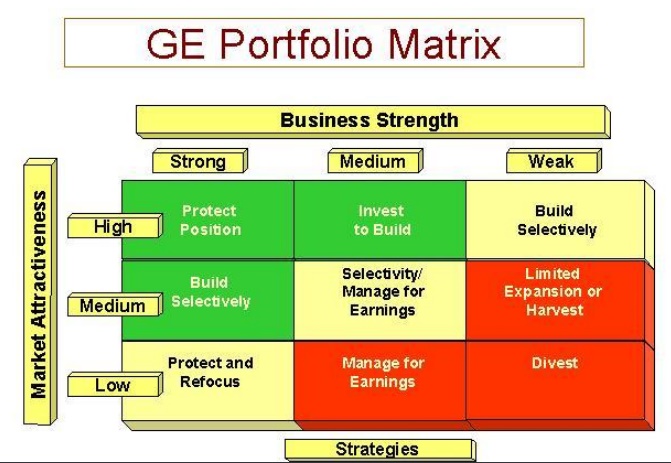

G E M a t r i x

The

business portfolio is the collection of businesses and products that make up

the company. The best business portfolio is one that fits the company's

strengths and helps exploit the most attractive opportunities.

The

company must:

(1) Analyse

its current business portfolio and decide which businesses should receive more

or less investment, and

(2) Develop growth

strategies for adding

new products and

businesses to the

portfolio,

whilst at the same time deciding when products and businesses should no longer

be retained.

The two

best-known portfolio planning methods are the Boston Consulting Group Portfolio

Matrix and the McKinsey / General Electric Matrix (discussed in this revision

note). In both methods, the first step is to identify the various Strategic

Business Units ("SBU's") in a company portfolio. An SBU is a unit of

the company that has a separate mission and objectives and that can be planned

independently from the other businesses. An SBU can be a company division, a

product line or even individual brands - it all depends on how the company is

organised.

The McKinsey / General Electric Matrix

The

McKinsey/GE Matrix overcomes a number of the disadvantages of the BCG Box.

Firstly, market attractiveness replaces market growth as the dimension of

industry attractiveness, and includes a broader range of factors other than

just the market growth rate. Secondly, competitive strength replaces market

share as the dimension by which the competitive position of each SBU is

assessed.

The

diagram below illustrates some of the possible elements that determine market

attractiveness and competitive strength by applying the McKinsey/GE Matrix to

the UK retailing market:

Factors that Affect Market Attractiveness

1. Whilst

any assessment of market attractiveness is necessarily subjective, there are

several factors which can help determine attractiveness. These are listed

below:

·

Market Size

·

Market growth

·

Market profitability

·

Pricing trends

·

Competitive intensity / rivalry

·

Overall risk of returns in the industry

·

Opportunity to differentiate

·

products and services

·

Segmentation

·

Distribution structure (e.g. retail, direct, wholesale

Factors that Affect Competitive Strength

Factors

to consider include:

·

Strength of assets and competencies

·

Relative brand strength

·

Market share

·

Customer loyalty

·

Relative cost position (cost structure compared

with competitors)

·

Distribution strength

·

Record of technological or other innovation

·

Access to financial and other investment resources

Strategic leadership refers to a manger‘s

potential to express a strategic vision for the organization, or a part of the

organization, and to motivate and persuade others to acquire that vision.

Strategic leadership can also be defined as utilizing strategy in the

management of employees. It is the potential to influence organizational

members and to execute organizational change. Strategic leaders create

organizational structure, allocate resources and express strategic vision.

Strategic leaders work in an ambiguous environment on very difficult issues

that influence and are influenced by occasions and organizations external to

their own.

The main objective

of strategic leadership is strategic productivity. Another aim of strategic

leadership is to develop an environment in which employees forecast the

organization‘s needs in context of their own job. Strategic leaders encourage

the employees in an organization to follow their own ideas. Strategic leaders

make greater use of reward and incentive system for encouraging productive and

quality employees to show much better performance for their organization.

Functional strategic leadership is about inventive

Strategic

leadership requires the potential to foresee and comprehend the work environment. It requires

objectivity and potential to look at the broader picture.

A few main traits / characteristics / features / qualities of effective

strategic leaders that do lead to superior performance are as follows:

Loyalty- Powerful

and effective leaders demonstrate their loyalty to their vision by their words and actions.

Keeping them updated- Efficient

and effective leaders keep themselves updated about what is happening within their organization. They have

various formal and informal sources of information in the organization.

Judicious use of power- Strategic

leaders makes a very wise use of their power. They must play the power game skillfully and try to develop

consent for their ideas rather than forcing their ideas upon others. They must

push their ideas gradually.

Have wider perspective/outlook- Strategic

leaders just don‘t have skills in their narrow specialty but they have a

little knowledge about a lot of things.

Motivation- Strategic leaders must have a

zeal for work that goes beyond money and

power and also they should have an inclination to achieve goals with energy

and determination.

Compassion- Strategic

leaders must understand the views and feelings of their subordinates, and make decisions after considering them.

Self-control- Strategic

leaders must have the potential to control

distracting/disturbing moods and desires, i.e., they must think before

acting.

Social skills- Strategic

leaders must be friendly and social.

Self-awareness- Strategic

leaders must have the potential to understand their own moods and emotions, as well as their impact on others.

Readiness to delegate and

authorize- Effective leaders are proficient at delegation. They are well aware of the fact that

delegation will avoid overloading of responsibilities on the leaders. They also

recognize the fact that authorizing the subordinates to make decisions will

motivate them a lot.

Articulacy- Strong leaders are articulate enough

to communicate the vision(vision of where

the organization should head) to the organizational members in terms that boost

those members.

Constancy/ Reliability- Strategic leaders constantly

convey their vision until it becomes

a component of organizational culture.

To

conclude, Strategic leaders can create vision, express vision, passionately

possess vision and

persistently drive it to accomplishment

Gap analysis:

It

generally refers to the activity of studying the differences between standards and the delivery of

those standards. For example, it would be useful for a firm to document

differences between customer expectation and actual customer experiences in the

delivery of medical care. The differences could be used to explain satisfaction

and to document areas in need of improvement.

However,

in the process of identifying the gap, a before-and-after analysis must occur.

This can take several forms. For example, in lean management we perform a Value Stream Map of the

current process. Then we create a Value Stream Map of the desired state. The

differences between the two define the "gap". Once the gap is

defined, a game plan can be developed that will move the organization from its

current state toward its desired future state.

The issue

of service quality can be used as an example to illustrate gaps. For this

example, there are several gaps that are important to measure. From a service quality perspective, these

include: (1) service quality gap; (2) management understanding gap; (3) service

design gap; (4) service delivery gap; and (5) communication gap.

Service Quality Gap.

Indicates

the difference between the service expected by customers and the service they

actually receive. For example, customers may expect to wait only 20 minutes to

see their doctor but, in fact, have to wait more than thirty minutes.

Management Understanding Gap.

Represents

the difference between the quality level expected by customers and the

perception of those expectations by management. For example, in a fast food environment, the customers may

place a greater emphasis on order accuracy than promptness of service, but

management may perceive promptness to be more important.

Service Design Gap.

This is the gap between management's

perception of customer expectations and the

development of this perception into

delivery standards. For example, management might perceive that customers

expect someone to answer their telephone calls in a timely fashion. To

customers, "timely fashion" may mean within thirty seconds. However,

if management designs delivery such that telephone calls are answered within

sixty seconds, a service design gap is created.

Service Delivery Gap.

Represents

the gap between the established delivery standards and actual service

delivered. Given the above example, management may establish a standard such that telephone calls should

be answered within thirty seconds. However, if it takes more than thirty

seconds for calls to be answered, regardless of the cause, there is a delivery

gap.

Communication Gap.

This is

the gap between what is communicated to consumers and what is actually

delivered. Advertising, for instance, may indicate to consumers that they can have their cars's oil changed

within twenty minutes when, in reality, it takes more than thirty minutes.

IMPLEMENTING

GAP ANALYSIS

Gap analysis involves internal and

external analysis. Externally, the firm must communicate with customers.

Internally, it must determine service delivery and service design. Continuing

with the service quality example, the steps involved in the implementation of

gap analysis are:

•

Identification

of customer expectations

•

Identification

of customer experiences

•

Identification

of management perceptions

•

Evaluation of

service standards

•

Evaluation of

customer communications

The

identification of customer expectations and experiences might begin with

focus-group interviews. Groups of customers, typically numbering seven to

twelve per group, are invited to discuss their satisfaction with services or

products. During this process, expectations and experiences are recorded. This

process is usually successful in identifying those service and product

attributes that are most important to customer satisfaction.

After focus-group interviews are

completed, expectations and experiences are measured with more formal,

quantitative methods. Expectations could be measured with a one to ten scale

where one represents "Not At All Important" and ten represents

"Extremely Important." Experience or perceptions about each of these

attributes would be measured in a similar manner.

Gaps can be simply calculated as the

arithmetic difference between the two measurements for each of the attributes.

Management perceptions are measured much in the same manner. Groups of managers

are asked to discuss their perceptions of customer expectations and

experiences. A team can then be assigned the duty of evaluating manager

perceptions, service standards, and communications to pinpoint discrepancies.

After gaps are identified, management must take appropriate steps to fill or

narrow the gaps.

THE IMPORTANCE

OF SERVICE QUALITY GAP ANALYSIS

The main reason gap analysis is important

to firms is the fact that gaps between customer expectations and customer

experiences lead to customer dissatisfaction. Consequently, measuring gaps is

the first step in enhancing customer satisfaction. Additionally, competitive

advantages can be achieved by exceeding customer expectations. Gap analysis is

the technique utilized to determine where firms exceed or fall below customer

expectations.

Customer satisfaction leads to repeat

purchases and repeat purchases lead to loyal customers. In turn, customer

loyalty leads to enhanced brand equity and higher profits. Consequently,

understanding customer perceptions is important to a firm's performance. As

such, gap analysis is used as a tool to narrow the gap between perceptions and

reality, thus enhancing customer satisfaction.

Distinctive Competence

Distinctive competence is a set of unique

capabilities that certain firms possess allowing them to make inroads into

desired markets and to gain advantage over the competition; generally, it is an

activity that a firm performs better than its competition. To define a firm's

distinctive competence, management must complete an assessment of both internal and external corporate

environments. When management finds an internal strength that both meets market

needs and gives the firm a comparative advantage in the marketplace, that

strength is the firm's distinctive competence. Taking advantage of an existing

distinctive competence is essential to business strategy development. Firms can

possess distinctive competence in a wide variety of areas, including

technology, marketing, and management.

Formulating Strategy

Strategy

can be defined as the tool managers use to adjust their firms to ever-changing environmental conditions.

Unless a firm produces only one type of merchandise or service, it must devise

strategies at both the corporate and business levels.

Corporate

strategy defines the underlying businesses and determines the best methods of

coordinating them. At the business level, strategy outlines the ways that a

business will compete in a given market. Strategic planning is often closely

tied to the development and use of distinctive competencies, and having an area

of distinctive competence can present a major strategic advantage to any firm.

To devise

corporate strategy, firm managers must consider a host of influences in their

surrounding environment that can affect the firm's ongoing operations as well

as the internal strengths and weaknesses that characterize the firm. When assessing the external

business environment, management must analyze the given situation, forecast

potential changes to it, and either try to change the situation or adapt to it.

The assessment must include an evaluation of current and projected market needs

and an evaluation of any existing comparative advantage over competitors.

To

determine the best strategy for their firm, managers must realistically assess

their own firm's status. A firm's internal strengths and weaknesses make it

better suited to pursue some strategic paths than others. When looking for a

match between opportunities and capabilities, managers must try to build upon

the strongest qualities of the firm and avoid activities that rely on more

vulnerable areas or are adverse to the firm's existing corporate culture.

Further,

it is important for managers to account for potential problems involved in

carrying out a strategy before they embark upon it. Thus, managers should

examine potential strategies, while keeping in mind their firm's history, its

culture and experiences, and its basic proficiencies. Once this assessment is complete, management must decide

which opportunities in the business environment to pursue and which ones to

pass up. Even if a firm does not have a distinctive competence, as is the case

for many, it must devise its overall strategy to build upon its strengths and

best use its resources.

Obviously, many successful business

strategies are built around a determined distinctive competence. To truly

succeed, a firm will have a competitive advantage over its rivals, giving it

some sort of strategic advantage. Logically, strengthening a competitive

position is made a great deal easier for a firm with one or more distinctive

competencies. Having a distinctive competence can allow a firm to follow a

different path than rival firms, utilize a strategy difficult for them to

imitate, and end up in a better position over the long term. If other firms in

the marketplace do not have a similar or countervailing competence, they will

have a very difficult time remaining competitive.

Defining and Building Distinctive Competence

To define a company's distinctive

competence, managers often follow a particular process. First, they identify

the strengths and weaknesses of their firm. Next, they determine the strategic

importance of these strengths and weaknesses in the given marketplace. Then,

they analyze specific market needs and look for comparative advantages that

they have over the competition. Importantly, while managers generally follow

this process, they often undertake more than one step simultaneously.

Distinctive competence can be built in a

number of ways. Firms can hire more qualified professionals than those employed

by competitors; they can find and exploit previously neglected market niches;

and they can be especially innovative or can gain advantage over competitors

through sheer strength of management. There are numerous areas in which a firm

can have a distinctive competence. Some companies have distinctive competence

because they manufacture a product with superior quality. Other firms excel in

technological innovation, research and development, or new product

introduction. Still other firms have advantages in low-cost production,

customer support, or creative advertising. For example, McDonald's distinctive

competence is its system of controls for operating its fast-food restaurant

franchises, which gives the company an unusually high profit margin.

Predicting Future Distinctive Competence

Since business environments and

marketplaces are always changing, the challenge for strategists is to maintain

the firm's distinctive competence. As defined earlier, distinctive competencies

are distinctive skills and capabilities firms can use to achieve an unusual

market position or to gain an advantage over the competition. Thus, a firm's

advantage comes largely from the fact that it has differentiated itself from

its competition. It follows that if the environment changes such that numerous

rivals have obtained competencies identical to those characterizing a

particular firm, the firm is in a very poor position and would do well to

reconsider its strategy.

Future strategic success requires that

firms keep their distinct advantages over their rivals. Thus, firms must

continuously assess their surrounding environments. They must be aware of

potential shifts in industrial standings and must realistically evaluate

whether

the distinctive competency continues to yield an advantage. They should also look to new markets and

evaluate the potential use of their distinctive competencies in those markets.

As business conditions and markets

change, many of the strengths and weaknesses that characterize a firm will also

change. Through strategic planning and leadership, management will be able to

determine how the basis for competition may be changing and whether the firm's

distinctive competencies need to be realigned. Indeed, some vulnerabilities and

strengths will be exaggerated, while others will be eliminated. Success in

these changing conditions can only come from taking advantage of opportunities

highlighted by close scrutiny of a firm's internal and external environment.

The most successful firms will be those that are able to locate and use

distinctive competencies found in these assessments.

The final

stage in strategic management is strategy evaluation and control. All

strategies are subject to future modification because internal and external

factors are constantly changing. In the strategy evaluation and control process

managers determine whether the chosen strategy is achieving the organization's

objectives. The fundamental strategy evaluation and control activities are:

reviewing internal and external factors that are the bases for current

strategies, measuring performance, and taking corrective actions.

Strategic

management is a broader term that includes not only the stages already

identified but also the earlier steps of determining the mission and objectives

of an organization within the context of its external environment. The basic

steps of the strategic managementcan be examined through the use of strategic

management model.

The

strategic management model identifies concepts of strategy and the elements

necessary for development of a strategy enabling the organization to satisfy

its mission. Historically, a number of frameworks and models have been advanced

which propose different normative approaches to strategy determination.

However, a review of the major strategic management models indicates that they

all include the following elements:

1. Performing

an environmental analysis.

2. Establishing

organizational direction.

3. Formulating

organizational strategy.

4. Implementing

organizational strategy.

5. Evaluating

and controlling strategy.

Strategic

management is a continuous and dynamic process. Therefore, it should be

understood that each element interacts with the other elements and that this

interaction often happens simultaneously.

The major

models differ primarily in the degree of explicitness, detail, and complexity.

These differences derive from the differences in backgrounds and experiences of

the authors. Some of these models are briefly presented below.

The

phases of this model are as follows:

* Strategic management’s elements:

"...to determine mission, goals, and values of the firm and the key decision makers."

* Analysis and diagnosis: ―...to search the environment and

diagnose the impact

of the

threats and opportunities."

* Choice: ...to consider various

alternatives and assure that the appropriate strategy is chosen."

* Implementation:

"...to match plans,

policies, resources, structure,

and

administrative style with the strategy."

* Evaluation: "...to ensure strategy

and implementation will meet objectives."

Related Topics