Financial Mathematics - Stocks, shares, debentures and Brokerage | 11th Business Mathematics and Statistics(EMS) : Chapter 7 : Financial Mathematics

Chapter: 11th Business Mathematics and Statistics(EMS) : Chapter 7 : Financial Mathematics

Stocks, shares, debentures and Brokerage

Stocks, shares, debentures and

Brokerage

To start any big business, a

large sum of money is needed. It is generally not possible for an individual to

manage such a large sum. Therefore the total sum of money can be divided into

equal parts called shares. The

holder of shares are called shareholders.

1. Types of shares:

There are two type shares namely common (or equity) and preferred.

The profit gained by the company

is distributed among the share holders The preferred share holders have a first

claim on dividend. When they have been paid, the remaining profit is

distributed among the common share holders.

2. Definitions

(i) Capital stock is the

total amount invested to start a company.

(ii) The

share purchased by the individual is also called stock.

(iii) The persons who buy the

shares are also called stock holders

(iv) Face

value : The original value of a share at which the company sells/ buys it to investors is called a ![]() face

value or nominal value or par value. It is to be noted that the original value

of share is printed on the share certificate.

face

value or nominal value or par value. It is to be noted that the original value

of share is printed on the share certificate.

(v) Market

value : The price at which the stock is bought or sold in the market is called the market value (or cash

value).

Remarks:

(i) If

the market value of a share is greater than the face value then, the share is

said to be above par (or at premium).

(ii) If

the market value of a share is the same as its face value then, the share is

said to be at par.

(iii) If the market value of a

share is less than the face value then, the share is said to be below par (or

at discount).

Dividend :

The profit gained by a company,

distributed among the share holders is called dividend. It is calculated on the

face value of the share.

Some useful results:

(i) Investment:

Money invested = number of shares

× market value of a share

(ii) Income:

Annual income = number of shares

× face value of a share × rate of dividend

(iii) Return percentage (or yield percentage):

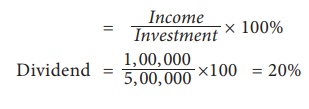

Percentage of return= Income / Investment x 100

(iv) Number of shares:

Number of shares purchased = Investment / market value of a share

Stock exchange:

The place where the shares are

traded is called the stock exchange (or) stock market.

Brokerage:

A broker who executes orders to

buy and sell shares through a stock market is called Stock Broker. A fee or

commission for their service is called the brokerage.

Brokerage

is

generally based on the face value and expressed as a percentage.

NOTE

(i) When the stock is purchased, brokerage is added to cost

price.

(ii) When the stock

is sold, brokerage is subtracted from the selling price..

Example 7.11

Find the market value of 325

shares of amount ₹100 at a premium of ₹18.

Solution :

Face value of a share = ₹100

Premium per share = ₹18

M.V. of 1 share = ₹118

Market value of 325 shares = number of shares × M.V of 1 share

= 325 ×

118

= ₹38,350

Therefore market value of 325

shares = ₹38,350.

Example 7.12

A man buys 500 shares of amount ₹100 at ₹14 below

par. How much money does he pay?

Number of shares = 500

Face value of a share = ₹100

Discount = ₹14

Market value of a share = 100

– 14 (face value – discount)

= ₹86.

Market value of 500 shares = Number of shares × market value of 1share

= 500 × 86

= 43,000

Market value of 500 shares = ₹43,000

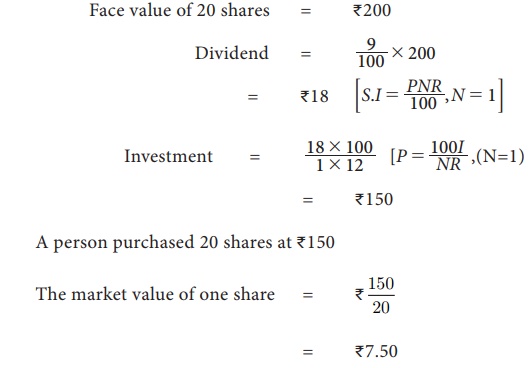

Example 7.13

A person buy 20 shares (par value

of ₹10) of a

company which pays 9% dividend at such a price that he gets 12% on his money.

Find the market value of a share.

Solution :-

Face value of one share = ₹10

Face value of 20 shares = ₹200

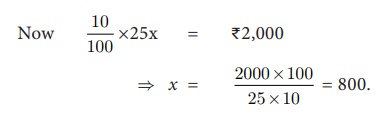

Example 7.14

If the dividend received from 10%

of ₹25 shares

is ₹2000.

Find the number of shares.

Solution :

Let x be the number of shares.

Market value of ‘x’ shares = ₹25 x

Hence the number of shares = 800

Example 7.15

Find the number of shares which

will give an annual income of ₹3,600 from 12% stock of face

value ₹100.

Solution :

Let ‘x’ be the number of shares.

Face Value = = ₹100

Market value of ‘x’ shares = ₹100x

12/100 × 100x = ₹ 3600

12 x = 3600 & x = 300

Hence the number of shares = 300

Example 7.16

A man invest ₹96,000 on

₹100

shares at ₹80. If the company pays him 18% dividend, find

(i) the

number of shares he buys

(ii) his

total dividend

(iii) his percentage return on

the shares.

Solution :-

(i) Investment = ₹96,000

Face

Value = ₹100

Market

Value = ₹80

The

number of shares bought =

Investments

/ M.V of one share

= 96, 000 / 80

=

1200 shares

(ii) Total dividend = No.

of shares × Rate of dividend × Face value of one share

= 1200× 18/100 x 100

= ₹21,600

(iii) Dividend on ₹ 96000 =

₹21600

Percentage return on the shares =

21600/96000 ×100

= 45/2 = 22.5

Thus return on the shares = 22.5%

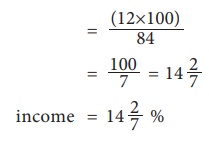

Example 7.17

A person brought at 12% stock for

₹54,000 at

a discount of 17%. If he paid 1% brokerage, find the percentage of his income.

Solution :

Face value = ₹100

Market value = ₹(100 – 17

+ 1)

= ₹84

percentage of his income

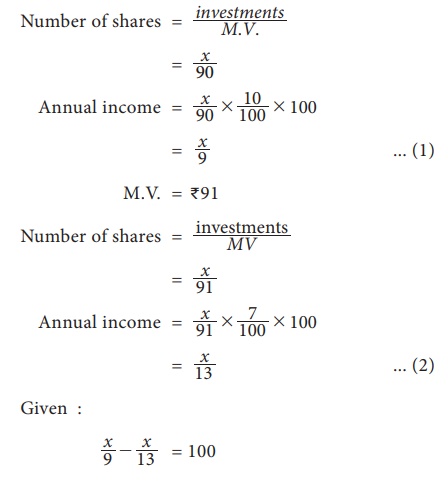

Example 7.18

Equal amounts are invested in 10%

stock at 89 and 7% stock at 90 (1% brokerage paid in both transactions). If 10%

stock bought ₹100 more by way of dividend

income than the other, find the amount invested in each stock.

Solution :

Let x be the amount invested in each stock

F.V. = ₹100, M.V.

= ₹90

x = ₹ 2925

The amount invested in each stock

= Rs.2925

Example 7.19

A capital company is made up of

1,00,000 preference shares with a dividend of 16% and 50,000 shares.The par value

of each of preference and ordinary shares is ₹10.The total profit of a company

is ₹

3,20,000.If ₹40,000 were kept in reserve and ₹20,000

were kept in depreciation fund, what percent of dividend is paid to the

ordinary share holders

Solution:

F.V. = ₹10

Preference shares investments = ₹1,00,000

× 10 = ₹10,00,000

Ordinary shares investments = ₹50,000

× 10 = ₹5,00,000

Total dividend = ₹(3,20,000 –

40,000 – 20,000) = ₹2,60,000

Dividend for preference shares =

10016 × 10,00,000 = ₹1,60,000

Dividend to ordinary shares = 2,60,000 – 1,60,000 = ₹1,00,000

Dividend rate for ordinary

share =

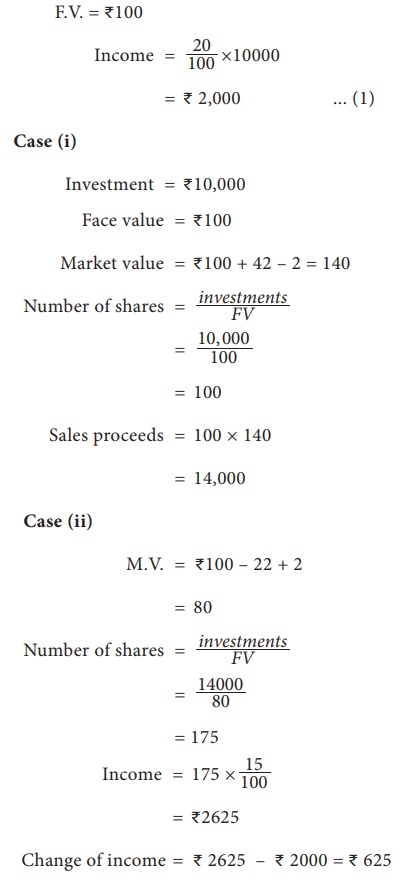

Example 7.20

A person sells a 20% stock of

face value ₹10,000 at a premium of 42%. With the a money obtained he buys a 15%

stock at discount of 22%. What is the change in his income if the brokerage

paid is 2%.

Solution:-

Change of income = ₹ 2625 – ₹ 2000 = ₹ 625

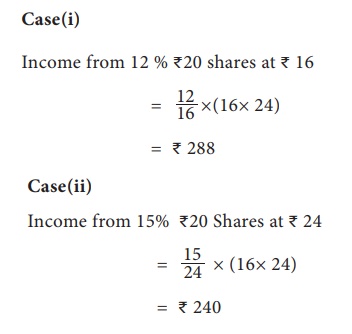

Example 7.21

Which is better investment 12% ₹20 shares

at ₹ 16 (or)

15% ₹ 20

shares at ₹24 .

Solution:

Let the investment in each case

be ₹ (16× 24)

Exercise 7.2

1. Find

the market value of 62 shares available at ₹132 having the par value of ₹100.

2. How

much will be required to buy 125 of ₹25 shares at a discount of ₹7

3. If the

dividend received from 9% of ₹20 shares is ₹1,620,

find the number of shares.

4. Mohan

invested ₹29,040 in 15% of ₹100 shares of a company quoted at

a premium of 20%. Calculate

(i) the

number of shares bought by Mohan

(ii) his

annual income from shares

(iii) the

percentage return on his investment

5. A man

buys 400 of ₹10 shares at a premium of ₹2.50 on

each share. If the rate of dividend is 12% find

(i) his

investment

(ii) annual

dividend received by him

(iii) rate

of interest received by him on his money

6. Sundar

bought 4,500 of ₹10 shares, paying 2% per annum.

He sold them when the price rose to ₹23 and invested the proceeds in ₹25 shares

paying 10% per annum at ₹18. Find the change in his

income.

7. A man invests ₹13,500

partly in 6% of ₹100 shares at ₹140 and

partly in 5% of ₹100 shares at ₹125. If

his total income is ₹560, how much has he invested in

each?

8. Babu sold some ₹100

shares at 10% discount and invested his sales proceeds in 15% of ₹50 shares

at ₹33. Had

he sold his shares at 10% premium instead of 10% discount, he would have earned

₹450 more.

Find the number of shares sold by him.

9. Which is better investment? 7%

of ₹100

shares at ₹120 (or) 8% of ₹100 shares at ₹135.

10. Which is better investment?

20% stock at 140 (or) 10% stock at 70.

Related Topics