Auditing - Scope (or) Functions of Internal Auditor | 12th Auditing : Chapter 3 : Internal Audit

Chapter: 12th Auditing : Chapter 3 : Internal Audit

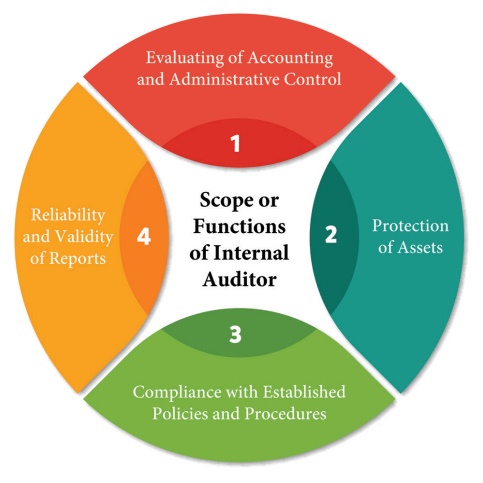

Scope (or) Functions of Internal Auditor

Scope (or) Functions of Internal Auditor

1. Evaluating of Accounting and Administrative

Control: Internal auditing

ensures effective and efficient system of accounting control,

standard costing, budgetary control and all other administrative controls.

2. Protection of Assets: Internal auditing besides ensuring proper accounting and

custody of companies asset’s it is concerned with the protection of the assets.

It reports to the management about the utilization of the asset and the adequacy

of return from the investment.

3. Compliance with Established Policies and

Procedures: Internal auditing is

concerned with reporting to the management about the compliance of the

predetermined policies, procedures and standards of performance.

4. Reliability and Validity of Reports: Internal

auditing ascertains the reliability of financial and operating reports prepared

throughout the enterprise. It also provides assurance to the management of the

validity of the reports and records. Internal auditing brings to light the

inadequacies in the check and control system in operation to the management.

Further, it provides advisory services to the management for the improvement of

the system.

Comparison between Internal Audit and External Audit

Internal Audit

Audit

conducted internally i.e., by the management to ensure that the company

complies with the policies, procedures and principles.

The

person who conducts internal audit is called as Internal Auditor, who is

appointed by the management. The scope of work, powers and duties of internal

auditor are determined by the management.

Internal

Auditor need not be a qualified Chartered Accountant and is remunerated in the

form of salary as he is an employee of the company.

Internal

auditor has to submit an Internal Audit report to the management.

External Audit

Audit

conducted externally i.e., by the shareholders to examine the accuracy of the

books of accounts, records and financial statements.

The

person who conducts external audit is called as Statutory or External Auditor

who is appointed by the shareholders of the company. The scope of work, powers

and duties of statutory auditor are determined by the Companies Act.

Statutory

Auditor should be a qualified Chartered Accountant and is remunerated in the

form of audit fees as he is an independent person.

Statutory

auditor submits Statutory Audit report to the shareholders of the company.

Related Topics