Chapter: Mechanical : Engineering Economics & Cost Analysis : Cash Flow

Rate of return method

In most of the practical decision environments, executives will be forced to select the best alternative from a set of competing alternatives.

Let us assume that an organization has a huge sum of money for potential investment and there are three different projects whose initial outlay and annual revenues during their lives are known. The executive has to select the best alternative among these three competing projects.

There are several bases for comparing the worthiness of the projects. These bases are:

1. Present worth method

2. Future worth method

3. Annual equivalent method

4. Rate of return method

RATE

OF RETURN METHOD

ü The rate of return of a cash flow pattern is the interest rate at which the present worth of that cash flow pattern reduces to zero.

ü In this method of comparison, the rate of return for each alternative is computed. Then the alternative which has the highest rate of return is selected as the best alternative.

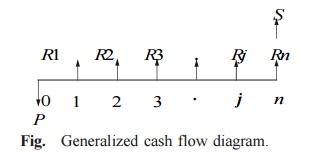

ü A generalized cash flow diagram to demonstrate the rate of return method of comparison is presented in Fig

In the above cash flow diagram, P represents an initial investment, Rj the net revenue at the end of the jth year, and S the salvage value at the end of the nth year.

The first step is to find the net present worth of the cash flow diagram using the following expression at a given interest rate, i.

PW(i) = – P + R1/(1 + i)1 + R2/(1 + i)2 + ...

+ Rj/(1 + i) j + ... + Rn/(1 + i)n + S/(1 + i)n

EXAMPLE

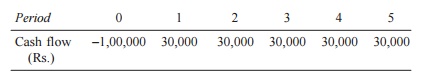

A person is planning a new business. The initial outlay and cash flow pattern for the new business are as listed below. The expected life of the business is five years. Find the rate of return for the new business.

Solution

Initial investment = Rs. 1,00,000 Annual equal revenue = Rs. 30,000 Life = 5 years

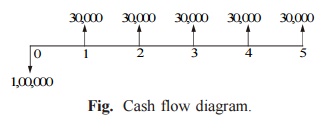

The cash flow diagram for this situation is illustrated in Fig.

Fig. Cash flow diagram.

The present worth function for the business is

PW(i) = –1,00,000 + 30,000(P/A, i, 5)

When i = 10%,

PW(10%) = –1,00,000 + 30,000(P/A, 10%, 5)

= –1,00,000 + 30,000(3.7908)

= Rs. 13,724.

When i = 15%,

PW(15%) = –1,00,000 + 30,000(P/A, 15%, 5)

= –1,00,000 + 30,000(3.3522)

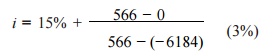

= Rs. 566.

When i = 18%,

PW(18%) = –1,00,000 + 30,000(P/A, 18%, 5)

= –1,00,000 + 30,000(3.1272)

= Rs. – 6,184

i= 15% + 0.252% = 15.252%

Therefore, the rate of return for the new business is 15.252%.

Related Topics