Accountancy - Practical problem on accounting software - Tally | 12th Accountancy : Chapter 10 : Computerised Accounting System- Tally

Chapter: 12th Accountancy : Chapter 10 : Computerised Accounting System- Tally

Practical problem on accounting software - Tally

Practical problem 1

Record the following

transactions in Tally.

1. Robert commenced a

transport business with a capital of Ōé╣

1,00,000

2. An account was opened

with State Bank of India and deposited Ōé╣

30,000

3. Purchased furniture by

paying cash Ōé╣ 10,000

4. Goods purchased on

credit from Mohaideen for Ōé╣

20,000

5. Cash sales made for Ōé╣ 8,000

6. Goods purchased from

Rathinam for Ōé╣ 5,000 and money

deposited in CDM

7. Goods sold to Rony on

credit for Ōé╣ 60,000

8. Money withdrawn from

bank for office use Ōé╣

9,000

9. Part payment of Ōé╣ 10,000 made to

Mohaideen by cheque

10. Rony made part payment

of Ōé╣ 5,000 by cash

11. Salaries paid to staff

through ECS Ōé╣ 6,000

12. Wages of Ōé╣ 3,000 paid by cash

13. Purchased stationery

from Pandian Ltd. on credit Ōé╣

4,000

Solution

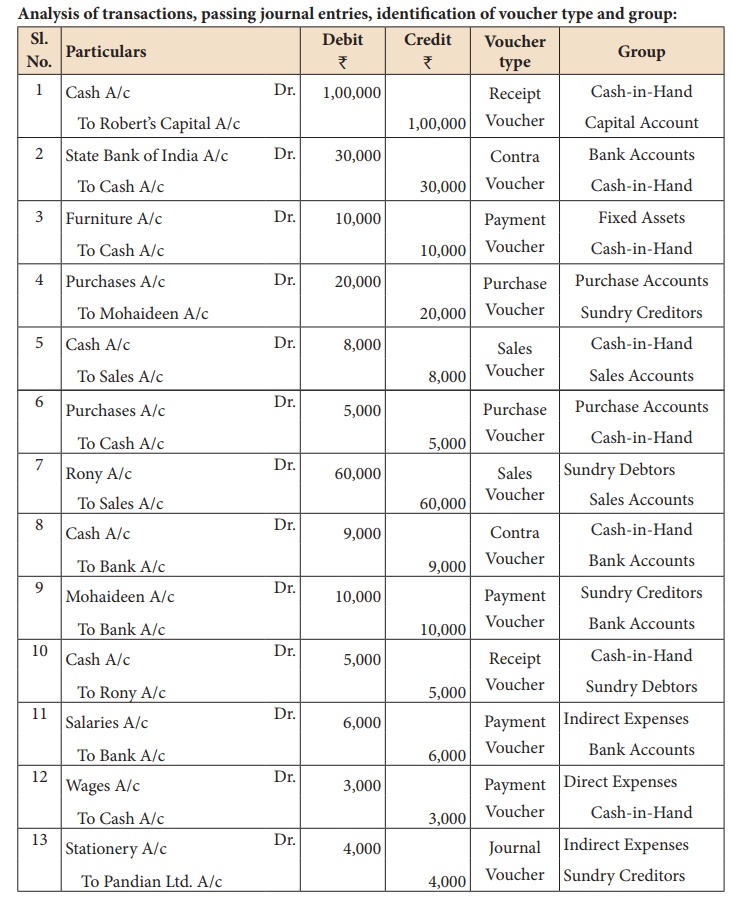

Analysis of transactions, passing journal entries, identification

of voucher type and group:

Following steps are to be followed

to enter the transactions in Tally.ERP 9

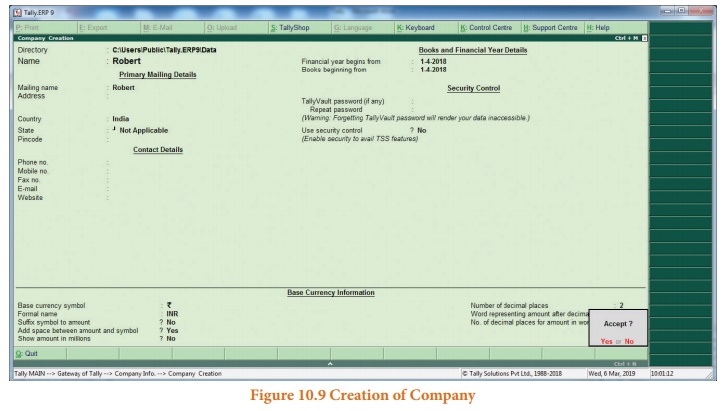

1. To create company

Company Info > Create

Company

Type the Name as Robert

and keep all other fields as they are and choose ŌĆśYesŌĆÖ to accept.

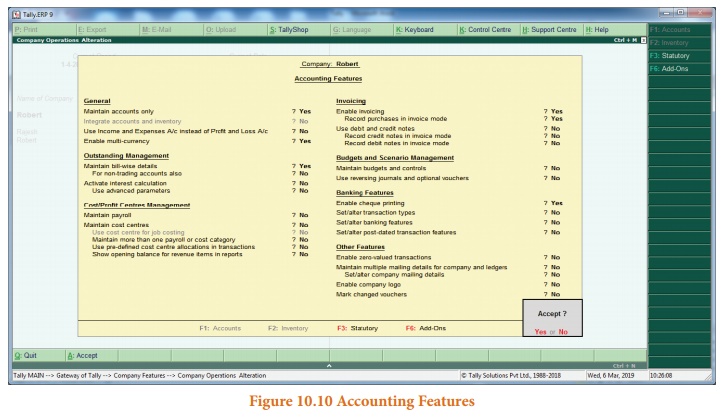

2. To maintain accounts

only

Gateway of Tally >

F11 Accounting Features > General > Maintain accounts only: Yes >

Accept Yes

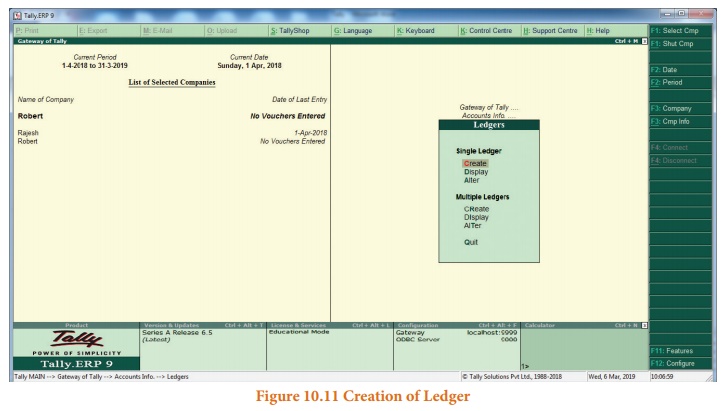

3. To create ledger

accounts

Gateway of Tally >

Masters > Accounts Info > Ledgers > Single Ledger > Create

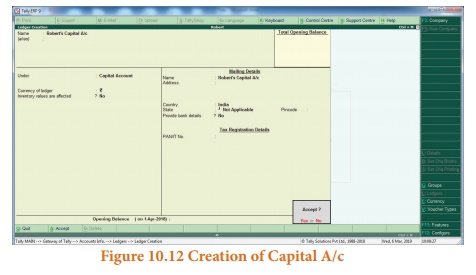

(i) To create RobertŌĆÖs

Capital A/c

Name: RobertŌĆÖs Capital

A/c

Under: Capital Account

Accept: Yes:

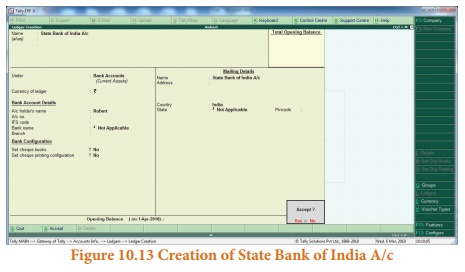

(ii) To create State

Bank of India A/c

Name: State Bank of

India A/c

Under: Bank Accounts

Accept: Yes

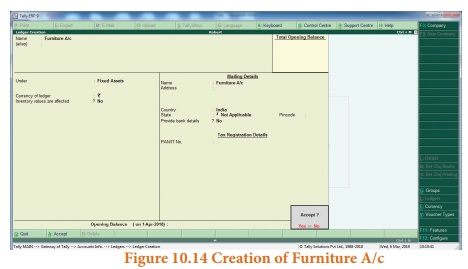

(iii) To create

Furniture A/c

Name: Furniture A/c

Under: Fixed Assets

Accept: Yes

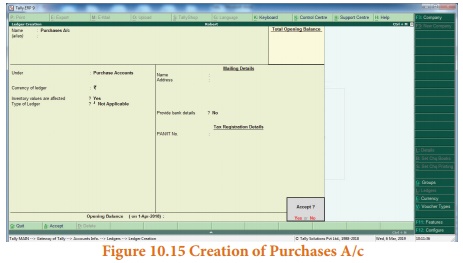

(iv) To create Purchases

A/c

Name: Purchases A/c

Under: Purchase

Accept: Yes

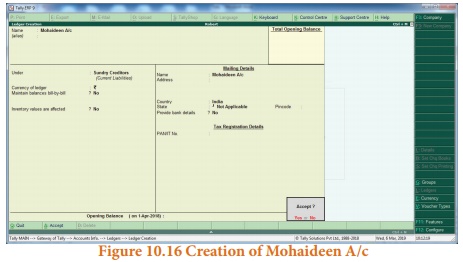

(v) To create Mohaideen

A/c

Name: Mohaideen A/c

Under: Sundry Creditors

Accept: Yes

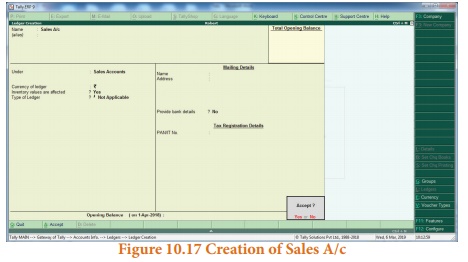

(vi) To create Sales A/c

Name: Sales A/c

Under: Sales Accounts

Accept: Yes

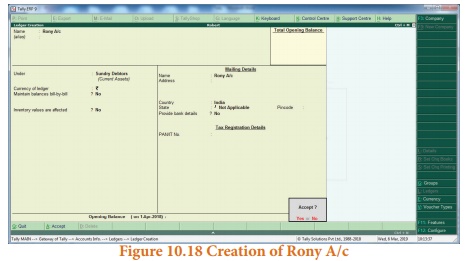

(vii) To create Rony A/c

Name: Rony A/c

Under: Sundry Debtors

Accept: Yes

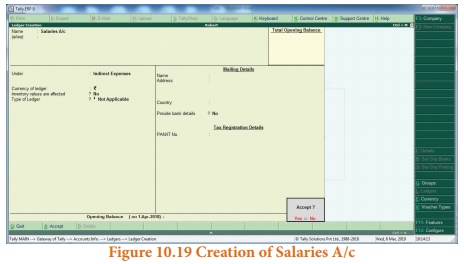

(viii) To create

Salaries A/c

Name: Salaries A/c

Under: Indirect Expenses

Accept: Yes

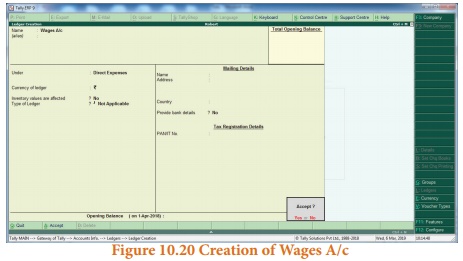

(ix) To create Wages A/c

Name: Wages A/c

Under: Direct Expenses

Accept: Yes

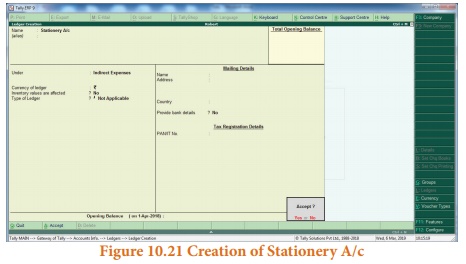

(x) To create Stationery

A/c

Name: Stationery A/c

Under: Indirect Expenses

Accept: Yes

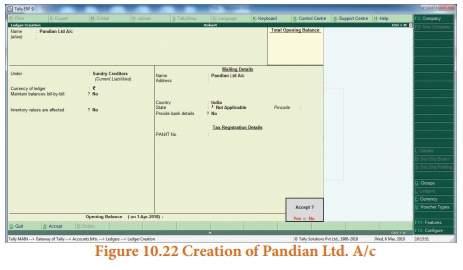

(xi) To create Pandian

Ltd. A/c

Name: Pandian Ltd. A/c

Under:Sundry Creditors

Accept: Yes

4. To enter transactions

through vouchers

Gateway of Tally > Transactions > Accounting Vouchers

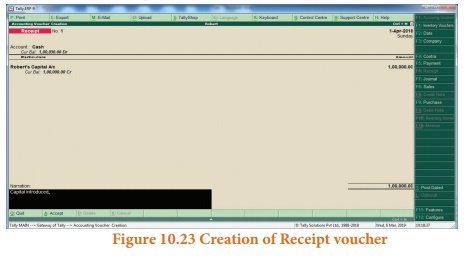

(1) Robert commenced a

transport business with a capital of Ōé╣ 1,00,000

F6: Receipt voucher

Account: Cash

Particulars: RobertŌĆÖs

Capital A/c (Choose from List of Ledger Accounts)

Enter the amount of

capital: Ōé╣ 1,00,000

Narration: Capital

introduced

Accept Yes.

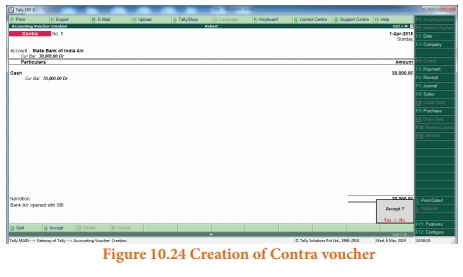

(2) An account was

opened with State Bank of India and deposited Ōé╣ 30,000

F4: Contra voucher

Account: State Bank of

India

Particulars: Cash

Amount: Ōé╣ 30,000

Narration: Opened bank

account in SBI

Accept Yes

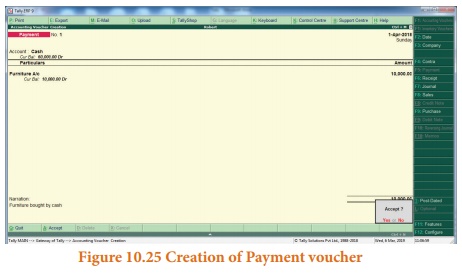

(3) Purchased furniture

by paying cash Ōé╣ 10,000

F5: Payment voucher

Account: Cash

Particulars: Furniture

A/c

Amount: Ōé╣ 10,000

Narration: Furniture

bought by cash

Accept Yes

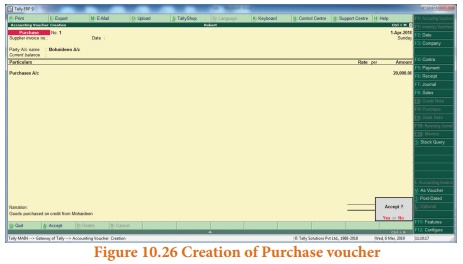

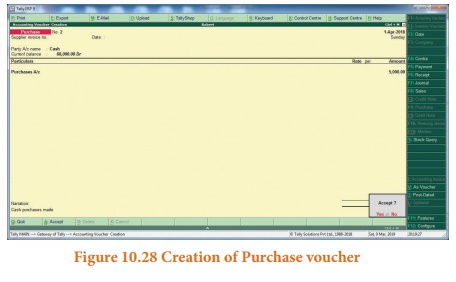

(4) Goods purchased on

credit from Mohaideen for Ōé╣ 20,000

F9: Purchase voucher

Party A/c name:

Mohaideen A/c

Particulars: Purchases

A/c

Amount: Ōé╣ 20,000

Narration: Goods

purchased on credit from Mohaideen

Accept Yes

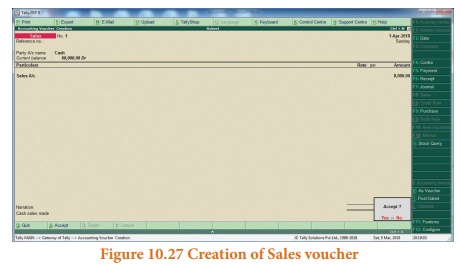

(5) Cash sales made for Ōé╣ 8,000

F8: Sales voucher

Account: Cash

Particulars: Sales A/c

Amount: Ōé╣ 8,000

Narration: Cash sales

made

Accept Yes

(6) Goods purchased from

Rathinam for Ōé╣ 5,000 and money deposited in CDM

F9: Purchase voucher

Account: Cash

Particulars: Purchases

A/c

Amount: Ōé╣ 5,000

Narration: Cash

purchases made

Accept Yes

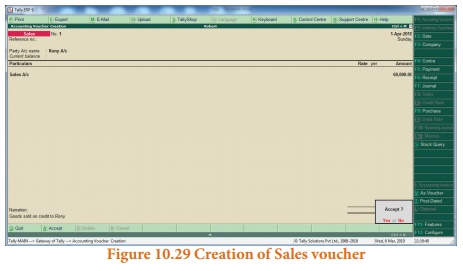

(7) Goods sold to Rony on credit for Ōé╣ 60,000

F8: Sales voucher

Party A/c name: Rony A/c

Particulars: Sales A/c

Amount: Ōé╣ 60,000

Narration: Goods sold on

credit to Rony

Accept Yes

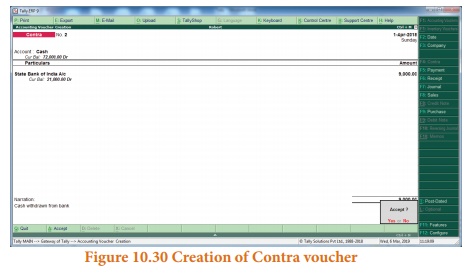

(8) Money withdrawn from bank for office use Ōé╣ 9,000

F4: Contra voucher

Account: Cash

Particulars: State Bank

of India A/c

Amount: Ōé╣ 9,000

Narration: Cash

withdrawn from bank

Accept Yes

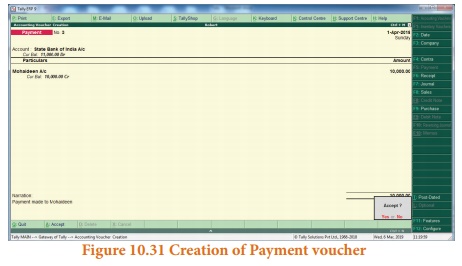

(9) Part payment of Ōé╣ 10,000 made to Mohaideen by cheque

F5: Payment voucher

Account: State Bank of

India

Particulars: Mohaideen

A/c

Amount: Ōé╣ 10,000

Narration: Payment made

to Mohaideen by cheque

Accept Yes

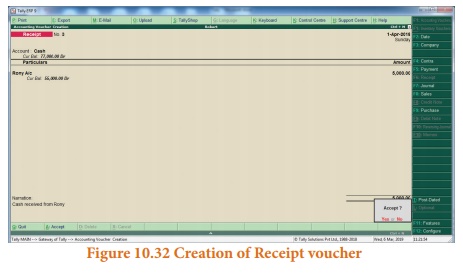

(10) Rony made part payment of Ōé╣ 5,000 by cash

F6: Receipt voucher

Account: Cash

Particulars: Rony A/c

Amount: Ōé╣ 5,000

Narration: Cash received

from Rony

Accept Yes.

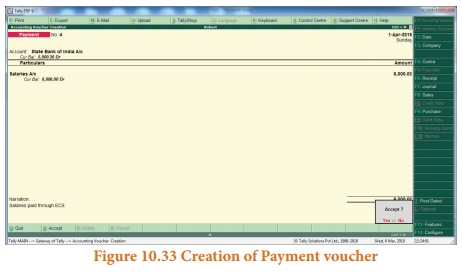

(11) Salaries paid to

staff through ECS Ōé╣ 6,000

F5: Payment voucher

Account: State Bank of

India

Particulars: Salaries

A/c

Amount: Ōé╣ 6,000

Narration: Salaries paid

through

ECS Accept Yes

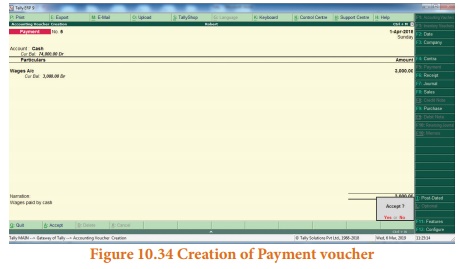

(12) Wages of Ōé╣ 3,000 paid by cash

F5: Payment voucher

Account: Cash

Particulars: Wages A/c

Amount: Ōé╣ 3,000

Narration: Wages paid by

cash

Accept Yes

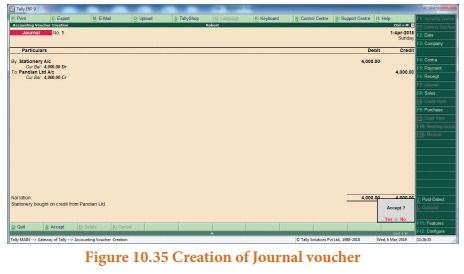

(13) Purchased

stationery from Pandian Ltd. on credit Ōé╣ 4,000

F7: Journal voucher

Particulars: Stationery

Amount: Ōé╣ 4,000

To Pandian Ltd.

Amount: Ōé╣ 4,000

Narration: Stationery

bought on credit from Pandian Ltd.

Accept Yes

5. To view reports

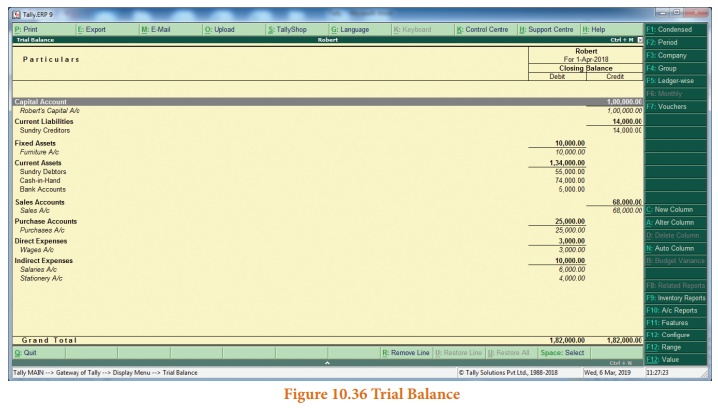

(i) To view Trial

Balance

Gateway of Tally >

Reports > Display > Trial Balance > AltF1 (detailed)

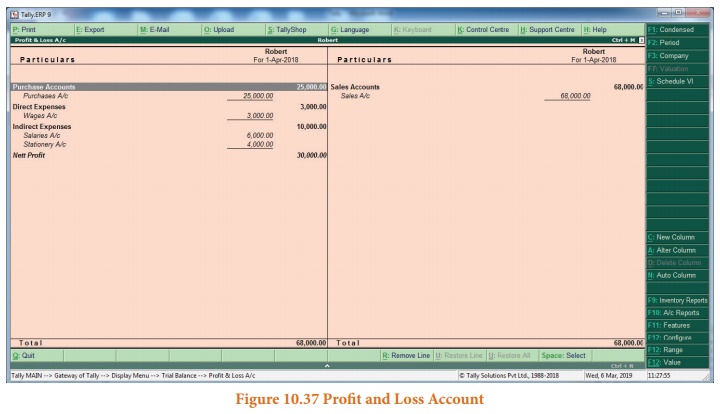

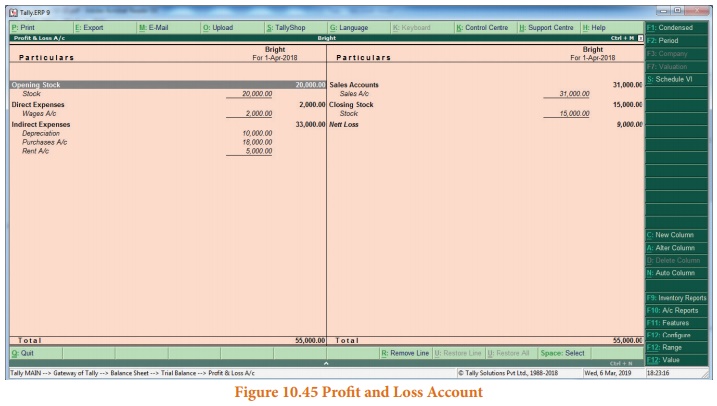

(ii) To view Profit and

Loss Account

F10: A/c Reports >

Profit & Loss A/c > AltF1 (detailed)

(or)

Gateway of Tally >

Reports > Profit & Loss A/c > AltF1 (detailed)

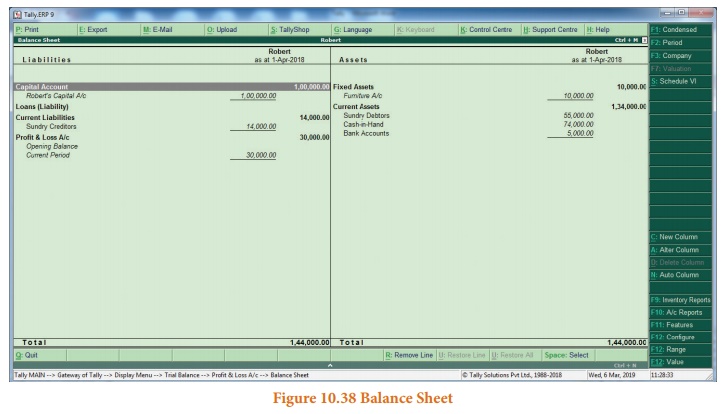

(iii) To view Balance

Sheet

F10: A/c Reports >

Balance Sheet > AltF1 (detailed)

(or)

Gateway of Tally >

Reports > Balance Sheet > AltF1 (detailed)

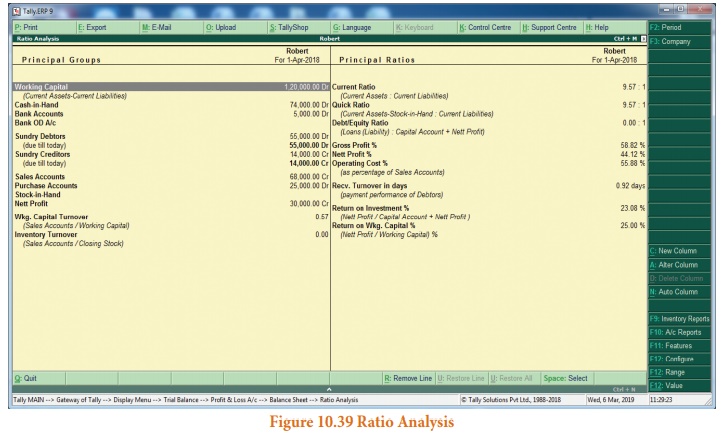

(iv) To view Ratio

Analysis

F10: A/c Reports >

Ratio Analysis

(or)

Gateway of Tally >

Reports > Ratio Analysis

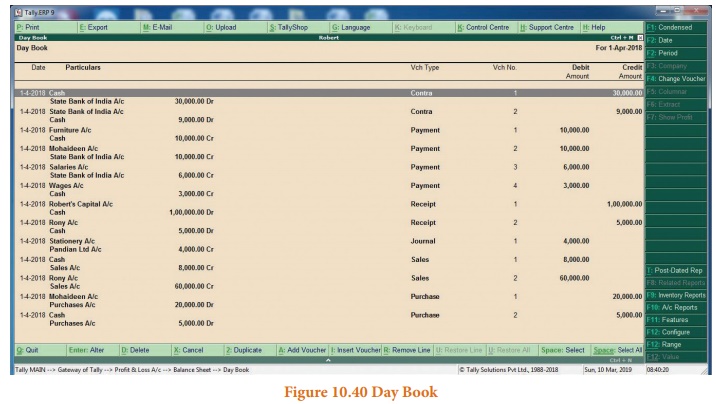

(v) To view Day Book

F10: A/c Reports >

Day Book > AltF1 (detailed)

(or)

Gateway of Tally >

Reports > Display> Day Book > AltF1 (detailed)

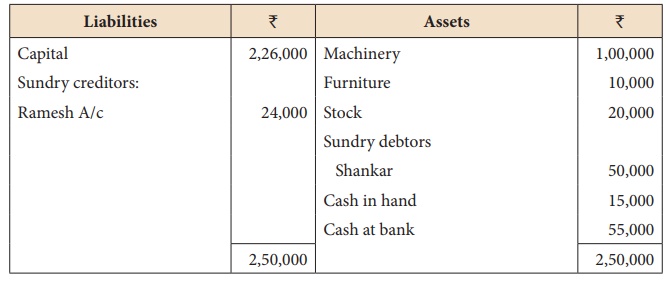

Practical problem 2

The following balance

sheet has been prepared from the books of Bright on 1-4-2018.

During the year the

following transactions took place:

a) Wages paid by cash Ōé╣ 2,000

b) Rent paid by cheque Ōé╣ 5,000

c) Cash purchases made for Ōé╣ 3,000

d) Good purchased on credit

from Senthamarai Ōé╣

15,000

e) Goods sold on credit to

Pushparaj Ōé╣ 25,000

f)

Payment made to Senthamarai by cheque Ōé╣ 5,000

g) Cash received from Shankar

Ōé╣ 30,000

h) Cash sales made for Ōé╣ 6,000

i)

Depreciate machinery at 10%

j)

Closing stock on 31.03.2019 Ōé╣

15,000

You are required to

prepare trading and profit and loss account for the year ended 31-03-2019 and a

balance sheet as on that date using Tally.

Solution

Following steps are to

be followed to enter the transactions in Tally.ERP 9

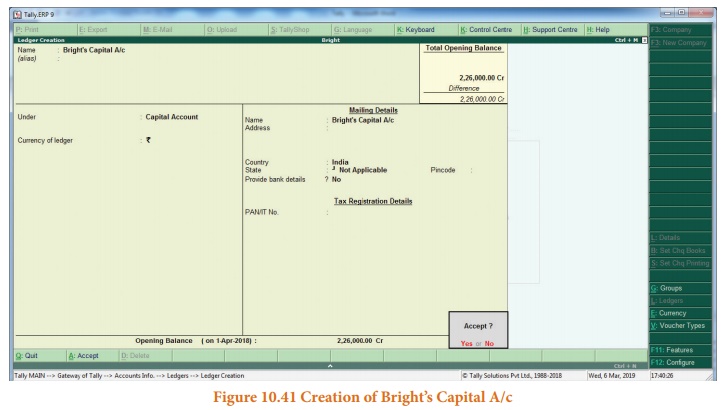

1. To create company

Company Info > Create

Company

Type the Name as Bright

and keep all other fields as they are and choose ŌĆśYesŌĆÖ to accept.

2. To maintain accounts

only

Gateway of Tally >

F11 Accounting Features > General > Maintain accounts only: Yes >

Accept Yes

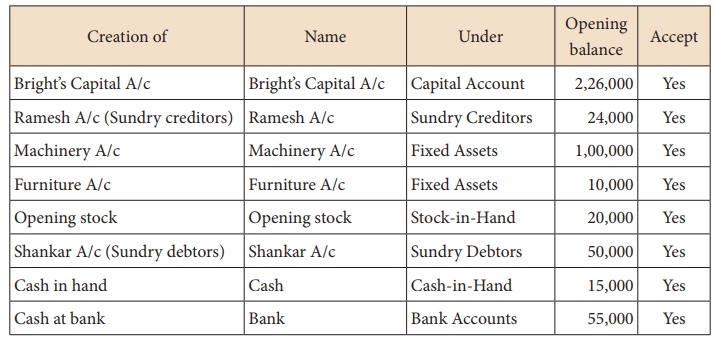

3. To create ledger

accounts with opening balances

Gateway of Tally >

Masters > Accounts Info > Ledgers > Single Ledger > Create

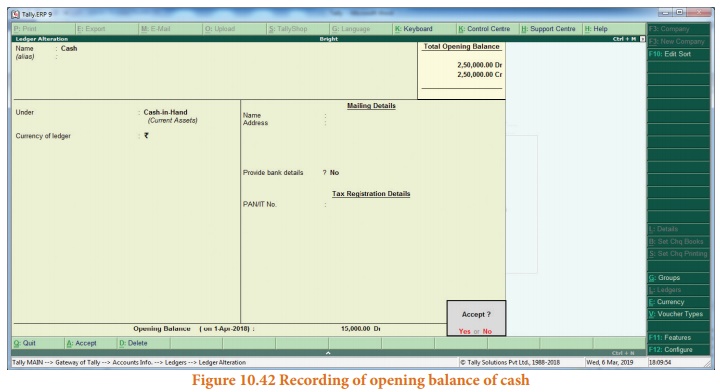

Note

Cash account need not be

created as it is a default ledger. Only the opening balance has to be recorded

by altering the cash account.

To record the opening

balance of cash:

Gateway of Tally >

Masters > Accounts Info > Ledgers > Single Ledger > Alter

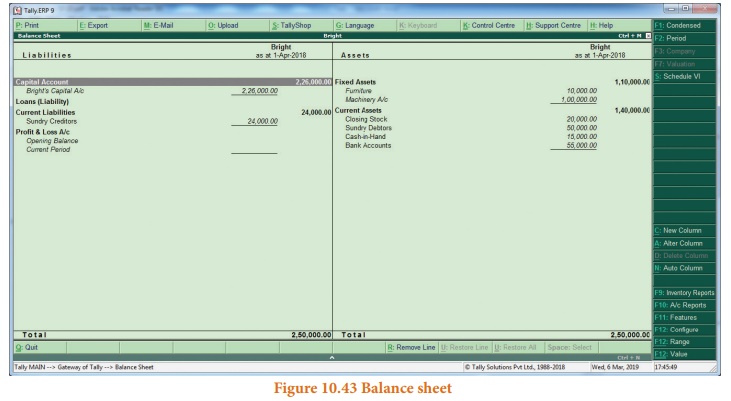

After creating the

ledgers and recording the opening balances of ledger accounts the balance sheet

of Bright is shown as in the following figure:

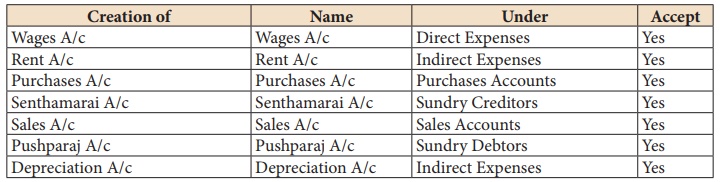

3. To create ledger accounts for transactions

4. To enter transactions through vouchers

Gateway of Tally >

Transactions > Accounting Vouchers

Example: Wages of Ōé╣ 2,000 paid by cash

F5: Payment voucher

Account: Cash

Particulars: Wages A/c

Amount: Ōé╣ 2,000

Narration: Wages paid by

cash

Accept Yes

In the similar way,

record the other transactions. Use Payment Voucher for rent paid and payment to

Senthamarai.

Use Purchase Voucher for

credit purchases from Senthamarai and cash purchases.

Use Sales Voucher for

credit sales to Pushparaj and cash sales.

Use Receipt Voucher for

cash received from Shankar.

Use Journal Voucher for

depreciation.

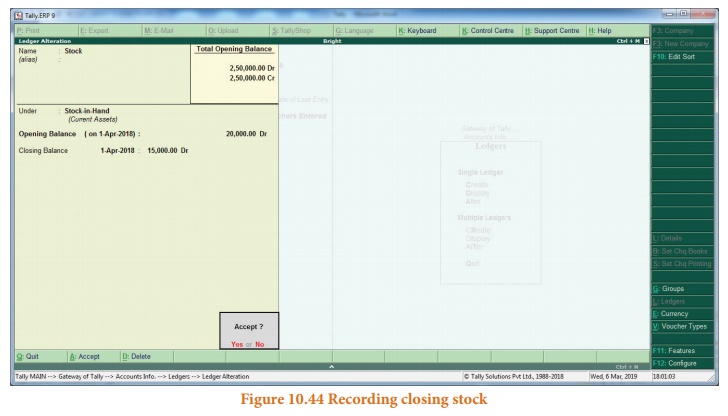

To record closing stock

Since maintain accounts

only is set to ŌĆśYesŌĆÖ and integrate accounts and inventory is set to ŌĆśNoŌĆÖ under

accounting features, stock has to be recorded manually. Hence, the closing

stock has to be recorded by altering the stock account and while entering the

date of closing stock, the date of opening stock has to be entered. The

following procedure is to be followed:

Gateway of Tally >

Masters > Accounts Info > Ledgers > Single Ledger > Alter >

Stock > Closing balance > Date (opening date) > Amount > Accept Yes

6. To view reports

(i) To view Profit and

Loss Account

F10: A/c Reports >

Profit & Loss A/c > AltF1 (detailed)

(or)

Gateway of Tally >

Reports > Profit & Loss A/c > AltF1 (detailed)

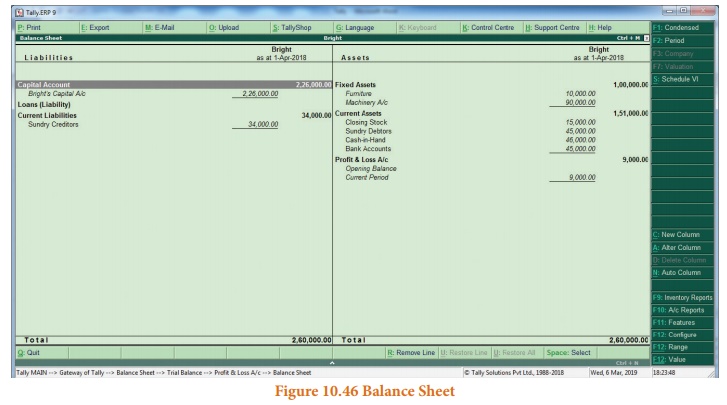

(ii) To view Balance

Sheet

F10: A/c Reports >

Balance Sheet > AltF1 (detailed)

(or)

Gateway of Tally >

Reports > Balance Sheet > AltF1 (detailed)

Related Topics