Accountancy - Practical application of accounting software ŌĆō Tally | 12th Accountancy : Chapter 10 : Computerised Accounting System- Tally

Chapter: 12th Accountancy : Chapter 10 : Computerised Accounting System- Tally

Practical application of accounting software ŌĆō Tally

Practical

application of accounting software ŌĆō Tally.ERP 9

Practical on application

of accounting software - Tally

1. Starting Tally

Tally can be started in

either of the ways as given below:

Click on Start > All

Programs > Tally.ERP 9 > Tally.ERP 9 icon

(or)

Click on Tally.ERP 9

icon (shortcut) on the desktop

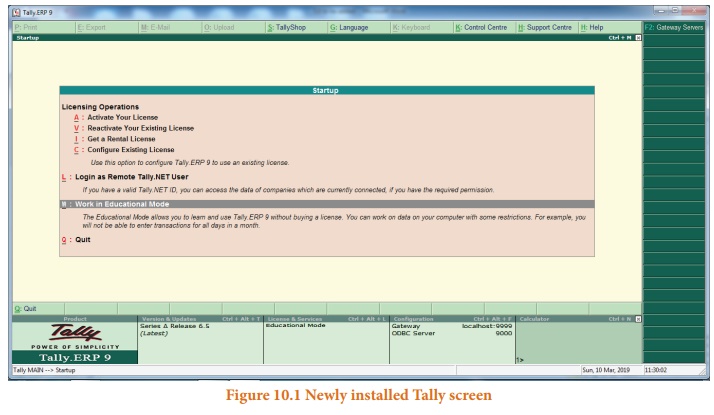

A newly installed Tally,

if opened, will appear as in figure 10.1.

When Tally is started,

choose the mode of operation as per the options listed on the screen. If

license is available, choose ŌĆśActivate Your LicenseŌĆÖ. Otherwise choose ŌĆśWork in

Education ModeŌĆÖ.

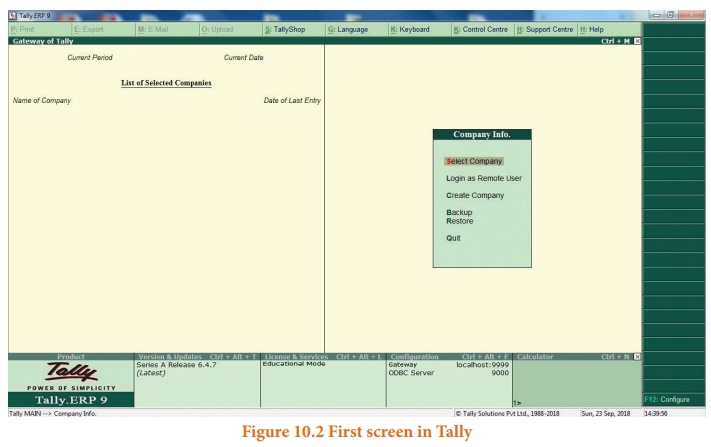

For practice, ŌĆśWork in

Education ModeŌĆÖ is chosen. After the selection, the first screen appears as in

figure 10.2.

2. Creation of a company

It is essential to enter

the particulars of the company for which accounts are to be maintained in

Tally.

In order to create a

company, the following steps are to be followed:

Company Info > Create

Company

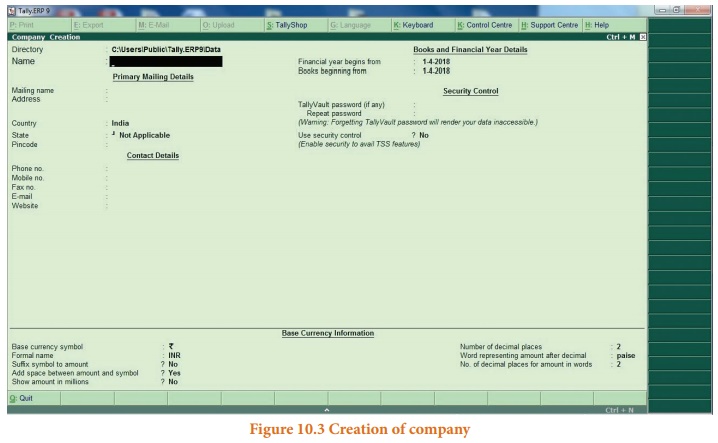

After selection of

Create Company from first screen in Tally, the Company Creation screen will

appear as in figure 10.3.

Tally asks for name,

address, books and financial year details, security control, base currency

information, etc. Now, provide all particulars of the company as required in

Tally. After completing all entries, choose ŌĆśYesŌĆÖ to accept data and create

company.

Tutorial note

For practice purpose,

enter only the name and keep all other fields as they are.

Following the above

procedure, multiple companies can be created.

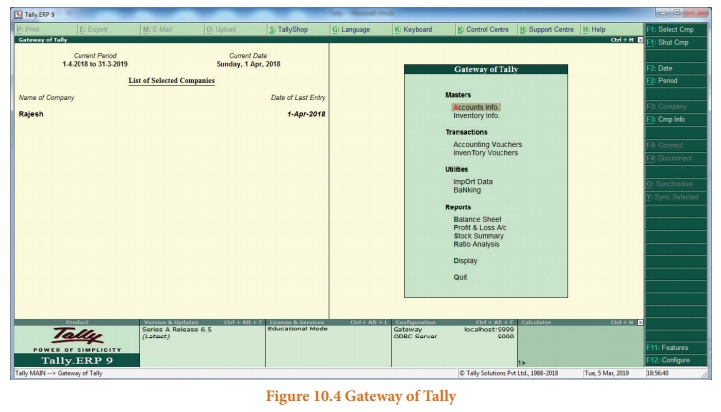

3. Gateway of Tally

Tally screen appears as

in figure 10.4 given below, after creation of a company and whenever Tally is

started. This screen is called Gateway of Tally. It shows the company selected

under List of Selected Companies on the left pane.

Gateway of Tally is

shown on the right pane which contains menu options such as Transactions and

Reports. The shortcut key for each menu option is a letter from the optionŌĆÖs

name, which will be highlighted in red.

Vertical button bar is

placed on the extreme right of the screen which contains buttons such as F1 and

F2 for quick interaction with Tally.ERP 9.

Bottom horizontal

information panel displays details of product, version, licence, configuration

and calculator.

The Gateway of Tally

screen will appear as below:

4.

Closing Tally

The following are the

two ways for closing Tally:

Press Esc Key > Press

Enter or Y

or

Click on Yes(or)Press

Ctrl + Q

5. Select a company

If multiple companies

are created, to choose a particular company, after opening Tally, click F1

(Select Cmp) on the vertical button bar. Tally.ERP 9 displays the Select

Company screen, with a list of companies that are already created. Select the

company for which accounting has to be done.

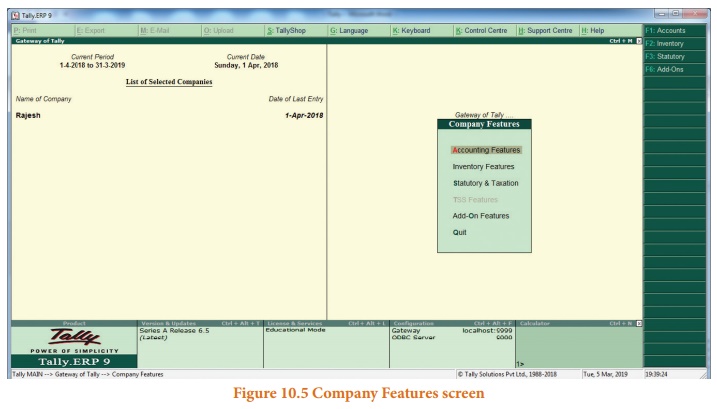

6. Company features

After creation of a

company, it is necessary to set up Tally.ERP 9ŌĆÖs features. The features in

Tally.ERP 9 are set of capabilities, provided as options, that enable

maintainenance of financial records as per the requirements of the users. Click

F11:Features, on the vertical button bar to go to Company Features menu. It

contains Accounting Features, Inventory Features, etc. The Company Features

screen will appear as shown in figure 10.5.

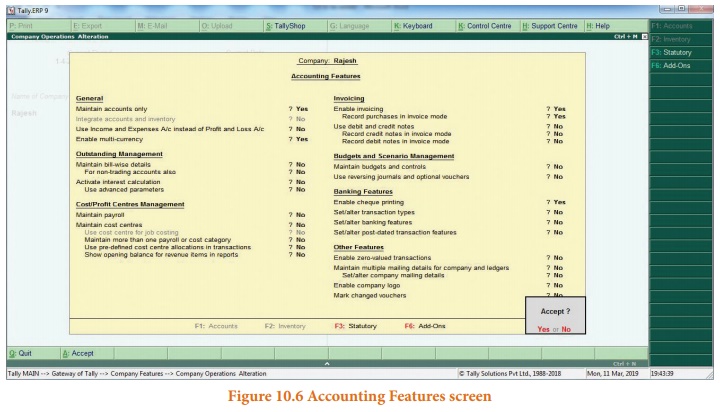

7. Accounting Features

The General Accounting

Features include ŌĆśMaintain accounts onlyŌĆÖ, ŌĆśIntegrate accounts and inventoryŌĆÖ

and use Income and Expenses A/c instead of Profit and Loss A/c. The other

Accounting Features include Invoicing, Banking Features, etc.

For practice purpose,

only the accounting aspects are considered and inventory features are not

considered.

Select Accounting

Features from the Company Features menu. Under General Accounting Features, set

ŌĆśYesŌĆÖ to ŌĆśMaintain accounts onlyŌĆÖ option. Leave all other features to default

values and accept ŌĆśYesŌĆÖ.

The Accounting Features

screen will appear as shown in figure 10.6. (see the next page)

8. Statutory and Taxation features

Statutory and Taxation

features include Goods and Services Tax (GST), Value Added Tax (VAT) and Tax

Deducted at Source (TDS). To enable Goods and Services Tax, set ŌĆśYesŌĆÖ to

ŌĆśEnable Goods and Services TaxŌĆÖ option. For practice purpose set to default

value of ŌĆśNoŌĆÖ.

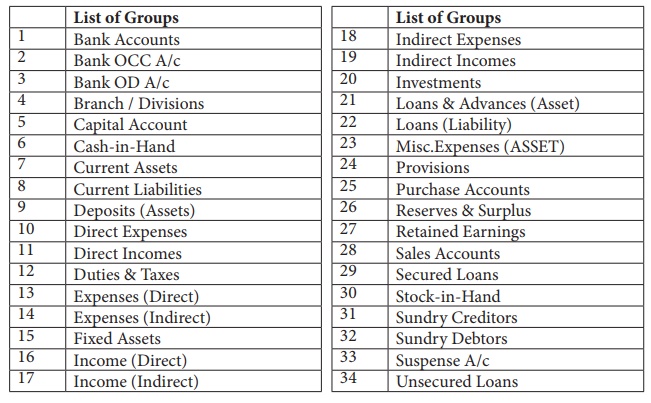

9. Creating Accounting Groups

In Tally, a Group is a

collection of ledgers of the same nature. There are predefined groups of

accounts which are widely used in accounts of many organisations. These

predefined groups comply with the basic accounting principles of classifying

various account heads into Assets, Liabilities, Income and Expense as shown

below:

Groups are categorised

as Primary Groups and Sub-Groups. Primary group includes Capital Account,

Current Liabilities, Fixed Assets, Current Assets, etc. Sub-Group includes

Reserves Surplus, Sundry Creditors, Sundry Debtors, etc.

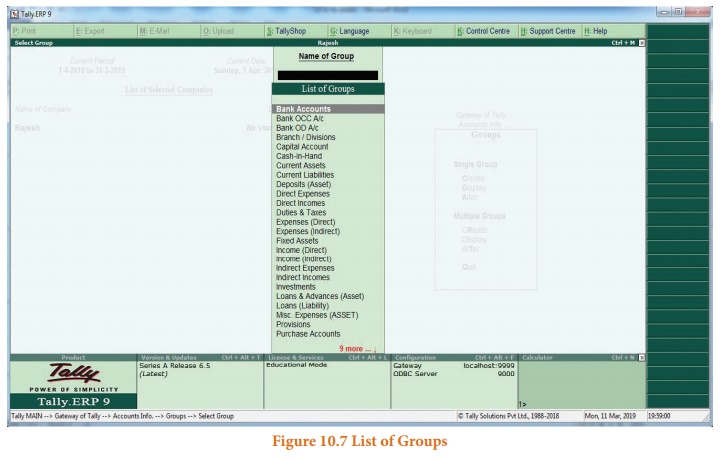

To view predefined

groups,

Gateway of Tally >

Masters > Accounts Info > Groups > Single Group > Display After

selection, Tally screen will appear as in Figure 10.7.

If any additional group

is required, it can be created as follows:

Gateway of Tally >

Masters > Accounts Info > Groups > Single Group > Create

10. Ledger Accounts

In Tally, to record

transactions, the transactions are to be identified with the related ledger

accounts. Tally has two predefined ledgers, Cash and Profit & Loss A/c. The

user has to create various other ledgers based on their requirements.

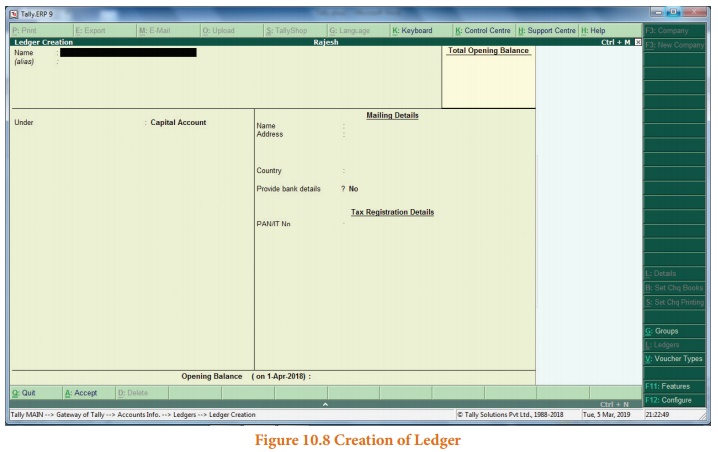

To create ledger:

Gateway of Tally >

Masters > Accounts Info > Ledgers > Single Ledger > Create After

selection, Tally screen will appear as in Figure 10.8.

While creating a ledger,

name and the Group under which the ledger account is to be classified should be

provided. Leave all other features to default values and accept ŌĆśYesŌĆÖ.

11. Modification of group and ledger

Alteration or deletion

of group and ledger is possible. While details of user-defined group/ ledger

can be fully altered, only name can be altered for predefined group/ledger.

Predefined group/ledger cannot be deleted. However, user-defined group/ledger

can be deleted.

To delete a ledger: Gateway of Tally >

Masters > Accounts Info > Ledgers > Single Ledger > Alter

> Select the Ledger to be deleted > Alt D > Yes

12. Vouchers

Voucher is a document

which contains details of transactions. Transactions are to be recorded through

voucher entries. Tally has a set of predefined vouchers such as Purchase,

Sales, Payment, Receipt and Contra.

To view the list of

voucher types:

Gateway of Tally >

Masters > Accounts Info > Voucher Types > Display As per the

requirements of users, additional voucher type can be created. Following are

some of the major accounting vouchers used in an organisation:

i.

Receipt Voucher

ii.

Payment Voucher

iii.

Contra Voucher

iv.

Purchase Voucher

v.

Sales Voucher

vi.

Journal Voucher

(i) Receipt Voucher

All transactions related

to receipt either in cash or through bank are recorded using receipt voucher.

In this voucher, cash or bank account is debited and other ledger account is

credited. To record receipt:

Gateway of Tally >

Transactions > Accounting Vouchers > F6:Receipt

(ii) Payment Voucher

All transactions related

to payments either in cash or through bank are recorded using payment voucher.

In this voucher, cash or bank account is credited and other ledger account is

debited. To record payment:

Gateway of Tally >

Transactions > Accounting Vouchers > F5:Payment

(iii) Contra Voucher

A transaction involving

both cash account and bank account is recorded using contra voucher. The

transaction may be for deposit of cash into bank account or withdrawal of cash

from bank account.

To record contra:

Gateway of Tally >

Transactions > Accounting Vouchers > F4:Contra

(iv) Purchase Voucher

Purchase vouchers are

used for recording both cash and credit purchases of goods.

To record purchases:

Gateway of Tally >

Transactions > Accounting Vouchers > F9:Purchase

(v) Sales Voucher

Sales vouchers are used

for recording both cash and credit sales of goods.

To record sales:

Gateway of Tally >

Transactions > Accounting Vouchers > F8:Sales

(vi) Journal Voucher

Journal vouchers are

used for recording transactions involving other than cash, bank, purchases and

sales such as depreciation, provision for bad debts.

To record journal:

Gateway of Tally >

Transactions > Accounting Vouchers > F7:Journal

To record transactions

using voucher, Accounting Voucher Creation has to be used. Accounting Voucher

Creation contains Name and Number of the voucher, Date of voucher, Particulars,

Debit and Credit and Narration.

Related Topics