Chapter: 11th 12th std standard Indian Economy Economic status Higher secondary school College

Loanable funds theory (Neo - classical theory) of Interest

Loanable funds theory (Neo -

classical theory) of Interest

The loanable funds theory was developed by Knut Wicksell,

Dennis Robertson and others. The loanable funds theory is wider in its scope

than the classical theory of interest. The term 'loanable funds' includes not

only saving out of current income but also bank credit, dishoarding and

disinvestments. But by saving, the classical economists referred only to saving

out of current income. We know now that bank credit is an important source of

funds for investment.

In the classical theory, saving was demanded only for

investment. But according to loanable funds theory, the demand for funds arose,

not only for investment but also for hoarding wealth.

The classical theory regarded interest as a function of

saving and investment, (r = f (S.I.) But, according to loanable funds theory,

the rate of interest is a function of four variables, i.e r = f (1,S M.L.)

where r is the rate of interest, I = investment, S = saving, M = bank credit

and L = desire to hoard or the desire for liquidity.

In

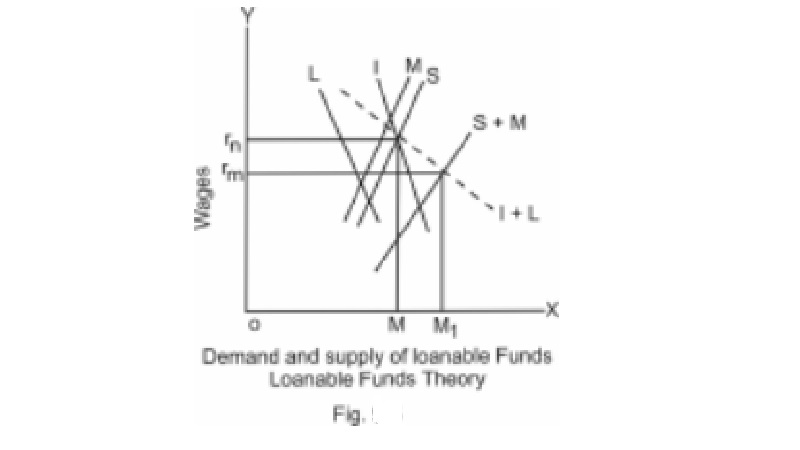

Fig. The Curve 'S' represents savings, the curve 'M' represents bank credit

(including dishoarded and disinvested wealth). The curve S + M represents total

loanable funds at different rates of interest.

On the demand side, the curve I represents demand for

investment. The curve L represents demand for idle cash balances or to hoard

money. The curve I + L represents the total demand for loanable funds at

different rates of interest. The market rate of interest rm is determined by

the intersection of S + M curve and I + L curve. The aggregate demand for

loanable funds is equal to the aggregate supply of loanable funds at this rate

of interest. In the classical theory, rn which may be called the natural rate

of interest is determined by the intersection of I and S curves. That is, when

the rate of interest is rn, the demand for investment is equal to the supply of

savings.

Related Topics