Chapter: 11th 12th std standard Indian Economy Economic status Higher secondary school College

Liquidity preference theory (Keynesian theory) of interest

Liquidity preference theory

(Keynesian theory) of interest.

Generally people prefer to hold a part of their assets in

the form of cash. Cash is a liquid asset. According to Keynes, interest is the

reward for parting with liquidity for a specified period of time. In other

words, it is the reward for not hoarding.

According to Keynes, people have liquidity preference for

three motives. They are 1. Transaction motive; 2. Precautionary motive; and 3.

Speculative motive.

The transaction motive refers to the money held to finance

day to day spending. Precautionary money is held to meet an unforeseen

expenditure.

Keynes defines speculative motive as 'the object of securing

profit from knowing better than the market what the future will bring forth.'

Of the three motives, speculative motive is more important in determining the

rate of interest. Keynes believed that the amount of money held for speculative

motive would vary inversely with the rate of interest.

Keynes was of the view that the rate of interest was

determined by liquidity preference on the one hand and the supply of money on

the other.

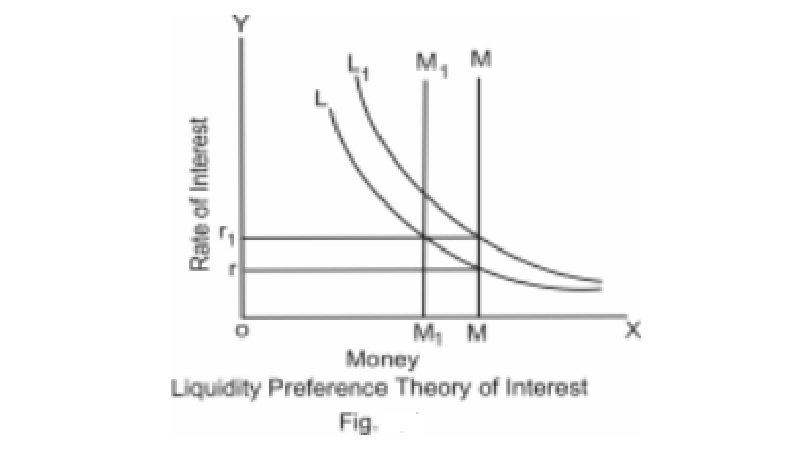

In fig. Liquidity preference is shown by L and the

supply of money is represented by M and the rate of interest is indicated by r.

Rate of interest is determined by the intersection of L and M curves. There

will be increase in the rate of interest to r1, when there is

increase in demand for money to L1 or by a decrease in the supply of

money to M1.

Criticism : Keynesian theory is a general theory of interest

and it is far superior to the earlier theories of interest. But critics say

that Keynes has over - emphasized liquidity preference factor in the theory of

interest. Moreover, only when a person has savings, the question of parting

with liquidity arises. In the words of Jacob Viner, 'without saving, there can

be no liquidity to surrender. The rate of interest is the return for 'saving

without liquidity'.

Related Topics