Auditing - Internal Check Trading Transactions | 12th Auditing : Chapter 1 : Internal Check

Chapter: 12th Auditing : Chapter 1 : Internal Check

Internal Check Trading Transactions

Internal Check Trading Transactions

1. Internal Check- Purchases

The

following system of internal check may be adopted as regards purchases.

1.

A purchase department should supervise and

control the entire purchase transactions of the organisation.

2.

The procedure for purchases should start with

issuing purchase requisition, making enquiry about the terms and conditions of

purchases from different suppliers.

3.

Purchase requisition should be in a printed

form and serially numbered. They should be given to all the departments in the

organisation.

4.

On receipt of requisition from various

departments, the purchase department should send enquiry letter to the

suppliers.

5.

The purchase department, after verifying the

quotation should place an order with the supplier.

6.

All the purchase orders should be signed only

by the Purchase Manager or any responsible person on his behalf.

7.

Goods should be received by a responsible

official and entered in the goods received note and the same should be recorded

in the goods received register.

8.

On receipt of invoice from the supplier, the

purchase department should check the invoice with the goods received note and

verify the rate, discount, quality and quantity of goods.

9.

Goods received should also be entered in the

stores ledgers and entries should be made in the bin card.

10. The

accounts department should verify the purchase invoice with the goods received

note and purchase order before making payment.

11. After

making payment, the accounts department should affix a rubber stamp on the

invoices in order to avoid duplication of payments.

12. At

frequent intervals a responsible person should check the entries in the

purchase book with supplier ledger account.

2. Internal Check-Purchase Returns

1. When

goods are returned to the supplier it should be entered in purchase returns

book.

2. A

credit note should be obtained from the supplier for each return of goods and

the note should be attached to the invoice.

3. The

purchase department should check such advice note with invoice and enter in

purchases returns book.

4. When

only part of the goods or returned to the supplier, the goods which are

accepted alone should be entered in the stores ledger.

3. Internal Check-Sales

Sales

are the most important source of revenue in a business and hence the

possibilities of errors and frauds taking place are greater. Frauds maybe

committed in the following ways:

·

Sales may be omitted from recording in the sales

book.

·

Fictitious sales may be accounted.

·

Sale of fixed assets may be treated as sale of

goods.

In order

to overcome the occurrence of such type of frauds, an effective system of

internal check as regards credit sales is necessary that may be in the following

manner.

1. On

receipt of order from the customers, it should be numbered and the particulars

entered in the order received book.

2. The

order copy should be handed over to the dispatch department who makes necessary

arrangements for delivery of goods.

3. When

the goods ordered or ready for delivery the dispatch department should inspect

the goods with the order copy and enter the details of goods delivered in the

dispatch memo.

4. The

invoice should be prepared based on the dispatch memo in three copies, one copy

should be sent to the customer, second copy to the accounts department and

third copy will be retained by the sales department.

5. A

responsible official should check the particulars in the invoices and also

confirm that the terms and conditions in the order have been duly followed and

finally he should put his initial on the invoice.

6.

The gatekeeper should

record particulars of the goods leaving the premises in the goods

outward book.

7. The

persons who are responsible for preparing the invoices should not be allowed to

post the entries in the customer’s accounts.

8. At

frequent intervals, the balances in the customers’ accounts should be verified

with the confirmations received from the customers.

9. A responsible

official should verify that only sale of goods are accounted in sales day book

and sale of assets are not accounted.

10. A responsible official should

deal with customers enquiries, overdue accounts and writing off bad debts.

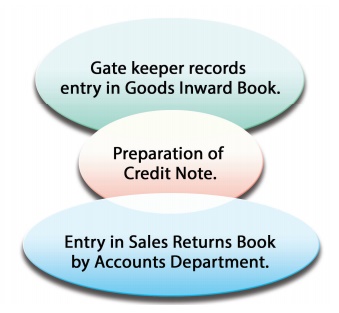

4. Internal Check-Sales Returns

1.

The goods returned by customer should be

entered in the sales return book and reason for the return should also be

recorded.

2.

The gatekeeper should also enter the goods

received in the goods inward book.

3.

A credit note should be prepared, duly checked

and initiated by a responsible official.

Related Topics